14.04.2020 by Quentin DconAccounting is one of the most important divisions of any enterprise responsible for the accuracy of a wide range of business processes. The specialist has to deal with: the execution of orders; cost allocation;document management;financial... Read more

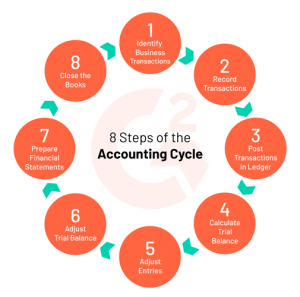

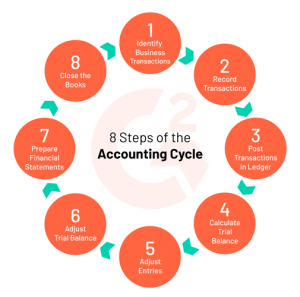

31.03.2020 by Quentin DconThe accounting cycle refers to a cyclical and systematic workflow followed by bookkeepers. The processes involved in the cycle are essential to comprehensively record, identify, and synthesize a business’ financial transactions. This came to be every... Read more

31.03.2020 by Quentin DconA cost-efficient payroll solution, Intuit showcases a payroll service that can be customized to fit the exact payroll service needs of any small business. Intuit offers several packages with different inclusions and services offered. Intuit payroll a... Read more

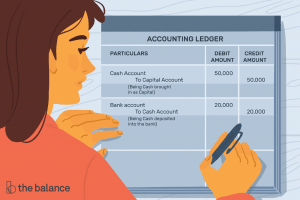

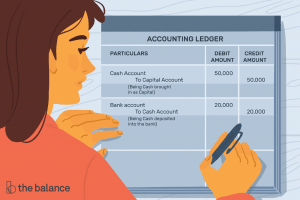

11.03.2020 by Quentin DconOpening entry in accounting refers to the primary entries of business at the beginning of each fiscal year or the beginning of its establishment. It involves the business’ assets, liabilities, and equity that are stated in a balance sheet. Its functi... Read more

06.03.2020 by Quentin DconZoho Books is a cloud software for accountants and bookkeepers. It is perfect for small and growing businesses. It allows growing companies to manage their books, to send the accounts, and to process payments in the same system. The system includes:t... Read more

25.02.2020 by Quentin DconTax-free is a system for returning the amount of value-added tax (VAT). The VAT is refunded on purchases made by foreign citizens when they cross the border of the country in which they were purchased. The refund amounts usually range from 8% to 25%... Read more

17.02.2020 by Quentin DconThe General Federal program or social security Program is a program of insurance for old age, loss of a breadwinner, and disability. The General Federal program is the only, although the largest pension program that has a distributive nature. All oth... Read more

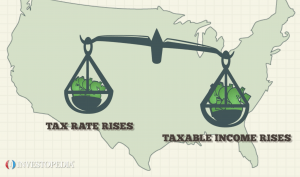

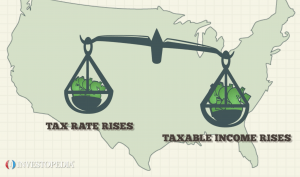

10.02.2020 by Quentin DconThe basis of the revenue part of the American budget (about 70%) is federal taxes. The most important tools for managing the level of income of the population are several types of taxes: income tax on the wages of individuals and self-employed e... Read more

10.02.2020 by Quentin DconTimely and full payment of taxes is the key to the stable development of any state. In the entire system of taxation, direct taxes are the most important and bring the highest income to the general treasury. Income tax is one of the most important ta... Read more

31.01.2020 by Quentin DconMany businesses are required to produce a document, such as an income statement. This source assumes the inclusion of figures that reflect how effectively the company is operating — in terms of revenue generation and business profitability. It is qui... Read more