Outside of academia, Julius is a CFO consultant and financial business partner for companies that need strategic and senior-level advisory services that help grow their companies and become more profitable. Working capital, or “net working capital ,” is a measure of a company’s liquidity, operational efficiency, and short-term financial health. Liquidity ratios are a class of financial metrics used to determine a debtor’s ability to pay off current debt obligations without raising external capital.As such losses in current assets reduce working capital below its desired level, it may take longer-term funds or assets to replenish the current-asset shortfall, which is a costly way to finance additional working capital. While it can’t lose its value to depreciation over time, working capital may be devalued when some assets have to be marked to market. That happens when an asset’s price is below its original cost, and others are not salvageable. Identify the cash balance which allows for the business to meet day to day expenses, but reduces cash holding costs. Guided by the above criteria, management will use a combination of policies and techniques for the management of working capital.

Smes: The Financial Kpis To Assess Your Trading Partners

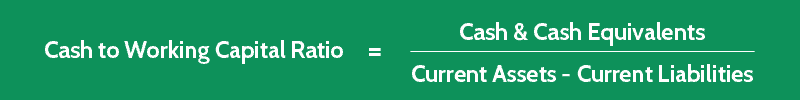

Because this number effectively corresponds to the time that the firm’s cash is tied up in operations and unavailable for other activities, management generally aims at a low net count. A company’s working capital is understood as the result from subtracting current assets from current liabilities.To tell you about Liquidity ratio, it measures how the liquid assets of a company are easily converted into cash as compared to its current liabilities. And there are 3 types of liquidity ratios – Acid Ratio, , and the other is current ratio and the last one is cash ratios. The key to understanding the current ratio begins with the balance sheet. As one of the three primary financial statements your business will produce, it serves as a historical record of a specific moment in time. While the balance sheet does not show performance over time, it does show a snapshot of everything your company possesses compared to what it owes and owns. This is why there are several useful liquidity ratios that can be calculated, like the current ratio.

This increases current assets by adding to the company’s available cash but doesn’t overly increase current liabilities. Analysts and lenders use the current ratio as well as a related metric, the quick ratio, to measure a company’s liquidity and ability to meet its short-term obligations.Construction Management This guide will help you find some of the best construction software platforms out there, and provide everything you need to know about which solutions are best suited for your business. If you have enough current assets to quickly pay current liabilities, you can make employees and creditors happy. Therefore, a good working capital ratio can determine just how liquid the assets really are. This can increase cash flow, reducing the need to draw on working capital for day-to-day operations. Cash flow is the amount of cash and cash equivalents that moves in and out of the business during an accounting period. The balance sheet is a snapshot of the company’s assets, liabilities and shareholders’ equity at a moment in time, such as the end of a quarter or fiscal year.Sophisticated buyers review closely a target’s working capital cycle because it provides them with an idea of the management’s effectiveness at managing their balance sheet and generating free cash flows. Working capital is calculated by subtracting current liabilities from current assets.

Invest In Financial Software Tools

This is represented by combining the accounts receivable and inventories, less accounts payable. This way, it gives a more realistic picture of the company’s liquidity position. The working capital ratio can be misleading if a company’s current assets are heavily weighted in favor of inventories, since this current asset can be difficult to liquidate in the short term. A similar problem can arise if accounts receivable payment terms are quite lengthy . A managerial accounting strategy focusing on maintaining efficient levels of both components of working capital, current assets, and current liabilities, in respect to each other.Working capital is the amount remaining after a company’s current liabilities are subtracted from its current assets. Accrual basis accounting creating deferred revenue while the cost of goods sold is lower than the revenue to be generatedE.g. A software as a service business or newspaper receives cash from customers early on, but has to include the cash as a deferred revenue liability until the service is delivered. The cost of delivering the service or newspaper is usually working capital ratio formula lower than revenue thus, when the revenue is recognized, the business will generate gross income. After all, working capital is an indicator of business efficiency and financial solvency. Healthy firms can meet current financial responsibilities, and positive working capital indicates an ability to invest in other operational needs. In this sense, even though a company may suffer from low cash flow at a given point in time, its Working Capital may be in a good position.Even if a company has a lot invested in fixed assets, it will face financial and operating challenges if liabilities are due. This may lead to more borrowing, late payments to creditors and suppliers, and, as a result, a lower corporate credit rating for the company.

