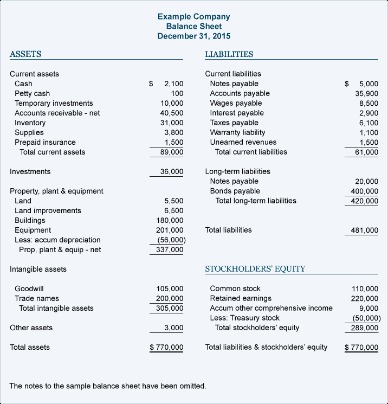

Learn more about what a balance sheet is, how it works, if you need one, and also see an example. A sample balance sheet for the fictitious Springfield Psychological Services at December 31, 2004 and 2003 is presented below, as an example.

This incredibly powerful tool not only tells you where you’ve been, but it will help you forecast into the future. Historically, balance sheet substantiation has been a wholly manual process, driven by spreadsheets, email and manual monitoring and reporting.

What To Look For In The Income Statement, Especially In Troubled Times

If a general price index is not available then an estimate should be based on movements in the exchange rate between the functional and a relatively stable foreign currency. For the same reasons, banks generally have a much higher debt/equity ratio than other firms. The cumulative amount of the reporting entity’s undistributed earnings or deficit. This is expenses incurred by the business, for which no supplier invoice has yet been received. This includes any prepayment that is expected to be used within one year. This includes all trade receivables, as well as all other types of receivables that should be collected within one year. Long-term assets, on the other hand, are things you don’t plan to convert to cash within a year.

What are the 3 most important financial statements?

The balance sheet, income statement, and cash flow statement each offer unique details with information that is all interconnected. Together the three statements give a comprehensive portrayal of the company’s operating activities.

Learn what a balance sheet is and what it tells you about your business. A balance sheet represents the financial state of your business in an easy-to-digest format. It’s often used as a report card of your company’s value to help attract investors. Because the two sides of this balance sheet represent two different aspects of the same entity, the totals must always be identical.

Why Is A Balance Sheet Important?

QuickBooks Online Advanced includes unlimited Tracked Classes and Locations. QuickBooks Plus includes up to 40 combined tracked classes and tracked locations. Tracked Classes and Locations are not available in Simple Start and Essentials. News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services. Fixed assets, like real estate and equipment, are categorized as “non-current” because they are less likely to sell in one year or less.

It’s easy to share reports with your business partners, investors, or colleagues. You can even schedule them to be automatically generated and sent daily, weekly, or monthly. Information and views provided are general classified balance sheet in nature and are not legal, tax, or investment advice. Information and suggestions regarding business risk management and safeguards do not necessarily represent Wells Fargo’s business practices or experience.

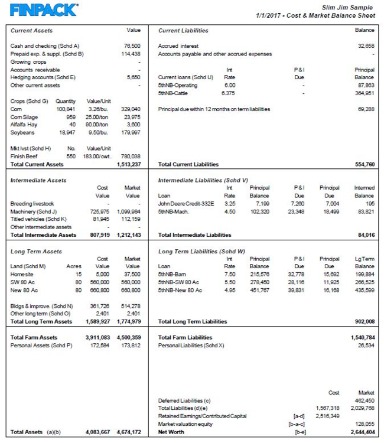

Short-term liabilities include accounts payable, such as short-term obligations accounts payable owed to vendors and creditors, and notes payable to others within the next 12 months. Long-term liabilities, due more than a year away, include a mortgage balance payable beyond the current year. Compare the current reporting period with previous ones using a percent change analysis. Calculating financial ratios and trends can help you identify potential financial problems that may not be obvious. Your balance sheet also provides some of the data you will need to calculate the basic financial ratios that can help you track the performance of your practice, identify trends and implement strategies to shore up your finances. With balance sheet data, you can evaluate factors such as your ability to meet financial obligations and how effectively you use credit to finance your operations . Amount of currency on hand as well as demand deposits with banks or financial institutions.

How To Prepare A Balance Sheet: 5 Steps For Beginners

Income taxes – The footnotes provide detailed information about the company’s current and deferred income taxes. The information is broken down by level – federal, state, local and/or foreign, and the main items that affect the company’s effective tax rate are described. Current liabilities are obligations a company expects to pay off within the year. A balance sheet provides detailed information about a company’s assets, liabilities and shareholders’ equity. This brochure is designed to help you gain a basic understanding of how to read financial statements. Just as a CPR class teaches you how to perform the basics of cardiac pulmonary resuscitation, this brochure will explain how to read the basic parts of a financial statement. It will not train you to be an accountant , but it should give you the confidence to be able to look at a set of financial statements and make sense of them.

A balance sheet is often presented alongside one for a different point in time for comparison. To ensure the balance sheet is balanced, it will be necessary to compare total assets against total liabilities plus equity.

Reading The Balance Sheet

It is a snapshot at a single point in time of the company’s accounts—covering its assets, liabilities and shareholders’ equity. A balance sheet is one of the key financial statements used for accounting and it’s divided into two sides. The other side shows the business’ liabilities and shareholders’ equity. For the best financial analysis, accountants may want to draw on data from the balance sheet and other forms, too. These can include a statement of cash flow or dynamic income statements.

