This is to say that the total market value of the company should not change. Therefore, the company must maintain a balance between declaring dividends and retaining profits for expansion. As an investor, one would like to know much more—such as the returns the retained earnings have generated and if they were better than any alternative investments.As stated earlier, companies may pay out either cash or stock dividends. Cash dividends result in an outflow of cash and are paid on a per-share basis.

The Difference: Cash Basis Accounting Vs Accrual Accounting

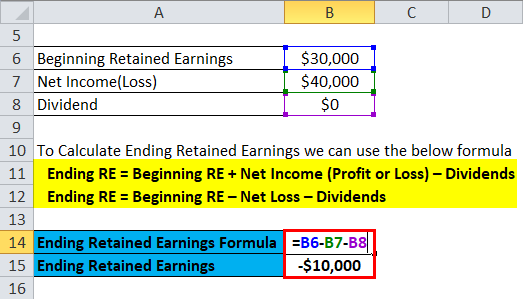

As a result, any items that drive net income higher or push it lower will ultimately affect retained earnings. At the end of an accounting period, whatever is leftover of the net income of a business, after distributing dividends to the owners , or shareholders , is referred to as retained earnings. Reinvesting a portion of your profit is key to growing your business, and retained earnings provide you with the funds to reinvest. Becca’s Gluten-Free Bakery has retained earnings of $28,000 for the current period, which is $8,000 more than the previous period. With the retained earnings formula, we can see how much money a business has to reinvest.

All the other options retain the earnings for use within the business, and such investments and funding activities constitute the retained earnings . The decision to retain the earnings or distribute them among the shareholders is usually left to the company management. Janet Berry-Johnson is a CPA with 10 years of experience in public accounting and writes about income taxes and small business accounting. To learn more, check out our video-based financial modeling courses. Below is a short video explanation to help you understand the importance of retained earnings from an accounting perspective. This post is intended to be used for informational purposes only and does not constitute as legal, business, or tax advice.

By Using This Service, Some Information May Be Shared With Youtube

If your company pays dividends, you subtract the amount of dividends your company pays out of your net income. Let’s say your company’s dividend policy is to pay 50 percent of its net income out to its investors. In this example, $7,500 would be paid out as dividends and subtracted from the current total. In an accounting cycle, the second financial statement that should be prepared is the Statement of Retained Earnings. This is the amount of income left in the company after dividends are paid and are often reinvested into the company or paid out to stockholders. When interpreting retained earnings, it’s important to view the result with the company’s overall situation in mind. For example, if a company is in its first few years of business, having negative retained earnings may be expected.Sage 50cloud is a feature-rich accounting platform with tools for sales tracking, reporting, invoicing and payment processing and vendor, customer and employee management. If you’re a private company, or don’t pay shareholder dividends, you can skip that part of the formula completely.

Retained earnings are related to net income because it’s the net income amount saved by a company over time. On the other hand, when a company generates surplus income, a portion of the long-term shareholders may expect some regular income in the form of dividends as a reward for putting their money in the company.

Get Ready For The Brexit Impact On Business

In rare cases, it can also indicate that a business was able to borrow funds and then distribute these funds to stockholders as dividends; however, this action is usually prohibited by a lender’s loan covenants. Since you are preparing a final tax return, the ending balances of all assets, liabilities and equity should be zero. If any assets have a balance at year-end, distributions of cash or property will need to be made. Retained earnings should boost the company’s value and, in turn, boost the value of the amount of money you invest into it. If a company can use its retained earnings to produce above-average returns, it is better off keeping those earnings instead of paying them out to shareholders. Spend less time on business admin and more on business development with QuickBooks cloud accounting software.

- However, they normally decide not to distribute retained earnings to shareholders for the new startup entity.

- Cash payment of dividends leads to cash outflow and is recorded in the books and accounts as net reductions.

- As stated earlier, dividends are paid out of retained earnings of the company.

- The payout ratio, or the dividend payout ratio, is the proportion of earnings paid out as dividends to shareholders, typically expressed as a percentage.

- The retained earnings account balance as per adjusted trial balance of the company was $3,500,000.

- The accounting equation defines a company’s total assets as the sum of its liabilities and shareholders’ equity.

