What we’re trying to calculate when we calculate inventory days is how long, on average, it takes BlueCart Coffee Company to turn green coffee beans into sales. To use the inventory days formula, you need both your average inventory formula and your cost of goods sold, or COGS. Inventory turnover ratio shows how quickly a company receives and sells its inventory. Inventory turnover days, on the other hand, calculates the average number of days a company takes to sell its inventory. And that means lower inventory carrying cost and less cash is tied up in inventory for less time. And there’s less risk that inventory expires or becomes obsolete. It is important for a business to maintain adequate stock levels.

How do you calculate raw material inventory days?

This measure determines raw material inventory days of supply, which is calculated as the value of raw materials inventory divided by the “value of transfers divided by 365 days.” It is part of a set of Process Efficiency measures that help companies optimize the performance of their “produce product” process by …

XYZ Limited is a leading retail corporation with an average inventory of $15 million. Cost of goods sold on their annual financial statements for 2018 was $300m. Assuming that the year ended in 365 days, determine XYZ Limited’s Days of Sales in Inventory. This metric should always be compared to the company’s capacity to stock-up. Days in inventory is the first of three parts for this calculation.

Properly managing your inventory levels is vital for all businesses, even more so for those of you that have retail companies or those selling physical goods. Managing inventory levels is vital for most businesses, and it is especially important for retail companies or those selling physical goods.

Days In Inventory Formula In Excel With Excel Template

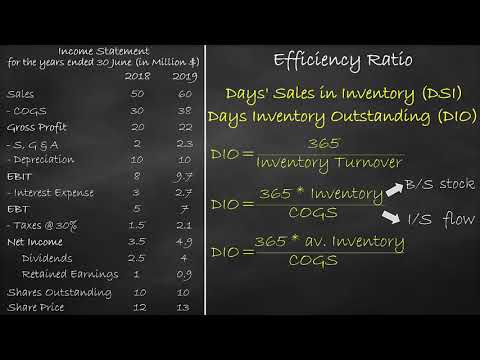

The days sales in inventory is a measure that tracks how many days of sales the current inventory level can sustain. If you have not calculated the inventory turnover ratio, you could simply use the cost of goods sold and the average inventory figures. Then you would multiply that number by the number of days in the accounting period. The days’ sales in inventory figure is intended for the use of an outside financial analyst who is using ratio analysis to estimate the performance of a company. The metric is less commonly used within a business, since employees can access detailed reports that reveal exactly which inventory items are selling better or worse than average.

In this article, we will discuss the importance of days sales in inventories, how to calculate them and provide examples of using DSI in a business. A company could post financial results that indicate low days in inventory, but only because it has sold off a large amount of inventory at a discount, or has written off some inventory as obsolete. An indicator of these actions is when profits decline at the same time that the number of days sales in inventory declines. In general, the higher the inventory turnover ratio, the better it is for the company, as it indicates a greater generation of sales. A smaller inventory and the same amount of sales will also result in high inventory turnover. Days inventory outstanding, or DIO, is another term you’ll come across.

A score of 500 and above means your inventory is performing efficiently, while anything lower than that could result in reduced storage volume space and overage fees. And in terms of inventory liquidity, DSI reflects the number of days a business’s current stock will last. Efficiently managing your inventory can lead to reduced operational costs, increased profitability, and accelerated business growth. It will also help you ship out orders to your customers more quickly or avoid missing sales due to stockouts. A company may change its method for calculating the cost of goods sold, such as by capitalizing more or fewer expenses into overhead. If this calculation method varies significantly from the method the company used in the past, it can lead to a sudden alteration in the results of the measurement. Management wants to make sure its inventory moves as fast as possible to minimize these costs and to increase cash flows.

- The managers at Bob’s furniture should use this information to make sure new merchandise is getting delivered to the store every 46 days.

- Inventory has a maintenance cost and as well as it has to keep under certain circumstances depending upon the product of the particular business.

