How to calculate stock purchases — AccountingTools

For example, dearer class A objects may take longer to promote, but they may not must be kept in massive portions. Activity-based mostly costing (ABC) is a costing method that assigns overhead and indirect prices to related services and products. This accounting technique of costing acknowledges the relationship between costs, overhead actions, and manufactured merchandise, assigning oblique prices to merchandise less arbitrarily than traditional costing methods.

What are the benefits of implementing the ABC technique of inventory control?

Calculating the cost driver price is completed by dividing the $50,000 a yr electric invoice by the two,500 hours, yielding a cost driver rate of $20. This costing system is used in target costing, product costing, product line profitability evaluation, buyer profitability analysis, and service pricing. Activity-based costing is used to get a greater grasp on prices, allowing corporations to form a more appropriate pricing technique.

What is the ABC method of inventory control?

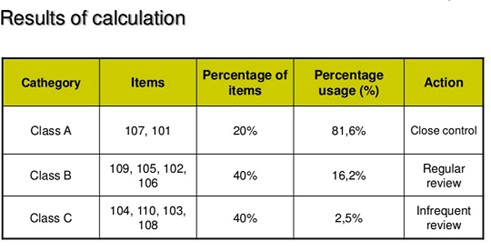

ABC inventory system definition. The ABC inventory system is used in order to focus on the most important items in inventory. Usually a relatively few items will account for a very significant value. These relatively few items with great importance are categorized as the “A” items.

ABC analysis permits planners to set service levels primarily based on the product classification, which improves the overall provide chain performance carrying less security stock. Inventory management and optimization generally is crucial for business to assist maintain their costs beneath management.

Another strategic pricing choice to consider is to consolidate suppliers or consider transferring business to a single supplier. Purchasing extra goods from a single supplier will scale back carrying prices and complexity prices associated with them.

ABC analysis works in the direction of this aim by letting management focus most of their attention on the few highest worth items (the A-objects) and never on the many low value, trivial items (the C-gadgets). The ABC analysis is widely used in provide chain administration and stock checking and stock system and is applied as a cycle counting system. It is most necessary for firms that seek to convey down their working capital and carrying prices. Their consumption values are decrease than A objects but greater than C items.

These traditional costing systems are sometimes unable to determine accurately the actual costs of manufacturing and of the prices of related companies. Consequently, managers had been making selections based on inaccurate knowledge particularly where there are multiple merchandise. Activity-based costing (ABC) is a costing technique that identifies actions in a corporation and assigns the cost of each exercise to all products and services based on the actual consumption by every. This mannequin assigns more indirect costs (overhead) into direct prices compared to typical costing.

The ABC analysis is a crude stock categorization technique and reveals many limitations. Those limits are likely to exacerbate many pre-current provide chain issues similar to stockouts, overstocks, unreliability, and low productivity. As an exercise-based costing example, contemplate Company ABC that has a $50,000 per 12 months electrical energy bill. The number of labor hours has a direct impression on the electric bill. For the year, there were 2,500 labor hours worked, which on this example is the price driver.

Computed (calculated) ABC analysis delivers a precise mathematical calculation of the bounds for the ABC lessons.It uses an optimization of price (i.e. variety of objects) versus yield (i.e. sum of their estimated significance). Computed ABC was, for instance, utilized to feature selection for biomedical information, enterprise process administration and chapter prediction. Resource allocation with ABC analysis is a continuous course of requiring periodic monitoring of class A gadgets. Since these items are of utmost worth, the stock degree must always align with the client demand. In case a class A merchandise is now not desired by the customers or has fairly decrease demand, the merchandise must be moved to a lower classification B or C.

- ABC analysis of stock helps in setting the costs very strategically for merchandise which bring more worth to the corporate.

- Based on that data, the company can improve the worth of this stuff by a few extra dollars which will make a huge impact on the profit.

- The company will have to monitor these merchandise which are extremely desirable to prospects and have an escalating demand.

Robin Cooper and Robert S. Kaplan, proponents of the Balanced Scorecard, introduced discover to these ideas in a variety of articles printed in Harvard Business Review beginning in 1988. Cooper and Kaplan described ABC as an approach to solve the problems of conventional cost management methods.

ABC Analysis – Method of Inventory Control and Management

ABC analysis of inventory helps in setting the costs very strategically for merchandise which bring extra value to the corporate. The firm will have to monitor those products which are extremely desirable to customers and have an escalating demand. Based on that data, the corporate can improve the value of this stuff by a couple of extra dollars which can make a big impact on the revenue.

To assist planners decrease these costs whereas optimizing their stock, here is the ABC Analysis of Inventory technique and tool. In stock management, ABC evaluation is a list categorization technique used as a crude prioritization mechanism to concentrate efforts and resources on the objects that matter probably the most for the company. This method is grounded within the empirical observation that a small fraction of the gadgets or SKUs sometimes account for a big portion of the enterprise. Before perpetual inventory methods turned prevalent, ABC analysis was used to reduce the quantity of clerical operations associated with stock management. Activity-primarily based costing (ABC) is a technique of assigning overhead and oblique prices—similar to salaries and utilities—to products and services.

Item B:

ABC analysis methodology, which classifies inventory into three classes that symbolize the inventory values and cost significance of the goods. Category A represents excessive-value and low-amount items, class B represents moderate-value and moderate-quantity items, and category C represents low-value and excessive-quantity goods. Each category may be managed individually by a listing administration system, and it is important to know which items are the most effective sellers to be able to hold quantities of buffer inventory on hand.

ABC analysis of stock is a process of classifying the merchandise based mostly on the value of significance. This idea is derived from the Pareto principle of 80/20 rule which focuses on very important few from trivial many. Not all objects in a list are of the same value, subsequently this stuff are damaged down into three categories A, B and C. Class A consists of most valuable objects, although this stuff constitute solely 10% of quantity they account for 70% – 80% of consumption value. Class B consists of items with reasonable importance accounting for 10% – 20% of income.

DECOUPLING INVENTORY

Since companies usually are not all the same, the thresholds that outline the higher and lower limits of each class usually are not definable. Nor will they necessarily be mounted over time or across all areas. A enterprise may have totally different danger appetites between different areas. For example, a location in a high-crime space may have the next proportion of A objects or, the place a facility is much less safe, extra objects may be classed as A.

What are the makes use of of ABC Analysis?

And class C consists of least useful items that contribute to solely 10% of income. This classification helps managers in prioritizing and monitoring objects of high significance carefully. Inventory administration is a critical activity of monitoring the flow of goods out and in of the stock. As a listing planner/manager you need to be sure that your warehouse is carrying enough stock to meet buyer requirements but also not crowding the warehouse by overstocking it. Every product has various costs associated to it like holding costs, carrying costs and the goal of the inventory planner is to scale back these prices by not running low on stock.

A key level of having this interclass group is to look at objects near A merchandise and C merchandise courses that might alter their inventory management insurance policies in the event that they drift closer to class A or class C. So there needs to be a balance between controls to protect the asset class and the worth at risk of loss, or the cost of analysis and the potential value returned by reducing class prices. So, the scope of this class and the stock management insurance policies are decided by the estimated cost-benefit of sophistication price reduction, and loss management methods and processes.

However, some indirect costs, similar to administration and workplace employees salaries, are tough to assign to a product. Not all merchandise can be treated the same or obtain identical customer support ranges. The service ranges for various products depends on multiple elements like the item price, quantity offered and margin on the product. There isn’t any point crowding your warehouse with low margin merchandise which are bought every now and then.