Explore definition, purpose, examples, and types of internal controls in this lesson. Physical control over assets and records helps protect the company’s assets. These control activities may include elec tronic or mechanical controls or computer-related controls dealing with access privileges or established backup and recovery procedures. Testing of internal controls includes making inquiries to management and employees, inspecting source documents, observing inventory counts, and actually re-performing client procedures.

Auditors Role In The Control Process

This involves making judgments regarding both precision and sufficiency of controls required to mitigate the risks. The internal controls, accounting measures and procedures in an organization will determine the accuracy and reliably of its accounting information. Auditors also look out for the available internal control measures in a company and to what extent the financial statements have complied with the accepted rules. In an audit process, auditors examine the effectiveness of the internal controls of a company and give opinions based on the examination. After the Sarbanes-Oxley Act was passed by Congress in 2002, it made managers responsible for the internal controls.Internal controls as related to fraud are the measures, policies, and procedures a company puts in place to safeguard assets and ensure the reliability of accounting data. A well designed process with appropriate internal controls should meet most, if not all of these control objectives. The financial reporting review provides assurance that financial reporting of actual results is complete, accurate and valid, detects material misstatements for correction. The quarterly variance analysis and flash forecast allow divisions to course correct throughout the year, deliver transparent reporting, and improve the quality of actual, budget, and forecast data. We will notify you when it’s time to perform this quarter’s controls via our regular weekly DFL Update email.For instance, the 2002 Sarbanes-Oxley Act requires companies to prove that their financial statements are accurately reported, and that they maintain effective policies to prevent fraud. Specifically, they require companies to perform a 404 audit providing evidence of control testing and enforcement. Companies must also demonstrate that they account for uncertainty, such as stock market fluctuations. Monitoring is the review of an organization’s activities and transactions to assess the quality of performance over time and to determine whether controls are effective. Management should focus monitoring efforts on internal control and achievement of organization objectives. For monitoring to be most effective, all employees need to understand the organization’s mission, objectives, and responsibilities and risk tolerance levels.

University Relations

Having proper segregation of duties is sometimes difficult for small organizations; however, organizations should try to segregate these functions to the best of their ability. In situations where segregation cannot occur, proper management oversight should be implemented so that any errors or irregularities can be timely caught. Internal controls helps to prevent errors and misstatement of financial statements.

What is internal control questionnaire?

An internal control questionnaire is a document which an auditor provides to employees of a company before performing an audit. … When employees answer the questions, the auditor knows whether the company is keeping accurate records overall, and has evidence that shows who is responsible for which documents.Establish new procedures and set up a perception of control so that the flow of responsibilities and transactions is diversified among staff – as much as possible. It’s essential to identify and analyze these risks in order to prevent an adverse event from occurring. If implementing a recommended control seems too expensive, be sure to consider the full cost of a fraud that could occur because of the missing control. In addition to any funds that may be lost, consider the cost of time that would have been spent by the department during the time of an investigation of the matter, and the cost of hiring a new employee. Validity – The objective is to ensure that all recorded transactions fairly represent the economic events that actually occurred, are lawful in nature, and have been executed in accordance with management’s general authorization.

What Is Internal Control?

Implementingsegregation of dutieswhere duties are divided among different people, to reduce the risk of error or inappropriate actions. Promote efficient and effective operations – Internal controls provide an environment in which managers and staff can maximize the efficiency and effectiveness of their operations. If employees calculate daily or weekly trial balances, this will help maintain analysis of the state of the system so that discrepancies can be discovered early.

Numerical sequences of transactions are accounted for, and file totals are controlled and reconciled with prior balances and control accounts. Development of new systems and changes to existing ones are controlled, as is access to data, files and programs. A system of internal controls tends to increase in comprehensiveness as a firm increases in size. This is needed, because the original founders do not have the time to maintain complete oversight when there are many employees and/or locations. Further, when a company goes public, there are additional financial control requirements that must be implemented, especially if the firm’s shares are to be listed for sale on a stock exchange. Internal control is the general responsibility of all members in an organization.

