Book Value of Debt

Capital construction deals with how a firm finances its general operations and development by way of completely different sources of funds, which may embody debt such as bonds or loans, among different sorts. The cost of debt is the efficient interest rate a company pays on its debts. The price of debt usually refers to before-tax cost of debt, which is the company’s value of debt before taking taxes into account. However, the difference in the cost of debt earlier than and after taxes lies in the fact that interest expenses are deductible.

Basic Things to Know About Bonds

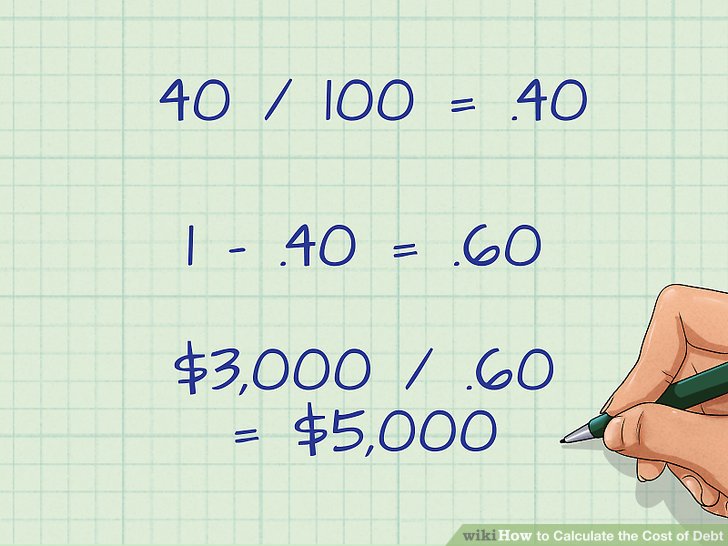

Where the market value isn’t out there, yield to maturity can’t be worked out however a relative strategy can be utilized to estimate cost of debt. Under the relative approach, called the bond-score approach, value of debt equals the average yield to maturity of comparable bonds, i.e. bonds carrying the same credit standing. For example, if an organization’s only debt is a bond it has issued with a 5% price, its pre-tax cost of debt is 5%. If its tax fee is 40%, the distinction between 100% and forty% is 60%, and 60% of the 5% is three%.

What Is the Cost of Debt?

Cost of debt is the required price of return on debt capital of an organization. Where the debt is publicly-traded, cost of debt equals the yield to maturity of the debt. If market value of the debt isn’t out there, value of debt is estimated based mostly on yield on other money owed carrying the identical bond ranking. Cost of debt is one a part of an organization’s capital structure, which additionally consists of the price of equity.

Should I Pay off Debt or Invest Extra Cash?

Suppose an organization named AIM Marketing has taken a mortgage for business growth of $500,000 at the fee of interest of eight%, tax rate applicable was 30%, right here we have to calculate after-tax cost of debt. Ltd has taken a mortgage from a financial institution of $10 million for enterprise expansion at a rate of curiosity of eight%, and the tax price is 20%. Cost of debt is a vital input in calculation of the weighted common cost of capital. WACC equals the weighted common of cost of fairness and after-tax price of debt based mostly on their relative proportions within the target capital construction of the company.

Formula

This is the current yield only, not the promised yield to maturity. In addition, it’s based mostly on the book worth of the legal responsibility, and it ignores taxes. Equity is inherently more dangerous than debt (besides, perhaps, within the unusual case the place a agency’s property have a negative beta). If taxes are thought-about in this case, it can be seen that at affordable tax charges, the price of fairness does exceed the price of debt. -The acceptable aftertax cost of debt to the corporate is the interest rate it would have to pay if it had been to concern new debt right now.

What are the benefits and downsides of capitalizing interest for tax functions?

Organizations have a number of options available when it comes to discovering funding for their operations. This ratio could be very complete as a result of it averages all sources of capital; together with long-time period debt, frequent stock, preferred stock, and bonds; to measure an average value of borrowing funds. Bonds and lengthy-term debt are issued with acknowledged interest rates that can be utilized to compute their total price. Equity, like common and most popular shares, then again, doesn’t have a readily available acknowledged price on it. Instead, we should compute an equity worth before we apply it to the equation.

