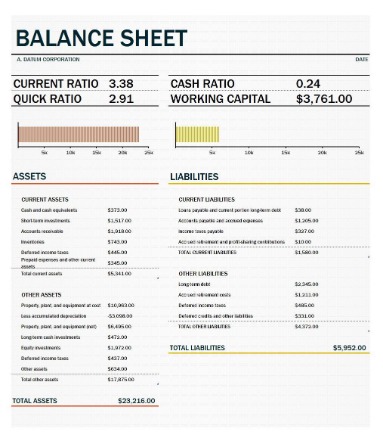

Income statements include revenue, costs of goods sold, andoperating expenses, along with the resulting net income or loss for that period. The foundation of the balance sheet lies in the accounting equation where assets, on one side, equal equity plus liabilities, on the other. Balance sheets can be created with ease, even if you’re not an accounting professional. The U.S. Small Business Administration offers a free 30-minute “introduction to accounting” course. SCORE provides a downloadable balance sheet template listing the categories in the financial statement. The balance sheet in isolation does not reflect this delay in the collection of cash. Profit and loss statements and cash flow statements therefore are key to obtaining a complete picture of your small business finances.

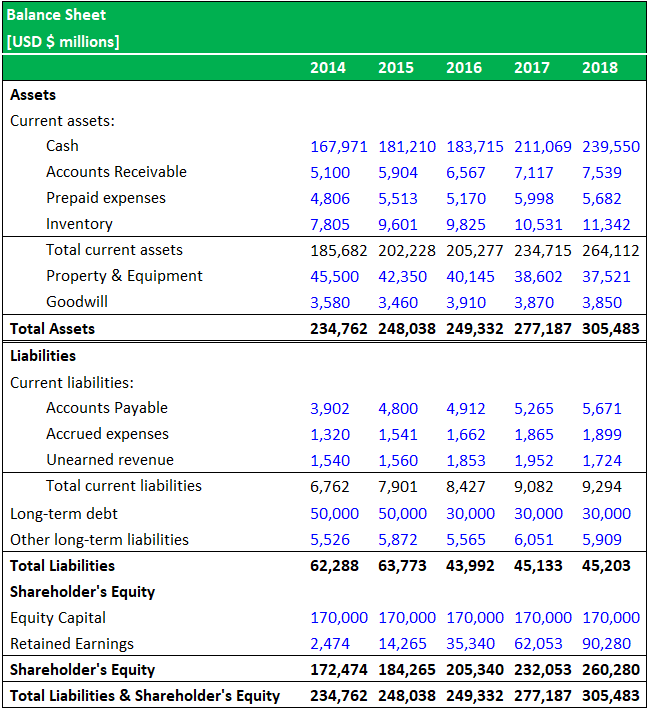

Return on Equity is a measure of a company’s profitability that takes a company’s annual return divided by the value of its total shareholders’ equity (i.e. 12%). ROE combines the income statement and the balance sheet as the net income or profit is compared to the shareholders’ equity.

This refers to non-monetary assets that have no physical substance and will last more than 1 year, such as a copyright, patent, or trademark. This is whatever will remain if you subtract the liabilities of the company from the assets. Exactly how the equity is made up will vary from company to company, depending on the business type and stage. To complete your balance sheet template you’ll need to add in details about the debts and liabilities your company owes. Whatever a business owns — its assets — have been financed by either taking on debt , or through investments from the owner or shareholders . As the name suggests, the equation balances out, with assets on the one side being equal to the sum of liabilities and equity on the other. This form is more of a traditional report that is issued by companies.

Do not include in current assets cash that is restricted, or to be used to pay down a long-term liability. On the other side of the equation are your liabilities, both short- and long-term, which are the monetary obligations you owe to banks, creditors, and vendors. Short-term liabilities include accounts payable, such as short-term obligations accounts payable owed to vendors and creditors, and notes payable to others within the next 12 months. Long-term liabilities, due more than a year away, include a mortgage balance payable beyond the current year. Investors, creditors, and internal management use the balance sheet to evaluate how the company is growing, financing its operations, and distributing to its owners. It will also show the if the company is funding its operations with profits or debt. Cost is the original cost or basis of the asset, less any accumulated depreciation.

