Most online payroll services offer an intuitive interface that makes payroll setup easy for users. The same goes for QuickBooks in which its setup wizard guides you through the whole process. QuickBooks Payroll integrates with SimplyInsured for health insurance, Guideline for retirement plans, Mammoth for HR and other Intuit products. But beyond that, choices are limited for exploring other outside add-ons.

QuickBooks Payroll partners with 3rd party providers to offer health insurance, workers’ compensation, and retirement plans. With RUN’s payroll and HR package, you will receive features that go above and beyond what you get with other providers.

You don’t even have to wait for the start of a new quarter or a new year — ADP can support your switch anytime. See our guidebook, Switching Payroll Providers Made Easy, for step-by-step resources for switching payroll. ADP has a variety of flexible options designed specifically for small businesses. Taking into consideration the added value of HR tools that are included with RUN Powered by ADP, it’s clear that our payroll solutions offer more value than other providers. Compare our payroll packagesto see which plan is right for you. The Benefits option in Intuit QuickBooks Online Payroll provides an easy way to obtain quotes and sign up for medical, dental, and vision insurance.

For Elite time tracking, clients will need to upgrade to QuickBooks Online Payroll Elite. Payroll is undoubtedly complicated and consumes more time when done manually. It is not an easy task employee accurately without any mishappenings with the numerical when the strength size is humongous.

Auto Payroll- The auto payroll feature lets employees run payroll without adding any additional entries, review payroll before processing, and add compensation as well as bonuses to the payroll. It costs $75/month plus an additional charge of $8 per additional employee. It streamlines accounting works for the company’s employees and helps in easy payroll processing. QuickBooks Payroll is the #1 payroll provider for small businesses – we help 1.4 million of them do payroll and file taxes. With also offer access to health benefits, workers compensation, and more. The Work Number is a user-paid verification of employment database created by TALX Corp., a data broker acquired by Equifax in 2007.

Yes, but first you will have to set up payroll services to start using them for QuickBooks Desktop. If you’ve purchased payroll from QuickBooks, it will automatically be activated for you.

Mobile Payroll For Employers

It’s smart to start slowly when you’re introducing a new application—especially one as exacting as payroll. QuickBooks Payroll Core is a good value for businesses that also use QuickBooks Online.

- Setting up your payroll software into desktop without any hassle.

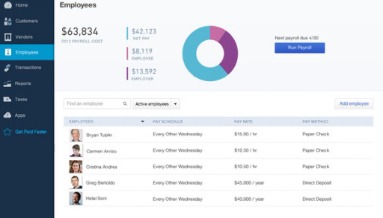

- At the top of the page is your total payroll run cost; QuickBooks breaks down the numbers by net pay, employee, and employer in a pie chart.

- ADP is a better way to work for you and your employees, so everyone can reach their full potential.

- However, in testing, most of the answers I received from the bot were about accounting service QuickBooks Online or Desktop Payroll.

- QuickBooks will recommend the best payroll plan for you, and you can even sign up for a 30-day free trial.

- Programs, rates, terms and conditions are subject to change without notice.

If you want to use that payday for other employees you plan to enter, you can check a box to do so. Adding your employees is the most time-consuming step in setup. Some sites, including OnPay, use separate areas of the site for tasks like creating pay schedules and defining benefits and other withholdings. Others, including QuickBooks Payroll and Square Payroll, take care of those tasks in the employee records. QuickBooks Payroll has the tools you need to manage your company’s payroll tasks in an easy-to-use website, but it lacks functionality and flexibility found in competing services. It works as a standalone application, but makes more sense as an add-on to QuickBooks Online.

Expert Support

Clear the checkboxInclude automated income and employment verification service powered by The Work Number from Equifax. When The Work Number receives a request for the information, the service will check against your QuickBooks payroll data for a match to the employee whose data has been requested. QuickBooks or Intuit Online Payroll customers will collect and store employee payroll data. Both payroll platforms have helped millions of small business customers. Yet, not every small business has the same payroll and HR needs or budget. Let’s look into some cases when each software could be a better solution for small businesses. When evaluating ADP vs Intuit Online Payroll for your small business, it can be helpful to consider how each software app integrates with other products you use for sales, accounting, and more.

Do you have to pay a monthly fee for QuickBooks?

$180/month. All Plus features for up to 25 users, plus analytics and insights, dedicated account team, online training and more. QuickBooks Online users can switch plans or cancel at any time without having to pay any installation, set-up or termination fees.

AFAICT, there isn’t a way for individual employees to opt out. Equifax’s security improvements included the addition of four multiple-guess questions whose answers were based on publicly-available data. But these requirements were easily bypassed, as evidenced by a previous breach at Equifax’s employment division. In future installments of this payroll series we will examine the products in greater depth along with their implementation and related issues. Between now and then, you can visit this official Intuit Firm of the Future Blog post for more information about each offering plus other details on support for payroll subscriptions. On November 1st, 2020, every existing QuickBooks Online Payroll user will be converted from their current subscription level to one of the three new subscription plans. QuickBooks Payroll does not offer a full suite of advanced state unemployment insurance management tools.

