It ensures clear communication, aligning needs and deliveries. Strengthen your supply chain to avoid those annoying late deliveries. Regularly review your supply chain and gather data at each phase. This helps gauge efficiency and keeps a close eye on your retail inventory. Think of your inventory as the unsung hero, often overshadowed by pricier assets like buildings or machinery.

Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets. For fiscal year 2022, Walmart Inc. (WMT) reported cost of sales of $429 billion and year-end inventory of $56.5 billion, up from $44.9 billion a year earlier. Secondly, average value of inventory is used to offset seasonality effects. It is calculated by adding the value of inventory at the end of a period to the value of inventory at the end of the prior period and dividing the sum by 2. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Optimize your supply chain

A high inventory turnover ratio, on the other hand, suggests strong sales. Alternatively, it could be the result of insufficient inventory. As problems go, ensuring a company has sufficient inventory to support strong sales is a better one to have than needing to scale down inventory because business is lagging.

- A higher receivables turnover ratio indicates the company is more efficient than its competitors when collecting accounts receivable.

- Inventory turnover is an especially important piece of data for maximizing efficiency in the sale of perishable and other time-sensitive goods.

- Here is a list of our partners and here’s how we make money.

- Since the inventory turnover ratio represents the number of times that a company clears out its entire inventory balance across a defined period, higher turnover ratios are preferred.

In addition, it may show that Walmart is not overspending on inventory purchases and is not incurring high storage and holding costs compared to Target. The inventory turnover ratio measures a company’s ability to manage its inventory efficiently and provides insight into the sales of a company. The ratio measures how many times the total average inventory has been sold over the course of a period. Analysts use the ratio to determine if there are enough sales being generated to turn or utilize the inventory. The ratio also shows how well inventory is being managed including whether too much or not enough inventory is being bought.

What Do Efficiency Ratios Measure?

We’ll now move on to a modeling exercise, which you can access by filling out the form below. Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. Here is a list of our partners and here’s how we make money. Access and download collection of free Templates to help power your productivity and performance.

It quantifies the frequency of inventory turnover and aids in making informed decisions about purchasing, production, and sales strategies. Inventory turnover rate might not account for seasonal fluctuations in demand, potentially resulting in inaccurate assessments of inventory management. Analyzing the performance of different products in terms of turnover rate and profitability allows businesses to allocate resources more effectively. Consumer demand can be unpredictable and can significantly impact ITR. A sudden spike in demand might lead to rapid stock depletion, while a drop in interest might leave companies with excess inventory, both affecting turnover rates.

Which of these is most important for your financial advisor to have?

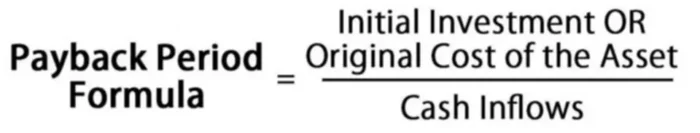

The purpose of calculating the inventory turnover rate is to help companies make informed decisions about pricing, manufacturing, marketing, and purchasing new inventory. For some businesses, the ideal inventory turnover ratio is between 5 and 10. This implies the companies sell and replenish their inventory approximately every one to two months. For example, a company like Coca-Cola could use the inventory turnover ratio to find out how quickly it’s selling its products, compared to other companies in the same industry. The formula used to calculate a company’s inventory turnover ratio is as follows.

What does a 1.5 inventory turnover ratio indicate?

Say those winter jackets were a hit last year; you’ll want to stock up again. When you dive into specifics, consumer discretionary brands stand out. Such brands cycle through their inventory close to seven times each year. One isn’t better than the other, but be sure you are consistent with your comparisons. You don’t want to use annual sales to find the ratio for one company while using the cost of goods sold for another. It wouldn’t give you any real sense of how the two compare.

Take your cost of goods sold and divide it by your average inventory. Knowing which items sell slowly also tells you what might be taking up too much space. Maybe it’s time to clear out old stock or adjust your orders. With your turnover ratio in hand, you can see where your supply chain might need a tune-up.

Failing to account for these costs can lead to suboptimal decisions and hinder overall profitability. It’s crucial for businesses to ensure that a high ITR is due to demand and not understocking. It allows companies to understand where they stand in relation to their peers, helping them identify areas of improvement or strength in their inventory management processes. For example, a company with $20,000 in average inventory with a COGS of $200,000 will have an ITR of 10. Average Inventory is the mean value of the inventory during a specific period, typically calculated by adding the beginning and ending inventory for a period and dividing by two.