Balance Sheet Equation

Since they cannot request special-purpose reports, external users must rely on the general purpose financial statements that companies publish. These statements include the balance sheet, an income statement, a statement of stockholders ‘ equity, a statement of cash flows, and the explanatory notes that accompany the financial statements. The balance sheet, sometimes called the statement of financial position, lists the company’s assets, liabilities,and stockholders ‘ equity as of a specific moment in time.

For example, the amount of accounts receivable will depend on the offsetting balance in the allowance for doubtful accounts, which contains a guesstimated balance. Also, accelerated depreciation can be used to artificially reduce the reported amount of fixed assets, so that the fixed asset investment appears to be lower than is really the case. The balance sheet, like the cash flow statement and the income statement, are all required by GAAP rules. As a financial statement, the balance sheet shows the current worth of the business, frozen in time on the date you run the report.

Depicting your total assets, liabilities, and net worth, this document offers a quick look into your financial health and can help inform lenders, investors, or key stakeholders about your business. For example, a positive change in plant, property, and equipment is equal to capital expenditure minus depreciation expense. If depreciation expense is known, capital expenditure can be calculated and included as a cash outflow under cash flow from investing in the cash flow statement. Accounts within this segment are listed from top to bottom in order of their liquidity. They are divided into current assets, which can be converted to cash in one year or less; and non-current or long-term assets, which cannot. Finally, you’ll need to calculate the amount of money you have invested in the company.

The Basic Equation

Assets also include intangibles of value, like patents or trademarks held. Regularly analyzing the financial position of a business is vital to keep an organization on track. And the balance sheet is one of the most important financial statements for analysis, because it provides a snapshot of your company’s net worth for a specific time. A balance sheet is a financial statement that communicates the so-called “book value” of an organization, as calculated by subtracting all of the company’s liabilities and shareholder equity from its total assets. Shareholder equity is the money attributable to the owners of a business or its shareholders.

You also have a business loan, which isn’t due for another 18 months. Long-term assets, on the other hand, are things you don’t plan to convert to cash within a year. Because of these factors, balance sheets can be created and managed by a variety of people. Multiple copies of balance sheets should be kept at all times and updated regularly. This will ensure that balance sheets have the same information and don’t contain discrepancies.

Assets = Liabilities + Owners Equity

The balance sheet is a financial statement comprised ofassets, liabilities, and equityat the end of an accounting period. This is essentially how easily can the company pay from existing assets for its ongoing expenses, including payroll, inventory, and investments in capital equipment. If your numbers are not balanced, you may have omitted, duplicated, or miscategorized one of your accounts. Understood in the simplest terms, a balance sheet is a financial statement that shows what a business owns , what it owes , and the value of the owner’s investment in the business (owner’s equity). In other words, it’s an important document that serves as a snapshot of a business’ finances at a specific point in time by comparing what you own to what you owe.

- By comparing your business’s current assets to its current liabilities, you’ll get a clear picture of the liquidity of your company.

- A company can be endowed with assets and profitability but short of liquidity if its assets cannot readily be converted into cash.

- QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost.

- In both formats, assets are categorized into current and long-term assets.

- Depreciation subtracts a specified amount from the original purchase price for the wear and tear on the asset.

We’re here to take the guesswork out of running your own business—for good. Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements every month. A balance sheet gives a snapshot of your financials at a particular moment, balance sheet example incorporating every journal entry since your company launched. It shows what your business owns , what it owes , and what money is left over for the owners (owner’s equity). The best technique to analyze a balance sheet is through financial ratio analysis.

Any accounts receivable balances you may have would be placed under the current header as would any inventory you have in stock. Equity represents the amount of money that you or your investors have invested in the business. Also called capital, the equity account represents a company’s net worth. Added together with the liability total, it should match or balance with your total assets. A balance sheet is a statement that shows the assets, liabilities, and equity of a business at a particular time.

Equity

Since a balance sheet’s primary role is for reporting, you’ll be compiling these on an ongoing basis — most likely on a per quarter frequency. Remember —the left side of your balance sheet must equal the right side (liabilities + owners’ equity). The Instant Revenue Program allows early access to receivables you’ve generated on various selling platforms. The receivables can be deposited into your Brex Cash Account minus a fee, or the receivables can be reflected as an increased spending limit on your Brex Card without any fee.

