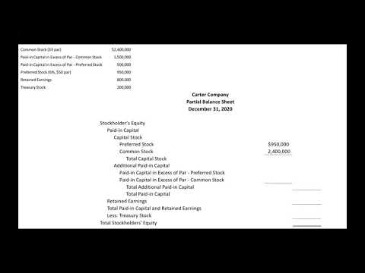

The stockholders’ equity subtotal is located in the bottom half of the balance sheet. Preferred stockholders may also have a defined dividend amount, while corporate management gets to decide if and how much to pay out in dividends for common stockholders each period. If the company liquidates for any reason, preferred stockholders receive payment before common stockholders. In the United States this is called a statement of retained earnings and it is required under the U.S.

Since equity accounts for total assets and total liabilities, cash and cash equivalents would only represent a small piece of a company’s financial picture. Companies may return a portion of stockholders’ equity back to stockholders when unable to adequately allocate equity capital in ways that produce desired profits. This reverse capital exchange between a company and its stockholders is known as share buybacks. Shares bought back by companies become treasury shares, and their dollar value is noted in the treasury stock contra account.

Successful Networking At Business Conferences

The expanded accounting equation is derived from the accounting equation and illustrates the different components of stockholder equity in a company. Conceptually, stockholders’ equity is useful as a means of judging the funds retained within a business. If this figure is negative, it may indicate an oncoming bankruptcy for that business, particularly if there exists a large debt liability as well. Unrealized gains and losses reflect the changes in pricing for investments. An unrealized gain occurs when an investment gains in value but hasn’t been cashed in.

- These are generally the buyback any firm makes to driver a price increase of the stock or to protect it from some rivalry that is trying to take over.

- After this date, the share would trade without the right of the shareholder to receive its dividend.

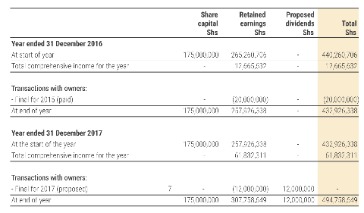

- Because it shows Non-Controlling Interest, it’s a consolidated statement.

- It breaks down changes in the owners’ interest in the organization, and in the application of retained profit or surplus from one accounting period to the next.

The document breaks down the value of stockholders’ ownership interest in a company during a specific accounting period, typically measuring any changes from the beginning to the end of the year. The stockholders’ equity is designed to show the financing that has been provided for the business from its owners. This can help potential investors understand the ownership structure for particular business. In this article we will review changes and structures of the statement of stockholders’ equity for our simulated business WH3 Corp. additionally we will also discuss the retained earnings, dividends, and stock splits. When a business is initially launching most business owners will file their business as a corporation, which is recognized as a legal entity separate from its owners in matters of personal liability.

How To Create A Shareholders Equity Statement?

Unlike common stock, preferred shareholders do not receive voting rights. It is called “preferred stock” because it has — wait for it — preferences. A dividend preference means dividends get paid to preferred stockholders before common stockholders. The two types of users in accounting are external users like investors, creditors, and the government, and internal users, such as business owners, managers, and, of course, a company’s accountant. Learn how external and internal users use accounting information, such as income statements, statements of retained earnings, balance sheets, and statements of cash flows. Shares OutstandingOutstanding shares are the stocks available with the company’s shareholders at a given point of time after excluding the shares that the entity had repurchased.

Holders of preferred stock do not have voting rights in the issuing company. Shareholders’ equity is the difference between a firm’s total assets and total liabilities.

What Is Stockholders Equity?

There will be grand total figures at the top and bottom of the matrix for the total amount of beginning and ending shareholders’ equity. Adds stock purchased and subtracts treasury stock re-issued during the period. The statement of shareholders’ equity gives a clear picture to the senior management to plan and repurchase the company’s shares to maximize the shareholders’ value. The following items will have a direct impact on the increase or decrease of the total stockholders’ equity. Stockholders’ equity is the value of a business’ assets that remain after subtracting liabilities, or its net worth. For some businesses, especially those that are new or conservative and have low expenses, lower stockholders’ equity is not a problem.

How is a company’s stock price calculated?

To figure out how valuable the shares are for traders, take the last updated value of the company share and multiply it by outstanding shares. Another method to calculate the price of the share is the price to earnings ratio.

Treasury shares continue to count as issued shares, but they are not considered to be outstanding and are thus not included in dividends or the calculation of earnings per share . Treasury shares can always be reissued back to stockholders for purchase when companies need to raise more capital. If a company doesn’t wish to hang on to the shares for future financing, it can choose to retire the shares. The approach may apply to separate additional columns for other classes of preferred stock. An employee stock ownership plan gives the employees of an organization the option to own a portion of the company’s stock.

Statement Of Stockholders Equity Definition

Overall financial health can be understood by analyzing the statement of equity as it gives a broad picture of the performance. If the negativity continues for a longer period, then the company may go insolvent due to poor financial health. Users Of Financial StatementsFinancial statements prepared by the Companies are used by different categories of individuals and corporates on the basis of their relevancy to the respective parties. The fourth and the final section reflects the equity at the time of the year-end of which a firm is tracking its equity balance. The net losses or any dividends paid to the investors are substracted in this section. This section reflects the firm’s equity when at the time of accounting period started.

