Understand these critical pieces of notation by exploring the definitions and purposes of debits and credits and how they help form the basics of double-entry accounting. Accounting is a rule-based system that requires memorization of the debits and credits system. Proper memorization and application of the basic concepts is invaluable when moving to more difficult concepts. Solid understanding of debits and credits is necessary for a student, CPA exam taker, and accounting professional. The Chart of Accounts established by the business helps the business owner determine what is a debit and what is a credit. Despite this, we can break down the confusion by looking at how banking and accounting define and manage debits and credits separately.

What is an example of a debit?

A debit is an entry made on the left side of an account. … For example, you would debit the purchase of a new computer by entering the asset gained on the left side of your asset account. A credit is an entry made on the right side of an account.

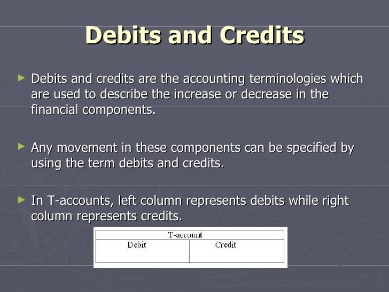

All accounts that normally contain a debit balance will increase in amount when a debit is added to them, and reduced when a credit is added to them. The types of accounts to which this rule applies are expenses, assets, and dividends. Business transactions are events that have a monetary impact on the financial statements of an organization. When accounting for these transactions, we record numbers in two accounts, where the debit column is on the left and the credit column is on the right. Debit balances generally occur in certain types of accounts, while credit balances generally occur in others.

Because the bank also follows the accounting principles of double-entry accounting, they will also enter a credit of $100 in your business’ checking account. The bank has not “earned” $100, but rather has an obligation and liability to return this $100 to you on demand whenever you as a business owner decide to withdraw it from the bank. A debit decreases liability and equity account balances while a credit increases liability and owner’s equity accounts.

What Is A Debit And Credit In Accounting?

Asset business accounts – Debits increase the balance and credits decrease the balance. A simple way to remember all of this is with an example. While this may be confusing to those who are not accountants, becoming more comfortable with these accounting principles will make this process easier. B. Expense Account – A credit (111.11-) to an expense account is reducing expenditures and freeing up dollars available to the account code or pool . A debit (111.11) to an expense account increases the expenditures to the account code and reduces dollars available for spending . It has increased so it’s debited and cash decreased so it is credited. A business owner can always refer to the Chart of Accounts to determine how to treat an expense account.

The act of adding or subtracting from your score is the same as debiting or crediting. The total amount of debits in a single transaction must equal the total amount of credits. In accounting, the debit column is on the left of an accounting entry, while credits are on the right. Understanding debits and credits is essential for bookkeeping and analysis of balance sheets.

Recording a sales transaction is more detailed than many other journal entries because you need to track cost of goods sold as well as any sales tax charged to your customer. As a business owner, you may find yourself struggling with when to use a debit and credit in accounting. Applicant Tracking Choosing the best applicant tracking system is crucial to having a smooth recruitment process that saves you time and money.

You give your Dad $100, which results in a debit of $100. The numbers to the right of zero are positive and they get bigger as they go to the right.

In double entry bookkeeping, debits and credits are entries made in account ledgers to record changes in value resulting from business transactions. A debit entry in an account represents a transfer of value to that account, and a credit entry represents a transfer from the account. Each transaction transfers value from credited accounts to debited accounts. For example, a tenant who writes a rent cheque to a landlord would enter a credit for the bank account on which the cheque is drawn, and a debit in a rent expense account.

The Double Entry System

The Equity section of the balance sheet typically shows the value of any outstanding shares that have been issued by the company as well as its earnings. All Income and expense accounts are summarized in the Equity Section in one line on the balance sheet called Retained Earnings. This account, in general, reflects the cumulative profit or loss of the company. AccountDebitCreditCash$1,000Equity $1,000Why is it that crediting an equity account makes it go up, rather than down? That’s because equity accounts don’t measure how much your business has. Rather, they measure all of the claims that investors have against your business. Let’s imagine that after buying that expensive desk, you want to get some extra cash for your business.

Thus, when the customer makes a deposit, the bank credits the account (increases the bank’s liability). At the same time, the bank adds the money to its own cash holdings account. Since this account is an Asset, the increase is a debit. But the customer typically does not see this side of the transaction. A credit is an accounting entry that either increases a liability or equity account, or decreases an asset or expense account.

Free Accounting Courses

Get clear, concise answers to common business and software questions. Accounting Accounting software helps manage payable and receivable accounts, general ledgers, payroll and other accounting activities. Reconciliation is an accounting process that compares two sets of records to check that figures are correct, and can be used for personal or business reconciliations.

