A multi-step income statement includes much of the information found in a single-step format, but it makes use of multiple equations to determine the profit, or net income, of a business. Multi-step income statements break down operating expenses and operating revenues versus non-operating expenses and revenues. This process separates expenses and revenues directly related to the business’s operations from those not directly related to its operations.

It is usually known as Trading Account as well where Direct Incomes and Expenses are mentioned. It provides detailed insight into the breaks involved in the calculation of net income. It requires companies to record when revenue is realized or realizable and earned, not when cash is received. Also there are events, usually one-time events, which create “permanent differences,” such as GAAP recognizing as an expense an item that the IRS will not allow to be deducted. If net income is negative, that means you’re operating at a loss—you’re spending more than you’re bringing in.

How do you calculate EPS from EBIT?

To calculate the level of EBIT where EPS remains stable, simply input the debt interest, current EPS and updated shares outstanding values and solve for EBIT: ($10.50 x 20,000) + 0 ÷ (1 – 0.3) + $500 = $300,500. Under this financing plan, the company must more than double its earnings to maintain a stable EPS.

Operating revenue is defined as revenue from primary business activities. Although Bob and his donut shop are still a small business and would not have otherwise been required to create a multi-step statement, he wants to take out a bank loan of $25,000.

Financial Ratios

And the Company’s Operating income is calculated by deducting these total operating expenses from the gross profit computed above in the first section. As discussed above, the multi-step income statement is like a single-step income statement, but the difference only lies in the representation part. In a multi-step income statement, the calculation is broken down into several parts to arrive at the net income figure at the bottom line.

Items that create temporary differences due to the recording requirements of GAAP include rent or other revenue collected in advance, estimated expenses, and deferred tax liabilities and assets. With respect to accounting methods, one of the limitations of the income statement is that income is reported based on accounting rules and often does not reflect cash changing hands. Preparing financial statements can seem intimidating, but it doesn’t have to be an overwhelming process.

- This is particularly helpful for analyzing the performance of the business.

- A multi-step income statement is an income statement that segregates total revenue and expenses into operating and non-operating heads.

- The two components explained above relate directly to the operations of the company.

- These principles include the historical cost principle, revenue recognition principle, matching principle, and full disclosure principle.

- As we’ve earleir discussed, income tax involves an outflow of cash and is hence considered a liability for the organization.

Intuit Inc. does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. While these statements provide different insights, they are both used by investors and lenders to make decisions about your business. Income statements can be prepared monthly, quarterly, or annually, depending on your reporting needs.

Tax Attorney Or Cpa: Which Does Your Business Need?

A multi-step income statement is an income statement that segregates total revenue and expenses into operating and non-operating heads. Users can gain insights into how a company’s primary business activities generate revenue and affect costs compared to the performance of the non-primary business activities. From the information obtained on the income statement, a company can make decisions related to growth strategies.

Is EPS same as dividend?

Earnings per share is a ratio that gauges how profitable a company is per share of its stock. On the other hand, dividends per share calculates the portion of a company’s earnings that is paid out to shareholders.

Direct costs refer to expenses for a specific item, such as a product, service, or project. Contrarily, indirect costs are generalized expenses that go towards a company’s broader infrastructure, and therefore cannot be assigned to the cost of a specific object. Examples of indirect costs include salaries, marketing efforts, research and development, accounting expenses, legal fees, utilities, phone service, and rent.

Elements Of The Income Statement

What is the difference between a multiple step income statement and a single step income statement? A company’s income statement shows the revenues, expenses and profits or losses for an accounting period. Smaller companies — such as sole proprietorships, partnerships and service companies — generally use the single-step format.

Conversely, though the single-step income statement lacks detail, it is easy to prepare and easy to analyze. Non-operating income needs to take into account any unexpected losses that are not attributed to the cost of doing business.

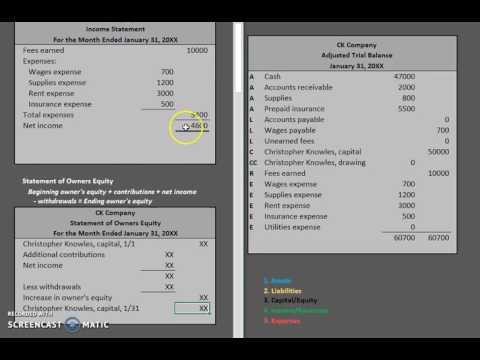

Single-step statements offer a basic look at a company’s revenue and expenses, making record-keeping easier for accountants and investors. Small businesses with a simple operating structure, including sole-proprietorships and partnerships, can choose between creating single-step or multi-step income statements. We will use the same adjusted trial balance information for CBS but will now create a simple income statement. The income statement is an important document for businesses of all sizes.

