Sometimes it is for buildings, warehouses, and offices occupied by the organization. Other times organizations rent different types of equipment – such as office or maintenance equipment – because they require more flexibility than the ownership of property offers. If accelerating the deduction of prepaid expenses was not a strategy in the past, there could be opportunities to do so this year. If this is the initial year of a business, the business can simply take the accelerated deductions for prepaid expenses on the tax return.

Where are prepaid expenses on balance sheet?

Generally, the amount of prepaid expenses that will be used up within one year are reported on a company’s balance sheet as a current asset. As the amount expires, the current asset is reduced and the amount of the reduction is reported as an expense on the income statement.

As such, rent expenses can be a material drain on a company’s operating income. Conversely, the provision requiring the periodic payment of interest is applicable to prepaid paid rent in addition to security deposits. Moreover, the notice requirements applicable upon sale or transfer of the property also apply to prepaid rents. Nevertheless, acceptance of prepaid rents appears to create less potential liability for landlords compared to security deposits.

Prepaid Rent And Accounting Principles

A security deposit can be used to pay for both property damage and missing rent payments. And collecting a security deposit will not affect your ability to evict a tenant. Account adjustments are entries out of internal transactions within a business, which are entered into the general journal at the end of an accounting period. Learn about their different types, purposes, and their link to financial statements, and see some examples. Unearned rent is a type of deferred revenue account, because the landlord has received income before providing the service.

We correctly expected that the owner was going to request all of those prepaid rent funds, less our management fee. While this seems fair and reasonable, there are reasons why the funds can’t be handled in the requested manner. It is not difficult to understand why an owner will want to deposit the full year of rent in their bank account. If they were managing the property themselves they would have those funds.

It does not mean the customary rent due at the beginning of any rental period. If the lease agreement defines the rent payments as contingent upon a performance or usage but also includes a minimum threshold, the minimum is used in the calculation of the lease liability.

Accrued revenue—an asset on the balance sheet—is revenue that has been earned but for which no cash has been received. An accrued expense is recognized on the books before it has been billed or paid. There are a few notable exceptions where a cash payment results in economic performance.

Prepaid Rent: Asset Or Liability

Generally, a business will claim a deduction in the same year that it pays the business expense. So, if you paid a $2,000 insurance premium in 2018, you would claim the deduction in 2018. Now, imagine that you have a multiyear insurance contract at a rate of $2,000 per year. If you wanted, you could pay the 2018 and 2019 premiums at the same time and deduct the $4,000 payment in 2018. Sadly, prepaid rent is an exception to the deduct when you pay rule. If you pay $50,000 in June for a years’ worth of rent, you could only deduct seven months of that rent on December 31.

The business will periodically generate a set of financial statements to summarize its financial position. These statements conform to a set of generally accepted accounting principals that standardize financial reporting so businesses can be compared to one another against a common backdrop. Standard accounting conventions specify how to carry outstanding rent deposits for a lease on the books until such a time as the deposit is actually applied as payment for a month’s rent. Both rent expense and lease expense represent the periodic payment made for the use of the underlying asset. Organizations may have a leasing arrangement or a rental agreement. Let’s start with collecting the rent, security deposit and prepaid rent. Use the rental item that points to your rental income for the rent collected for the first month’s rent.

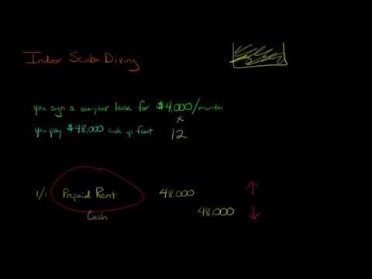

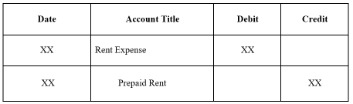

So, at some time during each month of the 12-month lease, it would recognize a rent expense of $2,250 and draw down the prepaid asset by this same amount. Terry Masters All businesses must maintain bookkeeping records to meet tax and other regulatory obligations. The amount of the prepayment is carried on the books of the business leasing the property as a current asset account that will be expensed at some point in the future. As the business does its bookkeeping, the prepaid rent expense account allows the bookkeeper to track the value of the asset until such a time that the amount in the account is spent. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash.

