Buying Series I Bonds for Your Portfolio

If you’re a call or put purchaser, picking the wrong strike price might outcome within the loss of the complete premium paid. This danger will increase the further away the strike price is from the present market worth, i.e. out of the money. In the case of a call author, the wrong strike value for the coated call might end result within the underlying stock being known as away.

This put would have intrinsic value — cash you could get if the option was exercised — if the inventory declines below $30. An within the money put possibility signifies that the strike value is above the market worth of the prevailing market value. An investor holding an ITM put option at expiry means the inventory worth is beneath the strike worth and it’s possible the option is worth exercising. A put choice purchaser is hoping the inventory’s price will fall far enough below the choice’s strike to no less than cowl the cost of the premium for buying the put. Options include an upfront payment cost—referred to as the premium—that buyers pay to purchase the contract.

Buying put choices may be attractive when you suppose a inventory is poised to decline, and it’s one of two major ways to wager in opposition to a inventory. To “brief” a stock, buyers borrow the inventory from their broker, promote it available in the market, and then purchase it again if and when the inventory value declines. Puts will pay out rather more than shorting a stock, and that’s the attraction for put patrons. Each contract represents one hundred shares, so for each $1 decrease within the stock under the strike price, the choice’s cost to the vendor will increase by $100.

Here’s What Happens When a Bond Is Called

The $2.26 is known as the premium or the price of the choice. Options contracts give buyers the chance to obtain vital exposure to a stock for a comparatively small price.

Puts for more distant expiration dates are costlier as a result of there may be more time for the stock to maneuver and make the put purchase profitable. One put possibility is for a hundred shares, so the price of one contract is a hundred instances the quoted value.

These components embrace the present market price of the underlying safety, time until the expiration date, and the worth of the strike value in relationship to the safety’s market worth. Typically, the premium reveals the worth market individuals place on any given option.

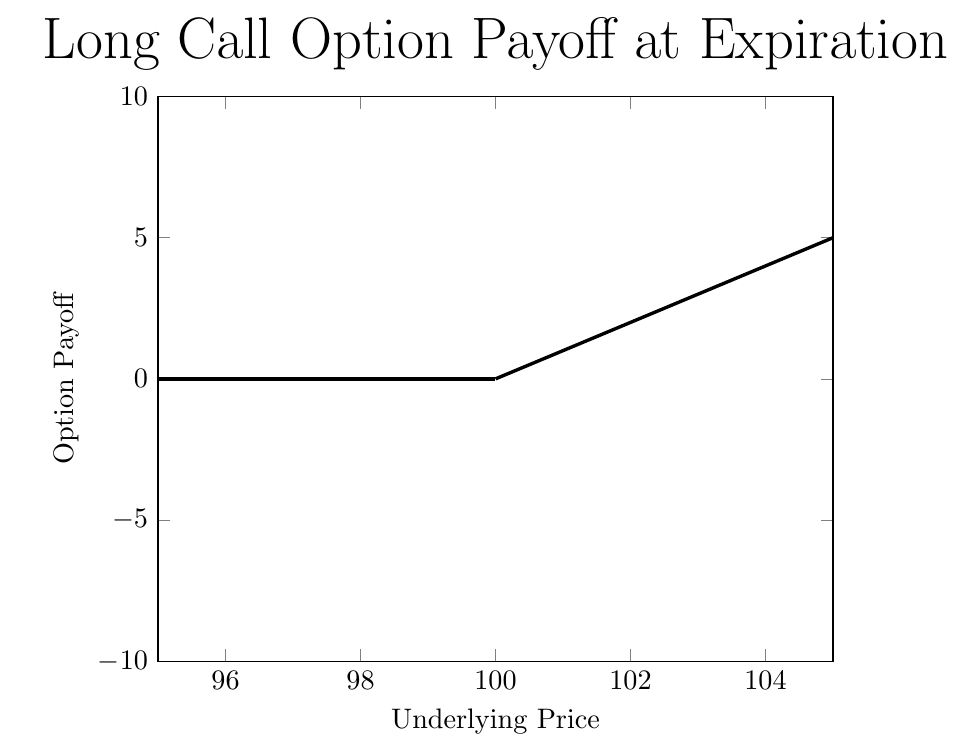

An possibility that has worth will probably have the next premium associated with it versus one that has little chance of being profitable for an investor. Investors who purchase name choices are bullish that the asset’s value will improve and shut above the strike value by the option’s expiration date. Options are available to trade for many financial products such as bonds and commodities but, equities are some of the in style for investors. The following technique for purchasing stock at a lowered price involves selling put options on one hundred shares of a particular stock. The purchaser of the options will have the right to promote you these shares at an agreed-upon price often known as the strike price.