By comparing your business’s current assets to its current liabilities, you’ll get a clear picture of the liquidity of your company. In other words, it shows you how much cash you have readily available. It’s wise to have a buffer between your current assets and liabilities to cover your short-term financial obligations. Return on Equity is a measure of a company’s profitability that takes a company’s annual return divided by the value of its total shareholders’ equity (i.e. 12%). ROE combines the income statement and the balance sheet as the net income or profit is compared to the shareholders’ equity.

Although these lines can be reported in various orders, the next line after net revenues typically shows the costs of the sales. This number tells you the amount of money the company spent to produce the goods or services it sold during the accounting period. An income statement is a report that shows how much revenue a company earned over a specific time period . An income statement also shows the costs and expenses associated with earning that revenue. The literal “bottom line” of the statement usually shows the company’s net earnings or losses. A balance sheet shows a snapshot of a company’s assets, liabilities and shareholders’ equity at the end of the reporting period. It does not show the flows into and out of the accounts during the period.

The interest income and expense are then added or subtracted from the operating profits to arrive at operating profit before income tax. Assets are generally listed based on how quickly they will be converted into cash. Current assets are things a company expects to convert to cash within one year. Most companies expect to sell their inventory for cash within one year. Noncurrent assets are things a company does not expect to convert to cash within one year or that would take longer than one year to sell. Fixed assets are those assets used to operate the business but that are not available for sale, such as trucks, office furniture and other property. Equity represents the amount of money that you or your investors have invested in the business.

The Income Statement

The Fed’s large-scale asset purchases were undertaken because, with interest rates nearly at zero, conventional interest-rate cuts wouldn’t suffice. However, as the FOMC recognized at the time, this relatively unfamiliar tool presented challenges, including the difficulty of estimating the effects of a given amount of asset purchases on near-term financial conditions. Predicting what market participants would infer about future policy from the Committee’s announcements about its asset-buying plans—the so-called signaling effect—was particularly challenging. Much of this response came through the signaling channel, as some market participants inferred that slower asset purchases also implied a more-rapid increase in short-term interest rates.

- Liabilities are funds owed by the business and are broken down into current and long-term categories.

- Return on Assets is a type of return on investment metric that measures the profitability of a business in relation to its total assets.

- Amount after accumulated impairment loss of an asset representing future economic benefits arising from other assets acquired in a business combination that are not individually identified and separately recognized.

- When on standby, the loan will be considered as equity by the financial institution.

- Marketable securities are unrestricted short-term financial instruments that are issued either for equity securities or for debt securities of a publicly listed company.

As you can see from the balance sheet above, it is broken into two main areas. Assets are on the top, and below them are the company’s liabilities and shareholders’ equity.

Determine The Reporting Date And Period

Board of Governors of the Federal Reserve System The Federal Reserve, the central bank of the United States, provides the nation with a safe, flexible, and stable monetary and financial system. Our platform features short, highly produced videos of HBS faculty and guest business experts, interactive graphs and exercises, cold calls to keep you engaged, and opportunities to contribute to a vibrant online community. More liquid accounts, such as Inventory, Cash, and Trades Payables, are placed in the current section before illiquid accounts (or non-current) such as Plant, Property, and Equipment (PP&E) and Long-Term Debt. Capital employed, also known as funds employed, is the total amount of capital used for the acquisition of profits.

Inventory, receivables, land, building, machinery and equipment do not pay obligations even though they can be sold for cash and then used to pay bills. If cash is inadequate or improperly managed the company may become insolvent and be forced into bankruptcy. Include all checking, money market and short term savings accounts under Cash. Working capital is the money leftover if a company paid its current liabilities (that is, its debts due within one-year of the date of the balance sheet) from its current assets.

Whether you’re doing your own accounting with accounting software, or you hired an accountant to prepare your financial statements, you’ve likely seen the balance sheet. The balance sheet, along with the income statement and statement of cash flows, provides an overview of a business’ financial standing. In addition to cash, IBM had other current and long-term assets, amounting to just over $150 billion in resources owned by the company at that point in time.

The balance sheet is one in a set of five financial statements distributed by a U.S. corporation. To get a complete understanding of the corporation’s financial position, one must study all five of the financial statements including the notes to the financial statements. This shows the changes in equity within a business for a specific reporting period. These include dividend payments, the sale or repurchase of stock, profit or loss changes. Accountants can use any of the above-described ratios with the information contained on balance sheets.

The use of funds must be short term so that the asset matures into cash prior to the obligation’s maturation. Proper matching would indicate borrowing for seasonal swings in sales which cause swings in inventory and receivables, or to repay accounts payable when attractive discount terms are offered for early payment. In addition to currency, the Fed now also has a large amount of short-term liabilities, primarily reserves held at the Fed by commercial banks and short-term assets of other counterparties, such as money market mutual funds. These liabilities were acquired in the process of the Fed’s asset purchases, as the bank accounts of those who sold assets to the Fed were credited; allowing assets to run off would extinguish those same liabilities.