The full-time salary of an accountant depends upon where you live, but did you know that their average wage, according to Payscale as of 2019, is $50,757? After you pay your employer taxes, you’re going to be closer to $56,000 a year, and that’s only likely to go up. Is that a cost you want to accrue just to keep your books and payroll straight? Online accounting and payroll services are an affordable solution. That’s why so many companies now use online payroll accounting and payroll services at a fraction of the cost. Payroll accounting is the recording and management of employees’ compensation and taxation. This information includes salaries, gross wages, bonuses, commissions, fringe benefits, holiday pay, and other types of paid time off.

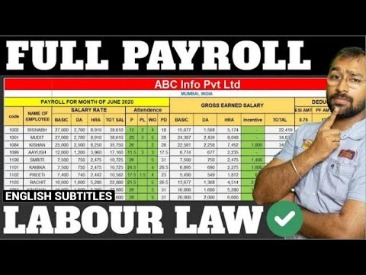

Below is a list of the accounts you will generally need to set up on your chart of accounts to track all payroll-related activities, along with a brief description of each account. There are some accounts you may not need, like health insurance if it’s not offered and others that are required, like federal income tax payable, to comply with payroll laws. If companies offer automatic distributions into 401k plans or other investment accounts, or paid vacation time for employees, the job of payroll accountants becomes more complicated. An hourly employee on paid vacation, for example, will have no record of hours worked during the vacation, but he must be compensated for 40 hours of work. Retirement account contributions must be calculated, withheld and submitted to the company holding the account. Any matching contributions offered by the employer may also be handled by payroll accountants. Employees must submit income tax, and employers must submit payroll tax, but the employer is responsible for filing and submitting both.

We are looking for a highly capable payroll accountant to manage our payroll system. In this role, your duties will include ensuring accurate salary payments, calculating overtime earnings, and updating payroll accounting employee hiring or termination information on the payroll system. Accounting software and payroll software often tightly integrate, since most businesses’ biggest expense is labor costs.

A payroll tax holiday is a deferral of payroll tax collection until a later date, at which point those taxes would become due. A payroll tax deferral is intended to provide some temporary financial relief to workers by temporarily boosting their take-home pay.

Payroll

At tax and payroll service companies, accountants work with organizations to process tax and payroll documents. With the government, they find work as budget analysts or auditors, ensuring the compliance of outside organizations. In the finance industry, accountants may work with clients seeking investment advice or supervision. With trade organizations, accountants often manage job estimates and assess factors that can affect the cost of employment. Aside from participating in the daily operations of a business’s payroll department, payroll accountants often act as internal payroll auditors.

What type of accounting is payroll?

What is Payroll Accounting? Payroll accounting is essentially the calculation, management, recording, and analysis of employees’ compensation. It includes whatever base salary an employee receives, along with other types of payment that accrue during the course of their work, which.

Payroll tax is a tax paid by employers for the wages of their employees. This tax is usually deducted from the salary of the employees. Learn about the different types of payroll taxes and their definitions and the computation example of the payroll tax from an employer’s point of view. As you can imagine, the payroll accounting process is a time-consuming one, even if you have a small workforce. One of the benefits of having an accountant for your business is that they can handle these duties quickly and accurately, but having an on-staff accountant isn’t always practical. Outsourcing to an online payroll accounting service like Ignite Spot is a great way to save money and leave these tasks in good hands. A modern approach to payroll accounting, Landin and Schirmer’s Payroll 2020 provides a “practitioner’s view” of this highly specialized area of accounting.

Journal 1 shows the employee’s gross wages ($1,200 for the week). After subtracting some of the most common payroll taxes, the employee’s wages payable or “take-home” pay is $925. Recording payroll on your books involves making sure that amounts are accurately posted to payroll accounts.

Record Keeping Requirements Under The Fair Labor Standards Act Flsa

Tax laws change, income tax rates vary, and employee benefits law isn’t set in stone. Quality payroll software can make life easier for you by incorporating changes when they occur, and rolling them out to your employees. Most employees have income tax deducted from their salary before they receive it. That’s your job as employer, and it’s important to get it right.

Furthermore, the need for payroll accountants has traditionally grown as tax and employment laws have evolved. Recent trends in globalization have also contributed to growth in the field. For many professionals, working as a payroll accountant serves as the first step in a long, successful career. After a few years in these roles, accountants may find jobs as payroll managers, specialists, and analysts. The chart below shows the mean salaries for each of these positions. As in many careers, the average salary of a payroll accountant changes depending on each individual’s professional experience.