What is Philippine capital adequacy ratio?

Published by Statista Research Department, Jun 21, 2021. As of 2019, the ratio of bank capital and reserves to total assets in the Philippines was approximately 11 percent. The Philippines’ banks’ capital adequacy ratio remained above the minimum ratio of capital to risk-weighted assets, which was 8 percent.A working capital ratio of less than 1.0 is a strong indicator that there will be liquidity problems in the future, while a ratio in the vicinity of 2.0 is considered to represent good short-term liquidity. The ratio is used by lenders and creditors when deciding whether to extend credit to a borrower. Accounts PayableAccounts payable is the amount due by a business to its suppliers or vendors for the purchase of products or services. It is categorized as current liabilities on the balance sheet and must be satisfied within an accounting period. Components Of Working CapitalMajor components of working capital are its current assets and current liabilities, and the difference between them makes up the working capital of a business.

Smes: Monitor Your Financial Performance

The biggest drain affecting your working capital requirement is payment delays. Late payments can force many companies to draw on their working capital to pay the bills in the best of times, and in fact payment delays are the leading cause of insolvencies. Providing a comprehensive view of diverse data sources to identify new opportunities to put cash to good use through strategic investment, product development, strategic partnerships with key suppliers, etc. In order to better understand the ways in which NWC, changes in NWC, and the NWC ratio are used, let us consider the example of fictional business Company X and its efforts to monitor and manage its liquidity. You can narrow the focus of your Net working capital calculation by removing cash and debts.Cash-up-front businesses, like many retailers, grocery stores, and restaurants, often have negative working capital because they use the cash to pay off their Accounts Payable rather than keeping liquid capital on hand. For example, if your customer pays by credit card before you have to pay your vendors for the product, this can improve your business’ efficiency and can save you from paying interest on bank financing. If your business works with suppliers, another helpful metric to know is your working capital requirement. This is the amount of money you need to buy goods or raw materials from suppliers and either hold them as inventory or use them for manufacturing in order to sell to customers. By providing a monetary indicator of supply and demand, this formula can help you adequately plan for an increase in sales, without running out of the cash needed to obtain the products or materials to satisfy growth. Other current liabilities vary depending on your occupation, your industry, or government regulations.

Investing in increased production may also result in a decrease in working capital. Working capital management focuses on ensuring the company can meet day-to-day operating expenses while using its financial resources in the most productive and efficient way. A business that maintains positive working capital will likely have a greater ability to withstand financial challenges and the flexibility to invest in growth after meeting short-term obligations. ScaleFactor is on a mission to remove the barriers to financial clarity that every business owner faces. Ultimately, a “good” current ratio is subjective and depends on your business and the industry in which you operate.

Why Is Net Working Capital Important To Your Business?

A high ratio in a broad view might mean that inventories are holding more financial strength of the company hence making it very hard for the available working capital to generate any cash. A lower ratio implies that the company can liquidate its inventories very fast and be able to make payments to its current liability. This example reveals that the company has an increasing trend over time in terms of how its operations depend on the inventory, which is very dangerous. With time it will be challenging for the company to turn over its inventories to make payments to its short term liabilities and accounts payable. Current assets such as cash equivalents, cash, and marketable securities are the best options when it comes to paying current liabilities.

- Which is the same case for pre-paid items such as insurance policies paid fully upfront.

- In other words, inventory to working capital ratio measures how well a company can generate additional cash using its net working capital at its current inventory level.

- Companies with low Working Capital Ratios will probably get denied for new loans, as their payment capacity is in question.

- Too little working capital can signal liquidity problems; too much working capital suggests you are not using your assets efficiently to increase revenues.

- When current assets are greater than current liabilities—meaning that the NWC is above one—this indicates that the company can generally manage its near-term financial obligations.

- Insert current assets and current liabilities totals from your most recent balance sheet to calculate the current ratio.

