We were able to successfully export information from our legacy software which was key for uploading to Acumatica and we dedicated a staff member to recreating AP in 2020. Bill and Jim were extremely helpful keeping us on target and requesting any missing information that we were able to fully onboard in 2 months and begin running parallel systems. This expedited timeline gave us a full month of working with Acumatica in 2020 before using it exclusively in 2021. Encumbrances are for internal planning and monitoring only and will NOT be reflected on invoices or reports to the sponsor.

- The salary encumbrance process calculates costs by individual that will be charged to accounts from a given point in time though a given point in time (represents the anticipated/predicted costs).

- Some accountants claim that this encumbrance accounting confuses the reader of the statement.

- Encumbrances represent amounts a government has committed to pay for goods or services that were not received prior to the end of the fiscal year.

- Restricted fund balance is considered to carry the firmest constraints because they are imposed externally.

- Anderson is CPA, doctor of accounting, and an accounting and finance professor who has been working in the accounting and finance industries for more than 20 years.

Encumbrance accounting is often used as a planning tool for budgetary control, particularly in government organizations using government accounting standards and nonprofits. Encumbrance accounting, also known as commitment accounting, tracks anticipated spending to budgeted amounts. The first step encumbers newly entered purchase order line items into the General Ledger to help prevent overspending. After that, you unencumber the line items once they go into an Accounts Payable invoice for payment. When you construct baseline versions of project budget versions that you enable for Budgetary Control, the application automatically constructs a control budget. How you choose to set the financial plan type attributes affects how you establish control budgets within your project.

Funding

At the same time, government needs good measures of cost, and needs to integrate those cost measures with levels of taxation so that it and its citizens understand what is really happening at any point in time. Furthermore, their financial statements should be more accessible to users and potential users in order to promote the kind of accountability that corporations have to their shareholders. Because nonprofit organizations enjoy tax-exempt status, any taxpayer should have the right to examine their financial statements and compare their financial performance with their objectives and accomplishments. An important related issue is whether the prices charged for services rendered by the current fund cover wear and tear on plant assets.

What is administrative encumbrance?

Administrative Encumbrance – due to non-payment of your tuition fees, not submitting your tax file number, failing to return university equipment or non-completion of the online Academic Integrity Module in your first study period. …