Company Size

Yes, you can manage payroll and your books in one place with the integrated suite of QuickBooks products including QuickBooks Desktop Pro, Premier, or Enterprise. Fortunately, Intuit says customers can opt-out of this program at any time – even if it’s after Aug. 1, 2021. If you decide later you want this service, follow the steps above and select the checkboxInclude automated income and employment verification service powered by The Work Number from Equifax. If you decide later you want the service, follow the steps above and select the checkboxInclude automated income and employment verification service powered by The Work Number from Equifax.

Applicant Tracking Zoho Recruit Zoho Recruit combines a robust feature set with an intuitive user interface and affordable pricing to speed up and simplify the recruitment process. QuickBooks Payroll is available on Android and iOS devices, but neither app is as comprehensive as the desktop site, nor as thorough as OnPay’s and Gusto’s mobile experiences. I didn’t notice any changes to the app since the time of my last review. “How much do you pay Tina?” is the introduction to the next task. You enter an hourly rate, salary, or commission-only, and then choose any other earnings types that might apply . QuickBooks Payroll Core offers the most common standard rates and lets you create an unlimited number of additional earnings types. If you’ve used or are currently using QuickBooks Online, QuickBooks Payroll Core’s screens should look familiar.

Applicant Tracking Choosing the best applicant tracking system is crucial to having a smooth recruitment process that saves you time and money. Find out what you need to look for in an applicant tracking system. CMS A content management system software allows you to publish content, create a user-friendly web experience, and manage your audience lifecycle. If you’ve already been paying employees, you can enter that historical data on your own. If you live in a state that has complicated payroll tax requirements, you can request help from a payroll agent or consult the QB Assistant bot. However, in testing, most of the answers I received from the bot were about accounting service QuickBooks Online or Desktop Payroll. Opening up the voluminous QuickBooks Support pages didn’t help much either, because responses are not prioritized by usefulness.

Welcome To Intuit

For small businesses running multiple or frequent payroll schedules, this cost can rise quickly. It’s not all bad news though — ADP makes it easy to set up individual pay rates and enroll employees to automate payroll runs. Also, ADP lets users run payroll online, by phone call, and a mobile payroll app. Intuit Online covers all the basic functions of payroll across its three plans. The admin portal is straightforward and intuitive, aided by the fact that there are separate tabs for employees, contractors, and benefits. Similar to ADP, reporting, direct deposit, and automated tax forms are available on every plan. While working with your payroll clients, you can determine which of the three subscriptions are a good fit for each client.

View My Paycheck is another marvelous feature that possesses by the QuickBooks Payroll. It’s a kind of application which employees can access with a unique ID & password checkout the details of their paychecks. In order to avoid any confliction between you and your clients work, Accountant’s Copy can be of much help. In case the user wants any kind of assistance, he/she can call our QuickBooks support team.

In selling payroll data to Equifax, Intuit will be joining some of the world’s largest payroll providers. For example, ADP — the largest payroll software provider in the United States — has long shared payroll data with Equifax. With 24/7 live support anytime you need it and a long history of payroll compliance expertise, ADP is an industry leader when it comes to customer service. When you choose ADP, you also get dedicated onboarding support. ADP’s suite of user-friendly tools include advanced state unemployment insurance management tools and in-product COVID-19 “return to the workplace” tools.

Uninstall And Reinstall Quickbooks

Also, if you opt out of online behavioral advertising, you may still see ads when you sign in to your account, for example through Online Banking or MyMerrill. These ads are based on your specific account relationships with us. Yes, Ace Cloud Hosting’s payroll experts can guide you through payroll setup and help you stay compliant.

Nothing contained in this communication is intended to be, nor should be construed as, particularized advice or a recommendation or suggestion that you take or not take a particular action. ADP, Inc. and its affiliates are not affiliated with Gusto, Paychex or QuickBooks Payroll. Information based on ADP internal research and is accurate as of April 26, 2021 and is subject to change.

They each include everything from the current product plus added benefits. Over the past year, QuickBooks® Online Payroll’s revamped lineup has rolled out to new customers. Your current payroll clients will have access to all three products by mid 2021, but they may have questions in the meantime. Prepare and submit payroll taxes- With QuickBooks payroll guide, the employees get easy tax filing and don’t have to worry about late filing penalties. The payroll helps in handling responsibilities related to Medicare tax, state and local taxes as well as FUTA and SUTA.

Employees can also visit the Equifax and The Work Number website to access their own employment data report or to submit a data dispute. The resource provides individuals with access to review information Equifax and The Work Number has in your file quickbooks payroll and to see who has obtained your information. Depending on the payroll software you are using, you may have slightly different steps. However, here are the steps we found that most users can follow to successfully opt-out of The Work Network.