Final entries in the accounts after the end of the annual accounting cycle. At the end of the year, based on the full inventory, the account entries are updated, and the turnover and balance are displayed for them. However, many accounts are closed in this period. This process is called balancing off accounts.

What is a Balance

In accounting, including balancing off accounts, the word “balance” has two meanings:

- equality of totals, when the totals of entries for analytical accounts and for the corresponding synthetic account are equal, the totals of assets and liabilities of the balance sheet, etc.;

- the most important form of accounting reporting that shows the state of the organization’s funds in monetary terms at a certain date.

Equal totals for the assets and liabilities of a horizontal balance sheet are located on the same level, occupying a strictly horizontal position, like the yoke of a balance sheet in the balance position.

A balance sheet is a model that represents the financial position of an organization at a certain point in time in the interests of users.

In modern economic conditions of the market economy, the value of the balance sheet is so great that it is often allocated to an independent reporting unit, which is supplemented by the totality of all other forms of accounting. The role of other forms of accounting is to decipher the data contained in the balance sheet. Modern balance sheets with accounts are based on the classification of economic assets and sources of their formation. However, a functional approach to creating a balanced format is also possible.

Balancing off Accounts — Process

All organizations are required to maintain accounting records, compile and submit to the tax authorities a mandatory copy of the accounting statements for 2019: the balance sheet and the report on financial results. A copy of the accounting statements – the balance sheet and the report on financial results must be submitted to the tax Inspectorate. In addition, you need to submit an audit report to those organizations that require an audit. Before preparing financial statements for the year, the accountant must summarize the organization’s activities and close the accounting accounts that determine the financial result of the organization’s activities. The work should also be guided by:

- the organization’s accounting chart of accounts,

- provisions

- data from the organization’s tax registers.

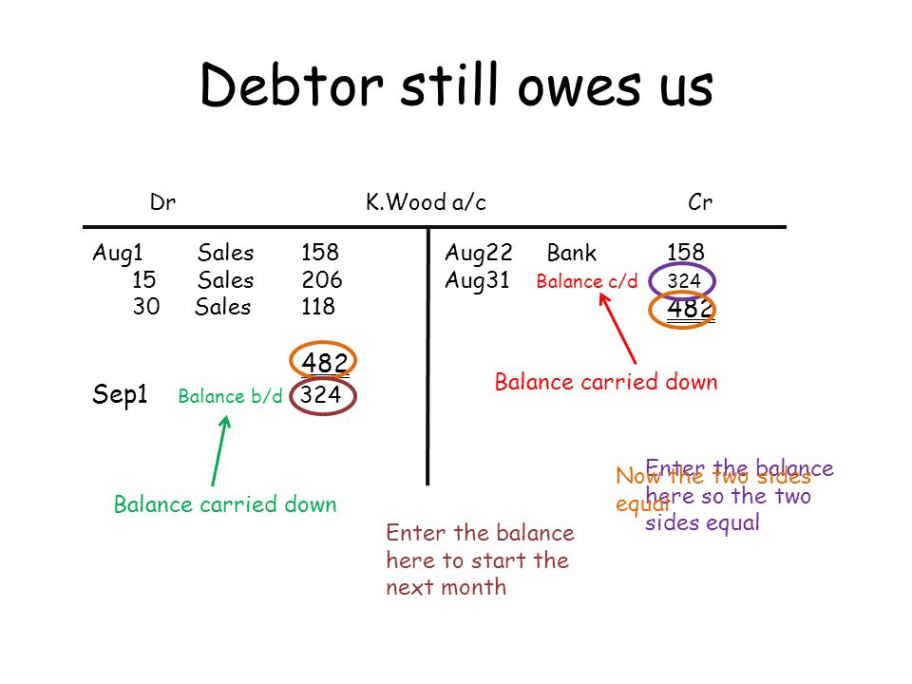

Balancing off Accounts: Example

It is clear that this is an unusual and difficult task for beginners, so we will briefly describe this process in an accessible form. To determine the financial performance of an organization, you need to close the reporting period. In accounting, the reporting period is a month. All accounts related to the display of production costs, revenue (income), and the formation of financial results for the preparation of the balance sheet of a small enterprise can be divided into three groups:

- accounts “General production expenses” and “General Economic expenses”;

- accounts that, in most cases, have a balance-work in progress, but can be completely closed (“Main production,” “Auxiliary production,” “Service industries and farms”);

- accounts that do not have a total balance at the end of the month, but have a balance for each sub-account – “Sales,” “other income and expenses.”

Balancing off Accounts with a Credit Balance

This can be seen in an example. For example, two accounts have different amounts of Debit turnover and Credit turnover. It turns out that for each of these accounts, there is a final balance. Right now, it doesn’t make much difference to us whether this balance is in Debit or Credit. We only care about one thing:

- Closing both accounts implies such actions that the balance turns to zero.

- In other words, we must make such entries for each account in the correspondence so that our numbers turn to zero.

- In other words, the balance would become zero. The balance on closed accounts must be zero.

Permanent and Temporary Accounts

GAAP accounting uses seven main types of accounts, divided into two categories:

- Permanent accounts: assets, liabilities, and shareholders ‘ equity.

- Temporary accounts: income, expenses, profits, and losses.

Permanent accounts are not closed and move from one reporting period to another. Their data is reflected in the balance sheet. These accounts are linked by the basic accounting equation, according to which the company’s assets are equal to liabilities (liabilities) plus equity of its owners, i.e., indicating the value of assets and the sources of their formation.

Forecasts are the core of any trading system, which is why well-made Forex forecasts can make You infinitely moneyed.

Temporary accounts reflect changes in permanent accounts during the company’s business operations. At the end of the reporting period, temporary accounts are closed by transferring their balances to permanent accounts.