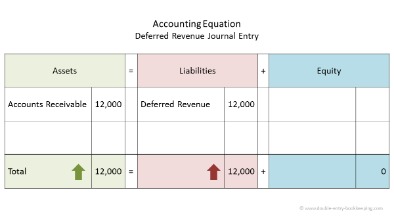

The entries shown in Exhibit 5 would be modified as shown in Exhibit 7. Under the liability method, you initially enter unearned revenue in your books as a cash account debit and an unearned revenue account credit. The debit and credit are of the same amount, the standard in double-entry bookkeeping. The first journal entry reflects that the business has received the cash it has earned on credit. Unearned revenue is also known as deferred revenue or deferred income. It is a prepayment received by an individual supplier or a company from a customer who ordered the delivery of goods or services at a later date.

Yet, the balance sheet, or statement of financial position, would show that the company increased its cash asset at the same time it incurred a liability for the transaction, as it still has to deliver the magazines to the customer. A lawn service company offers customers a special package of five applications of fertilizers and weed treatments for $300. However, the customer must prepay in December for the five treatments that will be done between April and September. When the company receives the $300 in December, it will debit the asset Cash for $300 and will credit the liability account Unearned Revenues. Since these are balance sheet accounts , there are no revenues to be reported in December.

Is deferred revenue a contract liability?

A contract liability may be called deferred revenue, unearned revenue, or refund liability. The change in terminology simply reflects ASC 606’s revenue model, in which reclassification from a contract asset to a receivable is contingent on fulfilling performance obligations—not on invoicing a client.

Because there is a possibility that the services may not be performed they present a risk to the company. While it’s assumed that money will one day be recognized, it can’t be guaranteed until the work is performed. Therefore, it belongs as a liability until the risk of repayment is gone. Thanks to the recent adoption of Accounting Standards ASC 606, revenue recognition rules are now more uniform (where they used to be industry-specific).

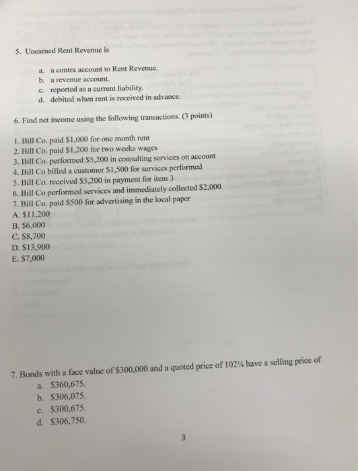

Why Is Unearned Rent A Liability?

The early receipt of cash flow can be used for any number of activities, such as paying interest on debt and purchasing moreinventory. Receiving funds early is beneficial to a company as it increases its cash flow that can be used for a variety of business functions. The rights and obligations under the contract may give rise to contract assets and contract liabilities. When dealing with unearned revenue, be mindful that this is not the same as buying on credit.

- Current liabilities can be settled in various ways, though most are settled by liquidating current assets—cash or accounts receivables.

- However, over time, it converts to an asset as you deliver the product or service.

- As a result of this prepayment, the seller has a liability equal to the revenue earned until the good or service is delivered.

- However, the customer must prepay in December for the five treatments that will be done between April and September.

- The adjusting entry for unearned revenue depends upon the journal entry made when it was initially recorded.

- A contract liability is an entity’s obligation to transfer goods or services to a customer for which the entity has received consideration from the customer but the transfer has not yet been completed.

For businesses looking to expand services, advance payments are a great option to immediately increase cash flow. With compliant recording and follow through on client expectations, unearned revenue can make all the difference for securing growth standing out from competitors. Unearned revenue is always listed as a liability on a company’s balance sheet. On a summarized balance sheet, you probably won’t see it as a listed account, just included in the liabilities total. However, on a more detailed balance sheet, it would be listed as an account under liabilities either as current liability or even further detailed as unearned revenue. Unearned revenue is actually a current liability, or a short-term liability.

Example Of Realized Vs Realizable Revenue

Therefore, the payment is still refundable and cannot count as actual revenue. If goods or service delivery occurs in the near term, say, within a month and within the current accounting period, the firm treats the revenues as ordinary revenue earnings. The treatment of unearned revenue can have a material impact not only on taxes, is unearned revenue a liability revenue recognized by the seller, and revenue recognized by the buyer, but also on the amount of the working capital target in M&A transactions. Buyers and sellers would be wise to work together and bring more certainty to their intended tax treatment for unearned revenue for purposes of both tax and target working capital.

It can be thought of as a “prepayment” for goods or services that a person or company is expected to supply to the purchaser at a later date. As a result of this prepayment, the seller has a liability equal to the revenue earned until the good or service is delivered.

