On the bank statement, debit memos commonly are listed first next to each transaction, then the credit memo and finally the running balance. If you want to take ownership over your financial situation, start by learning everything you can about your financial accounts. When you receive your bank statements, don’t be so quick to toss them away in a file but rather open them from time to time to check the various details.

Hence, the credit balance in the bank’s liability account is reduced by a debit. A debit memo on a company’s bank statement refers to a deduction by the bank from the company’s bank account. In other words, a bank debit memo reduces the bank account balance similar to a check drawn on the bank account. A debit memo on a statement indicates a reduction in the available account balance, according to AccountingCoach. The memo will also determine how a financial institution treats the debit. Merchants who accept card payments through a point of sale system may find themselves in the position of running a force pay debit transaction — triggering a force pay debit memo. A force pay debit memo is a classification for recording a specific type of debit transaction.

If the price calculated for the customer is too high, for example, because the wrong scale prices were used or a discount was forgotten, you can create a credit memo request. The credit memo request is blocked for further processing so that it can be checked. The system uses the credit memo request to create a credit memo. Automated Clearing House transactions, which are basically electronic check withdrawals, are included as debit memos as well.

But I Already Have A Debit Memo Now What?

Use this screen to automatically create debit memo vouchers for purchase order receipt quantities that have been rejected for credit and vouchered. You can optionally create debit memo vouchers for purchase order receipt quantities that have been rejected for repair/replacement and vouchered. This process creates records in the Enter PO Vouchers screen. The Debit Memo checkbox in the Enter PO Vouchers screen will be checked, indicating that the voucher is a debit memo. Once you have created these debit memo vouchers, you can maintain them in the Enter PO Vouchers screen.

What is debit note in SAP b1?

An A/P debit memo behaves in the same manner as an A/P invoice. You use A/P debit memos to document debts to your supplier that are not part of your operating costs, for example, administrative fees or charges.

If the credit memo is specifically related to a particular open invoice item, the payment program automatically attempts to offset the credit memo against the open item. If it is not possible to completely offset the credit memo against an invoice, you can post a debit memo to the vendor, who is to reimburse the amount. When you scan the debit memos on your bank statement, you may start to notice trends that could encourage you to change your behaviors during the next statement period. Taking out a specific amount of cash helps limit your spending whereas using a debit card gives you unlimited spending ability up to your available balance.

How To Create Debit Memo

A chargeback is the refund of a payment back to a customer after the customer disputes the charge. A merchant should always attempt to have a card purchase authorized by the issuer by using the chip on a card rather than through other methods. Force pay debit transactions often pose a high risk for chargebacks.

A debit memorandum, or “debit memo,” is a document that records and notifies a customer of debit adjustments made to their individual bank account. The adjustments made to the account reduce the funds in the account but are made for specific purposes and used only for adjustments outside of any normal debits.

I mean no disrespect to debit memos, but they’re just not very sexy, regardless how you spin it. At the 2016 Airline Reporting Corporation TravelConnect conference in D.C., I heard a few agency debit memo horror stories (i.e. ADMs dating back over four years). Many POS systems allow for a charge to be classified and processed as a force pay debit if the amount of the charge fits a certain criteria, or if the system loses connectivity to the network. A payment is forced through a POS using a previous authorization code, which is a series of digits, rather than authorizing a transaction through the issuer. The majority of POS transactions require issuer authorization. This is because force pay debits have been misused for fraud in recent years due to the way they are prioritized for payment. A typical statement from a financial institution is issued to an account holder regularly throughout the calendar year.

Examples Of Debit Memos Debit Notes

If a customer pays more than an invoiced amount, intentionally or not, the firm can choose to issue a debit memo to offset the credit to eliminate the positive balance. If the credit balance is considered material, the company would most likely issue a refund to the customer instead of creating a debit memo. This field indicates whether a debit memo should be created for this purchase order line.

Debit notes can be issued both from a buyer or a service provider. Click Enter/Adjust Invoice and select the Standard Invoice for which the amount should be reduced in the first line and the CD/DR memo in the next line. debit memo You will that the Total will be reduced which will your payment amount. Enter the check number, which is used by supplier to pay the refund amount. In Oracle Payables both of them are used to reduce the invoice amount.

Examples Of A Bank Debit Memo

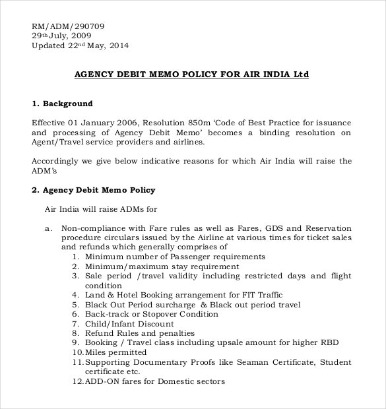

Without limitation, accuracy and completeness of booking and ticketing is the responsibility of the travel agent. Airlines have the right to audit and send ADM’s for all transactions. Delta policy for audit and memo issuance will be handled per IATA Resolution 850m. There was a scenario wherein our users realized that we made excess payment to supplier for some service that supplier provided. Finally, the account activity section details all memos that occurred during the statement period. For example, your customer pays $500 in advance for an annual service on January 1. In such cases, you can issue a prorated credit to your customer.