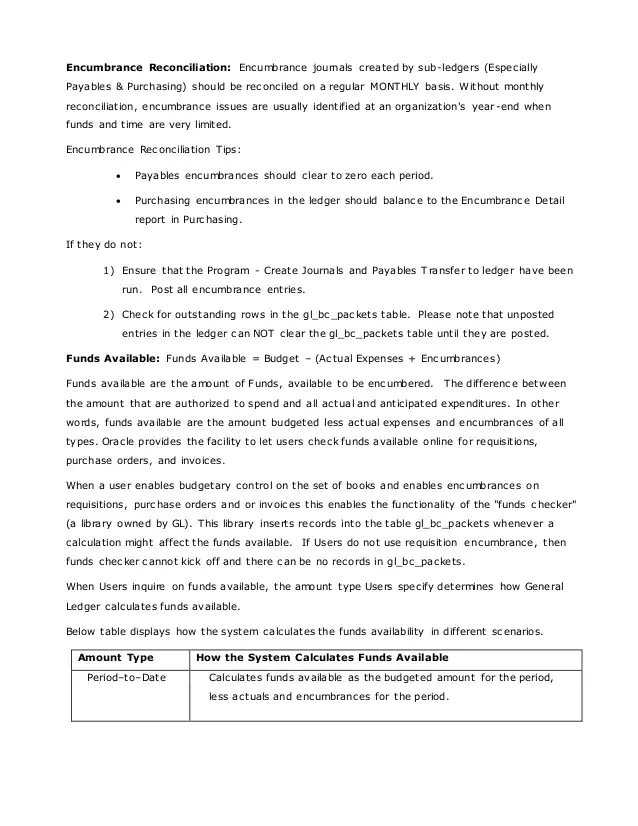

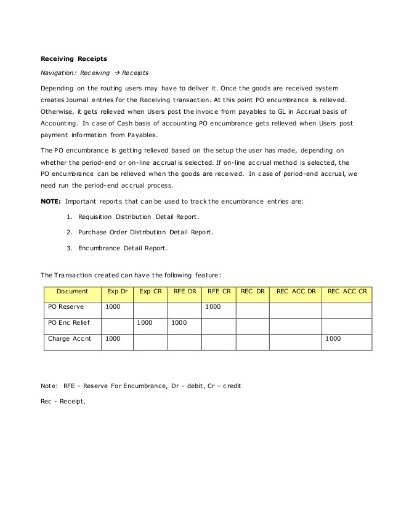

Budgetary control involves additional processes such as validating transactions to determine whether spending is permissible or whether sufficient funds are available. encumbrance accounting is only concerned with creating encumbrance journal entries for documents such as purchase requisitions and purchase orders. An encumbrance is a transaction recorded in the General Ledger that acts as an open commitment for a purchaser to pay for goods or services ahead of the actual purchase. Encumbrance accounting (AKA pre-expenditures) holds purchasers legally responsible for payment and helps businesses forecast spending so they don’t over-spend. An encumbrance refers to funds that are put in reserve after a requisition has been finalized. The purpose of encumbrance accounting is to avoid spending over your budgeted amount. Project managers can enable a project budget’s budgetary control to manage project budget spending at the project level or at each category level.

What Is Encumbrance In Accounting?

Encumbrances represent amounts a government has committed to pay for goods or services that were not received prior to the end of the fiscal year. At present, governments generally report such amounts as reserved fund balance.

For example, the large negative fund balance in the consolidated balance sheet of the U.S. government represents, in part, an investment in future social benefits. The investments made to achieve these benefits should be counted as assets and expensed as the benefits manifest themselves.

Considerations For Implementing Budgetary Control

These questions must be answered in light of what the trustees construe as the institution’s future ability to generate gifts for major additions. For each fund listed in Exhibit III, we shall examine the information that can be gleaned from the statement and suggest questions it should raise for any alert trustees reviewing it. The financial worries of New York City in the early 1970s began registering in the bond market in October 1974, when the city first encountered difficulty selling its securities. These problems reached a crisis stage in 1976, and it was not until then that the bond rating services reduced the city’s bond rating.

An encumbrance is a portion of a budget set aside for spending required by law or contract, but is not actually physically paid out yet, reports Accounting Tools. If business conditions continue as they are when you set the budget, then the encumbrance will become an expense. Conditions, however, may change over the course of a year or over the period set by the budget. Records adjustments to accounts payable encumbrances and reserve for encumbrances.

Encumbrance accounting, when properly implemented, allows for financial information to be seen and analyzed much quicker than a “budget to actual” accounting process. The definition of an encumbrance is not the same as used in the real estate profession, where it means mortgages, property liens, and easements. If you only require budget vs. actual expenditures reports intermittently, this will not call for implementing either Budgetary Control or Encumbrance Accounting. For your financial plan type’s planning amounts, you can choose from Cost, Revenue, or Cost and Revenue. Information about the sources of the funds is needed to evaluate Pepys’s financial management.

Manage Your Business

Upon a transaction’s submission or approval, it performs funds check and funds reservation in order to determine if spending is allowed. Budgetary Control in Oracle ERP Cloud is also closely associated with Encumbrance Accounting. The purpose of Encumbrance Accounting is to avoid spending over your budgeted amount. All requests for reserves for encumbrances are due to the Office of Finance and Administration by July 20.

What is Uncumbered?

Unencumbered refers to an asset or property that is free and clear of any encumbrances, such as creditor claims or liens. An unencumbered asset is much easier to sell or transfer than one with an encumbrance.

Indeed, some aspects of fund accounting already appear in business accounting; FASB Statement 14, on reporting for segments of a business enterprise, is an example. Just as segments of restricted and unrestricted funds must be reported to permit evaluation of the management of these funds, the segments of a business need to be identified with respect to performance and assets. The revenues and expenses spelled out in financial statements are incomplete measures of performance.

Encumbrance accounting helps your company with budget visibility and analysis by recording planned future payments. Rather than just looking at current transactions, this type of accounting encourages tracking upcoming expenses to help show a more detailed view of your cash flow. With encumbrance accounting, future payment obligations are recorded in financial documents as projected expenses. This allows organizations to determine the amount of funds available for future spending.

These observations indicate that the institution is much less solvent than a corporate balance sheet shows. Under business accounting principles, the restrictions on assets and fund balances would no doubt be explained in elaborate footnotes, which usually are not read as carefully as the rest of the report. The funds of a nonprofit enterprise are like a collection of cookie jars in which resources for various purposes are stored. The number represents a limit; if the company spends more, then it has gone over budget.

