Capitalize definition — AccountingTools

How Do Tangible and Intangible Assets Differ?

Financial statements, however, may be manipulated—for instance, when a value is expensed as a substitute of capitalized. If this occurs, current income might be inflated at the expense of future intervals over which further depreciation will now be charged. To capitalize is to report a price/expense on the steadiness sheet for the needs of delaying full recognition of the expense. In basic, capitalizing expenses is useful as corporations buying new belongings with long-time period lifespans can amortize the costs. At the end of an accounting interval, an accountant will book depreciation for all capitalized assets that are not fully depreciated.

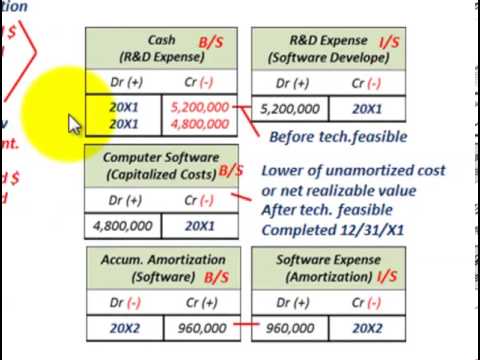

A capitalized value is an expense that’s added to the fee foundation of a fixed asset on an organization’s steadiness sheet. Capitalized costs are incurred when constructing or buying fastened belongings. Capitalized prices are not expensed in the interval they were incurred but acknowledged over a time period through depreciation or amortization. In accounting, the matching principle requires corporations to document expenses in the same accounting period during which the associated income is incurred. For instance, office supplies are typically expensed within the period when they’re incurred since they are anticipated to be consumed inside a brief time frame.

The revenue statement won’t be affected on the time of capitalization. Because capitalized prices are depreciated or amortized over a certain variety of years, their effect on the company’s income assertion is not immediate and, as an alternative, is unfold out throughout the asset’s useful life. Usually, the money impact from incurring capitalized prices is quick with all subsequent amortization or depreciation expenses being non-money charges. In accounting, the price of an item is allocated to the price of an asset, versus being an expense, if the company expects to devour that merchandise over a protracted time frame. Rather than being expensed, the price of the merchandise or fixed asset is capitalized and amortized or depreciated over its helpful life.

Capitalized costs are these bills that are incurred in constructing or financing a set asset. Examples of capitalized costs include labor expenses incurred in constructing a hard and fast asset or curiosity expenses incurred on account of financing the development of a fixed asset.

Depreciation expense related to the espresso roaster each year can be $5,000 (($forty,000 historical cost – $5,000 salvage worth) / 7 years). For example, bills incurred throughout development of a warehouse usually are not expensed instantly. The costs related to building the warehouse, together with labor prices and financing prices, could be added to the carrying value of the fastened asset on the steadiness sheet. These capitalized prices will be expensed via depreciation in future durations, when revenues generated from the manufacturing facility output are also acknowledged.

What does it mean to capitalize in accounting?

Capitalization is an accounting method in which a cost is included in the value of an asset and expensed over the useful life of that asset, rather than being expensed in the period the cost was originally incurred.

You can deduct some of the begin-up bills, but you have to capitalize different bills, attributing an annual percentage over time. The sort of asset determines the length of time for capitalization.

The journal entry for this depreciation consists of a debit to depreciation expense, which flows by way of to the revenue assertion, and a credit to accumulated depreciation, which is reported on the balance sheet. Accumulated depreciation is a contra asset account, meaning its natural steadiness is a credit which reduces the online asset worth. Accumulated depreciation on any given asset is its cumulative depreciation up to a single point in its life. By capitalizing such expenses, or adding them to the cost basis of the asset, a more true accounting image emerges of the acquisition price that extra precisely reflects the corporate’s investment within the asset. Since the asset shall be generating revenue over future intervals of time, it’s more accurate to deduct the capitalized costs related to the asset from revenues over these future accounting intervals.

