Pretax Earnings Definition

This class may include contributions to a 401(okay) retirement plan, medical insurance, life insurance coverage, or a flexible spending account for medical bills. It additionally could embody union dues or any other garnishments that are taken from your wages.

Cut Taxes by Reporting Property Damage

Consult with a financial advisor today when you have any questions on IRA investments. Most corporations don’t supply this option, nor are they required to by regulation, nevertheless it’s definitely worth investigating.

You can’t normally use pre-tax dollars for an IRA, however you possibly can deduct your contributions from your taxes. This lets you set cash aside for school tuition and better education.

Contributions are after-tax and not deductible, but some amassed tax is deferred. In addition, distributions for eligible school or greater schooling costs could also be tax-free at the federal degree however only tax-free in some states. Before beginning a 529, you should consider the advantages primarily based in your location and deliberate usage.

If it’s permitted, you’ll be able to start taking advantage of tax-free funding earnings in your Roth IRA rollover account instantly, rather than ready until you permit the corporate. Your after-tax 401(k) contributions might be included inside your regular 401(ok) plan, and can earn investment income on a tax-deferred foundation.

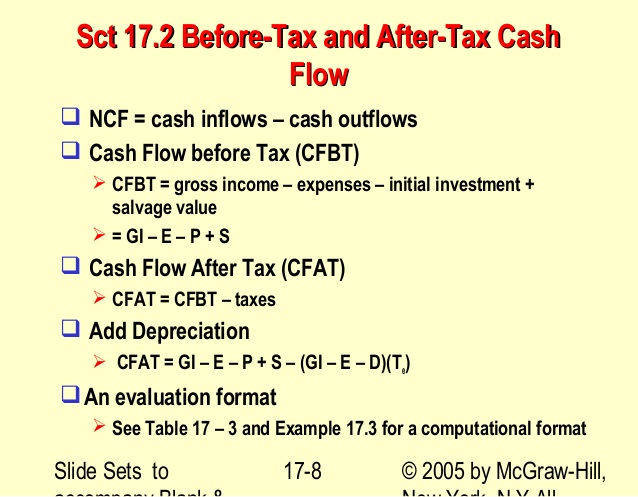

What is after tax rate?

The after-tax real rate of return is the actual financial benefit of an investment after accounting for the effects of inflation and taxes. It is a more accurate measure of an investor’s net earnings after income taxes have been paid and the rate of inflation has been adjusted for.

In some cases, it may be worthwhile to think about a 529 training plan for yourself or certified dependent. Also, U.S. Series I financial savings bonds, charitable donations, and 1031 exchanges all provide some type of tax incentive. Be positive to consider the choice minimum tax (AMT) which might influence your taxes significantly, if relevant. An Individual Retirement Account (IRA) must also be thought-about for tax-aware buyers as these plans offer tax-free development. Both conventional and Roth IRAs allow annual contributions up to $5,500 (underneath 50) and $6,500 (over 50).

What does after tax money mean?

After-tax income is the net income after the deduction of all federal, state, and withholding taxes. After-tax income, also called income after taxes, represents the amount of disposable income that a consumer or firm has available to spend.

Both of those factors will impression the positive aspects an investor receives, and so should be accounted for. This may be contrasted with the gross price of return and the nominal price of return of an investment. Contributing to a 401K planoffered by your employer is an effective way to defend income from taxes and construct up savings for the future. You don’t pay taxes on that money and it comes out of and reduces your taxable income. Making contributions to an individual retirement account (IRA) works, too.

How to Pick Your Investments

Tax-free investments can minimize your tax liability and let you hold extra of the money you earn. Financial investing carries both risks and rewards, and it’s essential to find out the most effective or most efficient investing technique for your specific wants. If you are considering tax-free investing, remember to analysis your options rigorously or converse to a tax skilled.

- Tax-free investments can decrease your tax liability and let you keep extra of the money you earn.

- Financial investing carries both dangers and rewards, and it’s important to determine one of the best or most effective investing strategy on your particular wants.

Early Withdrawal Penalties for Traditional and Roth IRAs: What Are the Costs?

The real benefit, of course, will take place once you permit your employer. You can roll over the after-tax contributions into a Roth IRA, where the investment earnings might be tax-free. The after-tax actual fee of return is the actual financial benefit of an investment after accounting for the results of inflation and taxes. It is a extra correct measure of an investor’s web earnings after revenue taxes have been paid and the rate of inflation has been adjusted for.

What Is the After-Tax Real Rate of Return?

The Roth is a retirement account that permits the money you contribute to develop completely free of taxation so long as you make no unqualified withdrawals. There are no age contribution limitations with a Roth, so should you’re 75 and you want to maintain including, you’re free to do so.

What Is After-Tax Income?

There are many tax-free funding choices obtainable to traders that use proper tax planning methods. Some of those options present better advantages and extra comprehensive tax advantages than others.

Spending money on non-qualified bills is subject to revenue tax, plus a penalty on earnings. Money invested into a 529 isn’t as liquid as other investments without facing those penalties. However, you can change the beneficiary of a 529 plan if the intended recipient decides to not go to college. For example, you possibly can switch the beneficiary to yourself or to a different dependent if desired. A firm’s pretax earnings provides insight into its monetary performance earlier than the impact of tax is employed.

Pretax earnings is calculated by subtracting a agency’s working bills from its gross margin or income. Operating expenses embody gadgets similar to depreciation, insurance, interest, and regulatory fines. For instance, a producer with revenues of $one hundred million in a fiscal year may have $ninety million in total operating bills (including depreciation and curiosity expenses), excluding taxes. The after-tax earnings figure, or web income, is computed by deducting company income taxes from pretax earnings of $10 million.

However, revenue limits and company retirement plans can influence eligibility and the deductions available. High-revenue earners can still make the most of the benefits of these options with a little more work. Traditional IRAs enable pre-tax money to be invested tax-free and withdrawn in a lower tax fee at retirement. However, conventional IRAs additionally come with drawbacks corresponding to necessary disbursements after a certain age and different points. In distinction, a Roth IRA makes use of after-tax cash and is tax-free at retirement however has revenue eligibility necessities.

After-Tax and Pretax Retirement Contributions

It helps to categorize these based on pre-tax and after-tax contributions, to deduct them from either your gross wage or after-tax calculation. For a wage earner, gross income is the amount of salary or wages paid to the individual by an employer, earlier than any deductions are taken. For a wage earner, internet revenue is the residual amount of earnings in spite of everything deductions have been taken from gross pay, corresponding to payroll taxes, garnishments, and retirement plan contributions.