The Audit Process – Tufts Audit and Management Advisory Services

An opposed opinion is the worst attainable consequence for a company and can have a lasting impact and authorized ramifications if not corrected. The auditor’s report is a doc containing the auditor’s opinion of whether or not an organization’s financial statements comply with GAAP.

BUSINESS IDEAS

What is audit report definition?

An audit report is a written opinion of an auditor regarding an entity’s financial statements. The report is written in a standard format, as mandated by generally accepted auditing standards (GAAS). A qualified opinion, if there were any scope limitations that were imposed upon the auditor’s work.

We do not categorical an opinion on the accompanying monetary statements of the company. An opposed opinion signifies that the auditor found that not only did the corporate not comply with accounting tips, but there were discrepancies in the financials. An antagonistic opinion indicates that the auditor might have suspicions of fabric misstatements or misrepresentations within the financial statements, but doesn’t have sufficient evidence to obviously specific that opinion.

An auditor’s report is a written letter attached to an organization’s financial statements that categorical its opinion on a company’s compliance with standard accounting practices. The auditor’s report is required to be filed with a public firm’s monetary statements when reporting earnings to the Securities and Exchange Commission (SEC). However, an auditor’s report just isn’t an analysis of whether or not a company is a good funding. Also, the audit report is not an analysis of the corporate’s earnings efficiency for the period. Instead, the report is merely a measure of the reliability of the financial statements.

Therefore, you should hope to obtain an unqualified audit report because it offers a positive impression of your small business. If points are materials and pervasive, the auditor points a disclaimer or opposed opinion. A certified audit report does not imply that your corporation is suffering, and it does not imply that your monetary statement isn’t transparent. The auditor’s report accommodates the auditor’s opinion on whether an organization’s financial statements comply with accounting requirements. In the event that the auditor is unable to finish the audit report because of absence of economic information or insufficient cooperation from management, the auditor points a disclaimer of opinion.

What Are the 4 Types of Audit Reports?

In addition, an unqualified opinion signifies that the financial information have been maintained in accordance with the standards often known as Generally Accepted Accounting Principles (GAAP). Inaccurate or erroneous financial information trigger audit legal implications. Auditors are responsible for making sure that each one line items on financial statements are offered pretty. The audit reports ultimately have an effect on business choices of banks, authorities, buyers, and different enterprise-associated entities.

In the second section, the auditor explains its own duties, duties and rights relating to the engagement. Here, the auditor emphasizes the nature of the audit and states that the auditor only examines internal controls and accounting information on a sample basis. In the third section, the auditor offers his opinion on the financial statements.

- The opinion embodies the assumptions that your corporation observed compliance with typically accepted accounting principles and statutory necessities.

- In an unqualified report, the auditors conclude that the monetary statements of your small business current fairly its affairs in all material aspects.

- Also generally known as a clear report, such a report implies that any adjustments in the accounting insurance policies, their software and effects, are adequately determined and divulged.

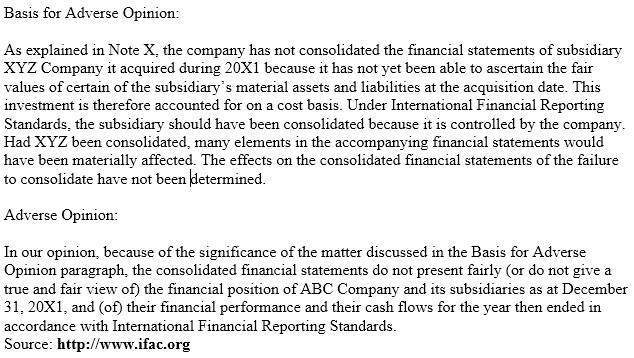

A third section outlines the auditor’s opinion on the monetary statements. Although it’s not present in all audit reports, a fourth part could also be offered as an extra clarification regarding a qualified opinion or an adverse opinion. An Adverse Opinion is issued when the auditor determines that the financial statements of an audited firm are materially misstated and, when thought of as a whole, don’t conform with Generally Accepted Accounting Principles (GAAP).

In an unqualified report, the auditors conclude that the financial statements of your corporation present pretty its affairs in all materials aspects. The opinion embodies the assumptions that your business noticed compliance with usually accepted accounting ideas and statutory requirements. Also known as a clean report, such a report implies that any changes within the accounting insurance policies, their utility and effects, are adequately decided and divulged.

Disclaimer report is given by auditors by which auditors distance themselves from giving any kind of opinion on the monetary statements. This kind of audit opinion is considered very harsh and creates a really antagonistic image of the company. The threat of an opposed opinion virtually all the time motivates a enterprise to provide way to the auditor and alter its accounting or disclosure in order to avoid getting the kiss of death of an opposed opinion. An antagonistic audit opinion says that the financial statements of the business are misleading. The Securities and Exchange Commission (SEC) doesn’t tolerate antagonistic opinions by auditors of public businesses; it might suspend trading in an organization’s securities if the corporate obtained an antagonistic opinion from its CPA auditor.

In addition, an unqualified opinion is given over the internal controls of an entity if administration has claimed duty for its establishment and maintenance, and the auditor has performed fieldwork to test its effectiveness. The audit report begins with an introductory part outlining the responsibility of management and the responsibility of the audit firm. The second section identifies the financial statements on which the auditor’s opinion is given.

A Qualified Opinion report is issued when the auditor encountered certainly one of two kinds of situations which don’t comply with usually accepted accounting rules, nonetheless the rest of the monetary statements are fairly introduced. This sort of opinion is very similar to an unqualified or “clean opinion”, however the report states that the monetary statements are fairly offered with a sure exception which is otherwise misstated. Often referred to as a clean opinion, an unqualified opinion is an audit report that is issued when an auditor determines that each of the monetary data offered by the small business is freed from any misrepresentations.

Unqualified Opinion

The auditor’s report is a written letter from the auditor containing the opinion of whether an organization’s financial statements adjust to generally accepted accounting rules (GAAP). The independent and exterior audit report is typically printed with the corporate’s annual report. The auditor’s report is essential as a result of banks and creditors require an audit of an organization’s financial statements before lending to them. In this text, we explain what goes into an auditor’s report in addition to evaluate an example of an audit report.

What are the 4 types of audit reports?

There are four types of audit reports: and unqualified opinion, a qualified opinion, and adverse opinion, and a disclaimer of opinion. An unqualified or “clean” opinion is the best type of report a business can get.

In an audit engagement, the auditor provides his opinion on the monetary data disclosed by your small business. The auditor’s report is an integral factor of your business’s audited financial assertion. At the culmination of the audit engagement, the auditor expresses his opinion within the auditor’s report, which can be certified or unqualified. The auditor reviews an unqualified opinion if the monetary statements are presumed to be free from material misstatements.

This is a sign that no opinion over the monetary statements was capable of be determined. A certified opinion is given when an organization’s financial information have not adopted GAAP in all monetary transactions. A qualified opinion could also be given due to both a limitation within the scope of the audit or an accounting method that did not follow GAAP. However, the deviation from GAAP isn’t pervasive and does not misstate the financial place of the corporate as a complete.

As a businessperson, you must remember that there are deep-held perceptions about auditors’ opinions. Banks, traders and regulators such as the IRS rely on audited monetary statements for his or her analytical needs. Stakeholders corresponding to banks and investors view certified audit report unfavorably.