It is one of the principal reports provided by a good accounting system. The balance sheet shows what is owned by a business, what is owed, and the owner’s equity of the business. By comparing past balance sheets with the present balance sheet, the growth or decline of assets, liabilities and net worth can be determined. Assets are generally listed based on how quickly they will be converted into cash. Current assets are things a company expects to convert to cash within one year. Most companies expect to sell their inventory for cash within one year.

Income Statement: Profits Minus Losses

Their value may thus be wildly understated or just as wildly overstated. The balance sheet adheres to an equation that equates assets with the sum of liabilities and shareholder equity. The balance sheet is one of the three core financial statements that are used to evaluate a business. Balance sheets can be used with other important financial statements to conduct fundamental analysis or calculating financial ratios. Bookkeepers and accountants should be preparing a balance sheet at the end of every accounting period particularly since GAAP rules require all U.S. corporations to issue a balance sheet report. Your account will automatically be charged on a [monthly/annual] basis until you cancel.

What are my liabilities?

Liabilities are debts, such as auto and student loans. Liability is a fancy word for debt, or something that you owe. Once you know your total liabilities, you can subtract them from your total assets, or the value of the things you own — such as your home or car — to calculate your net worth.

The financial statement should balance, showing assets equaling liabilities plus owner’s equity. A company’s balance sheet is one of three financial statements used to give a detailed picture of the health of a business. Investors and analysts will read the balance sheet alongside the income statement and cash flow statement, to evaluate the company’s overall financial position.

It does not show the flows into and out of the accounts during the period. Fixed assets are shown in the balance sheet at historical cost less depreciation up to date. Depreciation affects the carrying value of an asset on the balance sheet. The historical cost will equal the carrying value only if there has been no change recorded in the value of the asset since acquisition. Historical cost is criticized for its inaccuracy since it may not reflect current market valuation. The goal of working capital management is to ensure that the firm is able to continue its operations and that it has sufficient cash flow. Cash and cash equivalents are the most liquid assets found within the asset portion of a company’s balance sheet.

It is important to note all of the differences between the income and balance statements so that a company can know what to look for in each. Many of these ratios are used by creditorsand lendersto determine whether they should extend credit to a business, or perhaps withdraw existing credit.

The latter is based on the current price of a stock, while paid-in capital is the sum of the equity that has been purchased at any price. When you use a balance sheet to track your finances, you are better able to find hidden costs or roadblocks, reduce expenses, and maximize profits.

Next, if you’re tracking fixed assets, you’ll want to include the total of your fixed assets. Add your current and fixed asset totals to arrive at your assets total. Long-term liabilities are obligations that will not be paid off in the coming year. Examples of long-term liabilities include loans and notes payable, though some notes payable may be considered a current liability if they are due and payable within a year.

Propel Nonprofits is also a leader in the nonprofit sector, with research and reports on issues and topics that impact that sustainability and effectiveness of nonprofit organizations. On the reporting date, you’ll be looking back at the numbers for a previous time period, one that has already been resolved.

Equity can also drop when an owner draws money out of the company to pay themself, or when a corporation issues dividends to shareholders. We also have a balance sheet template you can download and use right now. If a company is public, public accountants must look over balance sheets and perform external audits. Furthermore, public companies have to prepare their balance sheets by following the GAAP. Public balance sheets have to be filed regularly with the SEC, too. A more in-depth analysis is always required if you want to determine the health of an investment or company.

Information and views provided are general in nature and are not legal, tax, or investment advice. Information and suggestions regarding business risk management and safeguards do not necessarily represent Wells Fargo’s business practices or experience. Please contact your own legal, tax, or financial advisors regarding your specific business needs before taking any action based upon this information. “Business owners need to understand, in terms of an income statement, what that cash vision looks like today and what it looks like projecting out tomorrow and the next day,” Chase Smith says. “For example, a restaurant owner has to go out and buy all his or her products, has to hire his or her staff, has his or her overhead in the building, and hasn’t sold any food yet.” The difference between assets and liabilities is shown on the right side of the balance sheet as “retained earnings” (if it’s a corporation) or “owner’s equity” (if it’s an unincorporated business).