The beginning retained earnings are the retained earnings from the previous accounting period. For example, if the dividends paid are greater than the beginning retained earnings balance, the resulting number would be negative. A negative retained earnings amount can also occur if the business had a significant loss in net income. Retained earnings appear on the balance sheet under the shareholders’ equity section. Negative retained earnings mean a negative balance of retained earnings as appearing on the balance sheet under stockholder’s equity. A business entity can have a negative retained earnings balance if it has been incurring net losses or distributing more dividends than what is there in the retained earnings account over the years.Retained earnings is derived from your net income totals for the year, minus any dividends paid out to investors. Dividends are a debit in the retained earnings account whether paid or not. Retained earnings is the cumulative amount of earnings since the corporation was formed minus the cumulative amount of dividends that were declared. Retained earnings is the corporation’s past earnings that have not been distributed as dividends to its stockholders. As mentioned earlier, retained earnings appear under the shareholder’s equity section on the liability side of the balance sheet.Keep in mind that if your company experiences a net loss, you may also have a negative retained earnings balance, depending on the beginning balance used when creating the retained earnings statement. Retained earnings can be used for a variety of purposes and are derived from a company’s net income. Any time a company has net income, the retained earnings account will increase, while a net loss will decrease the amount of retained earnings. Generally, you will record them on your balance sheet under the equity section. But, you can also record retained earnings on a separate financial statement known as the statement of retained earnings. To calculate retained earnings, you need to know your business’s previous retained earnings, net income, and dividends paid. Now, if you paid out dividends, subtract them and total the Statement of Retained Earnings.

Ratios To Evaluate Dividend Stocks

In other words, the value of a business’s assets is equal to what the business owes to others plus what the owners own (owner’s equity. Reinvestment is not affect returned earnings but if the entity expands its operation and then turns from the net income to net losses. According to the board approval and dividend policies, this earning will be reduced when the entity makes the payments to its shareholders. This statement is the extended version of the statement of change in equity, and this statement shows the detail of changes in retained earning of the period.You have beginning retained earnings of $4,000 and a net loss of $12,000. At the very least, it might show that the company ought to lower its dividend. Company executives may choose to keep earnings rather than pay them out to shareholders as dividends. If that happens, they need to show them on the balance sheet under shareholders’ equity. Because there will be fewer shares outstanding, the company’s per-share metrics, such as earnings per share and book value per share, could increase.

Definition Of Retained Earnings

This payment is declared by the entity when it gets approval from the board of directors and local authority. If that is the case, then the retained earnings will reduce by the dividend amounts. An alternative to the statement of retained earnings is the statement of stockholders’ equity. Gross revenue is the total amount of revenue generated after COGS but before any operating and capital expenses.Though the last option of debt repayment also leads to the money going out of the business, it still has an impact on the business’s accounts . Retained earnings is the amount of net income left over for the business after it has paid out dividends to its shareholders. For any company, the first priority to use retained earnings is to fund its working capital. Retained earnings are the amount a company gains after the taxation of its net income. Therefore, retained earnings are not taxed, as the amount has already been taxed in income. At the beginning of the quarter, she had $20,000 on her balance sheet and decided to launch a new line of gluten-free brownies.

Stockholders’ Equity

Ratios can be helpful for understanding both revenues and retained earnings contributions. Companies and stakeholders may also be interested in the retention ratio. The retention ratio is calculated from the difference in net income and retained earnings over net income. This shows the percentage of net income that is theoretically invested back into the company.Retained earnings represent the portion of the net income of your company that remains after dividends have been paid to your shareholders. That is the amount of residual net income that is not distributed as dividends but is reinvested or ‘ploughed back’ into the company. Earnings per share is the portion of a company’s profit allocated to each outstanding share of common stock. Earnings per share serve as an indicator of a company’s profitability. The payout ratio, or the dividend payout ratio, is the proportion of earnings paid out as dividends to shareholders, typically expressed as a percentage. Such items include sales revenue, cost of goods sold , depreciation, and necessaryoperating expenses. During the same period, the total earnings per share was $13.61, while the total dividend paid out by the company was $3.38 per share.