Below, you’ll find the average costs of different services compiled with data from the NSA’s most recent survey. “For someone who has super basic returns — so W2 income, maybe just taking the standard deductions — those will probably be in the few $100 range,” says Jariwala. “Once you start getting more complex — if you have 1099 income, you own a home, maybe you have some unique investments — that’s when the fee starts to go up, so it really varies.”

While determining CPA fees for each individual scenario isn’t an exact science, we can come up with rough approximations for the average CPA rates per hour based upon industry surveys. This can be a difficult situation to process because CPA fees do vary depending on your location, the firm you select, and the task you hire them for. The cost of a CPA preparing your taxes can differ not only based on the experience, location, and size of the firm you hire, but it can also differ based on the situation you find yourself in. If you’ve been wondering how much a CPA is for when tax season rolls around, this should give you a good overall picture. They estimate the average cost for professional tax preparation as ranging between $152 to $261 depending upon the complexity of your taxes and whether you have additional forms beyond the 1040 to prepare.

The average cost of tax preparation by CPAs by form

Expect to pay somewhere between $25 and $200 each month for paycheck processing, direct deposit, online access, and basic tax filing. Check a preparer’s credentials, including whether they have a valid PTIN for this filing season, through the IRS Directory of Federal Tax Return Preparers. If you decide that hiring an accountant will be most beneficial for your business, you might wonder how to find one.

- The most obvious difference will be the location, the experience of the individual you hire, and the type of accounting work you are looking to have completed.

- How much does a CPA charge to do taxes if you have a situation that is slightly out of the norm?

- For example, you might hire an accountant to audit your business and pay them per project or per hour if you need assistance in different areas.

Using a professional accounting service will help you run your business smoothly and avoid any major financial problems in the future. If you have a problem that isn’t necessarily within their scope, a personal accountant can refer you to a qualified professional who can assist you. The majority of them have close relationships with people in similar industries.

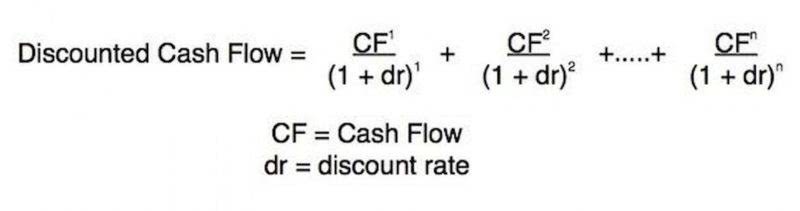

How to analyze the cost-benefit of hiring an accountant

You might be able to obtain a lower price quote during a less hectic time of the tax season. Be sure to ask what’s included in their fee if you decide to use a professional. Do they charge extra for electronic filing, or for each phone call and office visit?

Because a certified public accountant provides financial services beyond tax preparation, they may be more expensive than hiring a tax preparer to file basic taxes. Because a certified public accountant often can personal accountant provide financial services beyond basic tax preparation, they may be more expensive than hiring a tax preparer to file basic taxes. The good news is that you can avoid all of this by hiring a personal accountant.

What are Personal Accountant Services?

Accountants frequently help their clients with balancing books, preparing tax returns, managing accounts receivable and payable, and preparing financial statements. Here are a few examples of how pricing varies by service from Thumbtack accountants. Accounting Today, a well-known magazine featuring information for accountants and prospective accountants collected data regarding the national average for accounting costs for tax preparation. Filing your taxes on your own might save you money, but it can also be stressful and time-consuming – and your time and peace of mind are valuable! Self-employment taxes aren’t as straightforward as filing taxes as an employee, as you don’t have an employer to submit and deposit employment taxes on your behalf. As you’re self-employed, you’ll need to set aside time to prepare everything yourself, including filling out the correct tax forms, showing proof of income, submitting your expenses, and more.

Another option that will help you avoid tax preparation costs altogether for filing federal taxes is by filing independently, for free. Starting in 2022, almost anyone can file taxes for free on IRS.gov or with the IRS2Go app. You can prepare and file your federal income tax online using guided tax preparation, and find additional guidance in the abundance of free tax resources for the self-employed, available online. A survey conducted by Intuit in 2015 revealed that hourly billing is the most commonly used for accountant services fees, with 66 percent of accountants employing this method. When it comes to accountant fees, hourly rates can vary drastically based on the individual you are working with.

Variables That Affect Tax Preparation Fees

Additionally, academic background, years in the field and professional reputation all can affect an accountant’s rates. Some professionals also have certification from the IRS as an Enrolled Agent, which means they are expert on federal tax law. For example, they will not meet with your landlord/lady to present a month’s rent check. A personal accountant, on the other hand, may take an active role and negotiate payment arrangements on your behalf in some cases. There is also free accounting software with unlimited invoicing and mileage tracking features. With these accounting software platforms, you can handle your accounting activities yourself.

- Why spend on a CPA if you’re not even sure how much income you’ll make anyway.

- Before you gulp, you can take some comfort in knowing that this generally includes both your state and federal returns.

- Some firms, especially franchise chains like H&R Block, charge an extra fee for audit protection.

The accounting cost can also be affected by the amount of experience the individual possesses in the particular area you are interested in. Keep in mind that a more experienced worker might have higher accountant fees but can perform the work in a timelier manner. What may take a newcomer one hour to complete may take a seasoned accountant only half an hour.