How To Figure Out A Bimonthly Payroll

In recent years there have been several examples of payroll software going wrong – and the effect on staff morale can be devastating. Most payroll guides look at this topic from the perspective of the business – such as what it can do for you and how you can ensure you comply with relevant laws. Those are important issues, of course, but there’s more to it than that. If you treat them as an accounting ledger entry and nothing more, you might miss an opportunity to understand their needs. A federal employer identification number, or EINfor short, is like a social security number for your business.

- You should also confirm which employees received a commission on deals they closed for the organization.

- Barbara’s company, On-Call Controller, has been serving clients for over 25 years.

- The FLSA also sets out how to treat jobs that are primarily compensated by tipping.

- But within each of those categories, there exists multiple steps that you’ll need to satisfy and paperworkthat you’ll need to complete.

- Payroll tax is a tax paid by employers for the wages of their employees.

You can revisit the chapter resources whenever you need to brush up on your payroll accounting knowledge. Get guidance on federal and state laws and tax issues related to employer-provided benefits from the payroll practitioner’s perspective. Below are some payroll basic accounts that are used in association with accounting payroll entries as well as a description of each one and the relevance towards payroll. A few clicks should be all it takes to handle paperwork and payments for employees leaving your business. It’ll be a little more complex when new people join, butgood payroll softwarewill take you through the process easily.

Payroll Accountant Job Description Template

Individuals may be able to advance their careers by obtaining a Master’s degree in business administration or by pursuing a Certified Public Accountant license. There are also a number of specific payroll certifications that are provided by professional associations. Self-employment tax is the tax that a sole proprietor or freelancer must pay to the federal government to fund Medicare and Social Security. As a business grows, its accounting needs become more complex.

Charlette has over 10 years of experience in accounting and finance and 2 years of partnering with HR leaders on freelance projects. She uses this extensive experience to answer your questions about payroll. Compensating your employees is a major part of making sure that your business operates efficiently. But what, exactly, is covered under the term ‘compensation’? Your text has great instructor tools – like presentation slides, instructor manuals, test banks and more. Follow the steps below to access your instructor resources or watch the step-by-step video. To get started, you’ll need to visit connect.mheducation.com to sign in.

Payroll Officer Job Description

Make a second journal entry when you give your employee their paycheck. When you pay the employee, you no longer owe wages, so your liabilities decrease. These entries show the amount of wages you owe to employees that have not yet been paid. After you pay the wages, reverse the entries in your ledger to account for the payment. For these entries, record the gross wages your employees earn and all withholdings.

The FLSA sets out various labor regulations, includingminimum wages, requirements for overtime pay, and limitations on child labor. For example, FLSA rules specify when workers are considered on the clock and when they should be paid overtime. Payroll is the compensation a business must pay to its employees for a set period and on a given date.

These transactions include paychecks distributed to employees, deductions and taxes withheld from employee paychecks, and employers’ share of benefit contributions and taxes. Outsourced accounting and payroll services can free up time and allow you to focus on growing your business and keeping your customers and workers happy. Our payroll accounting service can help you reduce the amount of time you spend on your bookkeeping needs by up to 80%.

The result is one place where you can manage multiple services. A liability is an amount you owe, while an expense is an amount you’ve already paid. That means anything recorded as a payroll liability can become a payroll expense after you run payroll and disperse the money. If you’re overwhelmed with the many aspects of learning how to do payroll accounting, you’re not alone. It’s important to choose a quality accounting program that will make documenting transactions easier.

Employee Wages Or Compensation

The federal government requires you to withhold income taxes from employee paychecks and remit them periodically. Income tax withholding amounts are based on the amount of money an employee earns as well as the filing status he has indicated on his W-4 form. You also must withhold amounts for Social Security and Medicare, and make employer contributions to these funds.

After that, simply export the timesheet for payroll processing. The best way to trackand total the hours worked by each employee is with a software tool like Sling. Sling keeps track of all your employees’ comings and goings with both local and mobile clock-in. Payroll laws will differ from state to state and city to city. There can even be significant differences based on what type of business you run. That’s why it’s crucial to do a bit of research before attempting to tackle payroll.