Capital Lease Definition

What Are Typical Forms of Capital Assets Within a Manufacturing Company?

Capital leases are depreciated in the same means as other fixed property. Using straight-line depreciation, the annual depreciation expense is the price of the mounted asset minus the salvage worth, the outcome divided by the asset’s useful life. The salvage worth of an asset is its anticipated resale value at the finish of its useful life.

What Is a Capital Lease?

The lease on a long-term asset is considered a capital lease or operational lease for accounting functions. With a capital lease, payments are thought-about both a legal responsibility and an asset on the firm’s balance sheet as a result of the business assumes a number of the danger of possession. The agency can deduct capital lease curiosity expenses on each year’s tax return. To calculate the interest rate on a capital lease, the firm should know several parts, together with the entire quantity financed, the monthly lease fee quantity and the term of the lease.

An working lease for tools or property doesn’t count as an asset for an organization. The company reveals lease funds as an expense, and does not claim ownership of the property that is leased. In some instances a totally-paid capital lease can transfer all of the property to the corporate.

Even though a capital lease is a rental settlement, GAAP views it as a purchase of assets if sure standards are met. Unlike operating leases that don’t have an effect on a company’s balance sheet, capital leases can have an impact on corporations’ financial statements, influencing interest expense, depreciation expense, belongings, and liabilities.

What is the difference between a capital lease and an operating lease?

Capital Lease vs Operating Lease. A capital lease (or finance lease) is treated like an asset on a company’s balance sheet, while an operating lease is an expense that remains off the balance sheet. Capital leases are counted as debt. They depreciate over time and incur interest expense.

While it’s true that the overwhelming majority of leases require capitalization underneath the proposed lease accounting rules, there are some exceptions. Leases with a term equal to or less than 12 months might be exempt from capitalization. In those instances, the leases will proceed to be straight-lined, just like the present rules on accounting for operating leases.

Under GAAP, lessees are required to book a right-of-use asset and related lease legal responsibility for all leases, working or finance (underneath ASC 840) that aren’t thought-about short-time period leases. For tax purposes, an working lease might be treated as a true lease, with the lessor sustaining ownership of the asset and depreciation deductions, while the lessee has deductions associated to rental funds. A finance lease (capital lease beneath ASC 840) offers the tax benefits, such as depreciation deductions and deductions for curiosity payments, to the lessee. A lease settlement refers to the act of 1 company lending an asset to another company, in change for periodic hire funds (like renting an condo, for example). Capital leases are one form of lease, the place the lease is basically structured as a purchase order and financing agreement.

Accounting Treatment: Capital Lease vs Operating Lease

What is lease capital?

A capital lease is a lease in which the lessor only finances the leased asset, and all other rights of ownership transfer to the lessee. This results in the recordation of the asset as the lessee’s property in its general ledger, as a fixed asset. Ownership.

- An working lease for equipment or property does not depend as an asset for a company.

- The firm shows lease payments as an expense, and doesn’t declare possession of the property that’s leased.

- In some cases a fully-paid capital lease can switch all of the property to the company.

The journal entries to record depreciation are to debit depreciation expense and credit score accumulated depreciation, which is a contra account that reduces the value of the corresponding mounted asset. For example, if a leased manufacturing equipment prices $28,000 and it has no salvage worth at the end of its useful life of seven years, the annual depreciation expense is $28,000 divided by 7, or $4,000.

The lease is taken into account a mortgage (debt financing), and curiosity payments are expensed on the income statement. The current market value of the asset is included in the steadiness sheet beneath the assets aspect and depreciation is charged on the earnings assertion. On the other aspect, the mortgage amount, which is the online present worth of all future payments, is included underneath liabilities.

Capital leases keep in mind property life, or the length of time tools is usable. A capital lease also takes in account the possession switch at the finish of the lease time period, or somewhat, the transferal of the property when the payment plan has been accomplished. Capital leases additionally often consider the value of the property when determining the lease’s funds, so lessees don’t have to pay more than the property is value. A lease should meet considered one of 4 standards to determine if it is a capital or working lease. If not one of the circumstances are met, the agency has an operating lease and should deal with bills associated to the lease as an operating expense on the income assertion.

The Financial Accounting Standards Board has set standards for treating an operating lease as a capital lease. A capital lease is the opposite kind of lease, and unlike an operating lease, a capital lease requires the lessee to bear a few of the dangers and advantages of proudly owning the asset, although it never really owns the asset. A capital lease happens when the lessee records the asset on the balance sheet as if it owns the asset. The lessee would then make lease funds to the lessor, and these funds consist of curiosity and principal repayments, identical to a loan.There are several professional’s to capital leases.

