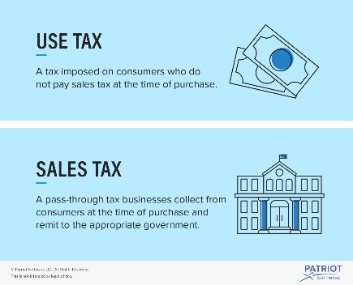

If you know the total amount consumed and the total percentage of the paid tax amount, you can conclude the percentage tax rate. For example, in many states where farming is the primary industry, the total price of products or equipment used to produce food for human or animal consumption are sales tax-exempt. This may also be the case with the sale of manufacturing equipment. Raw materials purchased by a business to manufacture or make something else that will be sold may also be exempt. Individuals can deduct sales taxes paid throughout the year from their income taxes.

- Below, learn what sales tax is, which states have the tax, and how to find sales tax.

- Rules and regulations regarding sales tax vary widely from state to state.

- This tax amount will be an estimate and may not match the actual amount of tax collected due to differences introduced by rounding.

- Your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10,000 ($5,000 if married filing separately).

- The customers must have resale certificates to be exempt from paying sales taxes.

- Intuit Inc. does not have any responsibility for updating or revising any information presented herein.

As a brick-and-mortar business, it’s also important to note where you’re responsible for paying sales tax. A state cannot demand that a company register to collect sales tax unless the business has a physical presence in that state. In many states, businesses must have a permit to collect sales tax. The Small Business Administration offers a breakdown of sales tax permit requirements by state. You can also check with your state’s department of revenue to evaluate your taxation obligations. In the U.S., sales tax is a small percentage (usually 4-8%) of a sales transaction.

Module 7: Percents

These states are Alaska, Delaware, Montana, New Hampshire and Oregon. Businesses operating in these states only add sales tax to their customers’ purchases if they need to collect it for the city or county. Hawaii and New Mexico also don’t have a state sales tax, but they have general excise and gross receipts taxes similar to sales tax. Postal Service with the delivery of mail and are independent of any state revenue systems. The boundaries can change and often don’t line up with tax rate jurisdictions. This makes them the wrong tool to use for determining sales tax rates in the United States.

Do you pay sales tax on sales or profit?

California’s state and local governments levy a tax on retail sales of tangible goods. This tax has two parts: Sales Tax on Retailers. When California retailers sell tangible goods, they generally owe sales tax to the state.

Let Avalara put your rates to work when you try Returns for Small Business at no cost for up to 60 days.

After running transactions, follow the steps below to manually back out the estimated tax from each department’s total sales. This content is for information purposes only and should not be considered legal, accounting or tax advice, or a substitute for obtaining such advice specific to your business.

Also, the cascading tax is harmful to new and marginal business activities, likely to set off inflationary tendencies, and is detrimental to exports. For more information about or to do calculations involving VAT, please visit the VAT Calculator.

Because sales tax can vary by state and by item, it can be difficult to predict exactly how much you’ll pay, but not nearly as hard to get a general idea. Another way to avoid sales tax completely is to shop on a tax holiday, which individual states periodically announce to try and boost consumer spending. First of all, if you’re shopping in New Hampshire, Oregon, Montana, Alaska, or Delaware, the sticker price will be the total price. First, determine who’s responsible to collect and remit the sales tax amount. Returns for small business Free automated sales tax filing for small businesses for up to 60 days.

Calculating Sales Tax How Much To Charge

That leaves you with $14,000 in revenue that includes tax. The minimum combined sales tax rate for New York City, New York is 8%. This is the total of state, county and city sales tax rates. Each state features its own unique set of products and services that are considered taxable. Generally speaking, retail, sales of tangible items, and prepared foods are subject to sales tax. To determine what’s taxable in your state, take a look at The Federation of Tax Administrators’ list of state revenue departments. Find your state’s hub page, and locate the sales tax rates, inclusions, and exemptions.

Of the many different methods tested, sales tax prevailed because economic policy in the 1930s centered around selling goods. Mississippi was the first in 1930, and it quickly was adopted across the nation. Today, sales tax is imposed in most states as a necessary and generally effective means to raise revenue for state and local governments.

So it’s not only money you’ll be saving with Wise, but time as well. AccountEverything you need to grow your business and operate internationally — without the high fees, hefty admin, and headache of a local bank. The first decimal place is the tenths place and the second is the hundredths place. This is why when we convert our percent we have to move two place. To convert a percent to a decimal, you just need to move the decimal over two places. To master the art of Excel, check out CFI’s FREE Excel Crash Course, which teaches you how to become an Excel power user. Learn the most important formulas, functions, and shortcuts to become confident in your financial analysis.

