What does the statement of cash flows reports quizlet?

The Statement of Cash Flows Reports cash inflows and outflows in three broad categories: 1) Operating Activities, 2) Investing Activities, and 3) Financing activities. … Net Income + or – Adjustments for non cash items = Net Cash inflow (outflow) from operating activities.The statement of retained earnings is the extended version of the statement of change in equity. It is normally prepared as required by the senior management team, the board of directors, or the local authority. The end of period retained earnings balance also appears on the current Balance sheet under Owner’s Equity. You can expand on the information listed in your statement of retained earnings if you want, such as par value of the stock, paid-in capital, and total shareholders’ equity. Or, you can keep your statement of retained earnings short, sweet, and to the point.

Understanding The Retained Earnings Statement

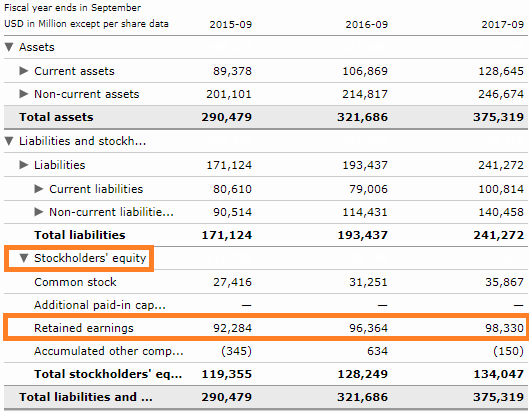

The concept of debits and credits is different in accounting than the way those words get used in everyday life. In accounting, debits and credits are references to the side of the ledger on which an entry gets made. Therefore, the retained earnings value on the balance sheet is a running total of additional gains minus dividends.

- Typically, the net profit earned by your business entity is either distributed as dividends to shareholders or is retained in the business for its growth and expansion.

- The statement of retained earnings summarizes any changes in retained earnings over a specific period of time.

- The statement of retained earnings can be seen either as a standalone statement or within the balance sheet or income statement of a company.

- It’s an overview of changes in the amount of retained earnings during a given accounting period.

- If you issue stock in the business, the changes in that stock would also appear in the expanded statement of retained earnings.

- Beginning and closing retained earnings are the same as the amount of retained earnings in the period 1 and period 2 of the balance sheet.

- Financial statements help with decision making and your ability to get outside financing.

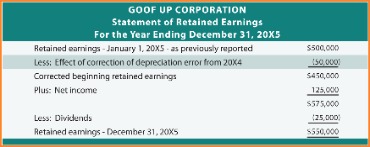

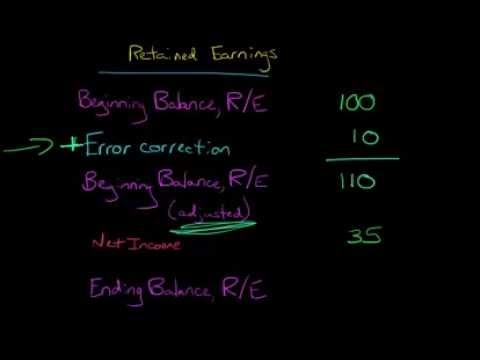

And accounting records could not record this into the accounting system. The entity may disclose it in the audit report or financial statements. This statement breakdown the key information related to the entity’s earnings to readers. That information including the opening balance of retained earnings, net income during the period, the dividend paid, or declaration during the year.Or, if you pay out more dividends than retained earnings, you’ll see a negative balance. The beginning period retained earnings appear on the previous year’s balance sheet under the shareholder’s equity section. The beginning period retained earnings are thus the retained earnings of the previous year. Retained earnings appear under the shareholder’s equity section on the liability side of the balance sheet. Retained earnings are the residual net profits after distributing dividends to the stockholders.

How Dividends Impact Retained Earnings?

These are the long term investors who seek periodic payments in the form of dividends as a return on the money invested statement of retained earnings by them in your company. This can happen when the company pays out more dividends than money is available.

