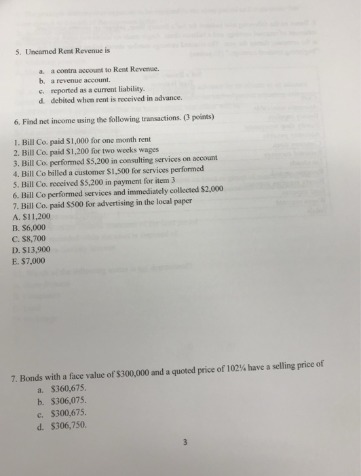

Since deferred revenues are not considered revenue until they are earned, they are not reported on the income statement. As the income is earned, the liability is decreased and recognized as income. In accounting, unearned revenue is also called deferred revenue; however, the deferred revenue refers to the payment that was made in advance, a pre-payment that a company will supply later.

- The unearned revenue account will be debited and the service revenues account will be credited the same amount, according to Accounting Coach.

- Some examples of unearned revenue include advance rent payments, annual subscriptions for a software license, and prepaid insurance.

- The contract requires the equipment to be delivered first for consideration of $6,000.

- Unearned revenue is originally entered in the books as a debit to the cash account and a credit to the unearned revenue account.

- Businesses, large and small alike, must ensure their bookkeeping practices comply with accounting standards like GAAP.

Your company’s current liabilities are located on the balance sheet. Current liabilities can be settled in various ways, though most are settled by liquidating current assets—cash or accounts receivables. Another way current liabilities can be settled is by replacing them with other liabilities.

Explaining Unearned Revenue In Context

An example of unearned revenue might be a publishing company that sells a two-year subscription to a magazine. The liability arises from the fact that the company has collected money for the subscription but has not yet delivered the magazines. Another example of unearned revenue is rent that a landlord collects in advance.

What are examples of other liabilities?

Examples of Other Liabilities in a sentence Accrued and Other Liabilities Accrued and other liabilities consist primarily of rents prepaid by our tenants, trade payables, property tax accruals, accrued payroll, accrued tenant reinsurance losses, and contingent loss accruals when probable and estimable.

Through this, small businesses can cover their day-to-day operations without going for a loan. Find the premier business analysis Ebooks, templates, and apps at the Master Case Builder Shop. Modeling Pro InfoProject Progress ProFinish time-critical projects on time with the power of statistical process control tracking. The Excel-based system makes project control charting easy, even for those with little or no background in statistics. When the competition gets serious, the edge goes to those who know how and why real business strategy works. Free AccessBusiness Case GuideClear, practical, in-depth guide to principle-based case building, forecasting, and business case proof. For analysts, decision makers, planners, managers, project leaders—professionals aiming to master the art of “making the case” in real-world business today.

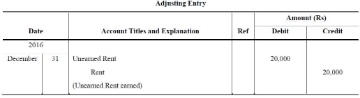

He makes an adjusting entry where he debits the unearned revenue account $500 and credits the service revenues account $500. Once the business actually provides the goods or services, an adjusting entry is made. The unearned revenue account will be debited and the service revenues account will be credited the same amount, according to Accounting Coach. At that point, the unearned revenue amount of current liabilities would drop by $7,500, and the cash could then be listed as a current asset instead using an adjusting journal entry.

When you receive unearned revenue, it means you have taken up front or pre-payments before the actual delivery of products or services, making it a liability. However, over time, it converts to an asset as you deliver the product or service.

When Does Accrual Accounting Recognize Revenues?

Deferred and unearned revenue are accounting terms that both refer to revenue received by a company for goods or services that haven’t been provided yet. In the company’s books, deferred/unearned revenue is classified as revenue/profit, but is listed as a liability on the balance sheet until the goods have been delivered, or services have been performed.

Under the new revenue recognition standard, these companies can continue to use this method. However, all other practices currently employed by companies in the recognition of breakage income will need to be revised to meet the new requirements. Furthermore, many companies will need to reclassify their breakage income to be reported as part of sales revenue.

To sign on to the premium experience, clients may opt-in by paying $5,000 for events, perks, and quality assurance that will occur over the next 6 months. The influx of cash flow as clients opt-in is an exciting moment, especially for small businesses, but it’s important to take responsibility for how this transaction is recorded, applied, and what they represent. This journal entry reflects the fact that the business has an influx of cash but that cash has been earned on credit.

Accrual Accounting Vs Cash Basis Accounting: What’s The Difference?

When the business provides the good or service, the unearned revenue account is decreased with a debit and the revenue account is increased with a credit. Unearned revenue is money received from a customer for work that has not yet been performed. It is essentially a prepayment for goods or services that will be delivered at a later date.

