For investors, a negative stockholders’ equity is a traditional warning sign of financial instability. It may also affect a company’s ability to secure financing or investment. It can also make it difficult for investors to assess the company’s financial health using traditional metrics since a negative stockholders’ equity can skew important financial ratios like the debt-to-equity ratio.

You can refinance up to 120% of your loan value with a VA IRRRL, which makes it a great choice for homeowners with negative equity. There are a few special programs that you may be able to use to refinance a loan with negative equity. You may be able to use Fannie Mae’s High Loan-To-Value Refinance program if you have a conventional mortgage. A High LTV Refinance can allow you to refinance a loan when you owe more money than your home is worth. Let’s say that you want to buy a home worth $150,000 and you have a 10% down payment of $15,000.

Negative Equity

A person buys a car that is worth $50,000 in the market, and he finances it using a loan with an interest rate of 5%, which needs to be paid over five years. Negative shareholders’ equity could be a warning sign that a company is in financial distress. It’s also possible that a company spent its retained earnings, as well as the funds from its stock issuance, by purchasing costly property, plant, and equipment. When a company conducts a share repurchase, it spends money to buy outstanding shares.

Like a High LTV Refinance, a Relief Refinance can help you refinance a loan even if you have negative equity. We’ll talk about how negative equity can occur and how you can avoid it. We’ll also go over the options you have if you have negative equity in your home. If some or all of a home is purchased by means of a mortgage, the lending institution has an interest in the home until the loan obligation has been met. Home equity is the portion of a home’s current value that the owner possesses free and clear. In other words, negative shareholders’ equity should tell an investor to dig deeper and explore the reasons for the negative balance.

It happens when the value of the asset remains constant, but the amount of the loan balance goes up. It can be due to the borrower not making sufficient repayments to the lender. Since 2007, those most exposed to negative equity are borrowers who obtained loans of a high percentage of the property value (such as 90% or even 100%).

Rocket Sister Companies

You can continue to make payments on your loan if you’re comfortable in your home and you can manage your payments. When home values rise again, you can eventually sell or refinance your home once your equity is out of the negative. When you sell your home, you typically use the money from the sale to pay off your existing mortgage. If there’s still an outstanding balance after the sale, you need to cover it before your lender closes your loan. To understand negative equity better, it is important that we first understand what positive equity is. A typical asset that is financed by a loan is denoted as positive equity for the owner.

To understand negative equity, we must first understand “positive equity” or rather as it is commonly referred to, home equity. Negative stockholders’ equity does not usually mean that shareholders owe money to the business. Under the corporate structure, shareholders are only liable for the amount of funds that they invest in a business. Freddie Mac’s version of the High LTV Refinance is the Relief Refinance.

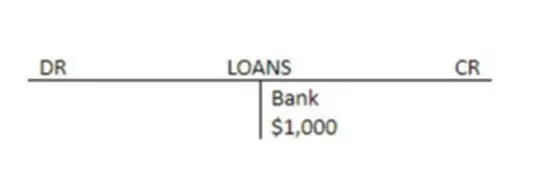

A house or car is normally financed through some sort of debt (such as a bank loan or mortgage). The price of a house can decline due to fluctuating real estate prices, and the price of a car can fall due to rapid use (depreciation). When the value of the asset drops below the loan/mortgage amount, it results in negative equity.

- Over time, a company will earn revenue and, hopefully, generate profits, which it can use to pay down its liabilities, reducing its negative equity.

- For listed companies, at times, a negative balance can appear for the equity line-item of the balance sheet.

- Accumulated losses over several periods or years could result in negative shareholders’ equity.

- You may have a tough time getting a refinance because lenders can’t loan out more money than your property is worth.

- You can continue to make payments on your loan if you’re comfortable in your home and you can manage your payments.

A negative balance may appear in the stockholders’ equity line item in the balance sheet. Negative stockholders’ equity is a strong indicator of impending bankruptcy, and so is considered a major warning flag for a loan officer or credit analyst. However, it can also mean that a business is in the ramp-up stage, and has used a large amount of funds to create products and infrastructure that will later yield profits. This situation is particularly common when a company has acquired another entity, and then amortizes the intangible assets recorded as part of the acquisition.

Meaning of negative equity in English

Accumulated losses over several periods or years could result in negative shareholders’ equity. In the balance sheet’s shareholders’ equity section, retained earnings are the balance left over from profits, or net income, and set aside to pay dividends, reduce debt, or reinvest in the company. A typical example of negative shareholder equity is when significant dividend payments are made to investors, which erode the retained earnings and make the equity of the company go into the negative zone.

Negative Equity – Implications

In real estate jargon, If the outstanding dollar amount remaining on mortgage is larger than what the home is worth, the property, the mortgage, and the homeowner are said to be underwater. When you refinance, you replace your old mortgage loan with a new loan that has more manageable terms. A refinance can allow you to lower your monthly payment by taking a lower interest rate or by lengthening your term. A refinance won’t improve the value of your home, but it can help you avoid foreclosure while you wait for local home values to rise.

But remember that mortgage lenders can’t close your loan until you pay off the entire balance of the outstanding loan. This means that if you can’t sell your home for at least enough to cover your current mortgage, you’ll need to pay your lender the rest in cash. In most circumstances, your home equity increases over time as you make payments on your loan. But if property values fall, you may find yourself with no equity or even negative equity. A person who has negative equity is said to have a negative net worth, which essentially means that the person’s liabilities exceed the assets he owns. When the opposite happens—when current market value of a home falls bellows the amount the property owner owes on their mortgage—that owner is then classified ashaving negative equity in the home.

Example of Negative Equity in the Real World

You may have a tough time getting a refinance because lenders can’t loan out more money than your property is worth. In this example, you could only refinance up to $120,000 of your home loan because that’s what your home is worth. The acquiring entity records the intangible assets of the acquired company at the fair market value, potentially, for the moment, inflating the company’s assets value. As the intangible assets are amortized, this can overwhelm already low or negative retained earnings, especially for firms that financed an acquisition largely with debt, sinking shareholder equity turn negative. Refinancing a home loan with negative equity is more complicated than a standard refinance. Under most circumstances, a lender cannot loan you more money than your home is worth.