What are the advantages and disadvantages of capitalizing curiosity for tax functions?

Capitalized assets are not expensed in full against earnings in the current accounting interval. A firm can make a large buy however expense it over a few years, depending on the type of property, plant, or tools involved.

What Is Capitalization?

- A capitalized price is an expense that is added to the price foundation of a fixed asset on an organization’s balance sheet.

- Capitalized costs usually are not expensed within the period they had been incurred however acknowledged over a time period by way of depreciation or amortization.

- Capitalized costs are incurred when building or buying fixed assets.

As the assets are used up over time to generate income for the corporate, a portion of the cost is allocated to every accounting interval. No set-in-stone technique or definition exists to separate expensed costs from capitalized costs. As a enterprise proprietor, you can also make that decision primarily based in your firm’s tax-planning and different monetary goals and wishes, inside the tips of usually accepted accounting ideas (GAAP). In sure situations, you’ll be able to capitalize the labor on your balance sheet as a capital asset.

Are Dividends Considered a Company Expense?

For accounting purposes, these expenses are capitalized, or added to the cost of the asset. They aren’t deducted from revenue within the interval during which they have been incurred. Instead, capitalized prices are deducted from revenues over time through depreciation, depletion, or amortization.

Adding capitalized costs to the price foundation of a set asset follows the usual accounting practice of matching bills with revenues within the periods by which revenues are earned. The IRS considers enterprise start-up bills, enterprise belongings and enhancements as long-term investments that you should capitalize on federal revenue taxes.

What does it mean to capitalize costs?

An item is capitalized when it is recorded as an asset, rather than an expense. This means that the expenditure will appear in the balance sheet, rather than the income statement. You would normally capitalize an expenditure when it meets both of these criteria: Exceeds capitalization limit.

What Is a Capitalized Cost?

Financial statements can be manipulated when a price is wrongly capitalized or expensed. If a value is incorrectly expensed, net revenue within the current period might be decrease than it otherwise must be. If a price is incorrectly capitalized, internet earnings in the current period shall be larger than it in any other case must be. To capitalize belongings is an important piece of contemporary monetary accounting and is necessary to run a business.

However, some larger workplace gear might present a benefit to the enterprise over more than one accounting period. These items are fixed belongings, corresponding to computer systems, vehicles, and office buildings. The cost of these items are recorded on the general ledger as the historic value of the asset. The total price of the capitalized asset is shown within the asset part of an organization’s steadiness sheet, but the depreciation costs associated to the assets are shown on the earnings statement. The method an expense is categorized for accounting purposes affects an organization’s reported net revenue.

Items that you just anticipate to last more than a yr that are not a minor value are capital bills. When you capitalize bills, you get well your cost by depreciation. Items with an estimated life of 5 years allow you to take 20 % each year until you have absolutely depreciated the merchandise. Post the entry to the corporate’s books, and print a replica of the trial stability to confirm that the entry posted correctly. The worth of the capitalized asset will appear within the worth of the corporation’s equipment and equipment on the stability sheet for the reporting interval.

When capitalizing costs, a company is following the matching principle of accounting. The matching principle seeks to report expenses in the identical period as the associated revenues. In different words, the aim is to match the price of an asset to the durations during which it’s used, and is subsequently generating revenue, versus when the initial expense was incurred. Long-term property might be generating income over the course of their helpful life. Therefore, their costs may be depreciated or amortized over a long period of time.

Current internet income is obtained by deducting current expenses from present revenues and taking other elements under consideration. Since capitalized prices are added to the price of a hard and fast asset, they contribute to the premise value of the asset upon which depreciation, depletion, and amortization are calculated. Capitalized prices are originally recorded on the steadiness sheet as an asset at their historic cost. These capitalized costs move from the stability sheet to the revenue assertion as they’re expensed through both depreciation or amortization. For instance, the $forty,000 coffee roaster from above may have a helpful life of 7 years and a $5,000 salvage value at the finish of that interval.