Is the Bond Market Still a Good Investment in 2019? What to Know and What to Do About It

The bond market is efficient and matches the present worth of the bond to mirror whether present interest rates are greater or decrease than the bond’s coupon rate. It’s important for buyers to know why a bond is trading for a premium—whether or not it is due to market rates of interest or the underlying company’s credit standing.

Current yield vs yield to maturity

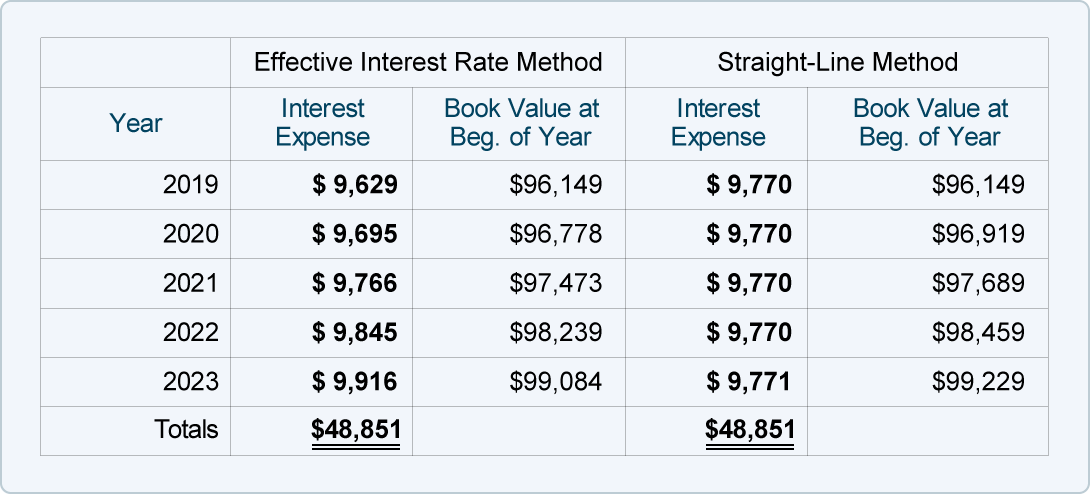

To calculate the bond discount, the present worth of the coupon payments and principal worth must be determined. Also, as charges rise, investors demand a better yield from the bonds they think about buying. If they expect charges to continue to rise in the future they do not want a fixed-fee bond at present yields. As a outcome, the secondary market price of older, lower-yielding bonds fall.

What is a Premium Bond?

Duration provides the approximate change in value that any given bond will expertise within the occasion of a 100-foundation-point (one proportion level) change in rates of interest. For instance, suppose that rates of interest fall by 1%, inflicting yields on each bond in the market to fall by the same amount. In that occasion, the worth of a bond with a length of two years will rise 2% and the value of a 5-12 months-length bond will rise 5%. A bond that’s buying and selling above its par worth within the secondary market is apremium bond. A bond will commerce at a premium when it provides a coupon (interest) price that is higher than the current prevailing interest rates being supplied for new bonds.

Premium Vs. Discount

A premium bond is one in which the market worth of the bond is greater than the face value. If the bond’s acknowledged rate of interest is larger than these anticipated by the current bond market, this bond will be a beautiful possibility for investors.

These existing bonds scale back in worth to replicate the fact that newer points within the markets have extra enticing rates. If the bond’s value falls below par, traders usually tend to buy it since they are going to be repaid the par worth at maturity.

Bonds are sold at a reduction when the market interest rate exceeds the coupon price of the bond. To understand this idea, keep in mind that a bond sold at par has a coupon price equal to the market interest rate. When the interest rate will increase previous the coupon rate, bondholders now hold a bond with lower interest funds.

This is as a result of investors desire a greater yield and will pay for it. In a sense they are paying it ahead to get the upper coupon payment.

Unlike common bonds, zero coupon bonds are one of the mounted-earnings securities that pay no curiosity. So, instead of a daily periodic fee, it generates a return at the maturity date.

- The bond market is environment friendly and matches the current price of the bond to mirror whether or not present interest rates are greater or lower than the bond’s coupon rate.

- It’s important for buyers to know why a bond is trading for a premium—whether it is due to market interest rates or the underlying firm’s credit rating.

