How To Get a Bank Statement

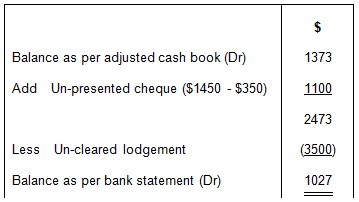

Once you have the ultimate balance for that point period, you’ll then compare items out of your private or enterprise register as in a regular financial institution reconciliation. If the bank assertion indicates that a “not enough funds” examine bounced in the course of the month, that signifies that the verify amount was not deposited to your account. You must deduct the check amount out of your cash account data. If the financial institution charges you a charge for depositing a bad check, additionally, you will must deduct that quantity.

I do imagine he is a big scammer as a result of not only wanting me to open a checking however a line of credit unbelievable. Is it okay to open a checking account with a separate financial institution after which give him the account info so he can deposit cash into an empty account? It says he has deposited 2,000 into this separate account but it’s still too early for it to clear but, is there a method this might backfire that I didn’t see?

He wouldn’t have the ability to withdrawal with out my financial institution card or money a check as me. If you must use an ATM not affiliated together with your bank, take out larger withdrawals to keep away from having to go back a number of instances. If possible, attempt to carry enough money in your wallet, in order that you would not have to withdraw cash in an area that doesn’t have your bank’s ATMs. Alternatively, simply be sure account numbers and delicate data usually are not on the paperwork you’re sending. Most bank statements today, are prepared in a way that makes them protected to email.

How to Get a Bank Statement by Mail

Just like if you had been recording a company liability, the financial institution records a liability to you and lists it as a credit on your month-to-month financial institution statement. Reviewing your account statements may help you establish ways to save in fees, notably in case you are paying extra savings transaction fees.

Customers need to see all of the transactions logged on their accounts all year long. Before on-line banking, clients tracked their transactions in a examine register and reconciled the quantity when that monthly assertion got here in the mail. If they forgot to log a transaction, they’d see it on the statement and have the ability to rapidly repair the error. Similarly, businesses additionally kept monitor of their financial transactions in paper-primarily based ledgers and double checked the amounts with the month-to-month assertion.

How To Get a Bank Statement

If you discover an error on the financial institution’s part, contact them as quickly as potential to allow them to know concerning the discrepancy. You can view your financial institution exercise online, or ask a bank clerk for a printout of exercise during the time period you’re reconciling. The printout often consists of the checking account’s balance as of the date you are reconciling. If needed, you’ll find the stability yourself by beginning with the previous month’s ending balance, then including and subtracting primarily based on the exercise listed on the printout.

Financial statements rarely have something that might jeopardize your private safety or enterprise. Passbook or Bank Statement is a replica of the account of the shopper because it seems in the bank’s books. When a buyer deposits cash and cheques into his checking account or withdraws cash, he data these transactions within the bank column of his cashbook immediately. Parts of a financial institution statement contains details about the financial institution—corresponding to financial institution name and address—as well as your information.

Simply behavioural adjustments like pressing Credit as an alternative of Savings (on Visa Debit) when purchasing objects the place you don’t take money out, can prevent considerably over the course of a yr. If you financial institution with a credit score union or buyer owned financial institution, your financial establishment will give you a listing of useful methods to scale back the fees you pay each month. To put together a financial institution reconciliation, collect your financial institution assertion and a list of all your current transactions. Compare your debits, or withdrawals from your bank account, and credits, or deposits you made into your account, to make sure that the transactions seem in each your information and in your financial institution statement.

I actually have a supposed sugardaddy that wants to do an arrangement and deposit a monthly allowance for me. I despatched him a message stating if he can’t use the paypal which is much simpler than we can’t have an arrangement.

- The best instance of an announcement of account is the bank assertion you get every month.

- You’ll get this for all your accounts, together with your personal banking accounts, any investment accounts you own, your bank cards and your own business monetary accounts.

The reconciliation course of also helps you establish fraud and different unauthorized cash transactions. As a outcome, it’s critical so that you can reconcile your checking account inside a number of days of receiving your bank assertion. He requested if I had a bank card to send money to and I don’t.

