ledger

There is not any upper limit to the variety of accounts concerned in a transaction – however the minimum is no less than two accounts. Thus, using debits and credits in a two-column transaction recording format is essentially the most essential of all controls over accounting accuracy. If you fail to make a journal entry or document a monetary transaction in an incorrect account, it will not show up as an error within the trial balance.

Error of Principle in Accounting

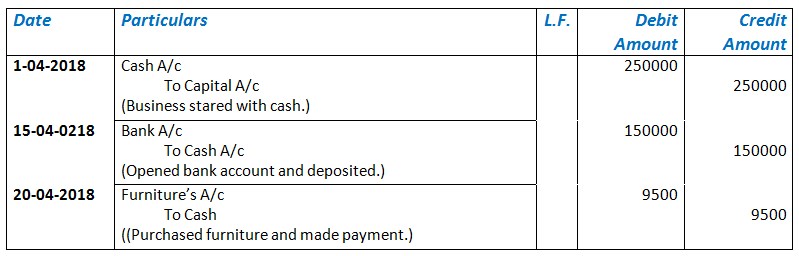

Cash needs to be elevated by $450 and accounts receivable must be reduced by $450. The correcting entry journal entry will debit cash by $450 and credit accounts receivable by $450 (debits enhance amounts, credits scale back them). A trial balance is a bookkeeping worksheet during which the balances of all ledgers are compiled into debit and credit score account column totals that are equal.

The financial institution money e-book relies on the principle of the double-entry system. It retains the record of each financial transaction affecting its debit and credit score account. A trial stability is ready to establish whether or not the posting made within the bank cash book is right or not. The totals of the debits and credits for any transaction must all the time equal each other in order that an accounting transaction is all the time mentioned to be in balance. Thus, using debits and credits in a two column transaction recording format is essentially the most essential of all controls over accounting accuracy.

For every open ledger account, total your debits and credits for the accounting interval for which you might be working the trial steadiness. Record the totals for every account within the acceptable column. If the debits and credits don’t equal, then there’s an error in the general ledger accounts. Run a trial balance regularly, a minimum of monthly; it helps you establish any problems rapidly and fix them as quickly as they arise.

When accounting for these transactions, we report numbers in two accounts, where the debit column is on the left and the credit score column is on the best. To understand debits and credits, know that debits are bills and losses and that credits are incomes and gains. You also needs to do not forget that they need to stability, which means that if a debit is added to an account, then a credit is added to a different account. To hold debits and credits in steadiness, hold a ledger with credits on one facet and debits on the opposite. Then, use the ledger to calculate the ending balance and replace your steadiness sheet.

Accounting Notes

In this technique, solely a single notation is manufactured from a transaction; it is often an entry in a check guide or money journal, indicating the receipt or expenditure of cash. A single entry system is simply designed to produce an earnings statement.

Because the business has amassed extra assets, a debit to the asset account for the cost of the acquisition ($250,000) might be made. To account for the credit score buy, a credit score entry of $250,000 might be made to notes payable. The debit entry increases the asset steadiness and the credit score entry will increase the notes payable liability balance by the same amount. For instance, if a enterprise takes a mortgage from a monetary entity like a bank, the borrowed cash will increase the company’s assets and the mortgage legal responsibility may also rise by an equal amount. If a enterprise buys uncooked material by paying money, it’s going to result in a rise in the inventory (asset) while lowering money capital (one other asset).

If a money account is credited to the purpose of turning into negative, this implies the account is overdrawn. A general ledger is a standard means of recording debits and credits for a selected account. Equity and liability are two different essential phrases to know for understanding debits and credits.

- If the debits and credits don’t equal, then there is an error in the basic ledger accounts.

- Record the totals for each account within the appropriate column.

- For every open ledger account, whole your debits and credit for the accounting period for which you’re operating the trial balance.