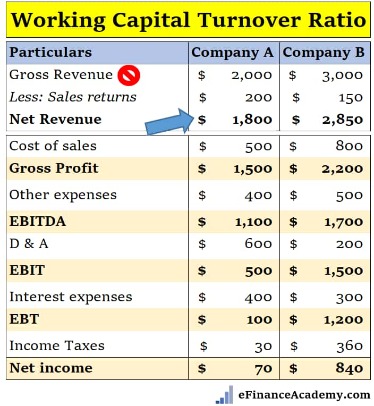

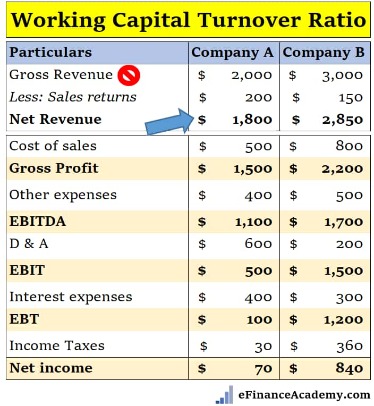

If you need help with determining your average working capital, you can post your legal need on the UpCounsel marketplace. Lawyers on UpCounsel come from prestigious law schools like Yale Law and Harvard Law and usually have 14 years of legal experience, including work on behalf of or with companies like Airbnb, Menlo Ventures, and Google. For instance, Company X has net sales of $10 million in a 12-month period and had an average working capital of $2 million within that same period. If your working capital ratio is high, it is not necessarily a good thing because it indicates that your business isn’t investing excess cash or has too much inventory. Sage 50cloud is a feature-rich accounting platform with tools for sales tracking, reporting, invoicing and payment processing and vendor, customer and employee management. If you’re looking to automate your business or are just in the market for something new, be sure to check out The Blueprint’s accounting software reviews. The working capital ratio provides you with a good look at the total liquidity of your business for the upcoming year.The answer may be counterintuitive, because a negative change indicates that Current Assets are increasing more than Current Liabilities. Conversely, a positive change indicates that Current Liabilities are outpacing Current Assets. While the above formula and example are the most standard definition of working capital, there are other more focused definitions. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.For most companies, working capital constantly fluctuates; the balance sheet captures a snapshot of its value on a specific date. Many factors can influence the amount of working capital, including big outgoing payments and seasonal fluctuations in sales. Days Sales Outstanding FormulaDays sales outstanding portrays the company’s efficiency to recover its credit sales bills from the debtors.It also might want to use some of its “excess” current assets, like cash, to invest in profit-generating components of the business. If a company’s NWC is less than one (“negative”), on the other hand, this suggests there might be a capital shortage or liquidity issues that will need to soon be addressed.

Liquidity

Working capital management is a strategy that requires monitoring a company’s current assets and liabilities to ensure its efficient operation. Working capital as current assets cannot be depreciated the way long-term, fixed assets are. Certain working capital, such as inventory and accounts receivable, may lose value or even be written off sometimes, but how that is recorded does not follow depreciation rules. Working capital as current assets can only be expensed immediately as one-time costs to match the revenue they help generate in the period. Calculating Working Capital Turnover Ratio provides a clear indication of how hard you are putting your available capital to work in order to help your company succeed. The more sales you bring in per dollar of working capital deployed, the better.Reliance on any information provided on this site or courses is solely at your own risk. Negative working capital is a giant red flag for a company as it means that the company is in financial trouble and management needs to act immediately to source additional funding. Working Capital is the money available to a business AFTER it’s fully paid off all its bills and short-term debts. UpCounsel is an interactive online service that makes it faster and easier for businesses to find and hire legal help solely based on their preferences. We are not a law firm, do not provide any legal services, legal advice or “lawyer referral services” and do not provide or participate in any legal representation. This indicates whether a company possesses enough short-term assets to cover short-term debt.You’ll have the cash you need to cover short-term obligations, handle emergencies, and invest in growth and innovation. The working capital ratio is a measure of liquidity, revealing whether a business can pay its obligations. The ratio is the relative proportion of an entity’s current assets to its current liabilities, and shows the ability of a business to pay for its current liabilities with its current assets.

What Is An Example Of Nwc?

No matter what part of the life cycle your business is in, calculating your working capital is important. While it’s possible to calculate this ratio manually, the best way to calculate your working capital is by using accounting software. That equation is actually used to determine working capital, not the net working capital ratio.