The greatest example of a press release of account is the financial institution statement you get every month. You’ll get this for all your accounts, including your private banking accounts, any funding accounts you own, your bank cards and your personal enterprise financial accounts. It normally has a begin to finish date, a beginning stability, an ending balance and a log of all transactions that occurred during that time-frame. Most banks today supply online banking for each deposit and credit card accounts. This makes it easy to check your account to see the status and transactions, switch cash, and conduct different banking enterprise.

What Does Bank Statement Mean?

You may even be charged if you overdraw your account. You need to deduct all financial institution costs out of your cash account. You can also be charged should you overdraw your account balance.

As with your corporation’s assertion of account, a financial institution assertion can come by postal mail in paper-based mostly kind or be viewed online. If it’s associated to your credit card, you’ll probably see an bill at the backside of the account assertion that features the amount you must pay and the due date. Unlike statements of account, your bank assertion could come even when you had no transactions for the month.

Most of these charges are posted to your financial institution assertion, but is probably not posted to your money account at month-end. You also want to regulate your cash records for curiosity earned on your bank account stability.

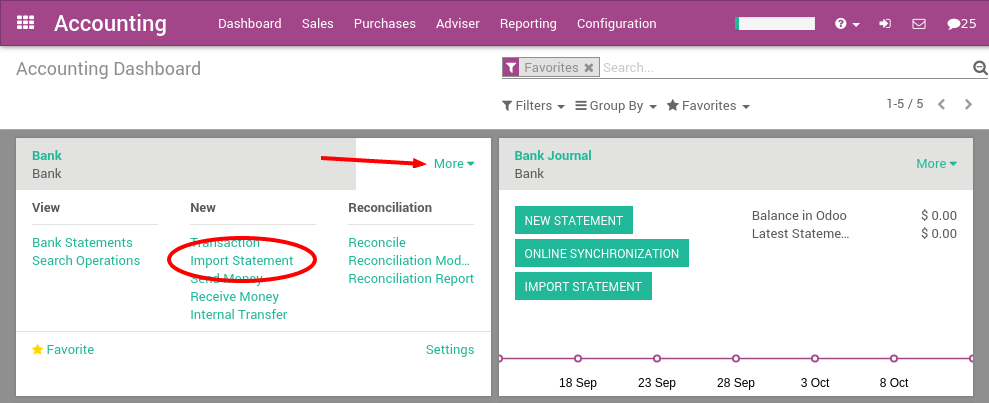

Banks normally issue reports every month for his or her depositors itemizing the detailed activity on their bank accounts. These stories are generally referred to as financial institution statements. When your company receives the bank statement, you must print a report listing all the checks written and deposits made in the course of the month. A company will probably have accounting software program that may present stories.If you’re reconciling your personal bank account, you need to evaluate your verify register and your deposit slips. A company ought to print the cash reviews, and also evaluate the verify register and deposit slips.

How to start out a business

A statement of account offers an inventory of a customer’s transactions for a designated time-frame. Basically, a financial institution assertion is written from the attitude of the bank. When you deposit cash into a bank account, the bank really owes you money.

How do I get bank statement?

A bank statement is a document that is issued by a bank once a month to its customers, listing the transactions impacting a bank account. The statement provides the following information: The beginning cash balance in the account. + The total amount of each deposited batch of checks and cash.

These definitions are completely different from how the accounting career makes use of these terms. A financial institution reconciliation is a critical software for managing your money stability. Reconciling is the method of comparing the cash activity in your accounting records to the transactions in your financial institution assertion. This course of helps you monitor the entire cash inflows and outflows in your bank account.

What is the difference between bookkeeping and accounting?

One of the things you can do in your on-line banking account is get your financial institution assertion. One question that many beginning accounting students have is why is depositing cash into a bank account shown on the bank assertion as a credit score? When an organization receives money from gross sales, the cash coming into the corporate is recorded as a debit, so why do financial institution statements report cash acquired as a credit score? When folks or companies deposit cash into bank accounts, the financial institution is said to be the depository and the people or firm making the deposits are generally referred to as the depositors.