This may require an adjusting entry to reclass rent expense to a prepaid account. Going forward, a monthly entry will be booked to reduce the prepaid expense account and record rent expense.

A prepaid is when you pay for a good or service in advance, so it represents an expenditure that has future benefit, and assets are things with future benefit. The BlackLine Journal Entry product is a full Journal Entry Management system that integrates with the Account Reconciliation product. It provides an automated solution for the creation, review, approval, and posting of journal entries. This streamlines the remaining steps in the process of accounting for prepaid items. Manufacturing companies may treat their rent expenses slightly differently.

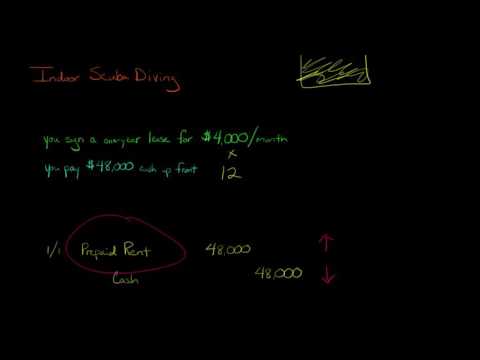

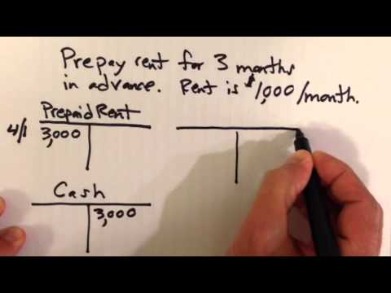

It is current asset account that reports the amount of future rent expense that was paid in advance of the rental period. The amount reported on the balance sheet is the amount that has not yet been used or expired as of the balance sheet date. Prepaid rent is shown as a current asset in the company’s balance sheet. Each time the company pays rent in advance, it must debit the current assets account for the amount of the rent prepayment, then write a simultaneous credit entry to the cash account. So, if XYZ Company paid the entire $27,000 annual rent in advance, it would debit the current prepaid assets for $27,000 and credit cash for $27,000. Non-refundable rent payments that cover the rent for future months are carried on the books of the owner of the property as deferred unearned revenue. The amount is carried on the books of the business renting the property in the prepaid rent expense account.

Furthermore, the landlord is not required to produce a detailed receipt at the time prepaid rent is accepted. The landlord may not deduct from the security deposit for ordinary wear and tear. Moreover, in cases of deductions for damages, the landlord is required to provide an itemized statement of the damages allegedly caused and the estimated or actual cost for repairing or replacing each item. The landlord is also required to attach copies of any paid receipts for repair or replacement to the statement.

Rent expenses have a direct impact on the amount of cash in your corporate vault. AccountDebitCreditPrepaid rent000Cash000Likewise, the journal entry here doesn’t involve an income statement account as both prepaid rent and cash are balance sheet items. Hence, the journal entry above is simply increasing one asset together with the decreasing of another asset . To create your first journal entry for prepaid expenses, debit your Prepaid Expense account. This account is an asset account, and assets are increased by debits. Credit the corresponding account you used to make the payment, like a Cash or Checking account.

Accounting

A balance sheet is a summary of the financial position of a company at a specific moment in time. Until the amount is actually applied in payment for a month’s use of the leased property, it must be properly represented as a current asset when the company generates its financial statements. The prepaid rent account allows the company to show that it has a current asset that will benefit the company at a future date. Regardless of whether it’s insurance, rent, utilities, or any other expense that’s paid in advance, it should be recorded in the appropriate prepaid asset account. Deferred rent is a liability account representing the difference between the cash paid for rent expense in a given period and the straight-line rent expense recognized for operating leases under ASC 840. When a rent agreement offers a period of free rent, payments are not due to the lessor or landlord. However, you are recording the straight-line rent expense calculated by dividing the total amount of required rent payments by the number of periods in the lease term.

Accordingly, a landlord may accept prepaid rent (e.g., first and last months’ rent) and deposit the same with other funds or in the same account used to deposit regular monthly rents. Moreover, landlords are not required to deposit prepaid rent in an interest-bearing account in a bank or other financial institution located within Illinois.

This change is automatic and does not require permission from the IRS in advance. An immediate one-time deduction is available for the previously capitalized prepaid expenses that would have been deducted under the new method for the year the change is made.

Adjustments For Prepaid Expenses

Often, they are translated as deferred expenses, but this is not entirely true. In essence, being such, they, according to the definition of current assets, must be consumed within one year from the date of the balance sheet.

Can a landlord demand rent in advance?

Under common law, providing the landlord gives a written tenancy agreement rent is payable in advance, otherwise a landlord cannot demand it – with no written agreement a residential tenant can legally demand to pay rent in arrears.

In particular, the GAAP matching principle, which requires accrual accounting. Accrual accounting requires that revenue and expenses be reported in the same period as incurred no matter when cash or money exchanges hands. Thus, prepaid expenses aren’t recognized on the income statement when paid, because they have yet to be incurred. Prepaid expenses are not recorded on an income statement initially. Instead, prepaid expenses are initially recorded on the balance sheet, and then, as the benefit of the prepaid expense is realized, or as the expense is incurred, it is recognized on the income statement.

Last Month’s Rent

Since the policy lasts one year, divide the total cost of $1,800 by 12. The landlord’s mailing by first class mail to the address provided in writing by the tenant, within 60 days of the refund or itemized accounting, or both, is sufficient compliance with this chapter. If the landlord does not refund the entire deposit, the landlord, within the 60-day period, shall provide the tenant an itemized list of amounts withheld.

