First, get the book value of all assets on the target’s balance sheet. This includes current assets, non-current assets, fixed assets, and intangible assets. You can get these figures from the company’s most recent set of financial statements. As you remember, the balance sheet is broken down into assets and liabilities. Goodwill or intangible assets are on the top portion, not under the current asset, but under the portion where the total assets are added up. When examining a company’s balance sheet, you may encounter a somewhat enigmatic item known as “goodwill.” This intangible asset can significantly influence a company’s financial health.

Goodwill is subject to periodic impairment testing to ensure its recorded value accurately reflects its worth. Factors such as changes in market conditions, legal issues, or a decline in the acquired company’s financial performance can trigger goodwill impairment testing. Goodwill is not the creation of assets, but simply the recognition of its existence, in the company’s financial statements as appears in the list of assets in a company’s balance sheet.

Goodwill vs. Other Intangible Assets: An Overview

Remember that Apple also acquired the equity of $20,000 in that company; therefore, Apple can list the whole purchasing price of $50,000 of the subsidiary as an asset. Now, it is important to note that buying other companies is not a method to grow assets that are turned into equity. The $50,000 which was the purchasing price is money that Apple has earned previously, so basically Apple is simply moving things around on their balance sheet. “Impairment” refers to the fluctuations in a business’s fair market value.

Identifiable net assets encompass the fair value of the acquired company’s tangible and intangible assets minus its liabilities. The resulting difference is recognized as goodwill on the acquiring company’s balance sheet. Buffett’s opinion of having Goodwill in the balance sheet isn’t bad. The net income of See’s Candy when he bought it in the 1970’s was $2M. He compared these two with just a generic example of Boring Square Company.

Practice Goodwill:

The value of a company’s name, brand reputation, loyal customer base, solid customer service, good employee relations, and proprietary technology represent aspects of goodwill. A company like Coca-Cola might have a strong brand name, but the brand name is not something you can lay your hands on. They also have an additional stream of money – the $10000-income of Best Apps. The brand name, the customer loyalty, the patents and the employee knowledge of how to make those applications did.

- The two commonly used methods for testing impairments are the income approach and the market approach.

- The amortization amount is adjusted if the asset’s value is impaired at some point after its acquisition or development.

- The company may face investigations, fines, and legal penalties if the negative goodwill results from unethical practices or violations.

- It contributes to customer loyalty, trust, and favorable recommendations, resulting in higher sales and a larger market presence.

Impairment tests are also required if certain events have an impact on the business’s fair market value, such as layoffs, changes in competition, or changes in the overall business climate. Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling. According to the US, Goodwill is treated differently under Generally Accepted Accounting Principles and International Financial Reporting Standards in terms of amortization. GAAP and IFRS do not require the amortization of goodwill since it is considered an indefinite useful life.

Tangible Asset

It is recognized only through an acquisition; it cannot be self-created. It is classified as an intangible asset on the balance sheet, since it can neither be seen nor touched. The economic goodwill is the concept that explains why a company can be worth far more than its net intangible assets.

Calculating Goodwill:

Under US GAAP and IFRS Standards, goodwill is an intangible asset with an indefinite life and thus does not need to be amortized. However, it needs to be evaluated for impairment yearly, and only private companies may elect to amortize goodwill over a 10-year period. Goodwill is an intangible asset that can relate to the value of the purchased company’s brand reputation, customer service, employee relationships, and intellectual property. The impairment results in a decrease in the goodwill account on the balance sheet.

Warren Buffet doesn’t place a lot of emphasis on the goodwill you find on the balance sheet (called accounting goodwill) Instead, he places a lot of emphasis on what he calls the economic goodwill. Economic goodwill is what can be earned more than the market return from intangible assets. This is also why businesses can be worth far more than net tangible assets.

Understanding Goodwill Impairment

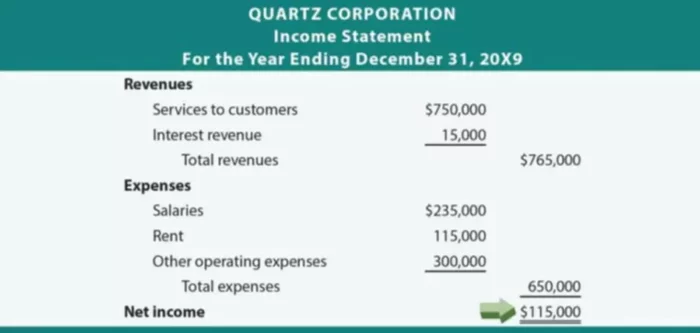

The expense is also recognized as a loss on the income statement, which directly reduces net income for the year. In turn, earnings per share (EPS) and the company’s stock price are also negatively affected. To get the net tangible assets, take the total assets and subtract the intangibles.