Since making a profit is a goal of most organizations, the most important function of the accounting system is to provide information on the profitability of its activities. Funds received from profitable work may remain at the enterprise in order to finance the diversification of its activities, or be distributed in the form of dividends between owners of shares.

Both the owners and managers of the enterprise want to know the size of the profit or loss incurred. The income statement is what people focus the most when they analyze the company. This statement tells how much a company might earn in a given period, and it is always related to a period (week, month, year).

What is a Single Step Income Statement?

What is a single step income statement? As the name suggests, a single step income statement is going to be a one-step process. We would take all the revenues a company has earned during the period the income statement is compiled for, and then we just subtract all the expenses. That gives us our net income value. This is why it is called a single step because we do not have any subtotals and just group all revenues and gains as well as expenses together.

Single Step Income Statement Example

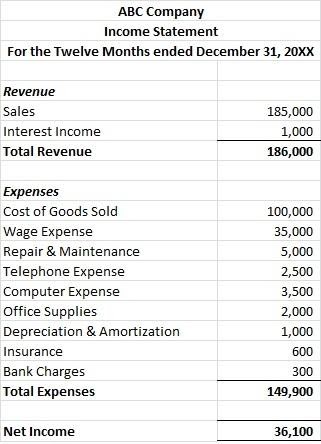

A single step income statement example for ABC Company for a year ended December 31, 20xx is presented below. The first part is all the revenues for the year. Here we can have Service or Sales Revenue, Interest or Dividends Income as well as any other income and gains. You can get all this information from an Adjusted Trial Balance that was compiled on December 31 of the same year.

Next, the Expenses accounts are also taken from the same Adjusted Trial Balance. We simply add up all these expenses to get a total amount. The final step would be to subtract total expenses from the total revenues, which will give as the amount of Net Income for that year.

What is the Multi Step Income Statement?

In the multi-step method, the profit and loss statement shows the main activity, the activity that is not repeated from period to period, financial activity, tax payments, operations of branches of the company, the statements of which are not consolidated in its own statements, and other similar indicators separately.

This explains the name of this method – multi-step because to get an indicator of net income for the company as a whole, you need to take several preliminary steps, namely, to calculate the intermediate results for certain types of activities and headings.

Thanks to that, this financial statement is going to be a lot more informative. This is beneficial when an investor or creditor tries to evaluate how the company is doing, what it took to earn income during this specific period, and if the company is managing its expenses effectively.

Multi Step Income Statement Example

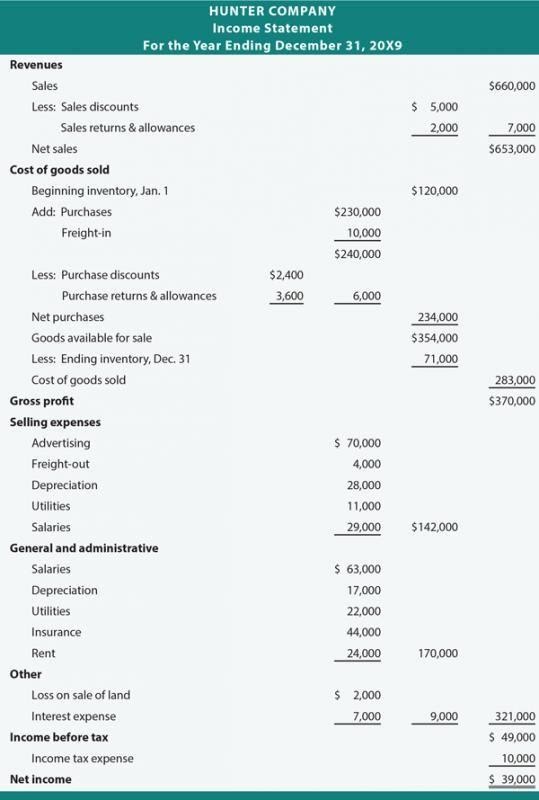

Just like with the other example, all the information to compile this multi step income statement was taken from the Trial Balance. As you can see, at the top of the multi-step income statement example, we include company name, financial statement name, and then for the year ended and the date.

The example shows several steps in determining net income. It begins with the values for Sales revenue. Contra-revenue accounts are then subtracted from it to arrive at Net sales. Then, COGS is deducted from Sales revenue in order to determine Gross profit. The other steps allow to get Operating income and, most importantly, Net income.

This statement shows the company’s ability to:

- Sell its product or service for more than it costs (Gross margin);

- Generate positive income from its core operations (Operating income);

- Generate income before taxes (Income before taxes);

- Shows earnings per share (the most important number in the financial world) for publicly traded companies.

Single-Step vs. Multi-Step Income Statement

When we compare these two formats, both income statements provide the same information, only the ordering in calculating income from a continuing operation is different.

The single-step income statement is called a single step because the Net Income (Loss) is calculated in just one step. One would just need to list all revenue accounts and total them up, then list all expenses accounts and total them up. The difference will be the final line on the income statement.

The multi-step income statement, on the other hand, shows several steps in determining net income. It distinguishes between operating and non-operating activities, making it more informative but harder to put together.