Understanding Encumbrance

For example, you would choose to use Budgetary Control over Encumbrance Accounting if you wanted all transaction amounts to undergo budget validation while the system processes the transaction in real time. You can configure the control budget to the track control level, which allows you to change the control level at a later time. Perhaps 85% of a budget should be mass encumbered as soon as these obligations are known and liquidated as they are expended, payroll by payroll, and claim by claim. It will be also necessary to make adjustments periodically to the encumbrances to reflect where expenditures are processed below or above expectations. An example would be where staff replacement salaries are below those who have left; or when a mild winter has reduced utility costs. The Business official should direct the Treasurer to implement mass encumbering of all known contractual commitments at latest by the end of the first quarter of each fiscal year and update the mass encumbering monthly.

Although our society clearly profits from education of our children, it is impossible to put an objective value on that education. So such benefits are not included in the accounting statements of nonprofit organizations. So for each group of funds of similar purpose and of material size, the statement reflects revenues flowing in, expenditures, and transfers of capital among funds. The college would not generally have a cash account for each fund; it would keep all cash pooled in a limited number of bank accounts and all endowment fund investments pooled in a portfolio.

All open encumbrances must be liquidated before a budget can be closed to status 4. Records adjustments to purchase order encumbrances and reserve for encumbrances.

When the first invoice is received and/or approved , part of the PO’s encumbrance is converted into an actual expense. Your SpeedType’s encumbered and actual balances are both decreased by the amount of the invoice. Your available balance is not decreased because your available balance already understood there was a claim against the funds. The encumbrance accounting configuration is found in the Nonprofit Accounting Suite, but leverages the Requisitions and Purchase order modules to record encumbrances. At the end of each fiscal year, all firm obligations of the University (purchase orders, shipping releases, contracts, etc.) that are chargeable to unrestricted funds are recorded as an expenditure and encumbrance payable in the encumbrance general ledger. An organization doesn’t have to spend the entire encumbered amount in a single purchase. If it’s involved in three lawsuits, for instance, it can encumber the contingent liabilities for all three, then pay them out one at a time.

In Defense Of Budgetary Accounting

This represents spendable funds that the board of Pepys has added to endowment to establish a source of annual revenues available for restricted purposes. Those who manage and deal with nonprofit institutions should have greater familiarity with the unique requirements of nonprofit financial structures and accounting practices. They should not rely on familiarity with business financial accounting and administration. Clearly these nonprofit organizations—including hospitals, educational institutions, religious groups, arts groups, social agencies, and museums, as well as municipalities—are under pressure to make their financial status better understood. Their managers, their board members or trustees, and taxpayers need to understand and deal with the reports that present their financial condition. At the same time, private nonprofits, increasingly dependent on the financial markets for capital funds, must obtain and maintain satisfactory credit and bond ratings in order to get these funds.

The existence of substantial interfund loans, particularly those of long tenure and in which the “debtor” fund seems to lack the resources to repay such a loan, also indicates fiscal stress. Nonprofits’ objectives differ from those of for-profit organizations to such a degree that similar formats would be misleading and would misdirect those evaluating the financial management of nonprofits. Encumbrance accounting is not used to account for commitments related to unperformed contracts for construction and services. Encumbrance accounting is used in all budgeted funds to reserve portions of applicable appropriations for which commitments have been made. Encumbrance accounting is also employed as an extension of formal budgetary integration in the governmental fund types. Want to see how these PO encumbrances and actual expenses look on your m-Fin Financial Detail report? PO encumbrance entries will show under the Encumb column, with a BAE Code beginning with EN.

The company may require that an officer or controller sign off on a requisition or purchase order before any funds – encumbered or not – are disbursed. This would be the case for required expenses such as tax payments, or the discretionary purchases of equipment and supplies, repairs, travel costs or inventory. The non-encumbered portion of the budget provides room for further discretionary spending as the need arises. A purchase order encumbrance, which is recorded as 83XXXX, is increased when a purchase order is created and is decreased or reversed when an invoice is matched to the purchase order. An accounts payable encumbrance, which is recorded as 03XXXX, is increased when an invoice is entered and is decreased or reversed when an invoice is paid. The encumbrance accounting rules may be used to record adjustments and make corrections to the encumbrance accounts and the reserve for encumbrance accounts. Encumbrance transactions are entered through the Budgetary Control module using the encumbrance adjustment screens.