Alternatively, the future value of $3,000 in one year’s time equals $3,000 multiplied by 1.10 percent, or $3,300. Another issue with relying on NPV is that it does not provide an overall picture of the present value formula gain or loss of executing a certain project. To see a percentage gain relative to the investments for the project, internal rate of return or other efficiency measures are used as a complement to NPV.

The time value of money is the concept that a sum of money has greater value now than it will in the future due to its earnings potential. Future value is the value of a currentassetat a specified date in the future based on an assumed rate of growth. The FV equation assumes a constant rate of growth and a single upfront payment left untouched for the duration of the investment.

Calculate Present Value

She most recently worked at Duke University and is the owner of Peggy James, CPA, PLLC, serving small businesses, nonprofits, solopreneurs, freelancers, and individuals.

Calculating present value involves assuming that a rate of return could be earned on the funds over the period. The present value of money is, simply put, how much a future amount is worth now. Suppose you have been promised a payment of $1,000 in 10 years. That money has a present value much less than $1,000 because it will grow to $1000 over those 10 years. Dividend Growth ModelThe Dividend Discount Model is a method of calculating the stock price based on the likely dividends that will be paid and discounting them at the expected yearly rate. In other words, it is used to value stocks based on the future dividends’ net present value. There is an NPV function in Excel that makes it easy once you’ve entered your stream of costs and benefits.

Keen investors can compare the amount paid for points and the discounted future interest payments to find out. Let us take the example of David who seeks to a certain amount of money today such that after 4 years he can withdraw $3,000. The applicable discount rate is 5% to be compounded half yearly. We are applying the concept to how much money we need to buy a business.

Why is present value calculated?

Present value is important because it allows investors to judge whether or not the price they pay for an investment is appropriate. For example, in our previous example, having a 12% discount rate would reduce the present value of the investment to only $1,802.39.

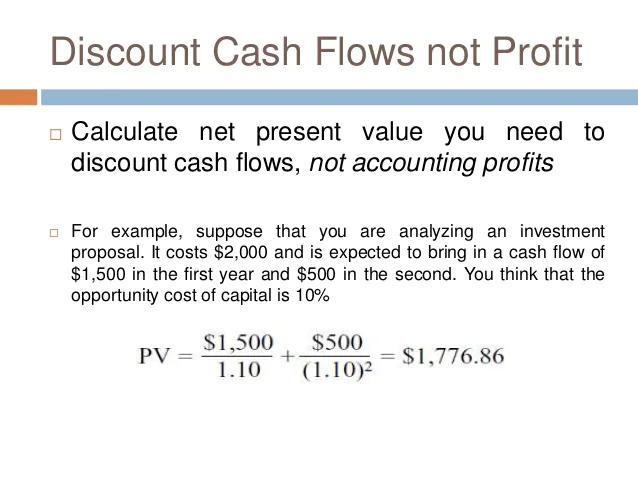

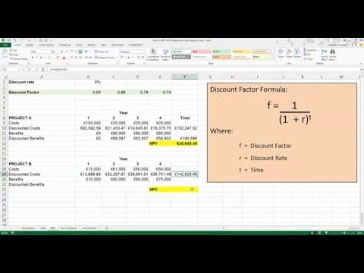

If you want to calculated semi-annual interest, you’ll need to divide these numbers in half. When it comes to investment appraisal, it can be highly beneficial to know how to calculate net present value. Find out exactly what you can learn from net present value and get the lowdown on the best net present value formulas to use for your business.

Present Value Calculator And The Present Value Formula

In this article, we will explain four types of revenue forecasting methods that financial analysts use to predict future revenues. Adjusted Present Value of a project is calculated as its net present value plus the present value of debt financing side effects. To make things easy for you, there are a number of online calculators to figure the future value or present value of money. Peggy James is a CPA with over 9 years of experience in accounting and finance, including corporate, nonprofit, and personal finance environments.