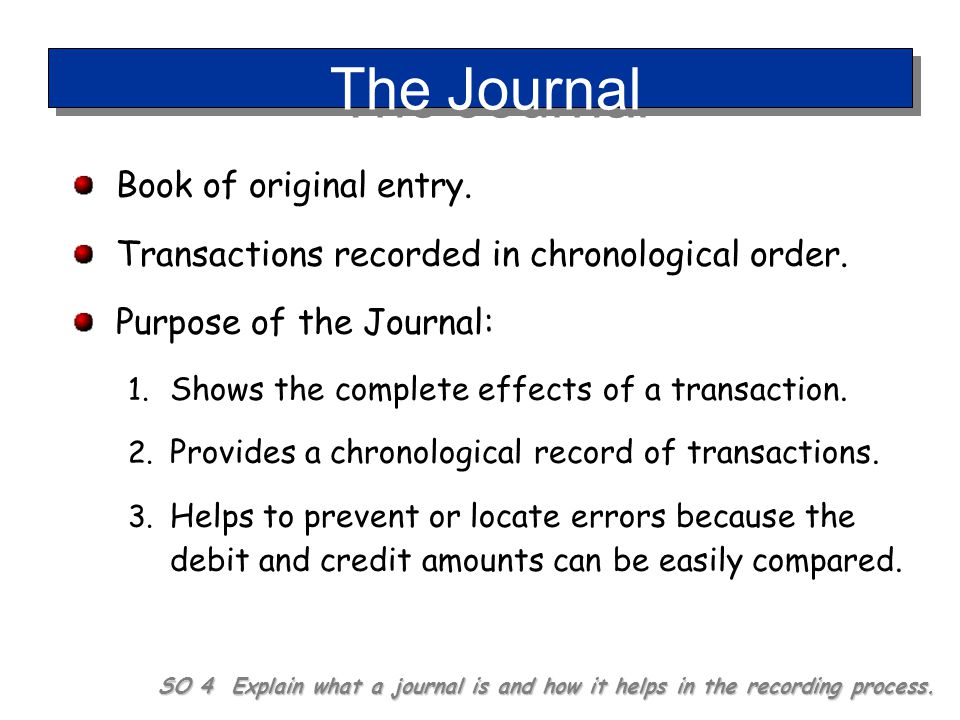

Which is the book of original entry in accounting?

Books of original entry refers to the accounting journals in which business transactions are initially recorded. The information in these books is then summarized and posted into a general ledger, from which financial statements are produced.

The complete quantity of debits should equal the whole quantity of credits in a transaction. Otherwise, an accounting transaction is said to be unbalanced, and will not be accepted by the accounting software. Hence, a ledger is called the e-book of secondary entry or last entry, as they are posted from the Journal and the balances of those accounts are used to organize the financial statements of the enterprise. Generally talking, debit means “improve,” so a non-failing enterprise ought to have a constructive cash account (or debit).

The books to be compulsorily maintained by a company are ______________.

Preparing the trial balance should be tied to the billing cycle of the corporate. In the double-entry system, transactions are recorded in terms of debits and credit. Since a debit in a single account offsets a credit in one other, the sum of all debits should equal the sum of all credits. The double-entry system of bookkeeping or accounting makes it easier to organize correct monetary statements and detect errors. Whenever an accounting transaction is created, a minimum of two accounts are at all times impacted, with a debit entry being recorded towards one account and a credit score entry being recorded against the other account.

Because there are two or more accounts affected by each transaction carried out by an organization, the accounting system is known as double-entry accounting. Business transactions are occasions that have a monetary impact on the financial statements of an organization.

List every open ledger account in your chart of accounts by account quantity. The account quantity must be the four-digit quantity assigned to the account whenever you set up the chart of accounts. List your whole debits and credit from each general ledger account. The columns ought to be the account quantity, account identify, debit, and credit. To account for the credit purchase, entries should be made in their respective accounting ledgers.

Debits don’t always equate to increases and credits do not always equate to decreases. Bank money guide is a multi-column ledger ready by operating level workplaces of the federal government of Nepal to keep up the report of cash & banking transaction beneath AGF No. 5. It is a statement, which keeps the report of cash receipts and funds made via the bank. It is a guide ready by operating stage workplaces for recording their banking transactions. It maintains the report of cash receipt and cash cost which are made both in cash or via cheque.

Numbers transposed in the debit column instead of within the credit column, additionally is not going to present up within the trial steadiness. Further, any failure to submit an accounting journal entry to the journal ledger won’t present up. The trial stability is the following step in the accounting cycle. It is the first step within the “end of the accounting interval” process. Debits and credit are important to the double entry system.

Debits increase asset or expense accounts and reduce liability or equity. Credits do the opposite — decrease assets and bills and enhance legal responsibility and fairness.

AccountingTools

In accounting, a debit refers to an entry on the left aspect of an account ledger, and credit score refers to an entry on the right side of an account ledger. To be in balance, the total of debits and credits for a transaction should be equal.

Commerce-Reliable Series-11th-Book-keeping & Accountancy-Chp 6

There are other normal methods to track down an error in a trial stability. If the debits and credits do not equal, see if the quantity 2 divides equally into the distinction. If it does, search for an account, look for an account incorrectly within the column with the bigger whole that equals half the distinction. If you discover you have an unbalanced trial steadiness, in other words, the debits do not equal the credit; then you have an error within the accounting process.