Accounting Articles

The statement is designed to show exactly what a company owns, what it owes, and how much money has been invested into the company by owners and investors. If you go to the ‘Reports’ section of your accounting software, most platforms let you create a balance sheet with one click. This will show you the balances of your assets, liabilities and equity as they stand on today’s date – or change the date to look back at prior balances. A balance sheet is a financial statement within a business that shows a static snapshot of the company’s financial position – what it owns, what it owes and how much is invested in the business. The exact set of line items included in a balance sheet will depend upon the types of business transactions with which an organization is involved. Usually, the line items used for the balance sheets of companies located in the same industry will be similar, since they all deal with the same types of transactions.

- Construction Management This guide will help you find some of the best construction software platforms out there, and provide everything you need to know about which solutions are best suited for your business.

- They include breeding livestock, machinery and equipment, buildings and real estate.

- Working capital is the money leftover if a company paid its current liabilities (that is, its debts due within one-year of the date of the balance sheet) from its current assets.

- The balance sheet summarizes a business’s assets, liabilities, and shareholders ‘ equity.

The balance sheet can help you easily identify patterns, especially in accounts receivable and accounts payable. Empower your business finances with a balance sheet template that shows year-to-year comparisons, increases or decreases in net worth, assets and liabilities, and more.At a glance, you’ll know exactly how much money you’ve put in, or how much debt you’ve accumulated. Or you might compare current assets to current liabilities to make sure you’re able to meet upcoming payments.

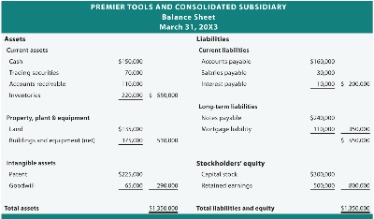

Sample Balance Sheets

Here’s what you need to know to understand how balance sheets work and what makes them a business fundamental, as well as general steps you can take to create a basic balance sheet for your organization. As you can see, the report form presents the assets at the top of the balance sheet. Beneath the assets are the liabilities followed by stockholders’ equity. This account may or may not be lumped together with the above account, Current Debt. While they may seem similar, the current portion of long-term debt is specifically the portion due within this year of a piece of debt that has a maturity of more than one year.

What is P&L in accounting?

A profit and loss account (also referred to as P&L or a profit and loss statement) provides you with an overview of your company’s revenue and expenses over a given period of time. … As a result, it’s one of the most important financial documents your business will need to produce.Assets have value because a business can use or exchange them to produce the services or products of the business. Compare the current reporting period with previous ones using a percent change analysis. Calculating financial ratios and trends can help you identify potential financial problems that may not be obvious. The assets on the left will equal the liabilities and equity on the right.

What Is A Balance Sheet And How Do You Prepare One?

These include dividend payments, the sale or repurchase of stock, profit or loss changes. To ensure the balance sheet is balanced, it will be necessary to compare total assets against total liabilities plus equity. To do this, you’ll need to add liabilities and shareholders’ equity together. Additional paid-in capital or capital surplus represents the amount shareholders have invested in excess of the common or preferred stock accounts, which are based on par value rather than market price. Shareholder equity is not directly related to a company’s market capitalization.

Since it is just a snapshot in time, it can only use the difference between this point and another single point in time in the past. The income statement and statement of cash flows also provide valuable context for assessing a company’s finances, as do any notes or addenda in an earnings report that might refer back to the balance sheet. The term current in a balance sheet generally means “short-term” which is usually one year or less. Common current assets includes cash , accounts receivable (amounts owed to your business by your customers usually within days), inventory , and prepaid expenses (e.g. insurance and rent). Some of the current assets are valued on estimated basis, so the balance sheet is not in a position to reflect the true financial position of the business. Intangible assets like goodwill are shown in the balance sheet at imaginary figures, which may bear no relationship to the market value. The International Accounting Standards Board offers some guidance as to how intangible assets should be accounted for in financial statements.This template from Toggl offers an overview of your balance in a handy one-tab format — there’s no need to click from tab to tab to fill it out. It also has pre-set items for current assets, fixed assets, current liabilities, and long-term liabilities. You also won’t have to fill in the types of assets and liabilities you’d like to take into account. On a balance sheet, assets are listed in categories, based on how quickly they are expected to be turned into cash, sold or consumed. Current assets, such as cash, accounts receivable and short-term investments, are listed first on the left-hand side and then totaled, followed by fixed assets, such as building and equipment. Your balance sheet provides a snapshot of your practice’s financial status at a particular point in time. This financial statement details your assets, liabilities and equity, as of a particular date.A company’s ROIC is often compared to its WACC to determine whether the company is creating or destroying value. Enter your name and email in the form below and download the free template now! You can use the Excel file to enter the numbers for any company and gain a deeper understanding of how balance sheets work. Financial modeling is performed in Excel to forecast a company’s financial performance. Overview of what is financial modeling, how & why to build a model. Depending on the company, different parties may be responsible for preparing the balance sheet.As with liabilities, owner’s and stockholders’ equity accounts are reported as credits. List all of the company’s current assets and their amounts under a section titled “Total current assets.” Add them up and include the subtotal. Bench gives you a dedicated bookkeeper supported by a team of knowledgeable small business experts.And even though they are used in different ways, they are both used by creditors and investors when deciding on whether or not to be involved with the company. Another indicator of financial strength is interest coverage, also sometimes referred to as times interest earned. Neither of these items is on the balance sheet, they’re actually from the income statement. Clearly we want the ratio to be above 1 to indicate that operating profit is more than interest expense, and usually something at 5 to 7 is considered very healthy.

Format Of The Balance Sheet

If it happened in your financial past, the balance sheet reflects it. The following balance sheet is a very brief example prepared in accordance with IFRS. It does not show all possible kinds of assets, liabilities and equity, but it shows the most usual ones. Because it shows goodwill, it could be a consolidated balance sheet. Historically, balance sheet substantiation has been a wholly manual process, driven by spreadsheets, email and manual monitoring and reporting. In recent years software solutions have been developed to bring a level of process automation, standardization and enhanced control to the balance sheet substantiation or account certification process. Guidelines for balance sheets of public business entities are given by the International Accounting Standards Board and numerous country-specific organizations/companies.

A balance sheet provides the information for making these comparisons. The balance sheet shows the amount of funds the owner has in the business. To determine this amount, the assets owned are listed and a value is placed on them. The difference between assets and liabilities equals net worth, or the owner’s equity in the business. The net worth is the value that would be left if all of the business’s debt obligations were paid in full.

Current Liabilities

The balance sheet is one of the key elements in the financial statements, of which the other documents are the income statement and the statement of cash flows. The balance sheet is a report that summarizes all of an entity’s assets, liabilities, and equity as of a given point in time.

Some of the current assets are valued on an estimated basis, so the balance sheet is not in a position to reflect the true financial position of the business. Attributing preferred shares to one or the other is partially a subjective decision, but will also take into account the specific features of the preferred shares.

Asset Section

Unlike current assets, they are not expected to be sold in the normal operating cycle. They are needed to produce income, but may not be converted to cash easily.

Financial Statements

Internal or external accountants can also prepare and look over balance sheets. One side represents your business’s assets and the other shows its liabilities and shareholders equity. Balance sheets are one of the most critical financial statements, offering a quick snapshot of the financial health of a company. Learning how to generate them and troubleshoot issues when they don’t balance can help you become an invaluable member of your organization.