An investor who buys a stock on 50% margin will lose 40% if the stock declines 20%.; also in this case the involved subject might be unable to refund the incurred significant total loss. In this ratio, operating leases are capitalized and equity includes both common and preferred shares. Instead of using long-term debt, an analyst may decide to use total debt to measure the debt used in a firm’s capital structure. The formula, in this case, would include minority interest and preferred shares in the denominator. A leverage ratio may also be used to measure a company’s mix of operating expenses to get an idea of how changes in output will affect operating income.

What financial leverage ratio tells us?

Financial leverage ratios are also called debt ratios. … They measure the ability of the business to meet its long-term debt obligations, such as interest payments on debt, the final principal payment on the debt, and any other fixed obligations like lease payments.

Learn what financial leverage is and if it’s a good option for your business. Applicant Tracking Choosing the best applicant tracking system is crucial to having a smooth recruitment process that saves you time and money. Appointment Scheduling Taking into consideration things such as user-friendliness and customizability, we’ve rounded up our 10 favorite appointment schedulers, fit for a variety of business needs. Business Checking Accounts Business checking accounts are an essential tool for managing company funds, but finding the right one can be a little daunting, especially with new options cropping up all the time. CMS A content management system software allows you to publish content, create a user-friendly web experience, and manage your audience lifecycle.

For example, companies that need significant funding to maintain operations, such as manufacturing companies, will have higher debt-to-equity ratios. It is to the business community’s advantage for methods of financial analysis to be easy to learn and apply.

Leverage has caused you to increase production on a product that loses money on each sale. As your losses mount, your cash flow dries up, you miss interest payments, and you find yourself in bankruptcy court. Interest on debt is tax-deductible, making debt a low-cost source of capital.

If you need financing but cannot sell equity, you might have to increase your borrowing, leading to a vicious circle that ends in bankruptcy. Your company’s asset-to-equity ratio is a measure of the total assets funded by company shareholders. Shareholders’ equity can be in the form of minority interest, common stock or preferred stock. CLO securitization has grown rapidly in recent years, with investors attracted by higher yields. In addition, a record volume of CLOs was refinanced or restructured, as CLO managers sought to lower their liability costs amid tighter market spreads.

What Is Leverage?

On the other hand, almost half of Lehman’s balance sheet consisted of closely offsetting positions and very-low-risk assets, such as regulatory deposits. On that basis, Lehman held $373 billion of “net assets” and a “net leverage ratio” of 16.1.

All of these measurements are important for investors to understand how risky the capital structure of a company and if it is worth investing in. Investors use leverage to significantly increase the returns that can be provided on an investment. They lever their investments by using various instruments, including options, futures, and margin accounts. In other words, instead of issuing stock to raise capital, companies can use debt financing to invest in business operations in an attempt to increase shareholder value.

Financial leverage, deployed correctly, can turbo-boost the amount of financial capital a company deploys. Used adeptly, financial leverage enables companies to produce a higher rate of investment return than it likely could without using leverage. Also, the more leveraged debt a company absorbs, the higher the interest rate burden, which represents a financial risk to companies and their shareholders. A highly common business and finance strategy, leverage can be used by a business to leverage debt to build financial assets. Financial leverage is largely defined as the leveraging of various debt instruments to boost a business’s return on investment. It is better for them to enter into venture financing or angel investment. Leverage not only magnifies your profits, it has the same effect on losses.

Financial Leverage Ratios To Measure Business Solvency

While a business with high financial leverage may be considered risky, using financial leverage also offers benefits, such as a higher return on investment . FInancial leverage can also appeal to stockholders who may see an increase in their initial investment as well. In a margin account, you can borrow money to make larger investments with less of your own money. The securities you purchase and any cash in the account serve as collateral on the loan, and the broker charges you interest. Buying on margin amplifies your potential gains as well as possible losses.

She most recently worked at Duke University and is the owner of Peggy James, CPA, PLLC, serving small businesses, nonprofits, solopreneurs, freelancers, and individuals. Let’s say you borrow the $99,900 dollars and invest it, along with your original $100 dollars, in your chosen stock. Rosemary Carlson is an expert in finance who writes for The Balance Small Business. She was a university professor of finance and has written extensively in this area. Invest in productivity enhancement broadly; in other words, invest in creating economic well-being to satisfy human needs. Invest in top- and bottom-line growth, not just in increasing asset prices. Income needs to grow faster than debt, but productivity needs to rise faster than income, so raising productivity is paramount.

