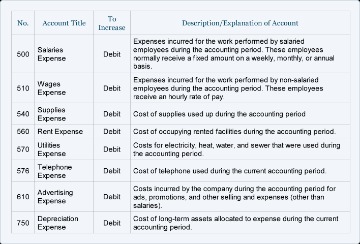

For example, Meals Expense might be a standalone account or it might be spread across the categories the meals relate to, such as Marketing, Conferences, or Travel. Gross margin is the profit after subtracting direct costs from sales. Everyone agrees that direct labor and direct materials are always direct costs. Emilie is a Certified Accountant and Banker with Master’s in Business and 15 years of experience in finance and accounting from large corporates and banks, as well as fast-growing start-ups.

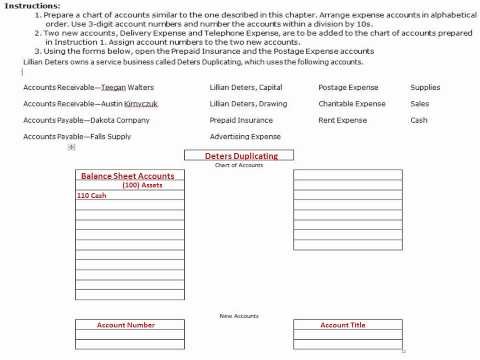

Each account in the chart of accounts is typically assigned a name. Accounts may also be assigned a unique account number by which the account can be identified. Account numbers may be structured to suit the needs of an organization, such as digit/s representing a division of the company, a department, the type of account, etc. The first digit might, for example, signify the type of account (asset, liability, etc.). In accounting software, using the account number may be a more rapid way to post to an account, and allows accounts to be presented in numeric order rather than alphabetic order. A chart of accounts is a list of accounts available for recording transactions in a company’s general ledger. Think of it as the filing cabinet for your small business’s accounting system.

Funds received as gifts must be forwarded to the University Advancement Office for processing. Funds received from grant agencies must be forwarded to Controller’s Office for processing. Funds other than gifts and grants are processed by the department or reporting unit. The department, reporting unit or activity manager must assign a seventeen-digit code to these receipts and forward them to the Controller’s Office for further processing.

Some of the components of the owner’s equity accounts include common stock, preferred stock, and retained earnings. The numbering system of the owner’s equity account for a large company can continue from the liability accounts and start from 3000 to 3999. Regardless of your chart of accounts numbering, make sure it makes sense to you. The purpose of the numbers is to make recording transactions easier. Some small business owners use a combination of letters and numbers (e.g., A100). Now that you know chart of accounts definition, it’s time to see how it works. The sub-accounts are then categorized in the five main accounts (e.g., asset account).

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein. She would then make an adjusting entry to move all of the plaster expenses she already had recorded in the “Lab Supplies” expenses account into the new “Plaster” expenses account. Instead of recording it in the “Lab Supplies” expenses account, Doris might decide to create a new account for the plaster. Expense accounts are all of the money and resources you spend in the process of generating revenues, i.e. utilities, wages and rent. Running this blog since 2009 and trying to explain “Financial Management Concepts in Layman’s Terms”.

This is important because assets are key in creating the balance sheet, which is critical to keeping the books balanced. At first glance, a chart of accounts can be one of the scariest concepts in accounting. Faced with hoards of seemingly random numbers, it’s no wonder many new business owners become confused. But a chart of accounts is necessary for any small business, and fortunately, there’s a method to the madness. In this post, we’re going to help you better understand the chart of accounts and how to set up yours.

Chart Of Accounts Examples And Tips To Set Your Finance Team Up For Success

You can think of this like a rolodex of accounts that the bookkeeper and the accounting software can use to record transactions, make reports, and prepare financial statements throughout the year. The chart of accounts structure determines the level of detail available for financial reporting. The chart of accounts is therefore the foundation of the financial statements. One of the advantages of a powerful chart of accounts is that it can prolong the useful life of even entry-level accounting software. Often frustration with financial reporting can be fixed by remodeling the chart of accounts, rather than going through the very painful process of migrating to new software. While it sounds great in theory, in practice financial statements are what get faithfully generated and reviewed by management each month.

Goodwill is different from other asset accounts in that goodwill, unlike other assets, is not used in operations and cannot be sold, licensed or transferred. In a chart of accounts, accounts are shown in the order that they appear on your financial statements. Consequently, assets, liabilities, and shareholders’ equity are shown first, followed by revenue and expenses . In short, it’s an index of all the financial accounts in your company’s general ledger. It allows you to break down all the transactions that your business made during a specific period into different subcategories. By separating out your revenue, liabilities, assets, and business expenditures, a chart of accounts enables you to gain insight into the effectiveness of different areas of your business. That’s why a chart of accounts can be a beneficial addition to your financial analytics tools.

Examples of categories under assets would be deposited funds, prepaid insurance, and company vehicles. Equity accounts include common stock, paid-in capital, and retained earnings. The type and captions used for equity accounts are dependent on the type of entity. While gains are generally included in income, they are not considered revenue. Accounts are usually grouped into categories, such as assets, liabilities, equity, revenue and expenses.

The best way for you or your bookkeeper to manage your chart of accounts is by using accounting software tailored for your business type. If you’re interested in a better accounting software solution for your business, check out The Blueprint’s accounting software reviews. Every chart of accounts is structured this way, though you can add additional accounts or sub-accounts to better track transactions specific to your business type.

What is the purpose of a GL?

A general ledger (GL) is a set of numbered accounts a business uses to keep track of its financial transactions and to prepare financial reports. Each account is a unique record summarizing each type of asset, liability, equity, revenue and expense.