Shareholders or stockholders usually can say that they own a part of the firm and are entitled to a certain profit percentage. The dividend amount doesn’t need to be equal to that of the stock owned, instead it is paid per share of the stock owned by a shareholder. So, before keeping the retained earnings, the owner of the company makes sure then keep the dividend aside. The shareholder equity statement is indeed a bit complicated and the business owners get intimidated by it. But, it is a very important and easier aspect and the owners should invest time to learn about it. The actual number of shares issued will not be more than the authorized share capital.

A company that’s been profitable for quite some time will probably show a large amount of retained earnings. Net Working Capital is the difference between a company’s current assets and current liabilities on its balance sheet. The financial statements are key to both financial modeling and accounting. Shareholders’ equity on a balance sheet is adjusted for a number of items. For instance, the balance sheet has a section called “Other Comprehensive Income.” It refers to revenues, expenses, gains, and losses; these aren’t included in net income. This section includes items like translation allowances on foreign currency and unrealized gains on securities.

Examples Of Shareholder Equity

They can omit the statement of changes in equity if the entity has no owner investments or withdrawals other than dividends, and elects to present a combined statement of comprehensive income and retained earnings. Additional Paid-in CapitalAdditional paid-in capital or capital surplus is the company’s excess amount received over and above the par value of shares from the investors during an IPO. It is the profit a company gets when it issues the stock for the first time in the open market.

For corporations, shareholder equity , also referred to as stockholders’ equity, is the corporation’s owners’ residual claim on assets after debts have been paid. Shareholder equity is equal to a firm’s total assets minus its total liabilities. Movement or changes in the capital structure and value is captured in the Stockholders’ equity statement. The statement of stockholder’ equity provides users with information regarding the change in a stockholders’ equity of a corporation. This statement of stockholders equity includes the contributed capital as well as the retained earnings which both help accountants, investors, and anybody using these financial statements to get a clear picture of the corporation’s ownership structure. The treasury stock business is the stock that has been repurchased from investors. A business will sometimes buy back stock from investors for a few reasons one being to increase the earnings-per-share of the business by lowering the overall number of outstanding shares.

Bob started off his business with nothing in capital or retained earnings in the company. Throughout this series on financial statements, you can download the Excel template below for free to see how Bob’s Donut Shoppe uses financial statements to evaluate the performance of his business. It is one of the four financial statements that need to be prepared at the end of the accounting cycle. The last line of the statement of stockholders’ equity will have the ending balance, which is the outcome of the beginning balance, additions, and subtractions. There could be more rows depending on the nature transactions a company may have. Retained earnings increase with an increase in net income and drop if net income drops.

Unrealized Gains And LossesUnrealized Gains or Losses refer to the increase or decrease respectively in the paper value of the company’s different assets, even when these assets are not yet sold. Once the assets are sold, the company realizes the gains or losses resulting from such disposal. The preference stock enjoys a higher claim in the company’s earnings and assets than the common stockholders. They will be entitled to dividend payment before the common stockholders receive theirs. As you might expect, the big changes to retained earnings were net income and dividends.

The stock dividends can also be thought of as much smaller increases that are proportional to the number of shares outstanding. An example of this would be if WH3 Corp. had a 10% dividend on its stock then a stockholder who owns 100 shares of stock would be awarded the value 10 shares of new stock in the Corporation. All the information needed to compute a company’s shareholder equity is available on its balance sheet. Current assets are assets that can be converted to cash within a year (e.g., cash, accounts receivable, inventory, et al.). Long-term assets are assets that cannot be converted to cash or consumed within a year (e.g. investments; property, plant, and equipment; and intangibles, such as patents). The accounting equation defines a company’s total assets as the sum of its liabilities and shareholders’ equity.

Just as with sole proprietorships and the statement of changes to owner’s equity, the big changes were net income and owner withdrawals. As you may realize by now, a sole proprietor decides when to take money out and how much earnings to withdraw, while a stockholder of a corporation has to wait for the board of directors to declare a dividend .

The statement of shareholders’ equity is an important component of planning because it shows the total amount of capital attributable to the owners of a business. In order to file an IPO the corporation must file a charter with their state of domicile then issue shares of stock by selling them to investors in exchange for other assets . These filings will help determine the total a number of authorized stocks, which will serve as the maximum number of shares that a corporation is allowed to print. The issuance of stock can also occur as part of the IPO because the initial public offering is the first time that stock in the business is offered to the public. When a corporation wants to repurchase or buy back shares of stock from investors this particular type of stock is referred to as treasury stock.

This equation is known as a balance sheet equation as all the relevant information can be gleaned from the balance sheet. A statement of shareholders’ equity details the changes within the equity section of the balance sheet over a designated period of time. The report provides additional information to readers of the financial statements regarding equity-related activity during a reporting period.

But, any business owner, small or big should pay attention to the operations as well. Bob bought $50,000 of capital stock of the business by investing it in cash. This is the date on which the actual dividend is received by the shareholder. The journal entry to record this would be to debit the dividends payable and credit cash accounts. Founder shares or class A shares have more voting rights than for instance the other class of shares. This simple equation does a lot in demonstrating that shareholder’s equity is the residual value of assets minus liabilities.