Break-Even Price Definition

Gross Margin vs. Contribution Margin: What’s the Difference?

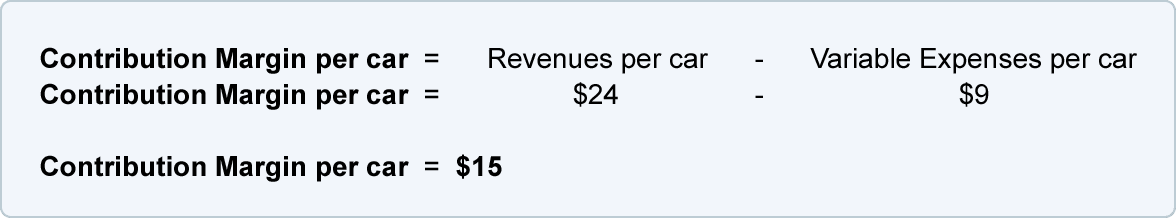

The diagram clearly shows how a change in value or selling worth can impact the overall profitability of the business. The idea of break-even analysis deals with the contribution margin of a product. The contribution margin is the surplus between the selling price of the product and total variable costs.

Number of items are plotted on the horizontal (X) axis, and whole sales/prices are plotted on vertical (Y) axis. Using the diagrammatical method, break-even point could be determined by pinpointing where the two (revenue and complete prices) linear strains intersect. The total income and whole value lines are linear (straight strains), since costs and variable prices are assumed to be constant per unit. The Break-even diagram could be modified to replicate completely different situation with various prices and prices.

For instance, the break-even price for promoting a product can be the sum of the unit’s fastened value and variable value incurred to make the product. It’s one of the greatest questions you’ll ask your self when beginning and operating a small business. Breaking even is a healthy sign of progress and could be the distinction between success and failure, hence the significance of conducting a break-even evaluation. This will allow you to decide fixed prices (like lease) and variable costs (like materials) so you’ll be able to set your prices appropriately and forecast when your small business will reach profitability. Central to the break-even analysis is the concept of the break-even level (BEP).

For instance, a company with $0 of fastened costs will automatically have damaged even upon the sale of the first product assuming variable costs don’t exceed sales income. However, the buildup of variable prices will restrict the leverage of the company as these expenses come from every item sold. In accounting, the break-even level method is decided by dividing the total fixed costs related to production by the income per individual unit minus the variable prices per unit. In this case, fastened costs discuss with those which do not change relying upon the variety of items bought.

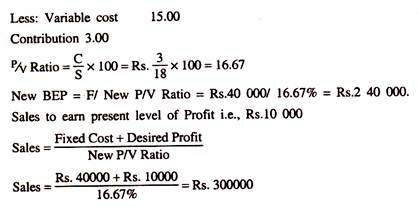

In the previous instance, the break-even level was calculated by way of variety of units. Break-even level can also be calculated in gross sales value (Dollars). This can be carried out by dividing firm’s complete fixed prices by contribution margin ratio. Contribution margin could be calculated by subtracting variable expenses from the revenues.

What do u mean by break even analysis?

A break-even analysis is a useful tool for determining at what point your company, or a new product or service, will be profitable. Put another way, it’s a financial calculation used to determine the number of products or services you need to sell to at least cover your costs.

How Operating Leverage Can Impact a Business

With a contribution margin of $40, the break-even level is 500 units ($20,000 divided by $40). Upon the sale of 500 units, the cost of all fixed costs are full, and the company will report a net profit or lack of $0.

The contribution margin ratio is the contribution margin per unit divided by the sale worth. Returning to the instance above the contribution margin ratio is 40% ($40 contribution margin per merchandise divided by $100 sale price per item). Therefore, the break-even point in gross sales dollars is $50,000 ($20,000 complete fixed prices divided by forty%).

This signifies that the selling value of the great must be greater than what the company paid for the nice or its components for them to cowl the preliminary worth they paid (variable and fixed costs). Once they surpass the break-even value, the corporate can start making a revenue.

Confirm this figured by multiplying the break-even in items by the sale price ($100) which equals $50,000. The breakeven formulation provides a dollar determine they should breakeven. This may be converted into items by calculating the contribution margin (unit sale price less variable prices). Dividing the fixed costs by the contribution margin will provide how many items are needed to breakeven. The break-even point formula is calculated by dividing the total mounted prices of production by the price per unit less the variable prices to produce the product.

- This kind of analysis is dependent upon a calculation of the break-even point (BEP).

- Break-even analysis is helpful within the willpower of the extent of manufacturing or a focused desired sales mix.

- The examine is for management’s use solely, as the metric and calculations usually are not essential for exterior sources similar to buyers, regulators or financial institutions.

Break-even analysis is useful within the determination of the extent of production or a targeted desired sales combine. The examine is for administration’s use solely, as the metric and calculations usually are not needed for external sources corresponding to traders, regulators or financial establishments. This sort of analysis is dependent upon a calculation of the break-even level (BEP). The break-even point is calculated by dividing the total mounted costs of production by the worth of a product per particular person unit less the variable costs of manufacturing. Fixed costs are those which remain the same regardless of how many items are bought.

The calculation of break-even evaluation may use two equations. In the primary calculation, divide the entire fixed prices by the unit contribution margin. In the example above, assume the value of the entire fixed costs is $20,000.

Break-Even Analysis

A demand-aspect evaluation would give a vendor important insight concerning selling capabilities. The break-even worth is mathematically the amount of monetary receipts that equal the quantity of financial contributions. With gross sales matching costs, the associated transaction is claimed to be break-even, sustaining no losses and incomes no profits within the process.

Break-even evaluation is extensively used to determine the variety of items the business must sell to be able to keep away from losses. This calculation requires the business to determine selling price, variable costs and glued prices. Once these numbers are determined, it is fairly simple to calculate break-even level in units or sales value.

Calculating the breakeven level is a key monetary evaluation software utilized by business house owners. Once you understand the fastened and variable prices for the product your business produces or a good approximation of them, you can use that data to calculate your company’s breakeven point. Small business homeowners can use the calculation to determine how many product models they should promote at a given value pointto break even. Break-even evaluation entails the calculation and examination of the margin of safety for an entity primarily based on the revenues collected and related costs.

The contribution margin reveals how a lot of the corporate’s revenues might be contributing in direction of masking the mounted prices. It could be expressed on per unit basis or for the total amount. Alternatively, the calculation for a break-even point in gross sales dollars happens by dividing the total fastened costs by the contribution margin ratio.

For instance, if an merchandise sells for $100, the total fixed prices are $25 per unit, and the whole variable prices are $60 per unit, the contribution margin of the product is $forty ($100 – $60). This $forty displays the amount of income collected to cowl the remaining fastened prices, excluded when figuring the contribution margin. Break-even evaluation appears on the stage of fastened costs relative to the revenue earned by each extra unit produced and bought. In general, an organization with lower fastened costs may have a decrease break-even point of sale.

Related Terms

Put in a different way, the breakeven level is the manufacturing degree at which total revenues for a product equal complete bills. The break-even point can be outlined each in models of manufacturing or dollar quantity. In different phrases, it’s a method to calculate when a project might be profitable by equating its total revenues with its whole bills. There are several completely different makes use of for the equation, however all of them cope with managerial accounting and cost management. It is only possible for a firm to pass the break-even point if the greenback worth of gross sales is larger than the variable cost per unit.