Liability accounts usually have the word “payable” in their name—accounts payable, wages payable, invoices payable. “Unearned revenues” are another kind of liability account—usually cash payments that your company has received before services are delivered. Set up your chart to have enough accounts to record transactions properly, but don’t go over board.

The Best Accounting Software For Chart Of Accounts

One can easily convert current assets into cash, such as checking accounts, money market, savings account, account receivables, inventory and so on. Current assets normally get the codes from 1000 to 1499, but again there are no hard rules for the same. Both the balance sheet and income statement accounts are further broken down into sub-categories. The chart of accounts is best for businesses which need simple and easier ways to manage documents.

- NerdWallet strives to keep its information accurate and up to date.

- You’ll be lost in the trees, unable to see the forest forever confused about your business’ finances.

- In short, it’s an index of all the financial accounts in your company’s general ledger.

- Well, this should be listed between the cash and accounts receivable in the chart, but there isn’t a number in between them.

- If so, and if this information is not needed for special reports, shut down these accounts and roll the stored information into a larger account.

- This includes records for each type of asset, liability, equity, revenue, and expense, which are organized into a variety of specific accounts.

In addition, periodically review the account list to see if any accounts contain relatively immaterial amounts. If so, and if this information is not needed for special reports, shut down these accounts and roll the stored information into a larger account.

Get Your Chart Of Accounts Organized, And Keep It That Way

Finally, a small business with no departments at all could have only a three-digit code assigned to its accounts such as yyy. Most of the organizations keep this as a three-digit code and assign these to the accounts such as assets, chart of accounts example supplies expense, revenue and so on. I am just transitioning my business record keeping from a invoicing program into an accounting program and this article has supported me massively in setting up my chart of accounts.

This helps keep track of money coming in and out of the company, especially when it’s time to file taxes. The general ledger is used to track the financial transactions of the business. However, the two are similar in that the general ledger uses the same account names and numbers as listed in the chart of accounts. The chart of accounts is a financial organization tool that lists every account in your accounting system – accounts are the ‘buckets’ where you put every business transaction. Initially, a company needs to decide the structure of its COA, the account types and the numbering pattern. If the firm wants to include all the expenses to provide a complete understanding of where it is spending the finances, it can customize its COA. However, the chart should be in line with the standard accounting norms.

Template: Standard Chart Of Accounts

If the amount of the journal entry is mixed in with the regular wage expense accounts, it can be difficult to see how much of the wage expense relates to cash payments and how much is accrued. The same is true for complex journal entries that adjust work in progress values, or over/under billings entries at companies that work with multi-month projects. Good month-end financial reports are made accurate with large non-cash journal entries. For example, if wages earned from October are paid on November 7, a journal entry must be posted to move that November 7 cash expense to October 31, to make October financials accurate. That approach can work as long as you have custom reporting capability.

Recording transactions to a specific account is what makes it possible to review the performance of your business at a glance. That isif, and this is ahugeif, your chart of accounts is organized correctly. If not, you won’t be glancing at reports and making fast decisions. You’ll be lost in the trees, unable to see the forest forever confused about your business’ finances. All the owner’s equity entries contain the account number starting with 3. Interest PayableInterest Payable is the amount of expense that has been incurred but not yet paid.

Let’s Book A Time To Connect

A chart of accounts is a list of financial accounts set up, usually by an accountant, for an organization, and available for use by the bookkeeper for recording transactions in the organization’s general ledger. Accounts may be added to the chart of accounts as needed; they would not generally be removed, especially if any transaction had been posted to the account or if there is a non-zero balance. Most importantly, it provides you with a clear picture of the financial health of your company. This is useful not just for business owners, but also investors and shareholders who may not have a handle on your company’s day-to-day operations. It also makes it easier for businesses to comply with financial reporting standards, which makes a chart of accounts extremely beneficial for businesses of all sizes. Each account on the chart of accounts contains an identification code, description, and name. This makes it easier to locate specific accounts, as a chart of accounts can get complex, especially for very large companies.

Nevertheless, the exact structure of the chart of accounts is the reflection on the individual needs of each entity. Essentially, if you placed the statements of financial position and performance on top of each other, you would come up with the chart of accounts. Emilie is a Certified Accountant and Banker with Master’s in Business and 15 years of experience in finance and accounting from corporates, financial services firms – and fast growing start-ups.

Expense Accounts

Plant and machinery, land and buildings, furniture, computers, copyright, and vehicles are all examples. If you are struggling to figure out an optimal chart of accounts for your business, Pilot is here to help. It’s technically okay to have your pants, socks, and shirts all jumbled together in one big dresser drawer, but it would be a nightmare to find anything.

Money is flowing out of your business, and in exchange, you’re gaining new equipment. The average small business shouldn’t have to exceed this limit if it sets up its accounts efficiently.

In a chart of accounts, there are primarily 2 accounts which are further divided into sub-accounts, in groups. There are a couple of ways you can successfully use your chart of accounts.

When deciding which accounts to include, think carefully about the type of business you run and the common assets and expenses you have. Only include information you actually need and account names that make sense to you . Doing the hard work of setting your accounts up correctly makes calculating margin by product or service line easy.

Unfortunately, using a pre-fabricated chart of accounts is like trying to build a dream house on a one-size-fits-all concrete foundation. The house would end up very different from the dream, and not be very functional. Accounting teams tend to focus on doing things the “right way” rather than asking the readers of the financial statements what they want to see. That is the equivalent of building a house for someone without asking how they want it built. In order to keep the number of accounts down to a manageable level, you may periodically review the list and close any accounts that are not fully utilized. The chart of accounts is as large and complex as the entity itself. Instead, each entity has the flexibility to customize its accounts chart to fit the specific individual needs of the business.