Putting all this double-entry bookkeeping data together will form a trial balance and the financial statements. Credits add money to accounts, while debits withdraw money from accounts.

You should always remember that each side of the equation must balance out. This is how we arrive at the term “balancing the books.” A small example will help you understand this equation. On the second day of the week you pay your rent, which is $1000. Since this is an expense, you subtract this amount from your cash balance.

Before double-entry accounting was invented, merchants, churches, and state treasuries used simple ledgers to account for what they earned and spent over a given period. Xero and QuickBooks Online are definitely the most popular double-entry accounting programs, but I also love Zoho Books and Wave. Which software is best for your company will depend on your company’s needs and size, but you can’t go wrong with any of these options. An expert in accounting, finance, and point of sale, Erica has been researching and writing about all things small-business since 2018. Erica’s insights into personal and business finance have been cited in numerous publications, including MSN, Real Simple, and Reader’s Digest.

What Is The Double Entry Concept In Accounting?

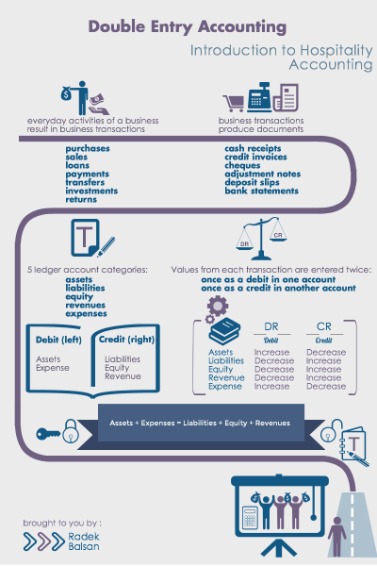

In a double-entry statement, you’ll see debits on the left-hand side and credits on the right. Botkeeper provides bookkeeping to businesses using a powerful combination of skilled accountants and automated data entry through the use of machine learning and AI. Botkeeper provides automated bookkeeping support to businesses by using a powerful combination of skilled accountants alongside machine learning and artificial intelligence . Our clients receive 24/7 accounting and support as well as incredible insight into their financials with beautiful dashboards and unlimited reporting. When you think of “Income,” think about the value of the work that you do. You may have a couple accounts in your chart of accounts that fall under “Income,” but the primary one will probably be your Revenue account.

“It was just a whole revolution in the way of thinking about business and trade,” writes Jane Gleeson-White of the popularization of double-entry accounting in her book Double Entry. In this article, we’ll explain double-entry accounting as simply as we can, how it differs from single-entry, and why any of this matters for your business. Adam Hayes is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

Now let’s take each transaction separately and apply the double-entry method to see where we would allocate each. Rosemary Carlson is an expert in finance who writes for The Balance Small Business. She has consulted with many small businesses in all areas of finance. She was a university professor of finance and has written extensively in this area. When a transaction takes place, it may impact only one side of the equation, or it may impact both. Check out CoinGeek’sBitcoin for Beginnerssection, the ultimate resource guide to learn more about Bitcoin—as originally envisioned by Satoshi Nakamoto—and blockchain. However, T- accounts are also used by more experienced professionals as well, as it gives a visual depiction of the movement of figures from one account to another.

Step 1: Set Up A Chart Of Accounts

The entry is a total of $6,000 debited to several expense accounts and $6,000 credited to the cash account. Thus, you are consuming an asset by paying for various expenses. A credit is that portion of an accounting entry that either increases a liability or equity account, or decreases an asset or expense account. I have a question about entries in Quick books premier desktop pro.

Merchant Maverick’s ratings are editorial in nature, and are not aggregated from user reviews. Each staff reviewer at Merchant Maverick is a subject matter expert with experience researching, testing, and evaluating small business software and services.

So this amount is debited to your account and raises the account balance to $4500. Let’s assume you have a $5000 cash balance at the beginning of the first week in June. Save money and don’t sacrifice features you need for your business. But with a little practice, you’ll be a pro at the double-entry accounting system in no time. You can also divide the major accounts in accounting into different sub-accounts.

The Small Business Guide To Adjusted Trial Balance

Single-entry bookkeeping is very different from the double-entry method. Just like it sounds, you record one entry for every transaction with single-entry. The best way to get started with double-entry accounting is by using accounting software. Many popular accounting software applications such as QuickBooks Online, FreshBooks, and Xero offer a downloadable demo you can try. If you’re ready to use double-entry accounting for your business, you can either start with a spreadsheet or utilize an accounting software.

It is necessary for an overall picture of your business finances. DebitCredit0000A debit is a transaction thatincreases assets and expenses anddecreases liabilities. Periodically, depending on the business, journal entries are posted to the general ledger.

Double Entry Accounting: What Is It?

Double-entry accounting is the only way to get an accurate view of your company’s finances. Single-entry accounting records income and expenses alone, whereas double-entry accounting takes assets and liabilities into account, giving you a more complete balance sheet.

When evaluating offers, please review the financial institution’s Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. Sole proprietors, freelancers and service-based businesses with very little assets, inventory or liabilities. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein.