Cost of debt formula helps to know the actual value of debt and likewise helps to justify the cost of debt in business. Ltd has taken a loan of $50,000 from a monetary establishment for 5 years at a price of curiosity of 8%, tax rate relevant is 30%.

A firm’s WACC can be used to estimate the expected prices for all of its financing. This includes payments made on debt obligations (value of debt financing), and the required price of return demanded by ownership (or cost of equity financing). This solely considers the dividend yield component of the required return on fairness.

How do you calculate the cost of debt?

After-tax cost of debt is the net cost of debt determined by adjusting the gross cost of debt for its tax benefits. It equals pre-tax cost of debt multiplied by (1 – tax rate). It is the cost of debt that is included in calculation of weighted average cost of capital (WACC).

- Cost of debt is the efficient interest rate that company pays on its current liabilities to the creditor and debt holders.

- The cost of debt is the minimal fee of return that debt holder will accept for the risk taken.

- The distinction between before-tax cost of debt and after tax price of debt is relied on the truth that curiosity expenses are deductible.

Matrix Pricing – Debt Ratings

Cost of debt, along with value of equity, makes up a company’s value of capital. After-tax cost of debt is the online price of debt decided by adjusting the gross price of debt for its tax advantages. It is the price of debt that is included in calculation of weighted average value of capital (WACC).

Financial Analyst Training

This curiosity expense is used for tax saving objective by a company as handled as enterprise bills. Financing new purchases with debt or equity could make a big effect on the profitability of a company and the general inventory value.

The price of debt is the minimal fee of return that debt holder will settle for for the chance taken. Cost of debt is the efficient rate of interest that firm pays on its current liabilities to the creditor and debt holders. The distinction between before-tax price of debt and after tax value of debt is trusted the truth that interest expenses are deductible. It is an integral part of WACC i.e. weight average cost of capital. Cost of capital of the corporate is the sum of the price of debt plus cost of fairness.

The value of debt is calculated by dividing the company’s interest expense by its debt load. In Walmart’s case, its latest fiscal 12 months curiosity expense is $2.33 billion. The tax fee could be calculated by dividing the revenue tax expense by income earlier than taxes. In Walmart’s case, it lays out the company’s tax rate in the annual report, stated to be 30% for the final fiscal 12 months.

Management should use the equation to stability the stock price, buyers’ return expectations, and the whole price of buying the property. Executives and the board of administrators use weighted average to evaluate whether a merger is appropriate or not. Calculating the whole price of debt is a key variable for investors who’re evaluating an organization’s financial well being. The rate of interest a company pays on its debt will determine the long-term cost of any business mortgage, bond, mortgage, or other debts a company uses to develop.

So, the price of debt has a major element tax fee and interest expense. Once the cost of debt is calculated then one can evaluate loan by evaluating enterprise revenue that mortgage has generated and value of debt. This price of debt supplies curiosity expense which in a while helps in taxation that might be a tax deduction.

A firm’s price of debt is the effective interest rate an organization pays on its debt obligations, together with bonds, mortgages, and any other types of debt the company could have. Because curiosity expense is deductible, it’s usually more helpful to find out a company’s after-tax cost of debt.

Taxes could be incorporated into the WACC formulation, although approximating the influence of various tax levels could be difficult. Cost of debt formulation is a device which helps one to know that mortgage availed is worthwhile for business or not as we will compare the cost of debt with earnings generated by mortgage quantity in business. The loan can be taken for a number of reasons from the issuance of a bond to buying of equipment prime purpose for it’s to generate revenue and grow enterprise.

Hence, if the YTM on excellent bonds of the company is noticed, the company has an accurate estimate of its price of debt. The yield to maturity strategy is useful where the market price of debt is available. Yield to maturity (YTM) equals the internal price of return of the debt, i.e. it’s the discount rate that causes the debt cash flows (i.e. coupon and principal payments) to equal the market value of the debt.