How to Prepare Accounts Receivable Aging Reports?

Similarly, an accounts payable growing older report permits you to view the balances you owe to other corporations for supplies, inventory and companies your organization receives. Several pieces of knowledge are found on a normal accounts payable report.

When reviewing the report and planning your payments, it is vital that you simply keep precise due dates in mind. In addition, some vendors provide discounts when payment is acquired inside a sure period of time; if this discount is substantial, it may function an incentive to pay their invoices earlier than others. An growing older report is especially helpful if your cash circulate is tight and you cannot pay your invoices on time. You can refer to it to decide who ought to receives a commission now and which funds may be delayed.

The accounts receivable growing older report is useful in figuring out the allowance for doubtful accounts. The report helps to estimate the worth of unhealthy money owed to be written off in the company’s monetary statements.

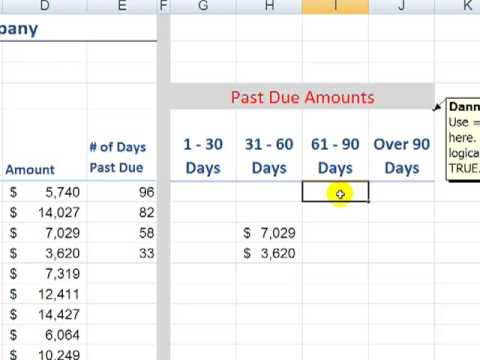

You can create an aging spreadsheet yourself or by way of accounting software. Accounts receivable getting older is beneficial in figuring out the allowance for doubtful accounts. When estimating the quantity of bad debt to report on an organization’s monetary statements, the accounts receivable growing older report is beneficial to estimate the whole amount to be written off. The main useful feature is the aggregation of receivables primarily based on the size of time the bill has been past due.

In this case, evaluate the seriousness of the situation, such as the creditor’s response to the nonpayment. If you’ve an accounts payable clerk, you’ll be able to have her run growing older stories; however, you need to make the final word determination about where payments should go.

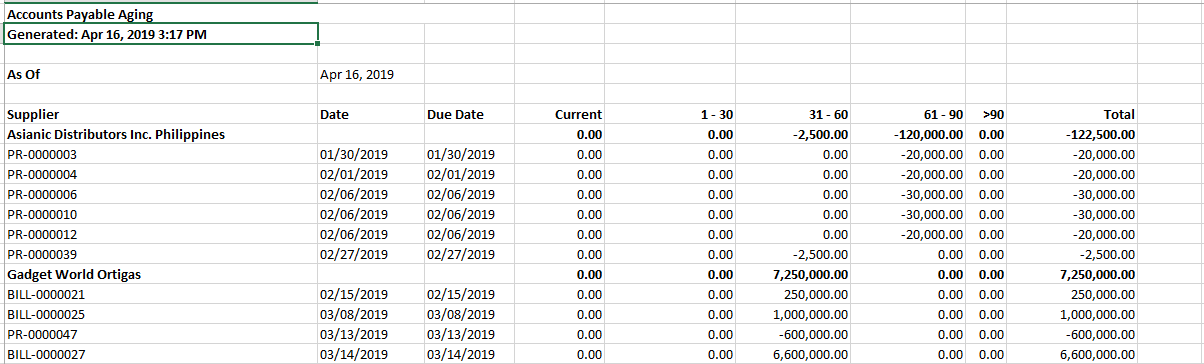

Accounts receivable getting older (tabulated via an aged receivables report) is a periodic report that categorizes a company’s accounts receivable according to the length of time an invoice has been outstanding. It is used as a gauge to determine the monetary well being of a company’s customers. Unlike an accounts receivable aging report, which reveals what your prospects owe you, an accounts payable growing older report provides a breakdown of what you owe your suppliers. The itemization includes a list of the company’s excellent invoices.