- The dayssalesin inventory is a key component in a company’s inventory management.

- Therefore, compare your days in inventory with other businesses in the same industry to determine if you are selling your inventory efficiently.

This ratio tells you how many times your inventory sitting in stock has been moved or “turned over” during the average year. In some cases, the most accurate way to estimate the actual number of days of sales in inventory is to only include finished goods, as those are the ones actually available for sale. Including inventory in early stages of the production process may also distort the calculation as that inventory will not be immediately available to be sold.

Days Sales In Inventory: Dsi

Working capital management is a strategy that requires monitoring a company’s current assets and liabilities to ensure its efficient operation. While both Walmart and Amazon are leading retailers, the mode of their operations explains the higher DSI value for the latter. Walmart sees a lot of foot traffic in its brick and mortar retail stores, and customers buy items in bulk as their purchases are comprised of groceries, which are perishable goods.

It is recorded as a deduction of revenue and determines the company’s gross margin. Due to this, you should be comparing value among their same sector peer companies. When you look at technology, automobile, and furniture sectors, these companies can hold inventory for long durations.

Days Sales In Inventory Uses, Cautions, Pitfalls

What this means is that Company A takes around 89 days to sell all of its Inventory during a year. We need to take an average of closing inventory as at current period-end and previous period-end. The formula for Days inventory outstanding is closely related to the Inventory turnover ratio. Hence, it is not preferred to have very high Days inventory on hand. Earlier, we discussed Inventory turnover ratio which indicates the number of times the company turns its inventory during the year. Days in Inventory formula also indicates the liquidity of the inventory and the position of working capital as. That means fresh, unroasted green coffee takes an average of 6.6 days from the beginning of the production process to sale.

Calculating days in inventory is actually pretty straightforward, and we’ll walk you through it step-by-step below. Conversely, a DSI higher than your industry benchmarks indicates either a subpar sales performance or you’re carrying excess inventory that may become obsolete eventually. High DSI may also mean that you’re keeping many units in your warehouse to meet expected demand spikes . But as long as you increase your sales to get your inventory levels back to a healthy range, you should see your DSI and sell-through rate improve. days sales in inventory helps you figure out how fast your products move. As you already know, storage and handling of inventory in a warehouse adds a lot of extra cost.

How many days will it take for your company to sell its entire inventory? Well, if you have no idea, then you can calculate the Days Sales in Inventory, also known as Days Inventory Outstanding or just Days in Inventory. Set your minimum and maximum days of stock for both your Amazon fulfillment center and 3PL warehouse to make it simple for you to determine how much inventory to order and when. So to see how well you’re managing your inventory, it’s essential to identify your retail category and compare your DSI rate with your industry standards. That means in one year; you’re able to sell one batch of inventory almost every four months. Whether that’s good or bad largely depends on the type of industry or product you’re selling.

Our Accounting guides and resources are self-study guides to learn accounting and finance at your own pace. Adam Hayes is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7 & 63 licenses.

How To Calculate Inventory Turnover Ratio Using Sales & Inventory

Retailers who sell perishable items have a smaller number of days in inventory than a company that sells cars or furniture. Therefore, compare your days in inventory with other businesses in the same industry to determine if you are selling your inventory efficiently. The value of inventory may change significantly within an accounting period. Therefore, it makes sense to calculate the average inventory when comparing inventory to total sales or cost of goods sold.

Suppose a business has 60 days of inventory worth $200,000 on hand. Management takes measures to streamline this part of the operation, so that the days of inventory are reduced to 30. The costs of holding inventory drop, and $100,000 in working capital is freed up for other uses. As long as the company does not experience shortages, this is clearly an improvement in efficiency. The days sales inventory ratio helps in informing the company on the average time it will to clear inventory and thus it is vital in determining the efficiency of the company’s operations. A low DSI is preferable because it shows that the company is managing inventory properly.

