Singapore Has Financial Leverage To Pressure Myanmar

When a business cannot afford to purchase assets on its own, it can opt to use financial leverage, which is borrowing money to purchase an asset in the hopes of generating additional income with that asset. In a business, debt is acquired not only on the grounds of ‘need for capital’ but also taken to enlarge the profits accruing to the shareholders. An introduction of debt in the capital structure will not have an impact on the sales, operating profits etc but it will increase the share of the equity shareholders, the ROE % . There is an implicit assumption in that account, however, which is that the underlying leveraged asset is the same as the unleveraged one. If a company borrows money to modernize, add to its product line or expand internationally, the extra trading profit from the additional diversification might more than offset the additional risk from leverage. Or if both long and short positions are held by a pairs-trading stock strategy the matching and off-setting economic leverage may lower overall risk levels.Since interest is usually a fixed expense, leverage magnifies returns and EPS. This is good when operating income is rising, but it can be a problem when operating income is under pressure. However, if a company’s operations can generate a higher rate of return than the interest rate on its loans, then the debt may help to fuel growth. A reluctance or inability to borrow may be a sign that operating margins are tight.

Operating Leverage

Leverage has caused you to increase production on a product that loses money on each sale. As your losses mount, your cash flow dries up, you miss interest payments, and you find yourself in bankruptcy court. Interest on debt is tax-deductible, making debt a low-cost source of capital.

Long-term debt is defined as obligations to repay with a maturity of more than one year. By and large, if a company has a short-term need for capital, or is involved in a complex business transaction like an acquisition, using financial leverage to get the job done can be a savvy business financing move. Operating leverage measures operational efficiency and operational risk while financial leverage measures the solvency of the company and bankruptcy risk. The formula for operating leverage is, while the formula for financial leverage is as explained above. There are several ratios that measure the financial leverage, such as the Debt ratio, Debt to equity ratio, Coverage ratios, etc.

Financial Leverage Should Be Tracked By All Businesses

Indeed, the utilization rates of NBFIs’ credit lines spiked in March 2020 but generally fell back to normal levels during the second half of last year. Thus, both operating and financial leverage are related to each other. In the sense, both of them when taken together, multiply and magnify the effect of change in sales level on the EPS. However, operating leverage has direct impact on sales level and is called first-order leverage whereas FL ha an indirect effect on sales and is called second-order leverage. If, the operating leverage explains business risk, then FL explains financial risk. If ROI is more than the cost of debt financing, then it is called favorable financial leverage or trading on equity or positive financial leverage. This situation encourages the finance manager to go in for more and more debt financing to enhance the benefits to shareholders.

- Thus, both operating and financial leverage are related to each other.

- Using leverage gives professionals more flexibility in directing the money they have to invest.

- The first is that the borrower must be able to make his payments, or he risks repossession.

- The objective of introducing leverage to the capital is to achieve the maximization of the wealth of the shareholder.

- When a business uses leverage—by issuing bonds or taking out loans—there’s no need to give up ownership stakes in the company, as there is when a company takes on new investors or issues morestock.

It also may sell shares in your margin account to bring your account back into good standing without notifying you. If you need to buy a car, you can purchase with a car loan, a form of leverage that should be used carefully. But you generally buy a car to provide transportation, rather than earn a nice ROI, and owning a car may be necessary for you to earn an income. When you borrow money to pay for school, you’re using debt to invest in your education and your future.For a company to be sustainable in the long term, these ratios must be balanced. Leverage refers to the way your company buys assets, increases cash flow and returns.

Thought On financial Leverage

A company with a high debt-to-equity ratio is generally considered a riskier investment than a company with a low debt-to-equity ratio. Leverage can be especially useful for small businesses and startups that may not have a lot of capital or assets. By using small business loansor business credit cards, you can finance business operations and get your company off the ground until you start earning profits. When you take out a loan or a line of credit, the interest payments are tax-deductible, making the use of leverage even more beneficial. The unusually large swings in profits caused by a large amount of leverage increase the volatility of a company’s stock price.

What does high degree of financial leverage refers to?