How To Calculate Ebita

One of the toughest things for a small business owner to learn is how to calculate sales tax correctly. Miscalculating sales tax is a common error that can trigger an audit. With the explosion of e-commerce, calculating sales tax has become even more critical. It’s especially challenging for online retailers, as they often don’t understand what’s taxable, which sales tax rate they should use, and which government agency receives the sales tax that they collect.

First, subtract the pre-tax value from the total cost of the items to find the sales tax cost. Add the sales tax value to the pre-tax value to calculate the total cost. Some states may have another type of rate — as a special taxing district.

Making a sizable down payment reduces your monthly payments, and can save you on interest. Please be advised that you will be liable for damages (including costs and attorneys’ fees) if you materially misrepresent that a product or activity is infringing your copyrights. Thus, if you are not sure content located on or linked-to by the Website infringes your copyright, you should consider first contacting an attorney.

Do You Need To Collect Sales Tax?

To find the sales tax multiply the purchase price by the sales tax rate. Remember to convert the sales tax rate from a percent to a decimal number. Once the sales tax is calculated, it is added to the purchase price. The result is the total cost—this is what the customer pays. You should be able to figure out the total how to calculate sales tax sales tax rate for your location by visiting your state’s Department of Revenue website. Keep in mind that if you have multiple locations, they may not all be subject to the same rates. Once you know the sales tax rate you need to collect at, use the sales tax formula to calculate how much to charge the customer.

No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Intuit Inc. does not have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research.

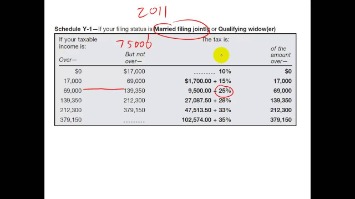

At the state level, all but five states do not have statewide sales tax. These are Alaska, Delaware, Montana, New Hampshire, and Oregon. States that impose a sales tax have different rates, and even within states, local or city sales taxes can come into play. Unlike VAT (which is not imposed in the U.S.), sales tax is only enforced on retail purchases; most transactions of goods or services between businesses are not subject to sales tax. As the business owner, you’re responsible for keeping track of the tax you collect so that you can report it to your local and state governments.

How To Calculate Sales Tax

There’s even a sales tax holiday for firearms, ammunition, and other hunting gear in Mississippi. Have you ever driven on the road, called 911, or attended a public school? Have you ever appreciated the streetlights, sidewalks, or parks in your area?

How do u calculate net pay?

Net pay is the take-home pay an employee receives after you withhold payroll deductions. You can find net pay by subtracting deductions from the gross pay.

Now, sellers with an economic presence in states where they sell online have nexus. This also means that they are required to collect sales tax and pay it to the state. Many states set aside special periods called “sales tax holidays,” during which specific purchases are exempt from sales tax. It is common for states to offer these holidays for school supplies, disaster preparedness gear, clothing, computers, and eco-friendly appliances.

Legislative BulletinsAnnual summaries of Minnesota tax law changes enacted during each legislative session. When readers purchase services discussed on our site, we often earn affiliate commissions that support our work. Mark Kennan is a writer based in the Kansas City area, specializing in personal finance and business topics. He has been writing since 2009 and has been published by “Quicken,” “TurboTax,” and “The Motley Fool.” When you take out a loan for the vehicle purchase, your taxes and fees are worked into the loan payments.

If you are deployed overseas, you can use the calculator to determine the sales tax you paid while you were in the United States. She has been saving money to buy an outfit for the first day at her new job. She has heard of sales tax but she isn’t quite sure how it works. Let’s see if we can help Melissa calculate the sales tax on her purchase to ensure she has enough money to pay for it. When you purchase a good or service, you will pay an extra amount on top of your purchase known as a sales tax. In this lesson, you will learn how to calculate sales tax.

The purchased item’s post-tax price can be divided by the tax paid in a decimal form calculated by converting a percentage into a decimal form. That resulted amount will be the amount before any amount of tax is applied. This is the pre-tax cost of the item, so if you have purchased an item that costs $95 after the allocated taxes, you can divide it by 1.05 and get $90.48. Some states recognize there are certain products that people must purchase to survive.