When a business cannot afford to purchase assets on its own, it can opt to use financial leverage, which is borrowing money to purchase an asset in the hopes of generating additional income with that asset. In a business, debt is acquired not only on the grounds of ‘need for capital’ but also taken to enlarge the profits accruing to the shareholders. An introduction of debt in the capital structure will not have an impact on the sales, operating profits etc but it will increase the share of the equity shareholders, the ROE % . There is an implicit assumption in that account, however, which is that the underlying leveraged asset is the same as the unleveraged one. If a company borrows money to modernize, add to its product line or expand internationally, the extra trading profit from the additional diversification might more than offset the additional risk from leverage. Or if both long and short positions are held by a pairs-trading stock strategy the matching and off-setting economic leverage may lower overall risk levels.

Fixed

Since the company isn’t using borrowed money to purchase the land, this is not financial leverage. Operating lease and equity capital don’t amount to financial leverage but debt, bank loan or capital or finance lease leads to financial leverage. While equity owners benefit from higher EPS attributed to increased leverage, too much interest expense increases default risk. This can scare away potential investors and spook existing investors, causing the demand and price of your stock to decline. Too much leverage might hobble your ability to issue additional equity.

Fixed costs play no role in determining how rapidly profit rises after break-even. This is determined by the ratio of variable cost per unit to price per unit. An even more extreme case is produced by letting Widget Works, Inc. have fixed costs of $10,000 and variable costs per unit of $1.00, while Bridget Brothers has fixed costs of only $100 and variable cost per unit of $1.99.

Construction Management This guide will help you find some of the best construction software platforms out there, and provide everything you need to know about which solutions are best suited for your business. Though Apple’s current debt-to-equity ratio is above 1.0, by no means is it unmanageable or alarming. Plus, it’s Apple — shareholders probably aren’t too worried about the company’s liabilities getting out of control. Borrowing money allows businesses and individuals to make investments that otherwise might be out of reach, or the funds they already have more efficiently. For individuals, leverage can be the only way you can realistically purchase certain big-ticket items, like a home or a college education. While leverage in personal investing usually refers to buying on margin, some people take out loans or lines of credit to invest in the stock market instead. Buying on margin generally takes place in a margin account, which is one of the main types of investment account.

Investments

Leverage can be positive, thanks to the countless individuals and businesses in existence who have relied on a loan to get started. Lending would not still be in existence after thousands of years if it wasn’t a useful tool in careful hands. But careful analysis and preparation by the borrower of several possible scenarios — good and bad — for the business, project, or investment are necessary to really know what you’re getting into. Most of us have an optimistic bias and prefer to think that leverage will expand our existing abilities rather than saddle us with a persistent burden of heavy cash outflows. No one buys a house or invests in a business thinking that it will go down in value. During periods of strong asset growth, the common association of “leverage” becomes too one-sidedly positive . The key to using leverage successfully is common sense, realistic assumptions, and a clear-eyed understanding of the risks.

- A ratio of 0.5 — an indication that a business has twice as many assets as it has liabilities — is considered to be on the higher boundary of desirable and relatively common.

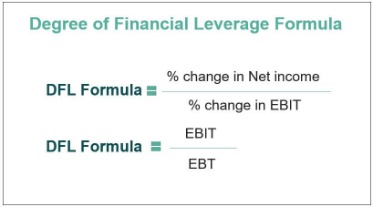

- When the degree of financial leverage is high, that means that the company will experience rapid changes in earnings.

- Leverage ratios are an essential part of understanding your company’s capital structure and obtaining financing.

- The company could have continued its operations without leveraging debt to obtain those new assets, but its profit wouldn’t have doubled.

- Leverage ratios use calculations from your business’s balance sheet, income statement or cash-flow statement to estimate your company’s long-term financial health.

- In those cases, you can gauge the soundness of a company’s financial leverage by comparing it to those of its competitors.

