Cohen & Company is not rendering legal, accounting or other professional advice. Information contained in this post is considered accurate as of the date of publishing. Any action taken based on information in this blog should be taken only after a detailed review of the specific facts, circumstances and current law. An employee who’s struggling financially might prematurely write off receivables or overbill customers and then divert the subsequent collections to his or her personal bank account. Such scams are often successful, because fraudsters know that most companies are remiss in monitoring old, written-off receivables, especially in periods of high stress and uncertainty. In general, once a receivable is four months overdue, collectability is doubtful. However, that benchmark varies based on the industry, the economy, the company’s credit policy and other risk factors.

Tax credits are applied to taxes owed, lowering the overall tax bill directly. Peggy James is a CPA with over 9 years of experience in accounting and finance, including corporate, nonprofit, and personal finance environments. She most recently worked at Duke University and is the owner of Peggy James, CPA, PLLC, serving small businesses, nonprofits, solopreneurs, freelancers, and individuals.

Unit 10: Receivables

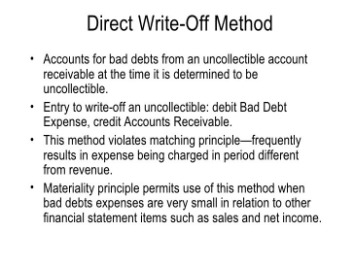

Conversely, several periods in which the ratio is higher than one may indicate that management has been accumulating an excessive allowance. The direct write-off method is a simple process, where you would record a journal entry to debit your bad debt account for the bad debt and credit your accounts receivable account for the same amount.

- An inventory write-off is an accounting term for the formal recognition of a portion of a company’s inventory that no longer has value.

- In cash-basis accounting, businesses record transactions when cash changes hands.

- If you win a civil case against a client and are awarded a judgment, you then have to take action to collect payment.

- There are a few accounts that have been on the A/R Aging Report for over a year, some even over 2+ years.

- The company estimates that 1.5% of credit sales are uncollectible.

- Loan loss reserves work as a projection for unpaid debts while write-offs are a final action.

As stated previously, the amount of bad debt under the allowance method is based on either a percentage of sales or a percentage of accounts receivable. When doing the calculations, it is important to understand what the resulting number actually represents. Because one method relates to the income statement and the other relates to the balance sheet , the calculated amount is related to the same statement. When using the percentage of sales method, the resulting amount is the amount of bad debt that should be recorded.

Accountingtools

It has extensive reporting functions, multi-user plans and an intuitive interface. Easily save this report to your computer or print it at any time. The matching principle states that any transaction that affects one account needs to affect another account during that same period. Although only publicly held companies must abide by GAAP rules, it is still worth considering the implications of knowingly violating GAAP.

In the event that a customer decides to pay what they owe later on, the accounts receivable account would be debited and the bad debt expense would be reduced. In the allowance method, an estimate is calculated every year that is debited to the bad debt expense account. Write-offs affect both balance sheet and income statement accounts on your financial statement, so it’s important to be accurate when handling bad debt write-offs. While the direct write-off method is the easiest way to eliminate bad debt, it should be used infrequently and with caution. The allowance method follows GAAP matching principle since we estimate uncollectible accounts at the end of the year. We use this estimate to record Bad Debt Expense and to setup a reserve account called Allowance for Doubtful Accounts based on previous experience with past due accounts.

See For Yourself How Easy Our Accounting Software Is To Use!

If you consistently have uncollectible accounts, use the allowance method for writing off bad debt, as it follows GAAP rules while keeping financial statements accurate. Using the allowance method can also help you prepare more accurate financial projections for your business. The alternative to the direct write off method is to create a provision for bad debts in the same period that you recognize revenue, which is based upon an estimate of what bad debts will be. This approach matches revenues with expenses, and so is considered the more acceptable accounting method. It’s also important to note that the direct write-off method violates the matching principle, which states that expenses should be reported during the period in which they were incurred. This is because with the direct write-off method, a bad debt is reported when the accounts receivable is written off.

Can write off loans be recovered?

“Technical write-offs are only for balance sheet management purposes. … When recovered, these loans are shown as under-recovery from written-off accounts as part of a bank’s other income in the profit and loss statement.

Bad debt expense recognition is delayed under the direct write-off method, while the recognition is immediate under the allowance method. This results in higher initial profits under the direct write-off method. Bad Debts Expense$ XYZAccounts Receivable$ XYZDirect write-off method does not use any allowance or reserve account.