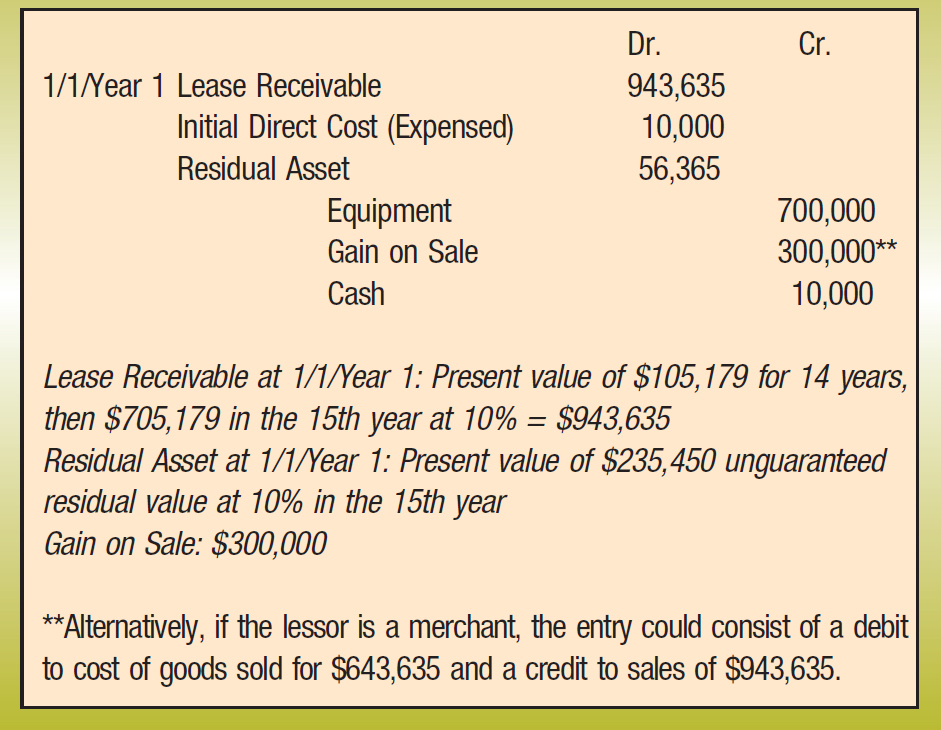

Accounting for Capital Leases

Capital leases are generally employed when companies loan giant pieces of equipment or other capital-intensive assets to one another. To account for a capital lease, familiarize yourself with the phrases of the association and make the suitable journal entries. Keep in mind that new guidelines issued by the Financial Accounting Standards Board (FASB) went into impact in 2018 for public corporations and in 2019 for all different organizations. In distinction, a capital lease includes the switch of ownership rights of the asset to the lessee.

Capital leases resemble asset purchases as a result of there’s an implied transfer of the advantages and risks of possession from lessor to lessee, and the lessee is liable for repairs and upkeep. Capital leases are categorised beneath the “mounted belongings” or “plant, property and gear” heading within the property section of a small or giant firm’s steadiness sheet. The first prevalent fantasy is that each one leases have to be capitalized, or recorded on the stability sheet with an asset and a legal responsibility.

Under ASC 840 and the old lease accounting rules, capitalization was solely required on capital leases. However, the brand new lease requirements require that operating leases are additionally capitalized, which is why capital leases will now be known as finance leases underneath each ASC 842 and IFRS sixteen.

For reporting purposes, there is often no separate “capital lease” line merchandise underneath fastened belongings as a result of leases are recorded in one of the regular fixed-asset objects, such as buildings and pc tools. The amount ought to be equal to the cost of the asset minus the accrued depreciation, which is the allocation of the costs of a set asset over its useful life. The liability component is reported within the liabilities section of the stability sheet as a “capital lease” line item. The quantity is the same as the discounted current worth of the lease payments over the lease term plus any interest accrued between the previous lease cost and the steadiness sheet date. Leases are contractual agreements between lessees and lessors in which lessees get the right to use leased assets for a specified interval in change for regular funds.

Just like if the enterprise actually owned the asset, they will choose to deduct the curiosity component of the lease payment each year for taxes, and can also claim depreciation every year on the asset. That is to say, because the asset decreases in worth each year, the business can benefit from this, whereas this may not be potential with an operating lease. Capital leases are just like monetary leases; however, any property purchased through a capital loan must be recorded as a taxable asset on the lessee’s financial records. Whereas financial leases are non-negotiable once entered into, capital leases supply lessees more flexibility.