Asset accounts, especially cash, are constantly moving up and down with debits and credits. Debits, abbreviated as Dr, are one side of a financial transaction that is recorded on the left-hand side of the accounting journal. Credits, abbreviated as Cr, are the other side of a financial transaction and they are recorded on the right-hand side of the accounting journal.

What is the difference between a credit and a debit?

When you use a debit card, the funds for the amount of your purchase are taken from your checking account in almost real time. When you use a credit card, the amount will be charged to your line of credit, meaning you will pay the bill at a later date, which also gives you more time to pay.

Then we translate these increase or decrease effects into debits and credits. In double-entry accounting, any transaction recorded involves at least two accounts, with one account debited while the other is credited. To fully understand debits and credits, you first need to understand the concept of double-entry accounting. Double-entry accounting states that for every financial transaction recorded at least two accounts in your chart of accounts are affected—and they’re affected in equal and opposite ways. For placement, a debit is always positioned on the left side of an entry . A debit increases asset or expense accounts, and decreases liability, revenue or equity accounts. The total debits in the trial balance ($500) equal the total credits ($500), as they should.

What Is An Account?

You credit an asset account, in this case, cash, when you use it to purchase something. The reason for the apparent inconsistency when comparing everyday language to accounting language is that from the bank customer’s perspective, a checking account is an asset account. From the bank’s perspective, the customer’s account appears on the balance sheet as a liability account, and a liability account’s balance is increased by crediting it. In common use, we use the terminology from the perspective of the bank’s books, hence the apparent inconsistency.

Most businesses these days use the double-entry method for their accounting. Under this system, your entire business is organized into individual accounts. Think of these as individual buckets full of money representing each aspect of your company.

These include cash, receivables, inventory, equipment, and land. We’ll help walk through setting up your business, switching accountant or any of your tax queries. All our fixed price accounting packages come with a 50% off for 3 months. Everyone knows that accountants will complete tax returns and accounts but the very best accountants will go one step further in ensuring the very best for the business. I know how important this is because I’ve been there as a small business owner – and I searched for a long time to solve this problem and make it painless. As a small business owner, having a good grasp of your business financials is key-even if you’ve hired an accountant. As a self-employed person or small business owner, getting a good grasp of accounting fundamentals can feel like an uphill task.

When To Use Debits Vs Credits In Accounting

The asset account above has been added to by a debit value X, i.e. the balance has increased by £X or $X. Likewise, in the liability account below, the X in the credit column denotes the increasing effect on the liability account balance , because a credit to a liability account is an increase. Before the advent of computerised accounting, manual accounting procedure used a ledger book for each T-account. The collection of all these books was called the general ledger. The chart of accounts is the table of contents of the general ledger.

- Debits increase expense accounts or asset accounts and decrease equity or liability.

- Enter your credit card knowing your information in transit from our website to Intuit is protected.

- In accounting, debits or credits are abbreviated as DR and CR respectively.

- It can take time to learn which accounts to debit and which to credit, and it becomes more complex and businesses grow and transactions accumulate.

- Likewise, if you add a negative number to any number on the number line, you always move to the LEFT on the number line to get your answer.

- Debits and credits accountswere formally invented in the 15th century by Luca Pacioli, as an official system to specify what was already used by merchants in Venice.

- That will likewise reduce your Accounts Payable amount by $20,000.

There are certain types of accounts, such as expense, asset, and dividend accounts, that will have a debit balance. This is because the debit balance increases when a debit is added and decreases when a credit is added.

The term “T-account” is accounting jargon for a “ledger account” and is often used when discussing bookkeeping. The reason that a ledger account is often referred to as a T-account is due to the way the account is physically drawn on paper (representing a “T”). The left column is for debit entries, while the right column is for credit entries. Current liability, when money only may be owed for the current accounting period or periodical.

Debit And Credit Rules

CMS A content management system software allows you to publish content, create a user-friendly web experience, and manage your audience lifecycle. To decrease an account you do the opposite of what was done to increase the account. For example, an asset account is increased with a debit.

Business Checking Accounts

Let’s say you’ve decided to invest an additional £15,000 into your business. Credit Sale – The debit would be recorded in the accounts receivable account, and the credit would be recorded in the revenue account. Before we get too involved in the discussion of debits and credits, let’s learn a few basics. Every business has various transactions that occur each day. Each of these transactions are examined by accountants and recorded in the accounts that they affect. Expense accounts are items on an income statement that cannot be tied to the sale of an individual product. Of all the accounts in your chart of accounts, your list of expense accounts will likely be the longest.

For example, when a company borrows $1,000 from a bank, the transaction will affect the company’s Cash account and the company’s Notes Payable account. When the company repays the bank loan, the Cash account and the Notes Payable account are also involved. To simply this explanation, consider that a debit entry always adds a positive number and a credit entry always adds a negative number . debits and credits are bookkeeping entries that balance each other out. Consider that for accounting purposes, every transaction must be exchanged for something else of the exact same value.