- When the accountant reviews the ledger and unadjusted trial balance, some adjustments may require.

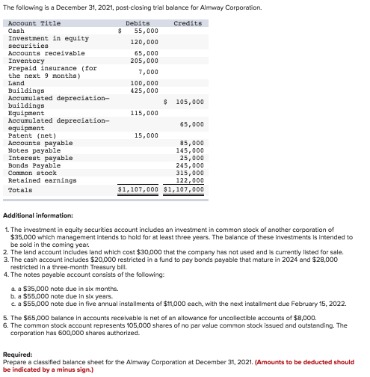

- As balance sheet entries are listed in the trial balance, it is done in similar ways balance sheet with first assets than liabilities and then equity.

- These journal entries are then posted into individual accounting ledgers in general ledgers.

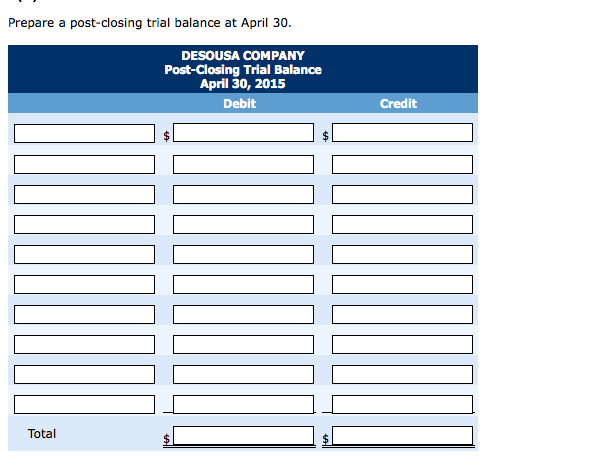

- The post-closing trial balance for Printing Plus is shown in Figure 5.8.

- An accountant prepares this trial balance after passing the adjusting entries.

- DebitsDebit is an entry in the books of accounts, which either increases the assets or decreases the liabilities.

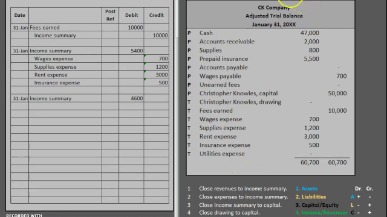

Before that, it had a credit balance of 9,850 as seen in the adjusted trial balance above. Since temporary accounts are already closed at this point, the post-closing trial balance will not include income, expense, and withdrawal accounts.

How Do You Do Post Closing Entries?

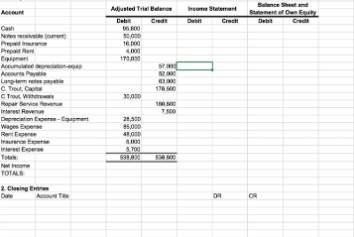

Just like in step 1, we will use Income Summary as the offset account but this time we will debit income summary. The total debit to income summary should match total expenses from the income statement. In the accounting cycle, there are two other trial balances that are prepared. This report lists all the accounts that a company has and their balances. The next one is called the adjusted trial balance and is a list of all the company accounts and their balances after any adjustments have been made. So if there are already two other trial balance reports, why would you possibly need another one? A trial balance also comes in handy to prepare the financial statement.

What is the purpose of the post closing trial balance and what does it evidences?

Purpose of the Post-Closing Trial Balance The post-closing trial balance helps you verify that these accounts have zero balances. It also verifies that debits still equal credit amounts after the closing entries, which ensures that you start the next accounting period with the correct amounts.Unadjusted trial balance – This is prepared after journalizing transactions and posting them to the ledger. Its purpose is to test the equality between debits and credits after the recording phase.

Next Step

In other words, the post closing trial balance is a list of accounts or permanent accounts that still have balances after the closing entries have been made. A pre-closing trial balance includes balances of both temporary post closing trial balance and permanent accounts, and a post-closing trial balance includes the company’s closing entries. This makes a description of the type of trial balance that is being prepared even more crucial to a trial balance user.

The last step in the process is preparing the post-closing trial balance. The big difference between this and the other trial balances is that the balance in the revenue and expense accounts should be zero. List all of the accounts and their balances in the appropriate debit or credit columns. Then add up both columns; if both columns have the same amount, the accounts balance. Companies initially record their business transactions in bookkeeping accounts within the general ledger.

What Goes In The Post Closing Trial Balance?