- Though Apple’s current debt-to-equity ratio is above 1.0, by no means is it unmanageable or alarming.

For a company to be profitable and provide healthy dividends to shareholders, the return on investment from loans must be higher than any interest owed on those loans. Issuance recovered somewhat in the first quarter of 2021, though the recovery was uneven across asset classes. Amid increased investor risk appetite, CLO and ABS issuance was elevated, whereas non-agency CMBS and RMBS issuance was weak during the first quarter. Higher risk is associated with a higher reward—there’s no getting around that. If you want profitable assets, you’re gonna have to risk leveraging some amount of debt. A highly leveraged company could still be perfectly viable and even ideal in its industry.

Thought On financial Leverage

Whether you’re a beginner looking to define an industry term or an expert seeking strategic advice, there’s an article for everyone. Financial leverage comes with a greater operational risk for companies in industries like automobile manufacturing, construction and oil production. Sage 50cloud is a feature-rich accounting platform with tools for sales tracking, reporting, invoicing and payment processing and vendor, customer and employee management. If your current accounting software application needs a boost, or you’re looking for more comprehensive reporting options, be sure to check out The Blueprint’s accounting software reviews and find a product that works for you. Going with Option A would have provided Joe with a profit of $30,000; a 12% return on his initial investment.

High leverage may be beneficial in boom periods as there might be sufficient cash flow. During the recessionary period, it may cause serious cash flow problems, as there might not be enough sales revenue to cover the interest payments. However, the finance manager should carefully view the situation and make a decision to enhance the benefits to shareholders.

A typical startup often has to incur significant debts to get off the ground and allocate a significant portion of its cash flow to settle them — making for higher financial leverage ratios. Businesses with higher production costs also tend to run higher debt-to-equity ratios than most others. An ideal financial leverage ratio varies by the type of ratio you’re referencing. With some ratios — like the interest coverage ratio — higher figures are actually better. But for the most part, lower ratios tend to reflect higher-performing businesses. For outsiders, it is hard to calculate operating leverage as fixed and variable costs are usually not disclosed. This ratio indicates that the higher the degree of financial leverage, the more volatile earnings will be.

If the ratios are high, it often means Debt is high and lenders are unlikely to provide additional financing. When asset-to-equity ratios are low, that means your company has chosen conservative financing with a minimal amount to Debt. EBITDA. If the ratio is low, this means your company has a manageable debt load. These types of risk assessments are critical to your ability to obtain financing and investments.

There are several types of leverage ratios and formulas to help investors and company owners analyze where they stand financially. While broader market spillovers appeared limited, the episode highlights the potential for material distress at NBFIs to affect the broader financial system.

Leverage In Personal Finance

Meanwhile, based on information through the fourth quarter of 2020, leverage at property and casualty insurers stayed at low levels relative to historical averages. While delinquencies have generally been flat, some uncertainty remains about whether the credit quality of bank loans will hold up after loss-mitigation programs end and government support runs out. In response to a set of special forward-looking questions in the January 2021 SLOOS, banks, on balance, reported they expect loan quality to deteriorate for most loan categories later this year. Nevertheless, banks’ willingness to lend is apparently increasing in some cases.

Both financial and operating leverage emerge from the base of fixed costs, i.e., operating leverage appears where there is fixed financial charge . The variability of sales level or due to fixed financing cost affecting the level of EPS . Creditors also rely on these metrics to determine whether they should extend credit to businesses. If a company’s financial leverage ratio is excessive, it means they’re allocating most of its cash flow to paying off debts and is more prone to defaulting on loans. The debt ratio measures a company’s total liabilities against its total assets and is expressed as a percentage.

Understanding Leverage

Greater such costs, greater is the riskiness of the company because if there are not enough profits, these expenses still need to be paid. Financial leverage deals with the amount of debt in the capital structure of the company and therefore the number of interest expenses and whether a company is capable enough to meet these expenses. For instance, if your company’s operating leverage is high, that indicates you have a high percentage of fixed costs and low variable costs. In this case, an increase in revenue could have a positive effect on your bottom line. The higher your company’s leverage ratio, the higher the financial risk and the less likely you are to receive favorable loan terms from lenders.