Differences Between Prepaid Rent & Rent Expenses

If you are a cash-based taxpayer, and most people are, the expense is deductible when you pay the cash. If you are an accrual-based taxpayer, the expense is only deductible when the event that generates the expense has fully occurred, such as the period of time the prepaid rent meant to cover has passed. If you are a tenant who has prepaid rent, it is important to note that only expenses attributed to business purposes are deductible from taxable income. If you are renting something for business, when you can deduct these expenses depends on your accounting method. TheBlackLine Account Reconciliations product, a full account reconciliation solution, has a prepaid amortization template to automate the process of accounting for prepaid expenses. It stores a schedule of payments for amortizable items and establishes a monthly schedule of the expenses that should be entered over the life of the prepaid items. With amortization, the amount of a common accrual, such as prepaid rent, is gradually reduced to zero, following what is known as an amortization schedule.

- One of the important steps in the accounting cycle when preparing financial statements is the adjusted trial balance.

- Accelerating deductions for prepaid expenses is a good way to save on your taxes for the current year.

- Therefore the variable portion of the rent payment is not included in the initial calculations, only expensed in the period paid.

- Company A signs a one-year lease on a warehouse for $10,000 a month.

In this example, the rent is six months at $2,000 and six months at $2,500, or $27,000 total. Divide this amount by the 12-month lease term, and you get an average payment of $2,250 per month. The company records this rent expense on the monthly income statement. Additional expenses that a company might prepay for include interest and taxes. Interest paid in advance may arise as a company makes a payment ahead of the due date.

Checking Your Browser Before Accessing Accountingcapital Com

Often abbreviated as OPEX, operating expenses include rent, equipment, inventory costs, marketing, payroll, insurance, step costs, and funds allocated for research and development. A deferred charge is a prepaid expense for an underlying asset that will not be fully consumed until future periods are complete. If the lease payment is variable the lessee cannot estimate a probable payment amount until the payment is unavoidable. Even if a high certainty the performance or usage the variable lease payment is based on will be achieved does exist, the payments are not included in the lease liability measurement.

Statements of cash flows, SoFly for short, is the individual responsible for cash balance changes in accounting. Learn the purpose and format of the statement of cash flows through examples, and the five reasons it’s important to the company. Doing so records the incurring of the expense for the period and reduces the prepaid asset by the corresponding amount. The provisions of the RLTO apply to every rental agreement for a dwelling unit located within the City of Chicago, regardless of where the agreement is made. This includes rental agreements entered into by and between condominium associations and tenants, after filing an eviction and taking possession of the unit due to the unit owner’s non-payment of assessments. Similarly, if the tenancy ends for reasons related to the tenant, it is possible a court might order the full prepaid amount returned to the tenant.

What Kind Of Account Is Rent Expense?

The owner has the assurance their rent will be paid each and every month. There should be some significant piece of mind in knowing the rent is already collected and ready to be disbursed each and every month. If Tenant is not in default of any of the provisions of this Lease, the Rent prepaid by Tenant for the last month of the term of this Lease, if any, shall be reduced by the amount so allocated in the Basic Provisions. Prepaid rent represents the value of operating rent paid in advance by the Group for various leased outlets.

Eventually, the lease payments increase to be greater than the straight-line rent expense. In the case of the rent abatement above, the company begins paying rent but the payments are larger than the average rent expense which includes the abatement period. The expense for the first two months has been incurred because the company has used the rented equipment or occupied the leased space, but cash for these services has not been paid.

Is it illegal to pay 6 months rent upfront?

Some landlords will ask for 6 months’ rent in advance or more. It is illegal for landlords to disguise extra fees in rent in advance payments. You can’t be charged more than what your rent would be for that period.

So, assume that a landlord receives $1,000 in rent for the month of April on April 1. The landlord has not earned the rent yet because the tenant has not used the property for the month. In some instances, you may choose to pay more than one rental payment in advance. For example, you might offer to pay a full year’s rent up front to secure a particular property when competition is fierce. Or, you might agree to pay a few months’ rent in advance in return for some other sweetener such as a 10 percent discount on the rent.

How To Record A Prepaid Expense: Examples

Prepaid expenses only turn into expenses when you actually use them. The value of the asset is then replaced with an actual expense recorded on the income statement. The process of recording prepaid expenses only takes place in accrual accounting.

It is a good idea to employ a certified public accountant to manage your books and do your taxes, as CPAs are aware of the current accounting rules and tax laws. In summary, when dealing with rent prepayments, store the prepaid rent as an asset on the balance sheet until the month in which the rent is consumed. If you forget to move the prepayment into the rent expenses account in the month to which the rent relates, your financial statements will over-report the asset and under-report the expense. It’s essential to keep track of the prepaid rent section of the current assets account and update the list before closing the books at the end of each month. A rental agreement to lease property is considered a tangible asset. When a business enters into such an agreement, it often has to pay not only the current month’s rent but also a certain number of months in advance as security for performance under the agreement.