We can clearly observe the difference between the adjusted trial balance and the post-closing trial balance. All the temporary accounts like revenue and expense accounts have been closed out into the retained earnings account via the income summary account . Temporary accounts are accounts that are closed at the end of each accounting period, and include income statement, dividends, and income summary accounts. These accounts are temporary because they keep their balances during the current accounting period and are set back to zero when the period ends. Revenue and expense accounts are closed to Income Summary, and Income Summary and Dividends are closed to the permanent account, Retained Earnings. The post-closing trial balance will end with the total of both debits and credits at the bottom, in order by assets, liabilities and equity, and the two totals should be equal.The income statement accounts would not be listed because they are temporary accounts whose balances have been closed to the owner’s capital account. Preparing the post closing trial balanceis one of the last steps in theaccounting cycle. It’s basically a summary of the general ledger at the end of an accounting period after the closing entries have been made and the financial statements have been prepared. The purpose of this trial balance is to make sure that no more temporary account balances exist before the books are rolled forward into the next year. The post-closing trial balance ensures there are no temporary accounts remaining open and all debit balance is equal to all credit balances.They are also transparent with their internal trial balances in several key government offices. Check out this article talking about the seminars on the accounting cycle and this public pre-closing trial balance presented by the Philippines Department of Health. Reversing entries are made because previous year accruals and prepayments will be paid off or used during the new year and no longer need to be recorded as liabilities and assets. These entries are optional depending on whether or not there are adjusting journal entries that need to be reversed. When the accountant reviews the ledger and unadjusted trial balance, some adjustments may require. All of the adjustments should be made to the ledgers and trial balance.What is the current book value of your electronics, car, and furniture? Are the value of your assets and liabilities now zero because of the start of a new year? Your car, electronics, and furniture did not suddenly lose all their value, and unfortunately, you still have outstanding debt. Therefore, these accounts still have a balance in the new year, because they are not closed, and the balances are carried forward from December 31 to January 1 to start the new annual accounting period. The revenue, expense, income summary and owner’s drawing accounts will not appear on a post-closing trial balance since these accounts will not carry a balance after the accounting period has ended. On the statement of retained earnings, we reported the ending balance of retained earnings to be $15,190. We need to do the closing entries to make them match and zero out the temporary accounts.If they aren’t, it indicates that you may have prepared the sheet incorrectly or didn’t account for all the line items you should’ve. Such uniformity guarantees there are no unequal debits and credits that have been incorrectly entered during the double-entry recording process. However, a trial balance cannot detect bookkeeping errors that are not simple mathematical mistakes. Closing entries are journal entries made at the end of an accounting period which transfer the balances of temporary accounts to permanent accounts. Closing entries are based on the account balances in an adjusted trial balance.

With the preparation of post-closing trial balance, the accounting cycle for an accounting period comes to its end. In the next accounting period, this cycle starts again with the first step i.e., preparation of journal entries. The last thing that occurs at the end of the accounting cycle is to prepare a post-closing trial balance. The post-closing trial balance is the report that lists all the accounts of a company and their balances after all adjustments and closing entries have been made.Closing entries to the general ledger reduce the balance of each expense to zero; the accounts are not included in the post-closing trial balance. As previously stated, only permanent accounts should be listed on this type of trial balance.

Accounting Topics

You will not understand how your decisions can affect the outcome of your company. A post-closing trial balance is a complete list of the balance sheet accounts that have a zero balance at the end of the reporting period you’re in. These accounts are temporary ones that the business has already closed; the balances of these accounts have already transitioned to the retained earnings account during the closing of the account.As balance sheet entries are listed in the trial balance, it is done in similar ways balance sheet with first assets than liabilities and then equity. Both the debits and credits totals are calculated at the end, and if these are not equal, one can know that there must have been some mistake in preparing the trial balance. Notice that the post-closing trial balance lists only permanent or balance sheet accounts. The balances of all temporary accounts have become zero as a result of closing entries. The temporary accounts have therefore not been listed in post-closing trial balance. In all three types of trial balance, the net balance is zero i.e., all the debit balances equal to all credit balance. Once an accountant determines the zero balance test , it means there are no further transactions for the old accounting period.

How To Prepare A Post Closing Trial Balance

This means you are preparing all steps in the accounting cycle by hand. Under the accrual method of accounting, a business is to report all of the revenues that it has earned during an accounting period. Answer the following questions on closing entries and rate your confidence to check your answer. If you like quizzes, crossword puzzles, fill-in-the-blank, matching exercise, and word scrambles to help you learn the material in this course, go to My Accounting Course for more. Debit BalancesIn a General Ledger, when the total credit entries are less than the total number of debit entries, it refers to a debit balance. A debit balance is a net amount often calculated as debit minus credit in the General Ledger after recording every transaction. And finally, in the fourth entry the drawing account is closed to the capital account.

Therefore, a post-closing trial balance will include a list of all permanent accounts that still have balances. We see from the adjusted trial balance that our revenue accounts have a credit balance. To make them zero we want to decrease the balance or do the opposite. We will debit the revenue accounts and credit the Income Summary account. The credit to income summary should equal the total revenue from the income statement.

Temporary And Permanent Accounts

Like all trial balances, the post-closing trial balance has the job of verifying that the debit and credit totals are equal. The post-closing trial balance has one additional job that the other trial balances do not have. The post-closing trial balance is also used to double-check that the only accounts with balances after the closing entries are permanent accounts.Now that we have completed the accounting cycle, let’s take a look at another way the adjusted trial balance assists users of information with financial decision-making. Financial ReportsFinancial Reporting is the process of disclosing all the relevant financial information of a business for a particular accounting period. These reports are used by the stakeholders (investors, creditors/ bankers, public, regulatory agencies, and government) to make investing and other relevant decisions. Credit BalancesCredit Balance is the capital amount that a company owes to its customers & it is reflected on the right side of the General Ledger Account. Usually, Liability accounts, Revenue accounts, Equity Accounts, Contra-Expense & Contra-Asset accounts tend to have the credit balance. Real AccountsReal accounts do not close their balances at the end of the financial year but retain and carry forward their closing balance from one accounting year to another. In other words, the closing balance of these accounts in one accounting year becomes the opening balance of the succeeding accounting year.The totals for debits and credits should always be equal to each other. However, if the debit and credit columns don’t equal each other, you’ll likely need to review your entries, as you may have missed transferring one to or from the ledgers correctly. The post-closing trial balance is the last step in the accounting cycle for a reporting period, after the unadjusted and adjusted trial balances.The closing entry will credit Dividends and debit Retained Earnings. Having a zero balance in these accounts is important so a company can compare performance across periods, particularly with income. It also helps the company keep thorough records of account balances affecting retained earnings.