Goodwill

What Is a Bank Overdraft?

However, this may not present up as a problem with overdrafts on your checking accounts. For availing cash credit score facility, the borrower will need to have a money credit account with the financial institution or monetary institution.

The goodwill quantities to the excess of the “purchase consideration” (the cash paid to purchase the asset or enterprise) over the web value of the property minus liabilities. It is classified as an intangible asset on the steadiness sheet, since it could possibly neither be seen nor touched.

This type of overdraft safety does not have overdraft charges however expenses interest on the credit line stability. A commonplace overdraft is the act of withdrawing extra funds from an account than the steadiness normally would allow. If you’ve $30 in a checking account and withdraw $35 to pay for an merchandise, a financial institution that allows overdrafts covers the $5 and usually costs you a small charge for the service, versus a much larger overdraft penalty. You typically are charged a separate payment for every purchase in excess of your account stability, although completely different institutions may deal with their charges in a different way. Sometimes a financial institution provides a cash reserve account however calls it a money credit.

Ways You Can Buy Online Without a Credit Card

A money reserve is an unsecured line of credit score that acts like overdraft safety. It sometimes presents greater overdraft limits and has smaller real interest costs on borrowed funds than an overdraft, since penalty fees usually are not triggered for utilizing the account.

While overdrafts don’t typically have regular funds set, the record will show the account is OK should you’ve stored it in good order and inside your limit. Unlike repaying loans, which are mounted repayments over a set period, overdrafts are a type of revolving credit, very similar to bank cards. This means you could add to an current overdraft (so long as you stay inside your authorised overdraft limit) – or pay it off completely one day, then dip into it the subsequent.

It doesn’t have an effect on authorised overdrafts, and the quantity varies depending on the financial institution or building society, and which present account you could have. The following ratios are generally used to measure an organization’s liquidity position, with every one utilizing a unique number of current asset parts in opposition to the current liabilities of an organization. If a business is making gross sales by providing longer terms of credit score to its clients, a portion of its accounts receivables could not qualify for inclusion in present property.

At the simplest stage, cash credit and overdraft are simply types of borrowing. An establishment allows you to withdraw funds that you do not have, usually in small amounts. The main distinction between these forms of borrowing is how they are secured.

Goodwill in accounting is an intangible asset that arises when a buyer acquires an current enterprise. Goodwill additionally doesn’t embrace contractual or different authorized rights no matter whether or not those are transferable or separable from the entity or other rights and obligations. Goodwill is also solely acquired by way of an acquisition; it can’t be self-created. Examples of identifiable assets which might be goodwill embrace an organization’s brand title, buyer relationships, artistic intangible assets, and any patents or proprietary know-how.

Business accounts usually tend to receive money credit, and it usually requires collateral in some kind. Overdrafts, then again, allow account holders to have a small adverse balance with out incurring a big overdraft charge.

Is a bank overdraft an asset?

An overdraft usually refers to a checking account where the amount of checks presented to the bank for payment exceeds the amount on deposit. When this occurs we say that the checking account customer has overdrawn its account. The overdraft means that the bank’s records indicate a negative checking account balance.

- In enterprise accounting, an overdraft is taken into account a current legal responsibility which is usually expected to be payable inside 12 months.

- In many circumstances, a financial institution overdraft could be instantly mounted if the corporate makes a deposit, say, the following day to cowl the quantity of overdraft.

- Since curiosity is charged, a cash overdraft is technically a brief-time period mortgage.

Private firms in the United States, nonetheless, may elect to amortize goodwill over a period of ten years or much less underneath an accounting various from the Private Company Council of the FASB. Overdrafts are entered onto your credit file, identical to most financial accounts. That means a record is saved of the stability you’ve excellent on your overdraft and a history of your payments.

Business organizations want funds to be able to meet their monetary requirement. Funding offered by banks for this purpose can either be long run or quick time period. Nowadays individuals/entities select quick time period loan facility, in the form of cash credit and overdraft. Cash Credit is a kind of facility provided by the bank or monetary establishment by which, an organization can withdraw an quantity greater than what he holds to his credit in opposition to the security of inventory. Overdraft safety also can be sold as a separate unsecured line of credit score tied to the primary account, performing as an emergency mortgage in the event of an overdraft.

In enterprise accounting, an overdraft is considered a current legal responsibility which is usually expected to be payable inside 12 months. Since interest is charged, a cash overdraft is technically a brief-time period loan. In many instances, a bank overdraft may be instantly mounted if the company makes a deposit, say, the next day to cowl the amount of overdraft. However, if any of a company’s accounts are in a cash overdraft state of affairs on the finish of its reporting interval, it’ll want report the quantity of the overdraft as a short-term liability.