Non-cash items such as write-downs or impairments and stock-based compensation also affect the account. The third line should present the schedule’s preparation date as “For the Year Ended XXXXX.” For the word “year,” any accounting time period can be entered, such as month, quarter, or year. Edriaan Koening began writing professionally in 2005, while studying toward her Bachelor of Arts in media and communications at the University of Melbourne. Koening also holds a Master of Commerce in funds management and accounting from the University of New South Wales. This is to say that the total market value of the company should not change. I did not include aprior period adjustmentin this example because they aren’t typically very common. Prior adjustments imply that something was done incorrectly, reports were misstated, or an error occurred.

See For Yourself How Easy Our Accounting Software Is To Use!

The statement is intended to show how a business will use these profits for future growth. Retained earnings are any remaining profit after accounting for dividend payments to shareholders and any other payments to investors. Between 1995 and 2012, Apple didn’t pay any dividends to its investors, and its retention ratio was 100%. But it still keeps a good portion of its earnings to reinvest back into product development. The company typically maintains a retention ratio in the 70-75% range. It depends on how the ratio compares to other businesses in the same industry. A service-based business might have a very low retention ratio because it does not have to reinvest heavily in developing new products.

A statement of retained earnings is a disclosure to shareholders regarding any change in the amount of funds a company has in reserve during the accounting period. Retained earnings are part of shareholder equity , which appear on the company’s balance sheet . Retained earnings increase if the company generates a positive net income during the period, and the company elects to retain rather than distribute those earnings. Retained earnings decrease if the company experiences an operating loss — or if it allocates more in dividends than its net income for the accounting period. Investors use financial statements to analyze the financial condition of a company before choosing to invest their money.

Is Retained Earnings A Debit Or A Credit?

Thus, retained earnings balance as of December 31, 2018, would be the beginning period retained earnings for the year 2019. As stated earlier, dividends are paid out of retained earnings of the company. Both cash and stock dividends lead to a decrease in the retained earnings of the company. This is the net profit or net loss figure of the current accounting period, for which retained earnings amount is to be calculated.

Which line item appears on both the income statement and the statement of retained earnings?

Firstly, how net income from the current period adds retained earnings to the firm’s total retained earnings. This total appears on both the Balance sheet and the Statement of retained earnings.The opening balance will use for adding with the current net income above. The dividend payments for preferred and common stock shareholders also appear on the current period’s Statement of changes in financial position , under Uses of Cash. Mark’s Ping Pong Palace is a table tennis sports retail shop in downtown Santa Barbara that was incorporated this year with Mark’s initial stock purchase of $15,000. During the year, the company made a profit of $20,000 and Mark decided to take $15,000 dividend from the company.To calculate your retained earnings, you’ll need to produce a retained earnings statement. Find out more about how to calculate retained earnings with our comprehensive guide. Note that in a project finance financial model retained earnings goes negative over the life of the project, but that’s okay It is quite standard. All it is saying is that the project’s paid out more in distributions than it has earned. It has paid out more in distributions to exactly the same amount as the Owners’ Equity.

For Investors

Our courses go into further detail than what we cover here, but hopefully this blog will help you when modeling retained earnings in your financial models. Retained earnings is used to show investors and the market how the business is doing and how much can be reinvested back into its operations or distributed to shareholders. Here’s how to show changes in retained earnings from the beginning to the end of a specific financial period. We believe everyone should be able to make financial decisions with confidence. A cash flow Statement contains information on how much cash a company generated and used during a given period.A statement of retained earnings should include the net income from the income statement and any dividend payments. Typically, this category contains cash dividends to owners of common stock, but would also include any stock dividends. The statement of retained earnings also consists of any outflows to owners of preferred stock and some impacts from changes in employee stock and stock option plans.Product Reviews Unbiased, expert reviews on the best software and banking products for your business. Accounting Accounting software helps manage payable and receivable accounts, general ledgers, payroll and other accounting activities. Business Checking Accounts BlueVine Business Checking The BlueVine Business Checking account is an innovative small business bank account that could be a great choice for today’s small businesses. According to the provisions in the loan agreement, retained earnings available for dividends are limited to $20,000. The purpose of the statement is to see how a company is distributing their profit. The decision to retain the earnings or to distribute it among the shareholders is usually left to the company management. Retained earnings, represent the net income, which has not yet been distributed among the participants/shareholders of the company.

