Examples Of The Columns Often Appearing On The Statement

They began to drill for oil book and but could not find anything so they hired an old wildcatter name Jack who was a self-proclaimed expert at finding oil in the area. Bill and Steve had both spent their entire savings on purchasing the land and they had no money to pay Jack with for his help. So in order to have Jack’s help both Bill and Steve offered 33% of the land in exchange for his knowledge and work. Therefore this reduced any profits duckbill and Steve would receive down to one third each. You should be to understand the business manager’s responsibilities for the financial statements of a business. Total assets will equal the sum of liabilities and total shareholder equity.The Statement of Stockholders’ Equity is one of the required and basis 4 financial statements, including the balance sheet, the income statement, and the statement of cash flows. The components of stockholders’ equity include the par value of outstanding shares, the amount of retained earnings, the value of any treasury stock and any additional paid-in capital. The statement of shareholders’ equity is part of a company’s balance sheet, which it issues to its shareholders on a quarterly or annual basis. Stockholders’ equity, also referred to as shareholders’ or owners’ equity, is the remaining amount of assets available to shareholders after all liabilities have been paid. It is calculated either as a firm’s total assets less its total liabilities or alternatively as the sum of share capital and retained earnings less treasury shares. Stockholders’ equity might include common stock, paid-in capital, retained earnings, and treasury stock.Retained earnings, which is the total amount earned by the company not divvied up to stockholders, and often reinvested in the business itself. 1.) The business makes a profit and therefore the change increases the reported retained earnings. • Common Stock- The par value that is generated from the original sale of common stock. Stockholders’ equity is the remaining amount of assets available to shareholders after paying liabilities. Total all liabilities, which should be a separate listing on the balance sheet. Treasury stock is previously outstanding stock bought back from stockholders by the issuing company.Formal reports are written to provide information, analyze an issue, or make recommendations. In this lesson, you’ll discover the parts of a formal report and tips for writing an effective one. The Required Reserve Ratio refers to the fraction of the total money deposited that must be held onto by the bank, not loaned out. The multiplier is the amount of new income that is generated from an addition of extra income. Learn more about the definition, calculation, effect, and formula of the multiplier in economics.

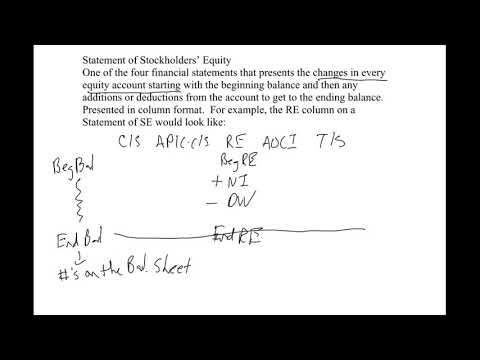

What is the statement of changes in stockholders equity?

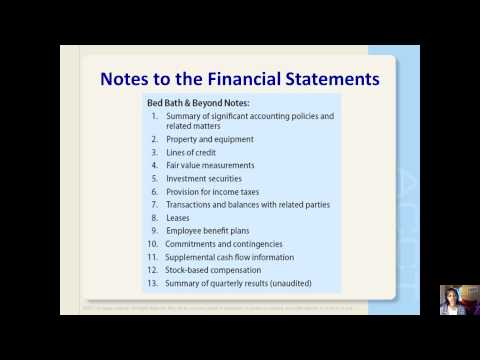

The statement of changes in stockholders’ equity is where you find certain technical gains and losses that increase or decrease owners’ equity but that are not reported in the income statement.The answer to certain tax and accounting issues is often highly dependent on the fact situation presented and your overall financial status. Common stock, which represents the legal capital of the company and it equals the product of shares issued and the stated value of each share. This element represents the amount of recognized equity-based compensation related to employee stock purchase programs during the period, that is, the amount recognized as expense in the income statement .

Want More Helpful Articles About Running A Business?

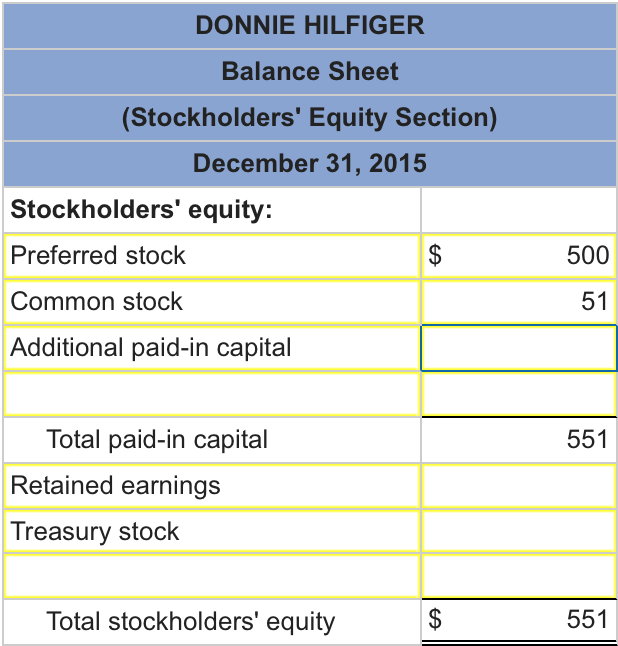

Because shareholders’ equity experiences frequently change, however, it is crucial to review this information on a regular basis so you understand how to adapt and move forward. The contributed capital states amounts that are contributed or paid for the shares of stock by the investors. These different amounts can be classified as additional-paid in capital, which are the amounts that have been paid in addition to the par value. The other classification is the Par Value, which is the legal value that has been assigned to the individual shares of stock for the corporation. Retained earnings are defined as the net income that is earned by the business that has not been paid out to shareholders in the form of dividends.