There are very few individual accounts and the statement does not consider cost of sales separate from operating expenses. Following income from operations are other revenue and expenses not obtained from selling goods or services or other daily operations. Other revenue and expenses examples include interest revenue, gains or losses on sales of assets , and interest expense. Other revenue and expenses added to income from operations produces net income . Multi-step income statement format is any day better than a single-step statement as it provides proper detailing.

What Is An Income Statement?

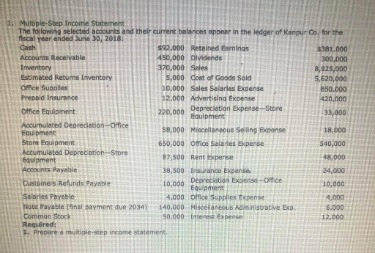

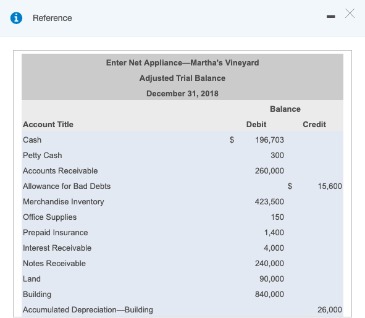

The following is select account data from the adjusted trial balance for the year ended, December 31, 2018. Note that the statements prepared are using a perpetual inventory system. While there are different types of income statements, they all include the key information listed above. Below is asample income statement provided by SCORE, the nonprofit small business mentoring group. The four basic principles of GAAP can affect items on the income statement. These principles include the historical cost principle, revenue recognition principle, matching principle, and full disclosure principle. You can use QuickBooks Online to generate income statements and other key financial reports .

Neil Kokemuller has been an active business, finance and education writer and content media website developer since 2007. Kokemuller has additional professional experience in marketing, retail and small business. With experience in earning securities and insurance licenses and having owned a successful business, her articles have focused predominantly on finance and entrepreneurship. Barlowe holds a bachelor’s degree in hotel administration from Cornell University. Learn more about how you can improve payment processing at your business today.

Is Income From Operations The Same Thing As Operating Income?

The most comprehensive step in creating a multi-step income statement is preparing the operating section. This is the amount of money obtained directly from the sale of goods and or services. A multiple-step income statement presents two important subtotals before arriving at a company’s net income. For a company that sells goods the first subtotal is the amount of gross profit. Income statements include revenue, costs of goods sold, and operating expenses, along with the resulting net income or loss for that period. Smaller companies — such as sole proprietorships, partnerships and service companies — generally use the single-step format. One disadvantage of the single-step income statement is the lack of relevant information communicated.

The important subtotals on the multiple-step income statement are convenient for the reader/user of the income statement. Notice where the three calculations mentioned take place from top to bottom. One clear advantage of the single-step format is that it’s an easy statement to prepare.

Anincome statementis an essential financial document a company prepares to describe its business activities over a given reporting period. This financial summary of a company’s revenue, expenses, and earnings are typically presented as part of a package that also includes a company’s balance single step vs multi step income statement sheet and cash flow statement. Multiple-step income statementsOn the other hand, a multiple-step income statement offers a more in-depth look at a company’s performance. A multi-step income statement is a financial reporting document that organizations use to determine and show net income.

Another useful metric is the gross margin, which underlines the variable costs attached to adding new units of sales. Revenues are exposed to a number of expense types, and understanding the relationship between costs and revenues is the primary function of the income sheet. The primary purpose of the income statement is to assess efficiency as revenues transform into profits/losses.

Nevertheless, many small business owners don’t think they need to create one. “Too many businesses operate at the seat of their pants and start putting internal controls andaccounting systemsin place to catch up with growth,” he said. Once all the items of Non-operating head are totaled, the net income for the period is computed by deducting or adding the total of the non-operating head from or to the income from operations.

The Single Step income statement totals revenues, then subtracts all expenses to find the bottom line. Give your statement a final QA either manually or using an automated platform.

Income statement is a company’s financial statement that indicates how the revenue is transformed into the net income. This content is for information purposes only and should not be considered legal, accounting or tax advice, or a substitute for obtaining such advice specific to your business. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Intuit Inc. does not have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research.