Financial leverage is the amount of debts that an equity uses for buying additional assets. Its basically the proportion of debt in the capital structure of the company. High degree of financial leverage means the company is using more debts. High degree of leverage indicates higher financial risk.Total capital is all the company’s Debt plus the total amount of shareholder’s equity. If your company’s total debt-to-capital ratio is more than 1, your company’s Debt exceeds its capital. In many cases, financial leverage a good debt-to-equity leverage ratio is 1-1.5, and a ratio above 2 is often considered risky. Let’s take a look at this concept with a bit more detail as well as look at some leverage ratio examples.

Apple’s 2021 Debt

This ratio is used to evaluate a firm’s financial structure and how it is financing operations. Typically, if a company has a high debt-to-capital ratio compared to its peers, it may have a higher default risk due to the effect the debt has on its operations. A high debt/equity ratio generally indicates that a company has been aggressive in financing its growth with debt. This can result in volatile earnings as a result of the additional interest expense. If the company’s interest expense grows too high, it may increase the company’s chances of a default or bankruptcy.

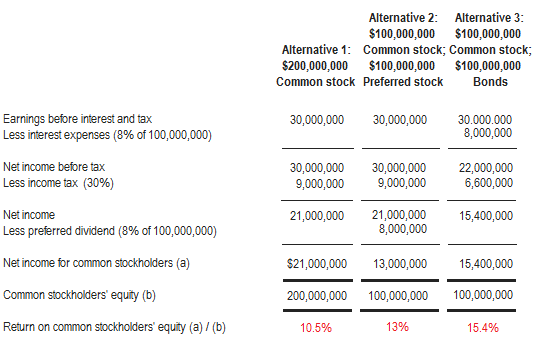

Meanwhile, based on information through the fourth quarter of 2020, leverage at property and casualty insurers stayed at low levels relative to historical averages. While delinquencies have generally been flat, some uncertainty remains about whether the credit quality of bank loans will hold up after loss-mitigation programs end and government support runs out. In response to a set of special forward-looking questions in the January 2021 SLOOS, banks, on balance, reported they expect loan quality to deteriorate for most loan categories later this year. Nevertheless, banks’ willingness to lend is apparently increasing in some cases.Delinquency rates on loans by large banks to NBFIs were higher in the second half of 2020 than before the pandemic, but they remained below delinquency rates on C&I loans to nonfinancial firms. Table 3 shows the sizes and growth rates of the types of financial institutions discussed in this section. The return on assets would, of course, vary with the assumed level of output. The simplified version of equation of the equation reveals that the change in owners’ rate of return resulting from a change in the level of output is not affected by interest expense. In evaluating the wisdom of their investment in a corporation, its owners should use the current market value of its stock, because this is what they would have available to invest elsewhere if they liquidated the stock. Joe has begun to look at purchasing a larger manufacturing facility, and currently has two options available. Option A allows Joe to purchase a new building that is slightly larger than his current facility, using cash in the amount of $250,000.There seems to be more uniformity in the definition of financial leverage. “Financial leverage,” say Block and Hirt, reflects the amount of debt used in the capital structure of the firm. Because debt carries a fixed obligation of interest payments, we have the opportunity to greatly magnify our results at various levels of operations. In his 1997 article, Rushmore says that positive operating leverage occurs at the point at which revenue exceeds the total amount of fixed costs. The reasons for using financial leverage may differ from individuals to firms. Companies may want to acquire property and equipment to increase shareholder value, but individual investors might use leverage to increase their return on investment. Financial leverage is the use of debt to acquire additional assets or fund projects.

Illustration Of Financial Leverage

He is a CFA charterholder as well as holding FINRA Series 7 & 63 licenses. He currently researches and teaches at the Hebrew University in Jerusalem.This can lead to rapid ruin, for even if the underlying asset value decline is mild or temporary the debt-financing may be only short-term, and thus due for immediate repayment. The risk can be mitigated by negotiating the terms of leverage, by maintaining unused capacity for additional borrowing, and by leveraging only liquid assets which may rapidly be converted to cash. Brokers may demand additional funds when the value of securities held declines. Banks may decline to renew mortgages when the value of real estate declines below the debt’s principal.Be sure to include both short-term and long-term debt when completing the calculation. News Learn how the latest news and information from around the world can impact you and your business. Alternatives Looking for a different set of features or lower price point? Accounting AccountEdge Pro AccountEdge Pro has all the accounting features a growing business needs, combining the reliability of a desktop application with the flexibility of a mobile app for those needing on-the-go access.