Office Of Audit, Risk, & Compliance

Any change that affects an element of the organization’s security architecture is a potential architectural control weakness. The focus of security architecture is to create a unified system for documenting and addressing the risks of the information technology environment. Weaknesses in a technical control are due to technological and maintenance changes or configuration failures. If controls are strong enough, we can be sure that errors and irregularities will always be detected. We do what the Office of Financial Affairs or the Department of Finance tells us to do. Good performance should be valued highly and recognized in a positive matter. Ted is a bookkeeper in the accounting department of a local department store.

- Specifically, they require companies to perform a 404 audit providing evidence of control testing and enforcement.

- Management is accountable to the board of directors, which provides governance, guidance and oversight.

- Architectural control weaknesses usually involve changes to hardware or software configuration.

- After the Sarbanes-Oxley Act was passed by Congress in 2002, it made managers responsible for the internal controls.

Also, Investors look out for internal controls in companies before they choose to invest in them. As contained in Sarbanes-Oxley Act of 2002, internal controls are part of corporate governance that companies must put in place to safeguard investors from fraudulent activities. Section 315 to obtain an understanding of internal control relevant to the audit.

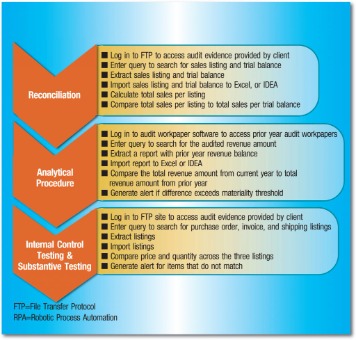

How To Conduct A Financial Audit

Additionally, controls ensure that your company’s accounting system is in accordance with applicable laws and regulations. Performing a self-evaluation can help you to highlight any areas that come up short before problems arise and give you the opportunity to use more effective controls. The easiest process to perform a self-evaluation is by conducting a trace of a particular transaction throughout company records and procedures.Risks and controls may be entity-level or assertion-level under the PCAOB guidance. However, a combination of entity-level and assertion-level controls are typically identified to address assertion-level risks. The PCAOB set forth a three-level hierarchy for considering the precision of entity-level controls. what is internal control in accounting Later guidance by the PCAOB regarding small public firms provided several factors to consider in assessing precision. Top-level reviews – analysis of actual results versus organizational goals or plans, periodic and regular operational reviews, metrics, and other key performance indicators .

Key Elements Of Good Internal Controls

It includes regular management and supervisory activities, and other actions personnel take in performing their duties. The scope and frequency of separate evaluations will depend primarily on an assessment of risks and the effectiveness of ongoing monitoring procedures. Pertinent information must be identified, captured and communicated in a form and timeframe that enable people to carry out their responsibilities. Information systems produce reports, containing operational, financial and compliance-related information, that make it possible to run and control the business. They deal not only with internally generated data, but also information about external events, activities and conditions necessary to informed business decision-making and external reporting. The control environment sets the tone of an organization, influencing the control consciousness of its people. It is the foundation for all other components of internal control, providing discipline and structure.In fact, access to a computer by an unauthorized person could result in significant theft in less time than with a manual system. In general terms, the purpose of internal control is to ensure the efficient operations of a business, thus enabling the business to effectively reach its goals. Undesirable trends in metrics like revenue, profitability, or customer attrition, may be related to a failure of internal controls. Tie together reports from all departments to get a picture of the entire organization. When reviewing accounts payable, you must verify that all payments are being sent to the right person or company. You must then cross-reference these payments with all financial statements, both internal and external . The Committee of Sponsoring Organizations has developed an internal control framework that describes the components of internal control for any organization.A control with direct impact on the achievement of an objective is said to be more precise than one with indirect impact on the objective or risk. Precision is distinct from sufficiency; that is, multiple controls with varying degrees of precision may be involved in achieving a control objective or mitigating a risk. There are many definitions of internal control, as it affects the various constituencies of an organization in various ways and at different levels of aggregation. Remember, everyone in your department has responsibility for internal controls. Detection controls attempt to uncover errors or irregularities that may already have occurred. Examples include reconciliations, monitoring of actual expenses vs. budget, prior periods and forecasts.