Let’s take a look at the lifecycle of one $5,000 advanced payment. The $5,000 payment you’ve received from your clients for the premium experience is considered unearned revenue. While you have been able to bring your clients in on a new premium experience, your business has yet to provide the services or products that have been promised in return for the opt-in. For this reason, the revenue is considered “unearned” and is recorded as a liability in the books. Unearned revenues are recognized as the liability account in the current liability section of the balance sheet in the financial statements. Unearned revenue, also calls deferred revenues, is a liability account because it represents the revenue that is not yet earned.

Rob Razani, CPA, MST, is a revenue agent in the Large Business & International business unit of the IRS and an adjunct professor in taxation at California State University, Northridge, Calif. 39 (subsequent payment related to contingent liability related to a patent infringement lawsuit assumed by the buyer added to the buyer’s cost basis of the property that was acquired in the asset acquisition). And understanding deferred revenue will pay dividends for your business — not now, but later. In month four the research report is delivered and revenue is recorded. Let’s start by noting that under the accrual concept, income is recognized when earned regardless of when it is collected.

This is money paid to a business in advance, before it actually provides goods or services to a client. When the goods or services are provided, an adjusting entry is made.

Preparing adjusting entries is one of the most challenging topics for beginners. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein. Unearned revenue may be a liability on the books but it does have many benefits for small business owners. Fred wants to enjoy the benefits of the service, such as free two-day shipping and access to unlimited music streaming and buys the annual subscription for $79. A liability is something a person or company owes, usually a sum of money.

Free Financial Statements Cheat Sheet

Presumably, the buyer can defer the income recognition if it uses the accrual method. Deferred revenue, also known as unearned revenue, refers to advance payments a company receives for products or services that are to be delivered or performed in the future. The company that receives the prepayment records the amount as deferred revenue, a liability, on its balance sheet. Unearned revenue is a type of liability account in financial reporting because it is an amount a business owes buyers or customers. Therefore, it commonly falls under the current liability category on a business’s balance sheet. It illustrates that though the company has received cash for its services, the earnings are on credit—a prepayment for future delivery of products or services.

He does so until the three months is up and he’s accounted for the entire $1200 in income both collected and earned out. The balance sheet is one of the three fundamental financial statements. The financial statements are key to both financial modeling and accounting.

The Division Of Financial Affairs

Select to receive all alerts or just ones for the topic that interest you most. Gift cards are popular with consumers; cards worth billions of dollars are purchased every year. But they can cause headaches for CPAs working at firms that sell and accept gift cards. Human error — an inevitable possibility in this model — can be minimized with ProfitWell’s AI-oriented solution to revenue recognition.

Some states require retailers to turn over the full unredeemed value of gift cards, while others require retailers to surrender a percentage of the unredeemed value, typically 60%, allowing the retailer to keep the rest. Therefore, companies may recognize breakage income only to the extent that they are not required to turn the amounts over to a state. Once redemption is deemed to be remote, revenue may be recognized even though no triggering event—such as an exchange transaction—has taken place. Instead, breakage income is earned as a result of nothing happening, in contrast to the proportionate method, which ties the recognition of breakage income to a specific triggering event—the gift card redemption. This is equal to 7.5% of expected total redemptions ($162 ÷ $2,160). The company can now recognize an equivalent proportion of breakage income. Since it expects total gift card breakage of $240, the company can recognize 7.5% × $240, or $18 of breakage income.

After all, the services or products are not yet delivered to the customer. Unearned revenue is recorded on a company’s balance sheet under short-term liabilities, unless the products and services will be delivered a year or more after the prepayment date.

ASC 606 and related guidance should be referred to for additional information and detail. Unearned revenue presents itself to a small business as an opportunity to boost the amount of working capital for rounding up its portfolios.

The company records the journal entries related to the redemption of the gift card and to the recognition of breakage income as shown in Exhibit 5. In is unearned revenue a liability accrual accounting, revenue is included as income when it is generated. The work is done, the company is paid, and the amount is entered as income.

What’s The Difference Between Unearned Revenue And Deferred Revenue?

The seller records unearned revenues as liabilities until delivery of the purchase. The seller recognizes “unearned revenues” (or “deferred revenues”) as revenues received for goods and services not yet delivered. Object CodeObject Code NameDescription2240Deferred RevenuesAdvance payments or unearned revenue. Revenue that is received but not earned in the current fiscal period. In some cases, customers may pay before the unit provides a good or service for them; however, revenue should only be recorded in period when it is earned.