The seller might also issue a debit note instead of an invoice in order to adjust upwards the amount of an invoice already issued . The bank’s use of the term debit memo is logical because the company’s bank account is a liability in the bank’s general ledger. The bank’s liability is reduced when the bank charges the company’s account for a bank fee.

- All of these three terms have the same meaning and are used interchangeably in practice.

- Sometimes returning the full shipment isn’t always feasible.

- It should also include why this Memo is raised, i.e., the reason for issuing it.

- Those lines that have their Create DM column set to “Y” will become debit memos.

- HighRadius Collections Software automates and optimizes the credit & collections management process to improve collector efficiency, minimize bad debt write-offs, improve customer relationships, and reduce DSO.

- These one-time events are independent of ongoing recurring subscription billing activity, such as billing mistakes, programmatic discounts, price changes, subscription amendments, or other account credits.

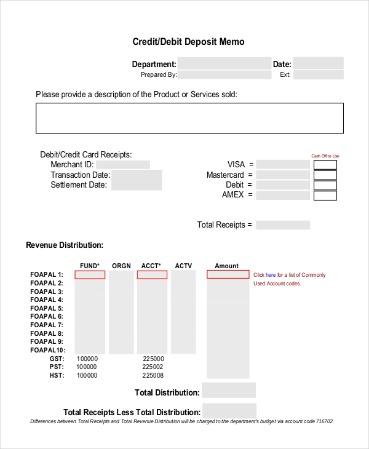

The debit memo is usually issued in the same format used for an invoice. When issued, debit memos typically appear on the monthly statements of outstanding accounts receivable that are sent to customers. To apply the debit or credit memo to a specific invoice, in the Apply to Inv # field, select the invoice number to apply the debit or credit memo to.

Debit Memo Quantity

A statement will cover a specific time period and features a summary, including the balance summary, then a list of transactions in the order in which they were posted. Each transaction on the statement will have a note, known as a memo, briefly explaining details on the transaction. Financial institutions use a system for classifying and coding different types of transactions that are reflected in the memo.

Is debit note same as debit advice?

A debit advice is also called a debit memorandum, debit note or debit. A banker sends a debit note to customers to inform them of deductions from their accounts. In other words, a debit refers to a decrease in a deposit account balance, such as a check posted to the account.

A Debit Memo is a document through which the business can charge its customers for any kind of changes made by the customer than that of a predefined contract or work order without issuing a new invoice. It is the continuation of the original Invoice and has to have a reference of the original invoice. You can make adjustments to an invoice after it is updated by entering a credit or debit memo using S/O Invoice Data Entry. Debit memos are normally issued to an account for billing errors, freight not billed, or miscellaneous charges. Credit memos are normally used to credit an account for returned goods. Credit memos can also be created if an invoice is posted to an incorrect date, an order is sold to the wrong customer, the wrong items are included in an order, or a duplicate invoice is created. The most common risk associated with force pay debits is a chargeback.

Debit notes are generally used in business-to-business transactions. Such transactions often involve an extension of credit, meaning that a vendor would send a shipment of goods to a company before the goods have been paid for. Although real goods are changing hands, until an actual invoice is issued, real money is not. Rather, debits and credits are being logged in an accounting system to keep track of inventories shipped and payment. If there is a small credit balance remaining in a customer account, a debit memo can be generated to offset it, which allows the accounting staff to clear out the balance in the account. This situation can arise when a customer overpays , or when an accounting error leaves a residual balance in an account.

What Does The Word Chargeback Mean?

The reasons a debit memorandum would be issued relate to bank fees, undercharged invoices, or rectifying accidental positive balances in an account. In retail banking, a debit memorandum is given to an account holder indicating that an account balance has been decreased as a result of a reason other than a cash withdrawal, a cashed check, or use of a debit card. Debit memos can arise as a result of bank service charges, bounced check fees, or charges for printing more checks. The memos are typically sent out to bank customers along with their monthly bank statements and the debit memorandum is noted by a negative sign next to the charge. In short, a debit memo on a bank statement is any transaction that reduces the amount due. This amount is sometimes accompanied with a negative symbol to show that it lowered the balance. The opposite of a debit memo is a credit memo, which is any addition to the account balance.

Debit transactions are not always posted based on their chronological date of occurrence. A force pay debit is a transaction that will be processed and posted ahead of other pending charges, even if those pending charges were incurred before the force pay debit. Financial institutions follow a posting order based on classification that prioritizes certain debit transactions over others — such as force pay debits. A force pay debit will process even if there are insufficient funds in the account. Credit memo request is a sales document used in complaints processing to request a credit memo for a customer.