In such cases, that rate of return should be selected as the discount rate for the NPV calculation. In this way, a direct comparison can be made between the profitability of the project and the desired rate of return. The rate used to discount future cash flows to the present value is a key variable of this process. Time value of money is the concept that receiving something today is worth more than receiving the same item at a future date. The presumption is that it is preferable to receive $100 today than it is to receive the same amount one year from today, but what if the choice is between $100 present day or $106 a year from today? A formula is needed to provide a quantifiable comparison between an amount today and an amount at a future time, in terms of its present day value. We have our rate at 6% listed first, and you can see below each year and the cash flow associated with that year.

For example, an investor might decide he must earn at a minimum a 2 percent yield for each of two years to justify an investment’s associated risk. The present value methodology infers that the current value of a future sum of cash is of greater value than is the future cash sum. To value the future cash flow, care must be taken when selecting a discount rate. The NPV is a metric that is able to determine whether or not an investment opportunity is a smart financial decision. NPV is the present value of all the cash flows , which means that the NPV can be considered a formula for revenues minus costs.

Calculating The Present Value Of A Single Amount Pv

NPV is based on future cash flows and the discount rate, both of which are hard to estimate with 100% accuracy. The accurate calculation of NPV relies on knowing the amount of each cash flow and when each will occur. For securities like bonds, this is an easy requirement to meet. The bond clearly states when each coupon payment will occur, the size of each payment, when the principal will be repaid, and the cost of the bond. Any implied annual rate, which could be inflation or the rate of return if the money was invested, could be expected to lose value in the future.

Such series of payments made at equal intervals is called an annuity. It may be safer for the consumer to pay some interest on a lower sticker price than to pay zero interest on a higher sticker price. It only makes sense to pay mortgage points now in exchange for lower mortgage payments later if the present value of future mortgage savings is greater than the mortgage points paid today. The present value provides a basis for determining the fairness of any future assets or liabilities. For example, having a potentially higher purchase price may or may not be worth having a possible cash refund reduced to present value. When buying a vehicle, the same financial equation applies to 0% financing.

The certainty equivalent model can be used to account for the risk premium without compounding its effect on present value. The NPV of a sequence of cash flows takes as input the cash flows and a discount rate or discount curve and outputs a present value, which is the current fair price. The present value of an annuity is the cash value of all future payments given a set discount rate. Knowing this formula can help you determine the value of your annuity or structured settlement if you choose to sell future payments for cash. High discount rates decrease the present value of your annuity. Money not spent today could be expected to lose value in the future by some implied annual rate, which could be inflation or the rate of return if the money was invested. Present value is thecurrent value of a future sum of money or stream of cash flow given a specified rate of return.

Knowing how to write a PV formula for a specific case, it’s quite easy to tweak it to handle all possible cases. Simply provide input cells for all the arguments of the PV function. If some argument is not used in a particular calculation, the user will leave that cell blank. As shown in the screenshot below, the annuity type does make the difference. With the same term, interest rate and payment amount, the present value for annuity due is higher. These examples assume ordinary annuity when all the payments are made at the end of a period. Please pay attention that the 3rd argument intended for a periodic payment is omitted because our PV calculation only includes the future value , which is the 4th argument.

The Formula For The Present Value Of A Future Amount

There are three places where you can make misestimates that will drastically affect the end results of your calculation. If you’re buying a piece of equipment that has a clear price tag, there’s no risk. The larger the positive number, the greater the benefit to the company. The last present value formula available is also the most accurate. The XNPV function requires one more input when compared to NPV being the date of the future lease payment. An advantage of NPV is that the discount rate can be customized to reflect a number of factors, such as risk in the market. In theory, an investor should make any investment with a positive NPV, which means the investment is making money.

- We hope you enjoyed this brief look at evaluating investments using the present value formula.

- It would probably go to trial, figuring it has nothing to lose, unless a trial would be a ‘slam dunk’ for plaintiff.

- If you don’t have access to an electronic financial calculator or software, an easy way to calculate present value amounts is to use present value tables .

- The word “discount” refers to the future value being discounted to the present.

- It only makes sense to pay mortgage points now in exchange for lower mortgage payments later if the present value of future mortgage savings is greater than the mortgage points paid today.

- However, if none of the options has a positive NPV, the investor will not choose any of them; none of the investments will add value to the firm, so the firm is better off not investing.

- The following years you will receive more cash due to an increase in production of widgets.