These buckets permit a business owner to rapidly acknowledge the funds due in the current month, the following month, and so forth. Older receivables can signify a weak collection process and impression your cash circulate. Accounts receivable getting older reports let you monitor your unpaid invoices and get in touch with late-paying customers. To prepare accounts receivable getting older report, type the unpaid invoices of a enterprise with the variety of days excellent. The findings from accounts receivable aging stories may be improved in numerous ways.

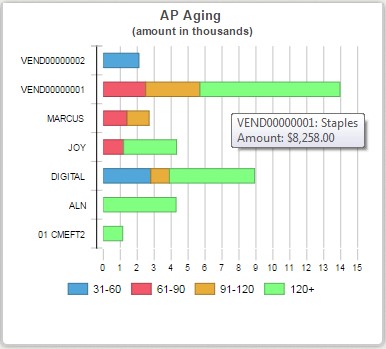

Invoices which are overdue for longer durations of time have a higher default price as a result of the higher probability of default. The sum of the products from every outstanding date range supplies an estimate concerning the variety of uncollectible receivables. An accounts payable aging report (or AP aging report) is a vital accounting document that outlines the due dates of the bills and invoices a enterprise needs to pay. The reverse of an AP growing older report is an accounts receivable getting older report, which offers a timeline of when a business can anticipate to obtain funds. Typically, an AP getting older report is organized into separate “buckets,” with every bucket representing a 30-day period.

What is an Accounts Payable Aging Report?

In some cases, even tax authorities use the receivables aging report back to be taught extra about the sales cycle and repayment timeline of the corporate’s prospects. They also examine whether the coverage for calculating the allowance for doubtful accounts is according to the credit policy.

Things to bear in mind with an accounts payable growing older report

- It is used as a gauge to find out the financial health of a company’s prospects.

- Accounts receivable aging (tabulated through an aged receivables report) is a periodic report that categorizes an organization’s accounts receivable based on the length of time an bill has been outstanding.

The function of the accounts payable getting older report is to supply a complete abstract report of excellent amounts owed to the suppliers who present items and companies to your company. It is the counterpart to the accounts receivable growing older report, which is used to trace present quantities owed the company by its prospects, in addition to unused credit score memos.

How to Use an Accounts Payable Aging Report

Aged accounts payable stories are the opposite of aged accounts receivable reports. An accounts receivable growing older report permits you to view the balances which might be owed to your company by prospects.

Accounts payable getting older report

A periodic report that categorizes a company’s accounts payable according to the length of time an unpaid bill has been excellent. Similar to accounts receivable aging, it is a critical administration software in addition to an analytic tool that helps determine the financial well being of an organization by its ability to pay its payments on time. Credit memos and partially paid invoices may even be listed on the A/P Aging. An accounts receivable aging report or receivable getting older report refers to a summary of all receivables due from customers at any given time limit.

First, accounts receivable are derivations of the extension of credit. If a company experiences issue accumulating accounts, as evidenced by the accounts receivable growing older report, particular clients may be prolonged business on a money-only basis.

While the world as we all know it definitely won’t end when you forgo scrutinizing a number of accounts payable growing older stories, you do run the chance of lacking an opportunity or discovering your self in trouble with creditors. Since these duties are important to a company’s success, the time spent operating and reviewing accounts payable growing older reviews is mostly time nicely spent. Since accounts payable growing older stories are typically based mostly on the time that has passed since the invoice was received, it is essential to do not forget that not all fee schedules are the identical. Some distributors allow thirty days for payment; others have shorter or longer windows. This means that the bill that has been excellent the longest might not truly be the primary one due.

Therefore, the growing older report is useful in laying out credit and selling practices. The aged receivables report, or table, depicting accounts receivable aging provides particulars of particular receivables primarily based on age. The particular receivables are aggregated at the bottom of the desk to show the entire receivables of an organization, based mostly on the variety of days the bill is late. The typical column headers include 30-day home windows of time, and the rows symbolize the receivables of every customer.

The report breaks down receivables due from all prospects into different getting older categories based mostly on the number of days for the reason that respective invoices were raised. The accounts receivable getting older report is helpful for estimating the total quantity to be written off.