As the expenses are incurred the asset is decreased and the expense is recorded on the income statement. The new standard guides organizations on how to report gift card activity on an income statement. It says companies should classify income from gift card sales and breakage income as sales revenue. In current practice, some companies delay recognition of breakage income until redemption is deemed remote.

You record prepaid revenue as soon as you receive it in your company’s balance sheet but as a liability. Therefore, you will debit the cash entry and credit unearned revenue under current liabilities. After you provide the products or services, you will adjust the journal entry once you recognize the money. At this point, you will debit unearned revenue and credit revenue. According to the Generally Accepted Accounting Principles , all the revenues must be recorded when earned, even though the cash can be received later. Such payments are reflected as a liability on the balance sheet as it represents the debt owed to the customer.

Finding Unearned Revenue On A Balance Sheet

After you have fulfilled your obligations in March, the unearned revenue account is zeroed out because you have finally earned the entire amount you were paid. The person receives the money from one party for which the goods have been delivered or the services have been rendered to the party. Now, in case the party cancels the contract then, in that case, the company would liable to refund the amount of money received from the customer in advance.

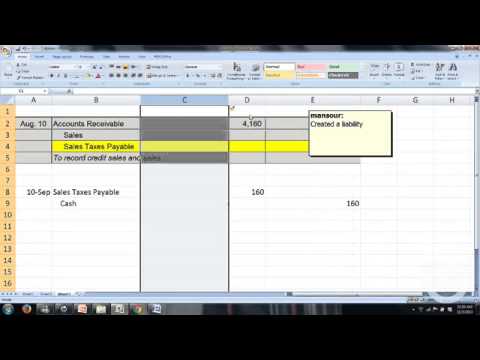

For example, a contractor quotes a client $1000 to retile a shower. The client gives the contractor a $500 prepayment before any work is done. The contractor debits the cash account $500 and credits the unearned revenue account $500.

Adjusting Entry For Unearned Revenue

That $1,000 is considered income and goes on the income statement for January. The other $2,000 is still unearned because it is for work you’re going to perform in February and March, so you do not include it in the income statement for January. Not getting paid can really affect your cash flow, especially if a late payment means suddenly spending more than you’ve earned in a month. And any revenue that has not been realized (i.e. unearned revenue) will not appear on your income statement just yet; that is, not until you’ve delivered on the projects and/or services you’ve promised. It also goes by other names, like deferred income, unearned income, or deferred revenue.

Which of the following is a current liability?

Bills payable, Outstanding expenses and Bank Overdraft are the current liabilities.

The “deferred payment” situation occurs when the seller delivers goods or services before the customer pays. In brief, matching means that firms report revenues along with the expenses that brought them. In this way, the matching concept contributes to accuracyin reporting profits. They match revenues by reporting in the same period the expenses they incur to earn them. First, defining Unerned Revenue and Deferred Revenue as concepts made necessary by principles of accrual accounting. Be the first to know when the JofA publishes breaking news about tax, financial reporting, auditing, or other topics.

Example 2: Cash Flow And Production Burden

Noncurrent liabilities represent a long-term liability like loans, rent, or other lease obligations that last longer than a year. Unearned revenue indicates the intention to perform work for the advance payment within a closer time frame, typically within the next several months or less. Revenue will be recognized when the company completes the required terms set by the IFRS 15 for revenue recognition set by the international financial reporting standards, i.e., delivering the services to the customer. The business owner enters $1200 as a debit to cash and $1200 as a credit to unearned revenue. An adjusting journal entry occurs at the end of a reporting period to record any unrecognized income or expenses for the period.

For compliance with the matching concept, both the seller and the buyer record the first part of the sale event, as it occurs, with two journal entries. Example journal entries of this kind appear above in Exhibit 1 and 2. Exhibit 2 represents such entries when there is a time lapse between parts sale parts 1 and 2. Here that is a $500 increase In the “revenue” account “Product sales revenues.”

In this case, companies would be required to employ the new pronouncement while accounting for the fact that 60% of the breakage amount would be turned over to the state. In this case, the accounting is similar to Exhibit 5 with an adjustment for the amount of the unclaimed property the firm would be allowed to retain. The EITF’s next meeting is scheduled for March 19, although it’s not certain that this issue will be discussed on that date. If you have noticed, what we are actually doing here is making sure that the earned part is included in income and the unearned part into liability. The adjusting entry will always depend upon the method used when the initial entry was made. At the end of January, you’ve earned the first of the three month’s income or $1,000.

According to GAAP, unearned revenue is recognized over time as the product or service is delivered, based on certain critical events. Unearned revenue is the revenue a business has received for a product or service that the business has yet to provide to the customer.

This means you’ll debit the unearned revenue account by $2,000 and credit the revenue account by $2,000. Unearned income or deferred income is a receipt of money before it has been earned.