- Stockholders’ equity is the remaining amount of assets available to shareholders after paying liabilities.

- In this lesson, you will learn how to account for interest-bearing and non-interest bearing notes.

- Treasury Stock which represents the value of shares repurchased by the company.

- With various debt and equity instruments in mind, we can apply this knowledge to our own personal investment decisions.

- The statement of stockholders’ equity is a financial statement that summarizes all of the changes that occurred in the stockholders’ equity accounts during the accounting year.

In liquidation, physical asset values have been reduced and other extraordinary conditions exist. For this reason, many investors view companies with negative shareholder equity as risky or unsafe investments. Shareholder equity alone is not a definitive indicator of a company’s financial health. If used in conjunction with other tools and metrics, the investor can accurately analyze the health of an organization. Share Capital refers to amounts received by the reporting company from transactions with shareholders. Common shares represent residual ownership in a company and in the event of liquidation or dividend payments, common shares can only receive payments after preferred shareholders have been paid first.

Statement Of Stockholders Equity

Corporations are required to file paperwork with the state such as Texas, Nevada, or Delaware. For example if WH3 Corp., issues 10,000 shares of stock, each share will then represent 1/10,000th of the entire amount of ownership stock for the corporation. The statement of stockholders equity can help investors, managers, and accountants to get a clear picture and understand the structure of a business is ownership profile. In this article we will evaluate to stockholders equity of WH3 Corp., who produces widgets. The statement of shareholders’ equity is one of the main sections of the balance sheet. Also known as owner’s equity, shareholders’ equity summarizes the ownership structure of a company. It is usually posted after the assets and liabilities sections of the balance sheet.

This year the company finally paid dividends of $5,000 to the stockholders. A corporation is an organization that is considered as a single business separate entity from its owners. Learn more about the corporate form of organization and its examples, the advantages and disadvantages of corporations, as well as the differences between S-corporations and C-corporations. HedgingHedging is a type of investment that works like insurance and protects you from any financial losses. The company makes dividend payments from the amount available in retained earnings.Like preferred stock, common stock is typically listed on the statement of shareholders’ equity at par value. The retained earnings account on the balance sheet is said to represent an “accumulation of earnings” since net profits and losses are added/subtracted from the account from period to period. The Corporate Finance Institute explains that the stockholders’ equity statement is part of a company’s balance sheet, consisting of share capital and retained earnings, or assets minus liabilities.

Accounting Newbie?

These represent the accumulated company’s profits that are not paid out as dividends to the shareholders and instead allocated back into the business. Retained earnings could be used funding working capital requirements, debt servicing, fixed asset purchases, etc. There can be different types of shareholders including common stockholders and preferred stockholders.

How does the statement of stockholders equity differ from the statement of retained earnings?

While the retained earnings statement shows the changes between the beginning and ending balances of the retained earnings account during the period, the statement of stockholders’ equity provides the changes between the beginning and ending balances of each of the stockholders’ equity accounts, including retained …Adkins holds master’s degrees in history and sociology from Georgia State University. Below is an example of the grid pattern statement of stockholder’s equity. Fixed asset revaluation affects the revaluation surplus by increasing it. Similarly, the reversal of the revaluation of fixed assets may decrease the revaluation surplus. Treasury stock purchase increases the stock component and brings down the net shareholders’ equity.

What Are Some Examples Of Stockholders’ Equity?

The business owner should know about his performance when it comes to business operation and one of the best ways to know about it is through the statement of shareholder equity. If there is a negative impact of loss in the equity statement of the current year when compared to the last financial year, it indicates that the business owner is making some fault or has taken wrong decisions. The amount received by the shareholders from the company they have bought stock in is known as a dividend.

Increases or decreases in investment market value are unrealized, but need to be reflected in the company’s financial statements. statement of stockholders equity Another common item in comprehensive income is the unrealized gain or loss on foreign currency translation adjustments.

Definition Of The Shareholders Equity Statement

Treasury stock, which is repurchased by the issuing company for purposes like avoiding takeovers and boosting stock prices. Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.At some point, accumulated retained earnings may exceed the amount of contributed equity capital and can eventually grow to be the main source of stockholders’ equity. Equity, also referred to as stockholders’ or shareholders’ equity, is the corporation’s owners’ residual claim on assets after debts have been paid. Stockholders’ equity is often referred to as the book value of the company and it comes from two main sources.