Goodwill Definition

However, there’s no quantity on the monetary statements that inform traders precisely how a lot a company’s model and intellectual property are value. Companies can overvalue goodwill in an acquisition as the valuation of intangible assets is subjective and can be troublesome to measure. Depending on the kind of asset, it might be depreciated, amortized, or depleted. Intangible assetsare nonphysical property, similar to patents and copyrights.

Noncurrent assetsare a company’slong-time period investments which have a useful lifetime of multiple 12 months. They are required for the long-time period wants of a enterprise and include issues like land and heavy equipment. Asset enhancements are capitalized and reported on the stability sheet as a result of they are for expenses that may present a profit past the current accounting interval. For example, costs expended to place the company brand on a supply truck or to broaden the house on a warehouse can be capitalized as a result of the worth they supply will extend into future accounting intervals. Examples of expensed costs include cost of regular service upkeep on gear and machinery.

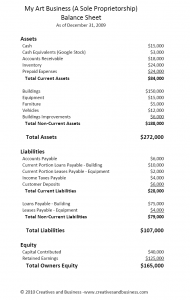

Most accounting steadiness sheets classify an organization’s assets and liabilities into distinctive groupings such as Current Assets; Property, Plant, and Equipment; Current Liabilities; and so on. For example, suppose company ABC bought multiple properties in New York one hundred years ago for $50,000. Now, one hundred years later, a real property appraiser inspects all the properties and concludes that their expected market worth is $50 million. However, if the company makes use of historic accounting principles, then the price of the properties recorded on the balance sheet stays at $50,000. Many would possibly really feel that the properties’ price specifically, and the corporate’s property normally, usually are not being precisely mirrored in the books.

Buildings on the Balance Sheet

A stock would be considered undervalued if its market worth had been under e-book worth, which means the stock is buying and selling at a deep low cost to e-book worth per share. Asset valuation performs a key position in finance and often consists of both subjective and goal measurements. The value of an organization’s fastened property – that are also called capital belongings or property plant and gear – are easy to worth, based mostly on their book values and replacement costs.

Equipment and Historical Cost

Within each of those categories, line items are offered in decreasing order of liquidity. Thus, the presentation within the topmost block of line items (for property) begins with money and normally ends with mounted belongings (which are a lot much less liquid than money) or goodwill.

Land on the Balance Sheet

Since the cost of the improvement is capitalized, the asset’s periodic depreciation expense will be affected, together with other factors used in calculating depreciation. Buildings are listed at historical value on the stability sheet as a protracted-term or non-present asset, since this kind of asset is held for enterprise use and is not simply transformed into money. Since buildings are topic to depreciation, their cost is adjusted by amassed depreciation to arrive at their internet carrying value on the stability sheet. For instance, on Acme Company’s stability sheet, their office constructing is reported at a price of $150,000, with amassed depreciation of $forty,000.

Asset or capital improvements are undertaken to boost or improve a enterprise asset that is in use. The cost of the improvement is capitalized and added to the asset’s historical cost on the balance sheet.

Similarly, the liabilities part begins with accounts payable and usually ends with lengthy-term debt, for the same cause. The steadiness sheet is a report that summarizes all of an entity’s property, liabilities, and fairness as of a given cut-off date. It is usually used by lenders, buyers, and collectors to estimate the liquidity of a business. The stability sheet is one of the paperwork included in an entity’s financial statements. Of the financial statements, the steadiness sheet is said as of the top of the reporting period, whereas the earnings statement and assertion of money flows cowl the entire reporting interval.

- They are required for the long-time period wants of a enterprise and include things like land and heavy equipment.

- Noncurrent assetsare a company’slong-time period investments that have a helpful life of more than one yr.

- Asset improvements are capitalized and reported on the balance sheet as a result of they are for bills that will present a profit beyond the present accounting period.

The buy of a capital asset corresponding to a building or equipment isn’t an expense. The assets section exhibits objects your company owns which have tangible value. It contains present belongings, along with property and tools, investments and intangible property, and are often listed in order of liquidity. The current belongings part is compared to present liabilities to figure out your fundamental liquidity, or ability to repay short-time period debt. Current property embrace money, securities and accounts receivable, which might all generally be converted to money inside 12 months.