A bare put, additionally known as an uncovered put, is a put possibility whose author (the seller) doesn’t have a place within the underlying stock or different instrument. This technique is best utilized by traders who want to accumulate a position within the underlying inventory, however provided that the value is low enough. If the client fails to exercise the choices, then the writer keeps the option premium. That allows the exerciser (buyer) to profit from the distinction between the inventory’s market value and the choice’s strike worth. Often occasions, merchants or buyers will combine options utilizing a selection technique, shopping for a number of options to promote a number of totally different options.

When the dealer’s price to put the commerce is also added to the equation, to be profitable, the inventory would want to trade even higher. Options traders can profit by being an possibility buyer or an choice author. Options enable for potential profit throughout each volatile times, and when the market is quiet or less unstable. A sequence of put choices with totally different expiration dates and strike prices will trade against a single stock. Put choices with greater strike prices will have higher costs to purchase.

An choice writer’s profitability is proscribed to the premium they obtain for writing the option (which is the option buyer’s price). The time period “near the cash” is sometimes used to describe an option that’s inside 50 cents of being at the money. For example, assume an investor purchases a call choice with a strike value of $50.50 and the underlying stock worth is trading at $50. The option could be close to the cash if the underlying inventory value was trading between about $49.50 and $50.50, in this case.

- This strategy is best used by investors who wish to accumulate a position within the underlying stock, but provided that the worth is low sufficient.

- A naked put, also referred to as an uncovered put, is a put option whose writer (the vendor) doesn’t have a place in the underlying inventory or different instrument.

First, if she owns the inventory, she will be able to exercise the contract, placing the stock to the put vendor on the strike worth, effectively promoting the inventory at an above-market worth and realizing the profit. Second, the client can sell the put earlier than expiration in order to capture the worth, without having to promote any underlying inventory. Of course, the risk with shopping for the calls somewhat than the shares is that if XYZ had not traded above $95 by possibility expiration, the calls would have expired nugatory and all $900 could be misplaced. In reality, XYZ had to commerce at $ninety eight ($95 strike value + $3 premium paid), or about 9% larger from its price when the calls had been purchased, for the commerce just to breakeven.

What Is Hedging as It Relates to Forex Trading?

The biggest risk of put writing is that the author may end up paying an excessive amount of for a stock if it subsequently tanks. The threat/reward profile of put writing is extra unfavorable than that of put or name buying because the maximum reward equals the premium received, but the maximum loss is way higher. That mentioned, as mentioned earlier than, the probability of having the ability to make a profit is larger. A name option writer stands to make a profit if the underlying inventory stays under the strike worth. After writing a put possibility, the dealer earnings if the value stays above the strike price.

When Convertible Bonds Become Stock

Spreading will offset the premium paid because the bought option premium will web towards the options premium bought. Moreover, the risk and return profiles of a spread will cap out the potential profit or loss. Spreads may be created to take advantage of nearly any anticipated price motion, and may range from the simple to the complicated. As with individual choices, any unfold technique may be either purchased or offered.

Some investors prefer to put in writing slightly OTM calls to give them the next return if the stock known as away, even if means sacrificing some premium revenue. With GE trading at $27.20, Carla thinks it could trade up to $28 by March; when it comes to downside danger, she thinks the stock may decline to $26. She, due to this fact, opts for the March $25 name (which is in-the-money) and pays $2.26 for it.

Used in isolation, they can present vital features if a inventory rises. But they can additionally result in a 100% loss of premium, if the decision possibility expires nugatory because of the underlying inventory worth failing to maneuver above the strike value. The benefit of buying name options is that risk is all the time capped on the premium paid for the option.

What is a full call?

A call price (also known as “redemption price”) is the price at which the issuer can redeem a bond or a preferred stock. This price is set at the time the security is issued.

Call Price

How do you find the price of a call?

A full call means that it is paying off the bond in its entirety, and all of the people who own shares of the bond will receive their principal back.

For instance, a single call option contract may give a holder the right to buy 100 shares of Apple stock at $one hundred up till the expiry date in three months. There are many expiration dates and strike costs for merchants to select from. As the value of Apple inventory goes up, the worth of the option contract goes up, and vice versa. If the inventory declines beneath the strike worth earlier than expiration, the option is considered to be “in the money.” Then the client has two choices.

The breakeven level occurs at $forty five per share, or the strike worth minus the premium obtained. The put vendor’s maximum profit is capped at $5 per share, or $500 whole. If the stock stays above $50 per share, the put vendor retains the entire premium. The option continues to price the put vendor money because the stock declines in value.