While the preceding description may make it appear that the calculation of the unit product cost is simple, there are a number of variations on the concept that make it more difficult to calculate. For US shipments, for example, ShipBob offers faster, affordable 2-day shipping options for qualified customers to meet customer expectations around fast shipping while also reducing shipping costs. Rather than renting a warehouse and hiring/managing a staff, you can store inventory in multiple fulfillment center locations within our network and track storage costs through the ShipBob dashboard. Whether it’s a slow-selling item or obsolete inventory, having an inventory management system in place can enhance visibility so you can make wise decisions about your product catalog sooner than later. Any expense incurred in the storage of unsold inventory is referred to as holding costs. These costs can range from warehousing to labor costs, to depreciation and opportunity costs.

Enter the direct materials cost, direct labor costs, and the factory overhead, and total units produced to calculate the unit product cost. Unit product cost is the total cost of a production run, divided by the number of units produced. It is useful to delve into the concept in more detail, to understand how costs are accumulated. A business commonly manufactures similar products in batches that may include hundreds or thousands of units per batch. Costs are accumulated for each of these batches and summarized into a cost pool, which is then divided by the number of units produced to arrive at the unit product cost.

Company

In the final step of our exercise, the total cost of production is divided by the total quantity of units produced to arrive at an average cost of $24.00. The sum of the manufacturer’s fixed and variable costs, i.e. the total cost of production, comes out to $600,000. Amid the conversion of raw materials it purchased into finished goods ready to be sold to its customers, the manufacturer incurred a total of $500,000 in fixed costs.

- Amid the conversion of raw materials it purchased into finished goods ready to be sold to its customers, the manufacturer incurred a total of $500,000 in fixed costs.

- While the cost per unit refers to how much you spend to deliver one unit, the price per unit refers to how much you charge customers for each item sold.

- In these instances, metrics such as labor-hours-per-client may replace unit costs.

- Costs are accumulated for each of these batches and summarized into a cost pool, which is then divided by the number of units produced to arrive at the unit product cost.

“ShipBob’s Inventory Planner integration allows us to have all of our warehouse forecasting and inventory numbers in one platform. Here is how ShipBob can turn your logistics operations into a revenue driver. “For reverse logistics, we have also been leveraging ShipBob’s Returns API to automate and streamline our routine RMA processes. One-fourth of online customers return 5-15% of what they purchase, and the retail industry loses about $50 billion in the form of deadstock per year.

What is Unit Product Cost?

In these instances, metrics such as labor-hours-per-client may replace unit costs. Depending on the various factors that affect the cost per unit, there are different ways of reducing fixed and variable costs in your ecommerce operations. Moreover, the variable cost per unit of production is $4.00, so the total variable costs incurred over the course of the fiscal year were $100,000. A high cost per unit means that your product pricing must be higher to accommodate desired company profits. Keeping average order value in mind, many businesses try to find ways to entice customers to spend more money in a single purchase (through bundles, discounts, and other incentives).

Greg’s Apothecary produces scented candles for an average of $10 per unit. It costs Greg’s biggest competitor $8 on average to create a similar candle. Each storage unit is prorated on a monthly basis, so if, for example, you only had inventory in a storage location for half of the month, you will be charged 50% of the cost. Instead of having to handle all SKU management and logistics on your own, you can outsource it to ShipBob and save time, energy, and money. “Overall, there is more transparency with ShipBob that even helps our team manage customer service better.

Cost Per Unit: What is it, How to Calculate it, & Tips to Reduce It

Initially, the average cost tends to decline as more units are produced—i.e. Economies of scale—but the cost savings and benefits to a company’s profit margins reverse course beyond a certain threshold in terms of unit production output. The calculation of the average cost is relatively straightforward, since the per-unit cost represents the ratio between the total cost of production and the total number of production units. The loss will be in its $5.00 unit-cost value, and perhaps also in additional costs in return shipping and disposal. Repricing at $4.00 may create a $1.00 loss-on-unit cost, but if the product sells at this price point, a greater loss may be avoided.

Unit Cost and Break-Even Analysis

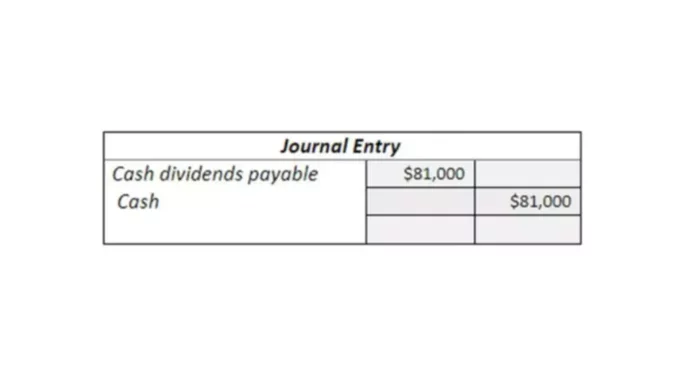

Understanding the unit product cost is crucial for any business involved in manufacturing or selling products. It’s a key metric for a variety of financial decisions, including pricing, profitability analysis, and strategic planning. The number of units sold within a specific period of time can also impact these costs. Examples are production costs, customer acquisition, packaging, and shipping costs. Total fixed costs remain the same, no matter how many units are produced in a time period.

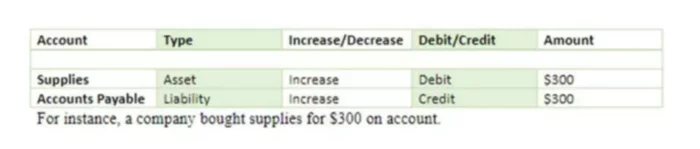

Cost per unit information is needed in order to set prices high enough to generate a profit. The cost per unit is derived from the variable costs and fixed costs incurred by a production process, divided by the number of units produced. Variable costs, such as direct materials, vary roughly in proportion to the number of units produced, though this cost should decline somewhat as unit volumes increase, due to greater volume discounts.

The Disadvantages of Allocating Fixed Costs

This is why ecommerce companies that sell their own goods must calculate and monitor their cost per unit over time. The average cost represents the standard cost incurred per unit of production. Having a process for SKU rationalization also helps you understand if a product is profitable or not. If the costs (and subsequent sales) don’t justify supporting a particular product, then it’s time to discontinue it.

A company’s unit cost is a simple measure for calculating profitability. If unit cost, including fixed and variable expenses, is calculated as $5.00 per unit, then selling a unit for $6.00 generates a profit of $1.00 for each sale. A selling price of $4.00 creates a $1.00 loss, although this analysis doesn’t accurately capture all market activity. The cost per unit should decline as the number of units produced increases, primarily because the total fixed costs will be spread over a larger number of units (subject to the step costing issue noted above). Many ecommerce businesses aim to have a profit margin of 20-40% (though this can be hard to achieve), so if we assume the profit margin is 30% (or $300), then the cost per unit may be around $700 (70% of $1,000). A business takes all costs and expenditures that it needs to produce a quantity of goods or services, and then divides these amounts by that quantity.