Prepaid expenses only turn into expenses when you actually use them. The value of the asset is then replaced with an actual expense recorded on the income statement. The process of recording prepaid expenses only takes place in accrual accounting.

Rather than account for fluctuating rent payments, it’s common to list a company’s rent expenses as a consistent amount from month to month. In a situation where a tenant pays the $10,000 to cover the entire year in advance, it’s necessary to adjust the books monthly to account for the shifting value of the asset. The tenant will have used up one month of the lease agreement by the end of the first month. This means that the books must be adjusted to reflect the value of $10,000 x 1/12. The tenant will repeat this every month until the prepaid balance no longer has value as an asset because it’s down to $0.

One of the more common forms of prepaid expenses is insurance, which is usually paid in advance. Similar to the treatment of prepaid rent, under ASC 842 the accruals are recorded to the ROU asset instead of a separate accrued rent account. Under ASC 842, you would see the same entries, but the prepaid rent would be recorded to the ROU asset in place of a separate prepaid rent account. For both the legacy and new lease accounting standards, the timing of the rent payment being known is the triggering event.

If an entity has a capital or finance lease, payments reduce the capital lease liability and accrued interest, and are therefore, not recorded to rent or lease expense. Recent updates to lease accounting have changed the accounting treatment for some types of leasing arrangements. In short, organizations will now have to record both an asset and a liability for their operating leases.

The business will periodically generate a set of financial statements to summarize its financial position. These statements conform to a set of generally accepted accounting principals that standardize financial reporting so businesses can be compared to one another against a common backdrop. Standard accounting conventions specify how to carry outstanding rent deposits for a lease on the books until such a time as the deposit is actually applied as payment for a month’s rent. Both rent expense and lease expense represent the periodic payment made for the use of the underlying asset. Organizations may have a leasing arrangement or a rental agreement. Let’s start with collecting the rent, security deposit and prepaid rent. Use the rental item that points to your rental income for the rent collected for the first month’s rent.

Do prepayments affect profit?

Prepayments help you to understand how much profit your business is making in any given month. For example, if you make a payment that covers several months, but you record it as a lump sum in the month when you made payment, it will affect your profit margins for that month.

Landlord shall be entitled to immediately endorse and cash Tenant’s prepaid Rent; however, such endorsement and cashing shall not constitute Landlord’s acceptance of this Lease. In the event Landlord does not accept this Lease, Landlord shall return said prepaid Rent. Prepaid Rent.The amount of prepaid rent, separate from the security deposit, is __________________________________ Dollars ($_____________), covering the period from ________ to ________. The new law would allow tenants to prepay rent, which would not be considered a deposit, and would be held in trust for the tenant and withdrawn by the landlord as rent payments come due.

Checking Your Browser Before Accessing Accountingcapital Com

Explore the purpose of a balance sheet, its components, and presentation format, wherein both sides must be equal. The accounting cycle refers to the specific steps used to complete the accounting process and maintain an organization’s financial records.

- That said, there are situations when upfront payments of rent that exceed the security deposit limit are in everyone’s interest.

- These types of payment terms are known as in-substance fixed rent.

- Prepaid assets are an asset that represents the spent funds, the benefits of which will be received, that is, they will be consumed within one year from the date the balance sheet is drawn up.

- Rent not tied to production such as office space is charged to SG&A.

- In order to provide proper notice, the landlord is obligated to notify the tenant that the security deposit has been transferred to and is being held by the successor landlord.

- This accounting convention is particularly important when generating a balance sheet.

This statement must be provided within 30 days after the tenant vacates the property. A young couple had been given funds from a Grandparent that was to be used for rent.

Other Prepaid Expenses

The balance sheet is one of the three fundamental financial statements. The financial statements are key to both financial modeling and accounting. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. To recognize prepaid expenses that become actual expenses, use adjusting entries.

Such notice must be given to the tenant within 10 days from the date of such transfer. The notice must contain the successor landlord’s name, business address, and the business telephone number of the successor landlord’s agent, if applicable. The notice must be in writing and must be hand-delivered or mailed to the tenant’s last known address.

We have four office locations, serving hundreds of clients and thousands of communities throughout Illinois, Indiana, and Wisconsin. Our attorneys are also licensed in Arizona, Florida, and Missouri. WILMOTH Group is headquartered in Indianapolis and Fort Myers, Fla.

Each piece of the funds collected will post the the proper category on the chart of accounts. So, if ABC company is preparing its income statement for June, and June’s rent comes to $5,000, then ABC would record a rent expense of $5,000. The company makes the same entry regardless of whether it paid the rent in June or in May.

Prepaid Rent And Accounting Principles

Record a prepaid expense in your business financial records and adjust entries as you use the item. To calculate prorated rent using this approach you begin by multiplying the monthly rent by 12 to get the annual rent amount. Then, multiply it by the number of days the tenant will be paying for. With respect to prepaid rent, it is not recommended to collect last month’s rent in advance. Although last month’s rent can provide a sense of security in the event that your tenant decides to skip out on the lease early, it can also lead to headaches down the line. Accounting utilizes journals, which are books documenting all business transactions, and also trial balance, which is a list of all business accounts. Discover what goes into these meticulous ways of keeping records and the significance of journal entries and trial balance to accurate accounting.