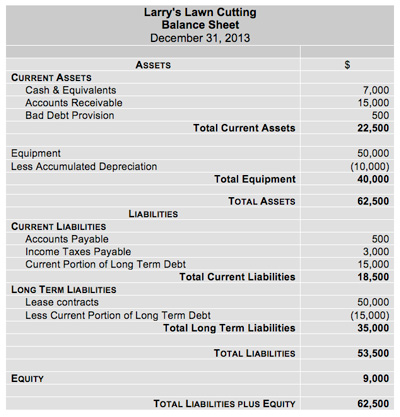

Recording Bank Overdrafts in a Balance Sheet

This creates a mismatch between the reported property and net incomes of firms that have grown without buying different firms, and those who have. These various measures are used to assess the company’s capability to pay outstanding debts and cover liabilities and bills with out having to promote fastened property. Additionally, creditors and investors hold a detailed eye on the present belongings of a business to assess the worth and threat concerned in its operations. Many use a variety of liquidity ratios, which symbolize a class of financial metrics used to determine a debtor’s capability to pay off current debt obligations without raising exterior capital. Such generally used ratios embody present property, or its parts, as a key ingredient of their calculations.

Is a bank overdraft a credit or debit?

In business accounting, an overdraft is considered a current liability which is generally expected to be payable within 12 months. In some cases, businesses treat a bank overdraft in the balance sheet as an asset or an operating expense, especially if they expect to pay back and reverse the overdraft quickly.

Under US GAAP and IFRS, goodwill is rarely amortized, because it is thought of to have an indefinite helpful life. Instead, management is responsible for valuing goodwill every year and to determine if an impairment is required. If the truthful market value goes below historical value (what goodwill was purchased for), an impairment must be recorded to convey it right down to its truthful market value. However, an increase in the honest market worth wouldn’t be accounted for in the financial statements.

What is the therapy of a financial institution overdraft on a balance sheet?

In some instances, businesses deal with a financial institution overdraft in the stability sheet as an asset or an operating expense, particularly in the event that they expect to pay back and reverse the overdraft rapidly. In this case, the bank overdraft accounting treatment might be to incorporate it as an Accounts Payable journal entry, with a coinciding enhance to the entire cash entry to steadiness. The money credit score account capabilities like a present account with cheque guide facility. The objective of taking cash credit is to fulfil working capital requirement of the agency. The money credit restrict is supposed to be equal to the working capital requirement of the company much less the margin funded by the company itself.

Overdrafts can be found for so long as the financial institution authorises them, and for so long as you pay the fees and charges that they incur. Current accounts now have a Monthly Maximum Charge (MMC) in place, which is the utmost amount you’d pay each month in charges, costs and interest on unarranged overdrafts.

The complete current belongings figure is of prime importance to the corporate administration as regards to the daily operations of a enterprise. As funds towards payments and loans turn out to be due at a daily frequency, corresponding to on the end of each month, the management must have the ability to prepare for the required money in time to pay its obligations. If the financial institution uses its own funds to cover your overdraft, it sometimes will not have an effect on your credit rating. When a bank card is used for the overdraft protection, it is possible that you could improve your debt to the point the place it could affect your credit score rating.

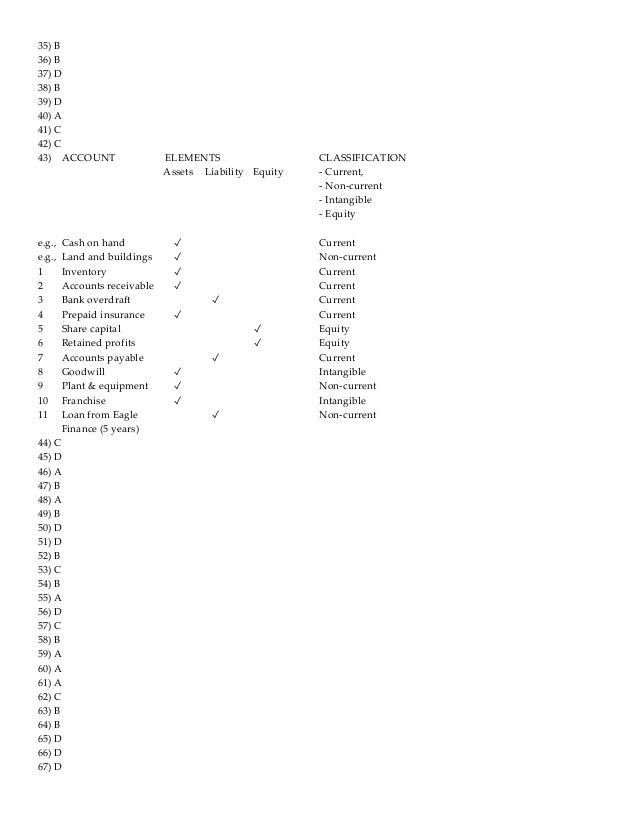

Conversely, Overdraft facility could be availed by the borrower, if he has a present account with the bank. The overdraft limit sanctioned is predefined by the financial institution relying upon the securities pledged or repayment capability of the Account holder. The drawing limit is specified by the financial institution, or financial establishment might vary from financial institution to bank and borrower to borrower.