Stranded inventory percentage – Stranded inventory is inventory that is sitting in at an Amazon warehouse to be fulfilled, but the listing is inactive, missing, or incomplete. Therefore, while it remains stranded, Amazon is not able to sell the inventory and it will sit collecting dust on their shelves. Not only do these stranded units incur storage fees without the possibility of being sold, they may reduce your IPI score as well. When managing your FBA inventory, it’s essential to keep these four influencing factors in mind to improve and maintain your inventory performance score. The Amazon Inventory Performance Index is an advanced scoring system for assessing how well sellers manage their inventory. The scores range from , depending on your FBA business performance.

However, some businesses may choose to use 360 days per fiscal year or 90 days per quarter. In this formula, the ending inventory is the amount of inventory a company has in stock at the end of the year. Physically counting inventory at the end of a period can ensure the most accurate calculations. Management strives to only buy enough inventories to sell within the next 90 days.

Days Sales Of Inventory Formula

In the example used above, the average inventory is $6,000, the COGS is $26,000 and the number of days in the period is 365. DSI can be measure of the effectiveness of inventory management by a company. The priority of any company is to effectively manage its merchandise. The fewer days the goods are stored, the better the management and the higher profitability of the organization. Conversely, if a product is stored for too long, not only does it drive up costs — it could also become obsolete.

The longer your days in inventory rate, the more likely you are to lose money on that inventory. Longer days in inventory can also reduce your overall return on investment and lower your profitability in the eyes of investors and creditors. A company’s cash conversion cycle measures how many days it takes to turn inventory into cash flow. This conversion is composed of three parts with the days in sales inventory as the first component. By analyzing your company’s cash conversion cycle, you can better understand the overall effectiveness of management and your company’s cycle of turning cash into inventory and back into cash again.

It also indicates the number of days money is blocked in inventories. This ratio is also known as Inventory turnover days, Days sales in inventory, etc. Thus from the above calculations, it has been found that the Business scenario is more or less in the same state. The rising inventory level suggests that there has been an increase in demand for the products but the efficiency of the business has been at the same level. In other words shorter the inventory outstanding indicates the company has the potential to convert the inventory into cash within a short time.

In our example, let’s consider BlueCart Coffee Company, a coffee roaster. You can use the days sales in inventory calculator below to quickly calculate the number of days a company needs to sell all its inventory by entering the required numbers. A lower DSI is also preferred because it ensures that the company reduces the storage cost. By selling the whole stock within a short period for the case of foodstuff, consumers are guaranteed fresh and healthy. However, a high DSI could also mean that the company’s management maybe has decided to maintain high inventory levels to achieve high order fulfillment rates.

In the formula above, a new and related concept of inventory is introduced which is the number of times a company is able to its stock over the course of a particular time period, say annually. To calculate inventory turnover you divide the cost of goods sold is by the average inventory. Days sales of inventory has a direct impact on a company’s liquidity, since proper goods management increases profitability.

Days Sales Of Inventory Definition

The days sales of inventory is a financial ratio that indicates the average time in days that a company takes to turn its inventory, including goods that are a work in progress, into sales. The days sales in inventory value are important in demonstrating the company’s efficiency. If the DSI value is low then it means the operations of the company are efficient since it takes a short time to clear inventory and then restock or put that money in other operations. It is ideal to have a low DSI because it ensures the company cuts of storage cost. Equally when dealing with perishable goods clearing inventory faster guarantees that customers can receive fresh products and minimize the chance of losses from goods expiring. In the formula above, both beginning and closing inventories are summed up and then divided by two to give the average inventory value. Then the average found here is divided by the cost of goods sold to give days sales in inventory value “during” that particular period.

Indicating the liquidity of the inventory, the figure represents how many days a company’s current stock of inventory will last. Generally, a lower DSI is preferred as it indicates a shorter duration to clear off the inventory, though the average DSI varies from one industry to another.