It also assumes that each one coupon payments are reinvested at the similar fee because the bond’s present yield. Bonds on the secondary market with fixed coupons will trade at reductions when market interest rates rise. While the investor receives the same coupon, the bond is discounted to match prevailing market yields. Discounts also happen when the bond provide exceeds demand when the bond’s credit standing is lowered, or when the perceived risk of default increases. Conversely, falling rates of interest or an improved credit standing may cause a bond to commerce at a premium.

Part 2 of 3: Calculating the Present Value of the Interest Payments

For instance, if a corporate bond is buying and selling at $980, it is thought-about a discount bond since its worth is beneath the $1,000 par value. As a bond becomes discounted or decreases in worth, it means its coupon fee is decrease than present yields. So, the nice equalizer is a bond’s yield to maturity (YTM).The YTM calculation takes into consideration the bond’s current market worth, its par value, its coupon rate of interest, and its time to maturity.

What Are the Risks of Investing in a Bond?

Short-term bonds are sometimes issued at a bond discount, particularly if they’re zero-coupon bonds. However, bonds on the secondary market may commerce at a bond low cost, which occurs when supply exceeds demand.

What’s the Difference Between Premium Bonds and Discount Bonds?

Some investors aren’t actually keen on zero coupon bonds because in contrast to other fixed revenue securities, a zero coupon bond doesn’t present revenue payments at intervals. So, it could discourage some buyers but still, many buyers think about “zero coupon bond” an opportunity to satisfy the long-term financial goals in a much less dangerous way.

In other phrases, if the premium is so high, it may be definitely worth the added yield as in comparison with the overall market. However, if investors buy a premium bond and market charges rise significantly, they’d be at risk of overpaying for the added premium. However, the “discount” in a discount bond does not necessarily imply that traders get a greater yield than the market is offering. Instead, investors are getting a lower price to offset the bond’s lower yield relative to rates of interest in the current market.

Investors can convert older bond costs to their worth within the present market by using a calculation referred to as yield to maturity (YTM). Yield to maturity considers the bond’s current market worth, par value, coupon rate of interest, and time to maturity to calculate a bond’s return. The YTM calculation is relatively complex, however many on-line monetary calculators can decide the YTM of a bond. The finish result of the period calculation, which is exclusive to every bond, is a danger measure that enables investors to match bonds with completely different maturities, coupons and face values on an apples-to-apples basis.

Bond Discount

What is a bond discount?

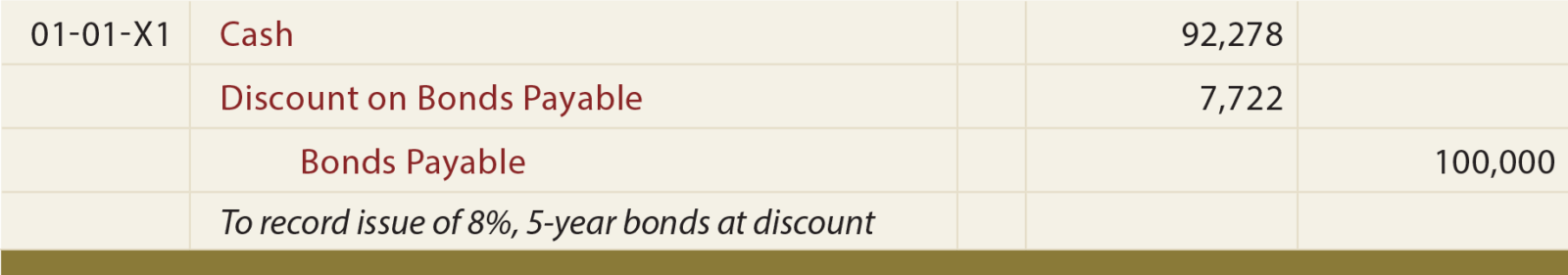

Bond discount is the amount by which the market price of a bond is lower than its principal amount due at maturity. This amount, called its par value, is often $1,000.

The primary features of a bond are its coupon fee, face value, and market worth. An issuer makes coupon payments to its bondholders as compensation for the money loaned over a fixed time frame. A bond bought at par has its coupon rate equal to the prevailing rate of interest within the economic system. An investor who purchases this bond has a return on funding that is decided by the periodic coupon payments.