ScaleFactor is on a mission to remove the barriers to financial clarity that every business owner faces. Another common example is using journal entries to show depreciation every month. It’s basically a summary of all the accounts in your chart of accounts . If you wanted the biggest of big-picture views of your business, you would turn to your general ledger. The biggest difference is that single-entry accounting could be done in a simple spreadsheet. For your columns, you’ll have the date, as well as a column for income and one for expenses.

What is a double-entry format?

The double-entry format is a useful technique to help you extend your thinking about a source or to critique an rhetor’s text. … The double-entry form shows the direct quotation on the left side of the page and your response to it on the right.

While you can certainly create a chart of accounts manually, accounting software applications typically do this for you. Once you have your chart of accounts in place, you can start using double-entry accounting. The products on the market today are designed with business owners, not accountants, in mind. Even if your knowledge of accounting doesn’t extend beyond Accounting 101, you’ll find most accounting software applications easy to use. Applicant Tracking Choosing the best applicant tracking system is crucial to having a smooth recruitment process that saves you time and money. Find out what you need to look for in an applicant tracking system.

Beginner’s Guides Our comprehensive guides serve as an introduction to basic concepts that you can incorporate into your larger business strategy. Construction Management CoConstruct CoConstruct is easy-to-use yet feature-packed software for home builders and remodelers.

Make sure you have a good understanding of this concept before moving on past the accounting basics section. This is always the case except for when a business transaction only affects one side of the accounting equation. For example, if a restaurant purchases a new delivery vehicle for cash, the cash account is decreased by the cash disbursement and increased by the receipt of the new vehicle. This transaction does not affect the liability orequity accounts, but it does affect two different assets accounts.

More Basic Accounting Resources

This is because her technology expense assets are now worth $1000 more and she has $1000 less in cash. The total debits and credits must balance, meaning they have to account for the total dollar value of a transactions. A transaction for $1000 must be credited $1000 and debited $1000. The definition of double-entry bookkeeping is an accounting method where a transaction is equally recorded in two or more accounts. A debit is made in at least one account and a credit is made in at least one other account. The general ledger reflects a two-column journal entry accounting system. Double-entry bookkeeping is an accounting method where you equally record a transaction in two or more accounts.

The overall complexity of your business will help dictate whether you manage your books using the single-entry or double-entry bookkeeping method. Common stock is a type of security that represents ownership of equity in a company. There are other terms – such as common share, ordinary share, or voting share – that double entry accounting are equivalent to common stock. Read on to learn more about why we use this accounting system, and how it’s used to balance a company’s books. An expense is money that has been spent, while a liability is money that is owed. For example, going to the office supply store and purchasing supplies is an expense.

It’s still considered single-entry because there is just one line for each transaction. A business transaction involves an exchange between two accounts. For example, for every asset there exists a claim on that asset, either by those who own the business or those who loan money to the business. Similarly, the sale of a product affects both the amount of cash held by the business and the inventory held. Nor can it decode things like checks, that don’t provide much information in your bank feed, very easily.

The total of the trial balance should always be zero, and the total debits should be exactly equal to the total credits. To utilize double-entry accounting, you’ll want to create several distinct accounts that relate to your business. You can be as detailed as you want—and it’s best to be as detailed as possible. Some common account categories include assets, liabilities, accounts payable, accounts receivable, inventory, and property. Each of these categories can be broken down further if you wish. In this system, the double entries take the form of debits and credits, with debits in the left column and credits in the right. For each debit there is an equal and opposite credit and the sum of all debits therefore must equal the sum of all credits.

- It also helped merchants and bankers understand their costs and profits.

- Since this is an expense, you subtract this amount from your cash balance.

- Under this approach, assets and liabilities are not formally tracked, which means that no balance sheet can be constructed.

- Understanding how to do it will equip you for all sorts of business challenges, specifically like how to read your financial statements with confidence and make thoughtful financial decisions.

Can’t produce much insight beyond a profit and loss statement. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Let’s say you just bought $10,000 of pet food inventory on credit.

Strategies To Improve Cash Flow

Sometimes, people show double-entry accounting as a T-account, which is a visual representation of the effect a transaction has on the accounts involved. Just as the accounting equation must always balance,total debits must always equal total credits. Debits always increase asset or expense accounts and decrease liability or equity accounts. Credits always decrease asset or expense accounts and increase liability or equity accounts, according to Accounting Tools. Under the double‐entry bookkeeping system, the full value of each transaction is recorded on the debit side of one or more accounts and also on the credit side of one or more accounts.

What Is The Difference Between Single Entry And Double

A business transaction is an economic event that is recorded for accounting/bookkeeping purposes. In general terms, it is a business interaction between economic entities, such as customers and businesses or vendors and businesses. Bear in mind that while you’ll be able to prove income tax reporting and calculate net income, you won’t be able to generate a complete set of financial statements. This will limit your ability to win investments down the road and may lead you to switch accounting systems at some point. Single-entry bookkeeping is what you do in your checkbook, recording checks and deposits in one register.