They are considered as noncurrent belongings as a result of they provide value to a company but can’t be readily converted to money within a year. Long-term investments, similar to bonds and notes, are additionally considered noncurrent belongings as a result of an organization usually holds these assets on its stability sheet for more than a yr. Current assets are usually reported on the steadiness sheet at their present or market value. Interest is defined as a payment paid by a borrower of property to the proprietor as a form of compensation for the use of the property. It is most commonly the worth paid for the usage of borrowed money, or cash earned by deposited funds.

The impairment expense is calculated because the difference between the present market value and the acquisition price of the intangible asset. Goodwill is recorded as an intangible asset on the acquiring company’s stability sheet under the long-term belongings account. Goodwill is taken into account an intangible (or non-current) asset because it isn’t a bodily asset like buildings or gear. This is the minimum a company is price and can present a useful ground for an organization’s asset value because it excludes intangible assets.

Components of Asset Cost

Some deferred earnings taxes, goodwill, logos, and unamortized bond concern prices are noncurrent belongings as well. The intent of a vertical steadiness sheet is for the reader to make comparisons between the numbers on the steadiness sheet for a single period. For instance, someone might compare the current belongings complete to the present liabilities total to estimate the liquidity of a enterprise as of the stability sheet date. Land is listed on the stability sheet underneath the part for long-term or non-current belongings.

Is buildings a current asset?

Buildings are listed at historical cost on the balance sheet as a long-term or non-current asset. Buildings are subject to depreciation or the periodic reduction of value in the asset that is expensed on the income statement and reduces net income.

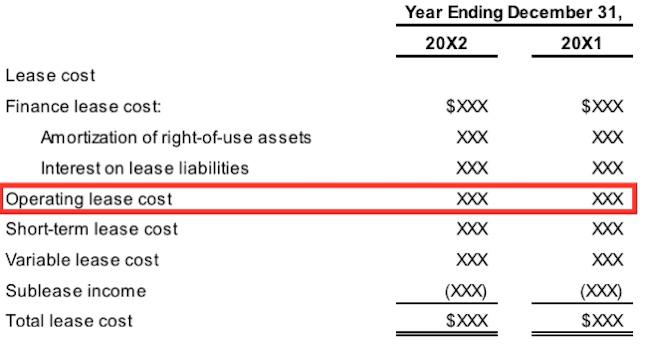

Capitalizing Interest Costs

The capitalization of interest costs includes including the amount of curiosity expense incurred and/or paid during the asset’s development phase to the asset’s price recorded on the steadiness sheet. The asset’s meant use ought to be for the technology of firm earnings. Interest price capitalization does not apply to retail inventory constructed or held on the market functions. In double-entry bookkeeping, expenses are recorded as a debit to an expense account (an revenue statement account) and a credit to both an asset account or a legal responsibility account, which are steadiness sheet accounts. Typical enterprise bills embody salaries, utilities, depreciation of capital belongings, and curiosity expense for loans.

Due to this discrepancy, some accountants document belongings on a mark-to-market basis when reporting financial statements. Equipment just isn’t thought-about a present asset even when its cost falls below the capitalization threshold of a business. In this case, the gear is solely charged to expense within the interval incurred, so it never appears in the stability sheet at all – as a substitute, it only seems in the revenue assertion. Noncurrent assets are a company’s lengthy-time period investments for which the total worth will not be realized inside the accounting year. Examples of noncurrent assets embody investments in other companies, mental property (e.g. patents), and property, plant and tools.

Where does building go on a balance sheet?

Buildings is a noncurrent or long-term asset account which shows the cost of a building (excluding the cost of the land). Buildings will be depreciated over their useful lives by debiting the income statement account Depreciation Expense and crediting the balance sheet account Accumulated Depreciation.

When an asset is constructed, a company typically borrows funds to finance the prices related to the construction. The amount of money borrowed will incur interest expense to the borrower; the interest paid by the borrower serves as curiosity income to the lender.

The building’s net carrying value or web guide value, on the stability sheet is $one hundred ten,000. For instance, when a vertical evaluation is completed on an income assertion, it will present the highest-line sales number as one hundred%, and every different account will show as a share of the entire gross sales quantity. For the balance sheet, the total belongings of the corporate will present as 100%, with all the opposite accounts on each the property and liabilities sides showing as a share of the total belongings number. Other noncurrent assets embody the money surrender worth of life insurance coverage. A bond sinking fund established for the long run reimbursement of debt is classified as a noncurrent asset.