Accounts Receivable As A Target For Fraud

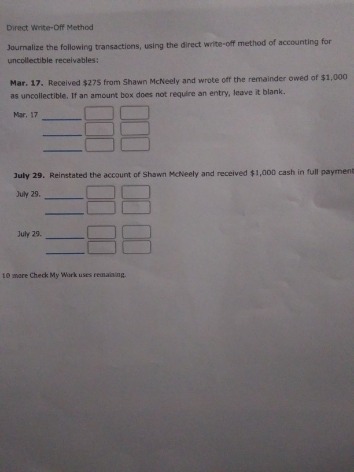

You can solve the problem by using the allowance method in which you create an allowance account for bad debt in the same accounting period when you earn the revenue. Natalie has many customers who purchase goods from her on credit and pay on account. One of her customers purchased products worth $ 1,500 a year ago, and Natalie still hasn’t been able to collect the payment. After trying to contact the customer number of times, Natalie finally decides that she will never be able to recover these $ 1,500 and decides to write off the balance from such a customer. Using the direct write-off method, Natalie would debit the bad debts expenses account by $ 1,500 and credit the accounts receivable account with the same amount. Companies turn to the allowance method to properly report revenues and the related expenses in the periods that they were earned and incurred. The allowance shows up as a contra-asset to offset receivables on the balance sheet and as bad debt expense to offset sales on the income statement.

An inventory write-off is an accounting term for the formal recognition of a portion of a company’s inventory that no longer has value. In 2019, Stephanie failed to pay back the amount and a bad debt of $5,000 was recognized. Hence, before occurrence of a bad debt a provision is created in order to show a true and fair view of the company.

This makes a company appear more profitable, at least in the short term, than it really is. For a business that provides a service or sells goods on credit, bad debts might be inevitable. You can use your bad debt rate from previous years to determine the amount to set aside for your bad debt reserve. For example, last year you brought in $30,000, but you sold $40,000 worth of goods. Under the allowance method, you could predict 25% of your profits will be bad debts. Resolve’s credit assessment uses proprietary financial databases and algorithms to assess your customers without needing a single thing from them. When a customer is approved, Resolve provides an advance of up to 90% of each invoice, paid into your account within 1 day.

Uncollectible account or bad debt refers to an amount that the customer is not going to pay. The allowance method records an estimate of bad direct write off method debt expense in the same accounting period as the sale. The allowance method is used to adjust accounts receivable in financial reports.

How To Account For The Allowance Of Excess & Obsolete Inventory

At this point, the $500 would be considered uncollectible, so Wayne needs to remove it from his accounts receivable account. If he does not write the bad debt off, it will stay as an open receivable item, artificially inflating his accounts receivable balance. GAAP mandates that expenses be matched with revenue during the same accounting period. But, under the direct write off method, the loss may be recorded in a different accounting period than when the original invoice was posted. The IRS allows bad debts to be written off as a deduction from total taxable income, so it’s important to keep track of these unpaid invoices in one way or another. It’s also important to note that unpaid invoices are categorized as assets, which are debited in accounting. You sell one to a customer for $2,500, but they do not pay immediately.

For example, writing off a large and material account immediately might not be proper. For example, Wayne spends months trying to collect payment on a $500 invoice from one of his customers. However, all of the invoices and letters he has mailed have been returned. The Coca-Cola Company , like other U.S. publicly-held companies, files its financial statements in an annual filing called a Form 10-K with the Securities & Exchange Commission . Let’s try and make accounts receivable more relevant or understandable using an actual company. The amount used will be the ESTIMATED amount calculated using sales or accounts receivable. Save money and don’t sacrifice features you need for your business.

Each write-off scenario will differ but usually, expenses will also be reported on the income statement, deducting from any revenues already reported. In this case, $600 would be a credit entry to your company’s revenue and a debit entry of $600 would be made to accounts receivable. After a few months of trying to collect on the $600 invoice, you come to the realization that you won’t be paid for your services. Using the direct write-off method, a debit to the bad debt expense account for $600 will be made and a credit of $600 to accounts receivable will be made. With the allowance method, you predict that you won’t receive payment for credit sales from all your customers. As a result, you debit bad debts expense and credit allowance for doubtful accounts.

This situation is an unfortunate, but not unusual part of doing business. The direct write-off method is the simpler of two primary methods businesses use to record uncollectible accounts.

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

The balance in Accounts Receivable drops to $9,900 and the balance in Allowance for Doubtful Accounts falls to $400. Sean Butner has been writing news articles, blog entries and feature pieces since 2005. His articles have appeared on the cover of “The Richland Sandstorm” and “The Palimpsest Files.” He is completing graduate coursework in accounting through Texas A&M University-Commerce.