In finance, the net present value or net present worth applies to a series of cash flows occurring at different times. The present value of a cash flow depends on the interval of time between now and the cash flow. A discount rate directly affects the value of an annuity and how much money you receive from a purchasing company. The discount rate is the investment rate of return that is applied to the present value calculation.

Time Value Of Money

Reinvestment rate can be defined as the rate of return for the firm’s investments on average, which can also be used as the discount rate. The discount rate is the rate of return on investment applied to the calculation of the Present Value . In other words, if an investor chose to accept an amount in the future over the same amount today, the discount rate would be the forgone rate of return. Present value , also known as discounted value, is a financial calculation to find the current value of a future sum of money or cash stream in today at a specific rate of return. In simple terms, it compares the buying power of one dollar in the future to the purchasing power of one dollar today. Yet another issue can result from the compounding of the risk premium.

For example, if an investor receives $1,000 today and can earn a rate of return 5% per year, the $1,000 today is certainly worth more than receiving $1,000 five years from now. If an investor waited five years for $1,000, there would be an opportunity cost or the investor would lose out on the rate of return for the five years.

Not to mention the right-of-use asset is derived from the lease liability. If your lease liability present value calculation is incorrect, so is the right-of-use asset value. In contrast, if you must wait five years to receive the $5,000, you incur an opportunity cost in the form of the interest that you could have otherwise earned on the principal for three years.

How To Create Present Value Calculator In Excel

Present Value, or PV, is defined as the value in the present of a sum of money, in contrast to a different value it will have in the future due to it being invested and compound at a certain rate. Step #5 –Next, determine the difference between the discount rate and the growth rate. Step #4 –Next, determine the growth rate, if any, corresponding to the infinite cash flows.

Disadvantages Of The Npv Method

Remember, at time 0 , you must outlay $500,000 in order to receive the new piece of machinery. The following years you will receive more cash due to an increase in production of widgets.

Many of you readers are in industries which have some sort of equity or variable compensation in your annual income. Any honest accounting of an offer evaluates your compensation other than salary, such as stock, options, or bonuses with some sort of a present value calculation . We see that the present value of receiving $1,000 in 20 years is the equivalent of receiving approximately $149.00 today, if the time value of money is 10% per year compounded annually. The answer tells us that receiving $1,000 in 20 years is the equivalent of receiving $148.64 today, if the time value of money is 10% per year compounded annually.

Another advantage of the NPV method is that it allows for easy comparisons of potential investments. As long as the NPV of all options are taken at the same point in time, the investor can compare the magnitude of each option. When presented with the NPVs of multiple options, the investor will simply choose the option with the highest NPV because it will provide the most additional value for the firm. However, if none of the options has a positive NPV, the investor will not choose any of them; none of the investments will add value to the firm, so the firm is better off not investing.

Future Value tells you what an investment will be worth in the future, while Present Value tells you how much you would need to earn a specific amount in the future in today’s dollars. It gives you an idea of how much you may receive for selling future periodic payments.

An alternative to using discount factor to adjust for risk is to explicitly correct the cash flows for the risk elements using rNPV or a similar method, then discount at the firm’s rate. If you own an annuity or receive money from a structured settlement, you may choose to sell future payments to a purchasing company for immediate cash. Getting early access to these funds can help you eliminate debt, make car repairs, or put a down payment on a home. Let us take another example of John who won a lottery and as per its terms, he is eligible for yearly cash pay-out of $1,000 for the next 4 years. Calculate the present value of all the future cash flows starting from the end of the current year. In many cases, a risk-free rate of return is determined and used as the discount rate, which is often called the hurdle rate. The rate represents the rate of return that the investment or project would need to earn in order to be worth pursuing.

An NPV calculated using variable discount rates may better reflect the situation than one calculated from a constant discount rate for the entire investment duration. Refer to the tutorial article written by Samuel Baker for more detailed relationship between the NPV and the discount rate. Company management also use this theory when investing in projects, expansions, or purchasing new equipment. By using the net present value formula, management can estimate whether a potential project is worth pursuing and whether the company will make money on the deal. For instance, when someone purchases a home, they are often offered the opportunity to pay points on the mortgage to reduce insurance payments.