Such a balance can be both positive or negative, depending on the net profit or losses made by the company over the years and the amount of dividend paid. The beginning period retained earnings is nothing but the previous year’s retained earnings, as appearing in the previous year’s balance sheet. Beginning Period Retained Earnings is the balance in the retained earnings account as at the beginning of an accounting period. That is the closing balance of the retained earnings account as in the previous accounting period.This information is educational, and is not an offer to sell or a solicitation of an offer to buy any security. This information is not a recommendation to buy, hold, or sell an investment or financial product, or take any action. This information is neither individualized nor a research report, and must not serve as the basis for any investment decision. All investments involve risk, including the possible loss of capital. Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals. Information is from sources deemed reliable on the date of publication, but Robinhood does not guarantee its accuracy. The main goal of the statement is to find the retention ratio and the payout ratio.

Difference Between Cash Flow Statement And Statement Of Share Holders Equity

This is the amount of income left in the company after dividends are paid and are often reinvested into the company or paid out to stockholders. The accumulated retained earnings balance for the previous year, which is the first line item on the statement of retained earnings, is on both the balance sheet and statement of retained earnings. Dividends are treated as a debit, or reduction, in the retained earnings account whether they’ve been paid or not. Before we go any further, this is a good spot to talk about your small business accounting. To calculate retained earnings, generate other financial statements, and prepare the report, you need accurate financial data.The notes on the Statement of Retained Earnings is very simple and straight forward. It is very critical to have a better understanding of Retained Earnings as it is one of the very important statements that investors look at when reviewing the annual AFS. Investors regard some mature, established firms, as reliable sources of dividend income. Sage 50cloud is a feature-rich accounting platform with tools for sales tracking, reporting, invoicing and payment processing and vendor, customer and employee management. Best Of We’ve tested, evaluated and curated the best software solutions for your specific business needs.Understanding how to properly read financial statements is vital to constructing useful financial ratios. The amount of retained earnings can be used for launching new products or services, expanding business, paying off debts/loans, or pay out dividends.However, some entity prepares it for management purposes or for investors to get easy to analyst entity’s earnings. The amount of retained earnings that a corporation may pay as cash dividends may be less than total retained earnings for several contractual or voluntary reasons. These contractual or voluntary restrictions or limitations on retained earnings are retained earnings appropriations. For example, a loan contract may state that part of a corporation’s $100,000 of retained earnings is not available for cash dividends until the loan is paid. Or a board of directors may decide to use assets resulting from net income for plant expansion rather than for cash dividends. Once accounting for non-operating income and expenses and subtracting taxes, the company showed a net income of $3.9B.Now, add the net profit or subtract the net loss incurred during the current period, that is, 2019. Since company A made a net profit of $30,000, therefore, we will add $30,000 to $100,000. As mentioned earlier, management knows that shareholders prefer receiving dividends. This is because it is confident that if such surplus income is reinvested in the business, it can create more value for the stockholders by generating higher returns. In this article, you will learn about retained earnings, the retained earnings formula and calculation, how retained earnings can be used, and the limitations of retained earnings. Retained earnings represent the portion of the net income of your company that remains after dividends have been paid to your shareholders.A statement of retained earnings can be a standalone document or appended to the balance sheet at the end of each accounting period. Like other financial statements, a retained earnings statement is structured as an equation. Negative retained earnings mean a negative balance of retained earnings as appearing on the balance sheet under stockholder’s equity. A business entity can have a negative retained earnings balance if it has been incurring net losses or distributing more dividends than what is there in the retained earnings account over the years. Thus, at 100,000 shares, the market value per share was $20 ($2Million/100,000). However, after the stock dividend, the market value per share reduces to $18.18 ($2Million/110,000).